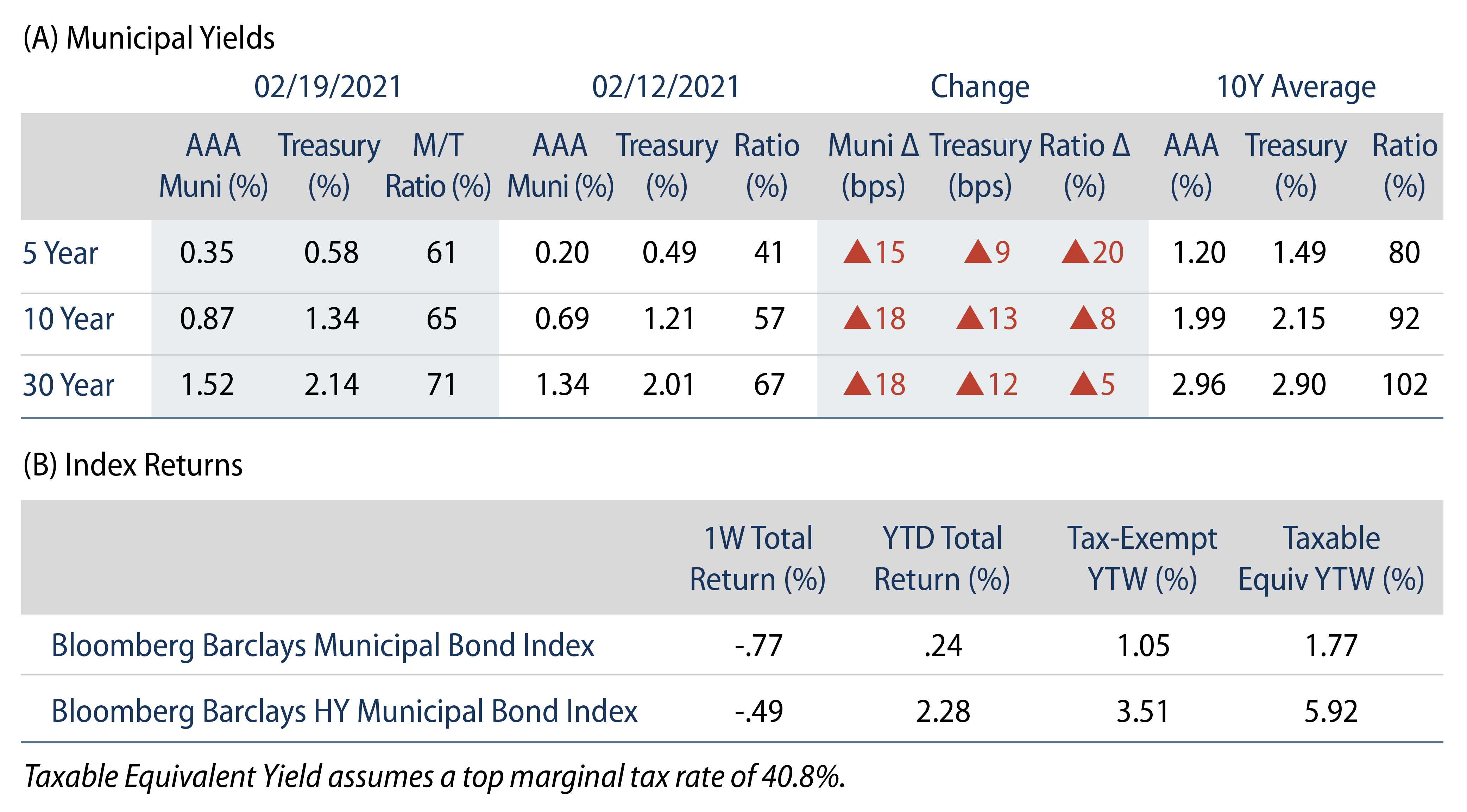

Municipal Yields Moved Higher in Sympathy With Treasuries

US municipal yields moved higher across the curve last week. Municipal fund inflows continued despite the market weakness. AAA municipal yields moved 15-18 bps higher across the curve. Municipals underperformed Treasuries and Muni/Treasury ratios retreated from record lows. The Bloomberg Barclays Municipal Index returned -0.77%, while the HY Muni Index returned -0.49%. This week we assess Illinois’ budget that passed last week.

Positive Fund Flows Continue to Support Favorable Technicals

Fund Flows: During the week ending February 17, municipal mutual funds recorded a 15th consecutive week of net inflows, totaling $2.0 billion, according to Lipper. Long-term funds recorded $1.4 billion of inflows, high-yield funds recorded $578 million of inflows and intermediate funds recorded $333 million of inflows. Year-to-date (YTD) net inflows total $26 billion.

Supply: The muni market recorded $6.3 billion of new-issue volume during the week, down 31% week-over-week (WoW). New issuance YTD of $50 billion is down 11% year-over-year. This week’s new-issue calendar is expected to pick up to $9.8 billion (+56% WoW). The largest deals include $3.1 billion University of California and $537 million San Diego County Regional Transportation Commission transactions.

This Week in Munis: Illinois’ Inflection Point?

Challenging credit headwinds faced by the state of Illinois could potentially shift with new leadership and a fiscal 2022 budget released last week that features better-than-anticipated tax collections and austerity measures rarely seen from the state.

The $5.5 billion budget gap forecast in November 2020 has been revised downward to $2.6 billion, due to outperforming income tax and sales tax collections. Governor Pritzker proposes closing the budget without substantial additional federal support and with changes to the state’s corporate tax code. Expenditures were kept unchanged in 2022, compared to a 5.6% general fund expenditure annual growth rate from fiscal years 2016-2019. Continued budget savings include a 22% reduction in the state’s active workforce and negotiated health care cost savings. Favorably, the state plans to continue to fully fund its pension system.

In addition to Illinois’ fiscal improvements, the House Democrats are working to advance President Biden’s $1.9 trillion rescue package, which includes $350 billion in aid to states and local governments. Illinois may benefit greatly, as the state could receive as much as $7.5 billion in direct funding, with another $5.7 billion earmarked for local governments. Some have suggested the state would use these funds to pay off the $2.8 billion it owes the Municipal Liquidity Fund and its back-log of unpaid bills, which currently stand at $4.7 billion.

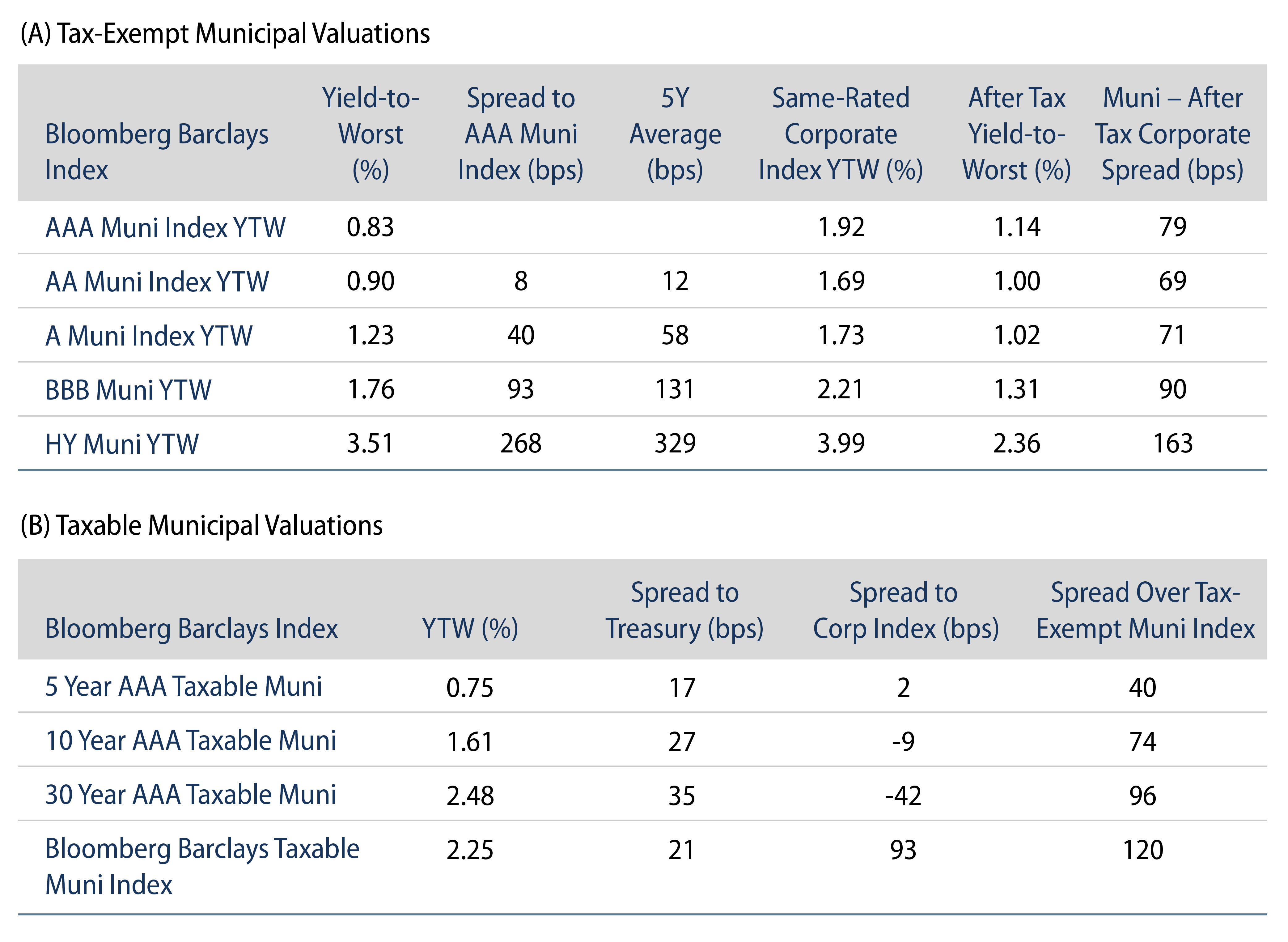

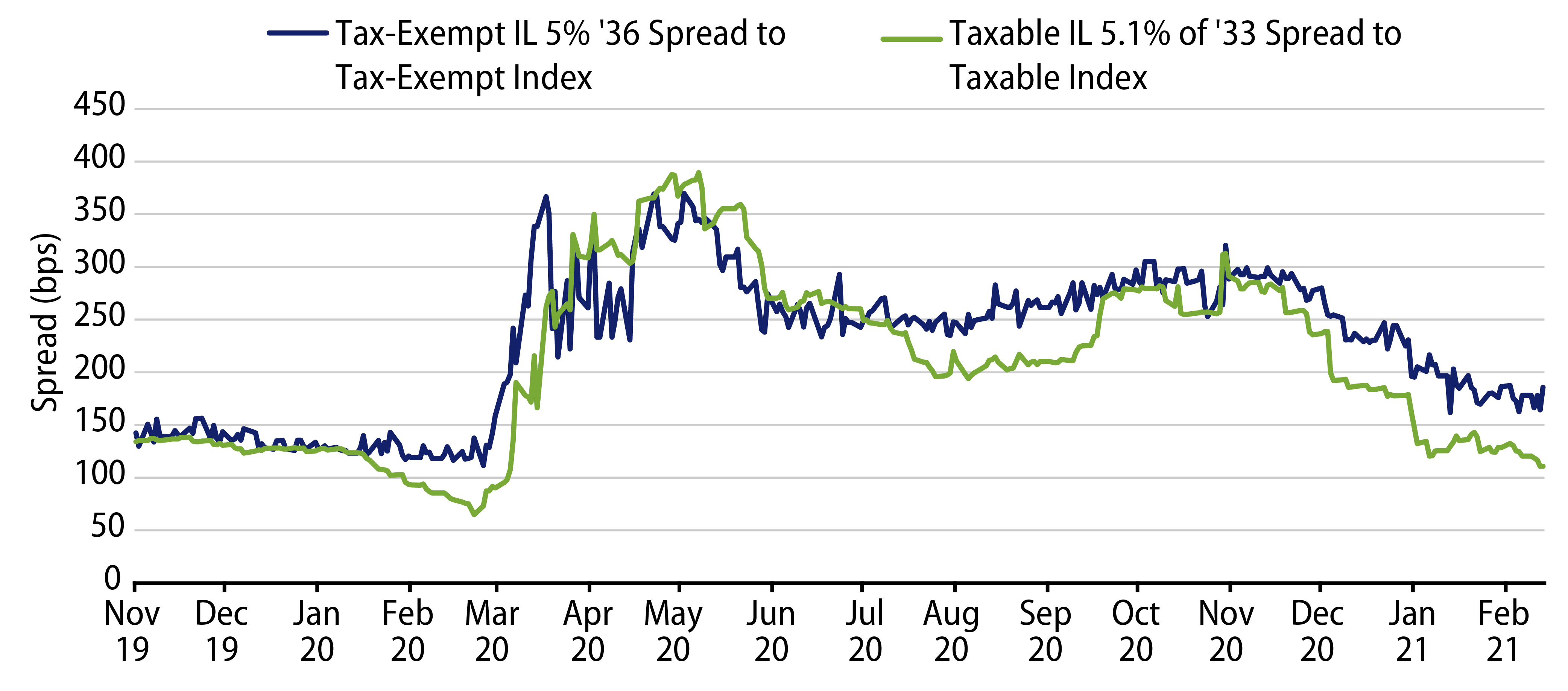

With the Democrats firmly in control of the legislature, we anticipate Governor Pritzker should be able to pass a balanced budget through the legislature, which we believe improves the state’s path to recovery from legacy structural budgetary and pension issues that were exacerbated by the pandemic. General obligation bonds issued by the state may offer opportunity for both taxable and tax-exempt municipal investors, as spreads of Illinois taxable and tax-exempt bonds are still elevated to pre-Covid levels and would stand to benefit from further fiscal improvement.