Municipals Outperformed During the Week

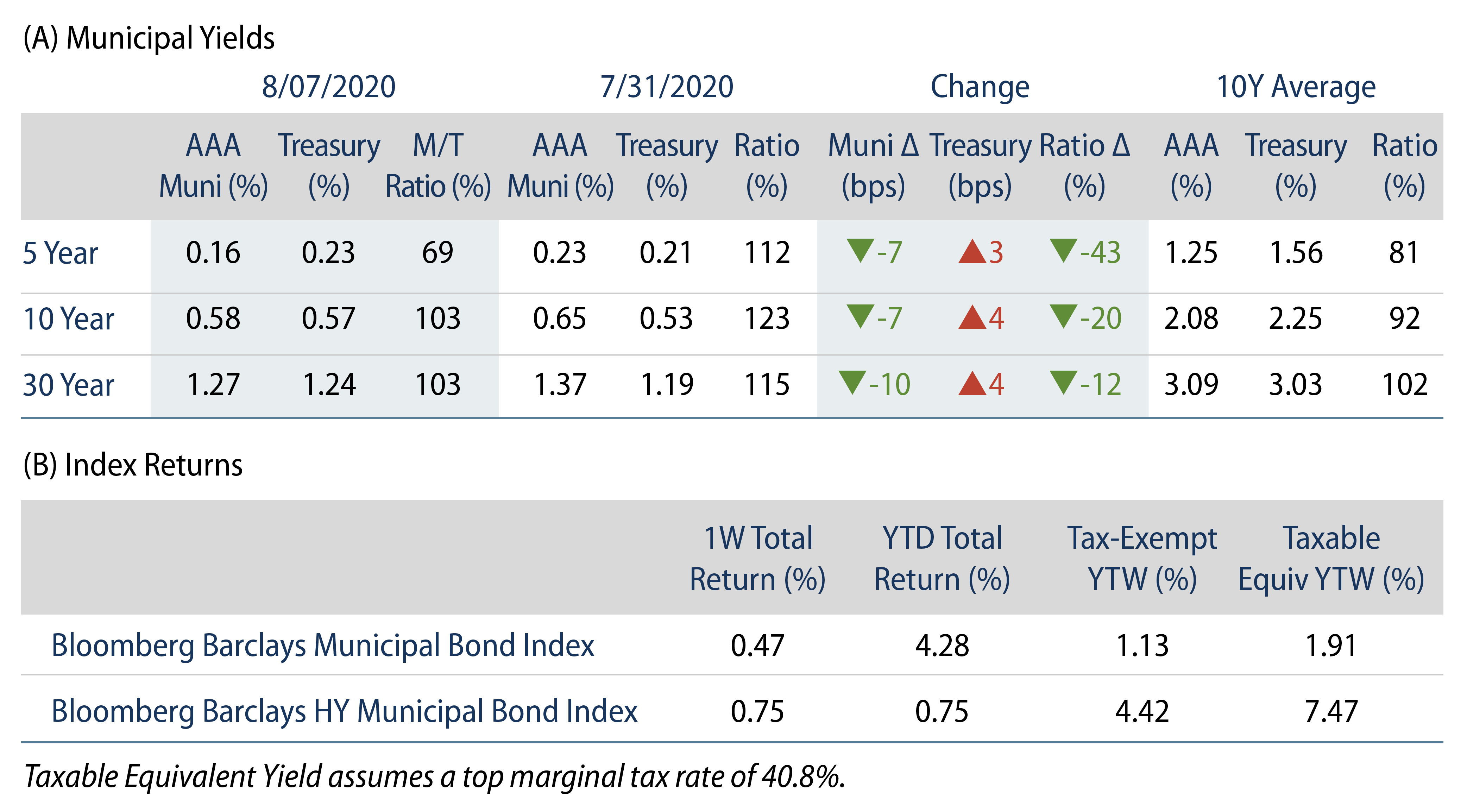

AAA municipal yields moved 7-10 basis points lower during the week, outperforming Treasuries and leading the Municipal/Treasury ratios lower to 69%-103% across the yield curve. The Bloomberg Barclays Municipal Index returned 0.47%, while the HY Muni Index returned 0.75%.

Technicals: Strong Fund Flows Continue

Fund Flows: During the week ending August 5, municipal mutual funds reported a 13th consecutive week of inflows at $1.6 billion, according to Lipper. Long-term funds recorded $610 million of inflows, high-yield funds recorded $103 million of inflows and intermediate funds recorded $14 million of inflows. Municipal fund net inflows YTD now total $6.0 billion.

Supply: The muni market recorded $8.8 billion of new-issue volume last week, up 18% from the prior week. Issuance of $256 billion YTD is 30% above last year’s pace, primarily driven by taxable issuance, which is approximately 4.5x last year’s levels and comprises 30% of YTD issuance. We anticipate approximately $10 billion in new issuance this week (+17% week-over-week), led by $1.4 billion LA MTA and $561 million taxable Michigan State Building Authority transactions.

This Week in Munis: Tax Policy Makes Headlines in New York and California

More tax policy rhetoric came into focus in California and New York last week, which would have direct implications for the municipal market’s largest issuers and investors.

A proposal in California detailed a retroactive income tax hike that would raise the top rate to 16.8% from 13.3%. Proponents forecast that the proposed tax increase could raise close to $7 billion and help close an estimated $55 billion state budget deficit. Opponents argue that passage would cause wealthy taxpayers to flee California and detract from long-term growth prospects. The most recent tax-increase legislation that raised California’s top rate to 13.3% passed by a margin of 55% to 45% in 2012 and was extended in 2016.

Last Tuesday, New York Governor Andrew Cuomo pleaded with New York City’s wealthiest residents to return to the city, highlighting the top one percent of the city’s population pays 50% of the tax revenues. New York City faces a $30 billion budget deficit due to the pandemic and it will be exacerbated if those who have left the city do not return in a post-COVID world.

This week’s rhetoric highlights the sizeable budgetary challenges faced by the municipal market’s largest issuers, as well as the demand for federal aid to help cure budgetary shortfalls. Absent significant federal aid, we anticipate austerity measures that would result in downgrades across the municipal market. At the same time, the prospect of higher taxes is a tailwind for tax-exempt municipal valuations and demand prospects. For California residents, considering a 16.8% top tax rate, we anticipate the taxable-equivalent yield of a 30-year state general obligation security would increase 24 bps from 2.94% to 3.18%.