Municipal Yields Moved Lower and Outperformed Treasuries as Rate Volatility Stabilized

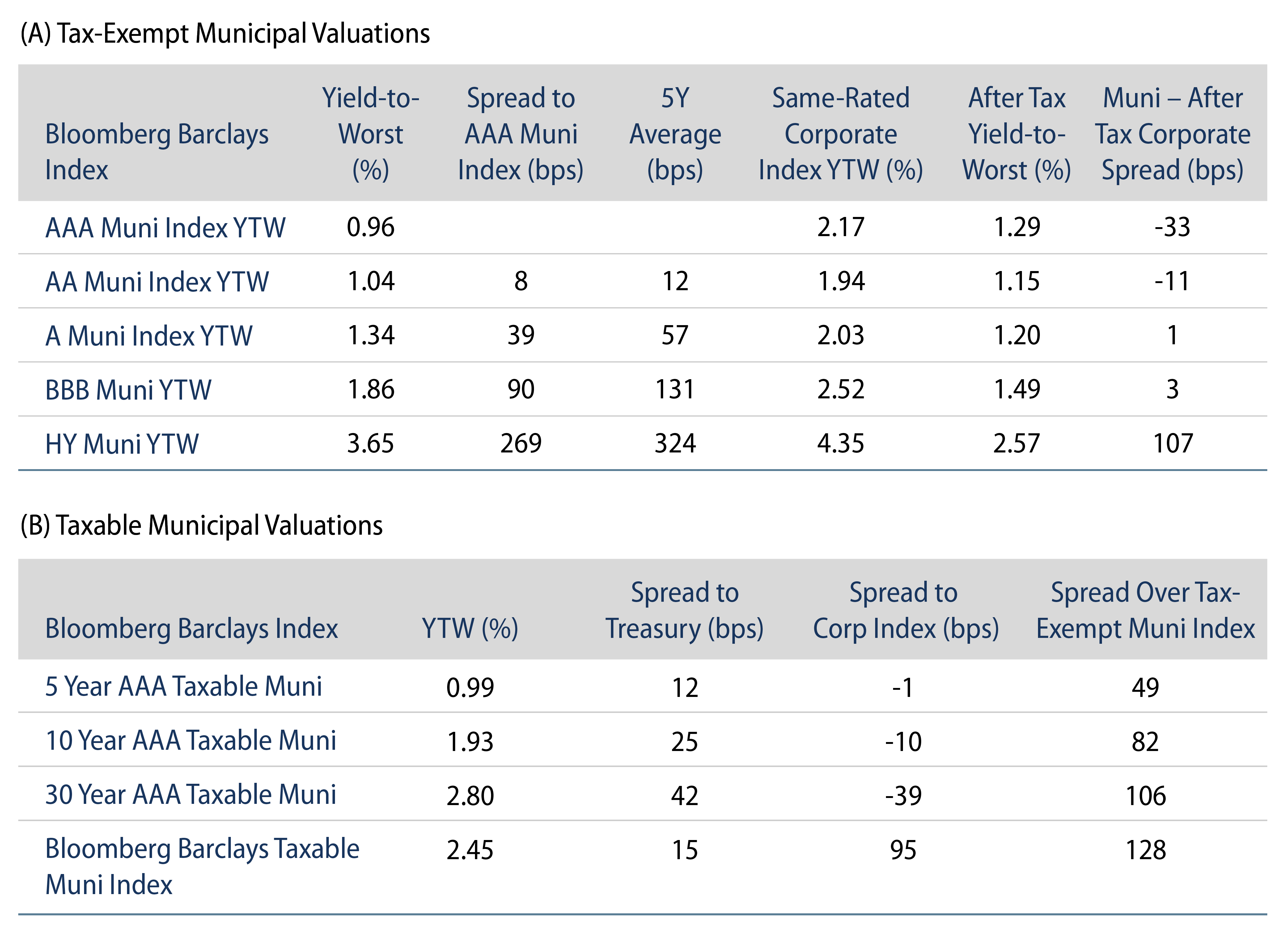

US municipal yields moved lower across the curve and outperformed Treasuries as demand technicals remained strong. AAA municipal yields moved 5-7 bps lower across the curve. Fund flows remained positive amid elevated issuance. The Bloomberg Barclays Municipal Index returned 0.41%, while the HY Muni Index returned 0.45%. This week we explore the restrictions placed on the massive stimulus package that could shape the scope of local fiscal policy in the near term.

Fund Flows Maintain a Record Pace YTD Amid Elevated Supply

Fund Flows: During the week ending March 24, municipal mutual funds recorded $592 million of net inflows. Long-term funds recorded $513 million of inflows, high-yield funds recorded $256 million of inflows and intermediate funds recorded $100 million of inflows. Year-to-date (YTD) net inflows stand at $31.1 billion, a record pace from the beginning of the year through the end of the first quarter.

Supply: The muni market recorded $11.8 billion of new-issue volume during the week, in line with the prior week. Total issuance YTD of $103 billion is up 16% from last year’s levels, with tax-exempt issuance up 14% while taxable issuance is 24% higher. This week’s new-issue calendar is expected to fall to $3.3 billion, given the holiday-shortened week. The largest deals include $1.0 billion taxable Golden Tobacco Refunding and $345 million Washington State Convention Center Public Facilities District transactions.

This Week in Munis: Stimulus Stipulations

Though the $350 billion in aid to state and local governments from the America Rescue Act gives municipal governments more spending flexibility than the CARES Act did, it does impose some limits on how the monies may be used. The Act explicitly prohibits the use of stimulus funds to replenish revenue lost through tax cuts enacted after March 3. Also, states may not use the funds to shore up underfunded pensions, though this prohibition does not apply to local governments. The law establishes a procedure for the federal government to reclaim funds used by states found to be in violation, and Treasury is committed to tracking stimulus funds. But, as the stimulus money is fungible, Republicans continue to slam the effort as a bailout for mismanaged states.

The restrictions have led to resistance from 21 Republican state attorneys general, and Ohio is suing the Biden Administration, claiming the mandate violates state sovereignty. More suits may follow unless Treasury provides additional clarity. The Treasury Department did clarify earlier that tax cuts would be permitted so long as states did not finance the cuts with Rescue Act monies. Missouri, for example, is considering abolishing state income taxes and replacing the revenue by expanding its sales tax—and that would presumably pass muster.

Western Asset believes that states and the federal government will come to terms. The impasse could jeopardize the timing of the rollout; however, we doubt that it would cause a reduction in the amount of funding that states ultimately receive as states have a strong incentive to work within the law. Western Asset’s view is that the unprecedented support afforded by the American Rescue Act will continue to stabilize the credit profile of the state and local government sector, enhancing the outlook of even those states that the market perceives as sorely mismanaged.