Municipals Posted Negative Returns Last Week

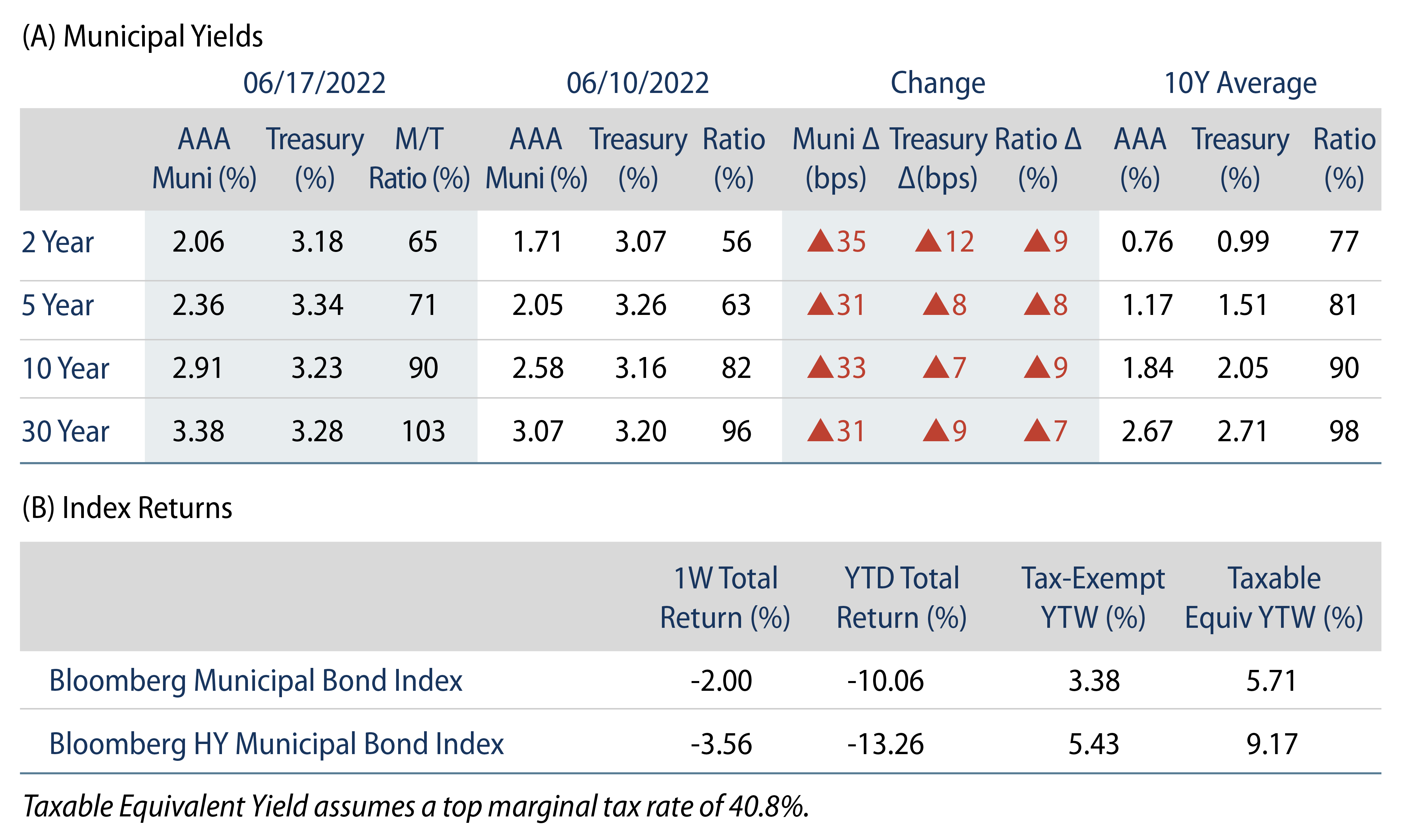

Munis posted negative returns last week and underperformed Treasuries across the curve, resulting in higher Municipal/Treasury ratios. High-grade municipal yields increased 31-35 bps across the curve. Weekly reporting municipal mutual fund outflows accelerated. The Bloomberg Municipal Index returned -2.00%, while the HY Muni Index returned -3.56%, sending year-to-date (YTD) returns below -10%. This week we highlight overriding municipal budget themes as we enter a new fiscal year for most municipalities.

Market Technicals Weakened as Municipal Mutual Fund Outflows Accelerated

Fund Flows: During the week ending June 15, weekly reporting municipal mutual funds recorded $5.6 billion of net outflows, according to Lipper. Long-term funds recorded $5 billion of outflows, high-yield funds recorded $1.8 billion of outflows and intermediate funds recorded $286 million of outflows. The week’s fund outflows mark the highest weekly outflow of the year, and contribute to the record $73 billion outflow cycle.

Supply: The muni market recorded just $2.5 billion of new-issue volume, down 66% from the prior week. Total YTD issuance of $189 billion is now 2% lower than last year’s levels, with tax-exempt issuance trending 6% higher year-over-year (YoY) and taxable issuance trending 31% lower YoY. This week’s new-issue calendar is expected to increase to $7 billion. Large deals include $1.6 billion City of Los Angeles and Revenue Anticipation Notes and $1.2 billion State of Georgia transactions.

This Week in Munis: Wrapping Budget Season

June 30 marks the end of fiscal year 2022 for the majority of municipal issuers, and most major municipalities have proposed or enacted budgets for the coming fiscal year. An overriding theme of these budgets is that municipal credit fundamentals continue to improve, and while broader macroeconomic volatility is anticipated, recent fundamental trends place municipalities in a better position to navigate inflation pressures and slowing growth trends.

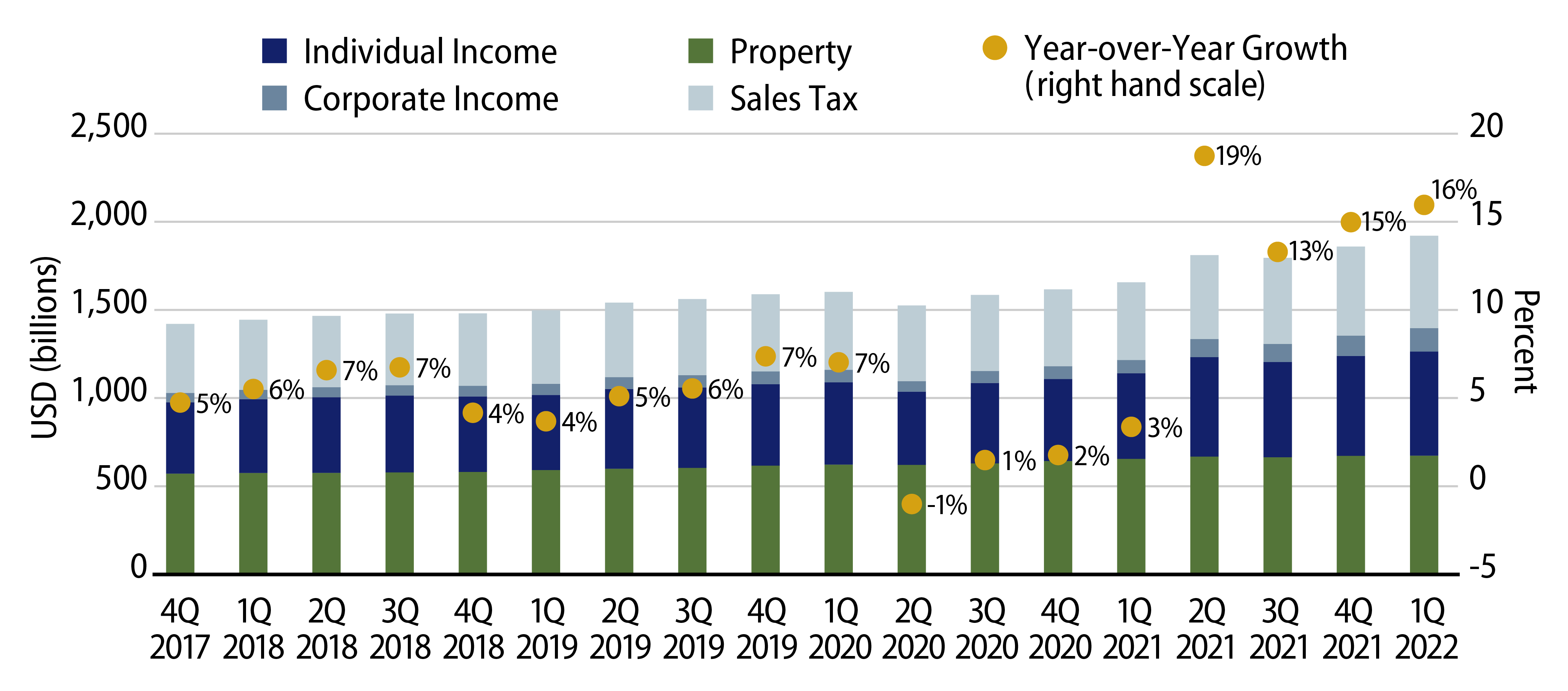

State and local revenues, as highlighted by Census data released this month, align with the improved revenue trends highlighted in most municipal budgets. Over the trailing 12 months, tax collections from major state and local categories (property taxes, sales taxes, and income taxes) reached a record $1.9 trillion, up 16% from the prior record-breaking year. 1Q22 total state and local tax revenues were 21% higher than 1Q21 levels. Robust revenue collections have provided the bandwidth for states and local governments to pursue a variety of initiatives within their budgets. Most municipalities have increased rainy day funds and reserves which could help provide support through budgetary shortfalls that could arise from an economic contraction. We have also observed issuers with historically higher debt burdens de-lever outstanding debt and make higher pension contributions, which could soften the impact of negative market returns.

States are also utilizing excess surpluses to provide direct cash refunds to residents, which can lower their burden related to the inflation of gas, groceries and housing costs. Many large states and localities have also provided additional funding for public safety and social services to tackle homelessness and crime, as well as other quality-of-life improvements such as investing in parks, cultural institutions and other public spaces. While improved fundamentals support the trend of upgrades that have surpassed downgrades across the municipal market over the past year, we anticipate this credit improvement could be peaking in a late-cycle environment. We caution that much of the fundamental improvement was directly or indirectly attributable to robust, but temporary, federal stimulus measures. As we look forward to fiscal year 2023, Western Asset will focus on issuers that can sustain their fiscal positions in a slower growth environment with less federal support.