Sales of new single-family homes rose another 4.8% in August, on top of 14.7%, 20.5% and 22.5% gains over the previous three months. In other words, new-home sales in August were 77.4% above the April low. Even more impressively, new-home sales were some 25% above prevailing levels holding prior to the onset of the Covid shutdown.

We saw last week that retail spending by consumers and businesses continues to grow unabated despite concerns from various commentators that the lack of further government stimulus and ongoing fears over the virus put the post-shutdown recovery at risk. Apparently, that message didn’t filter down to homebuyers.

We hear constantly that the purchase of a new home is the most momentous decision a household will ever make. Certainly, the low mortgage rates available at present are helping boost housing demand, but it is nevertheless extremely impressive that so many households are willing to brave not only health but also job risks and make a long-term commitment to a new home. No, the current recovery is not “bullet-proof,” but it is showing a lot more resilience and breadth than was expected just a few months ago.

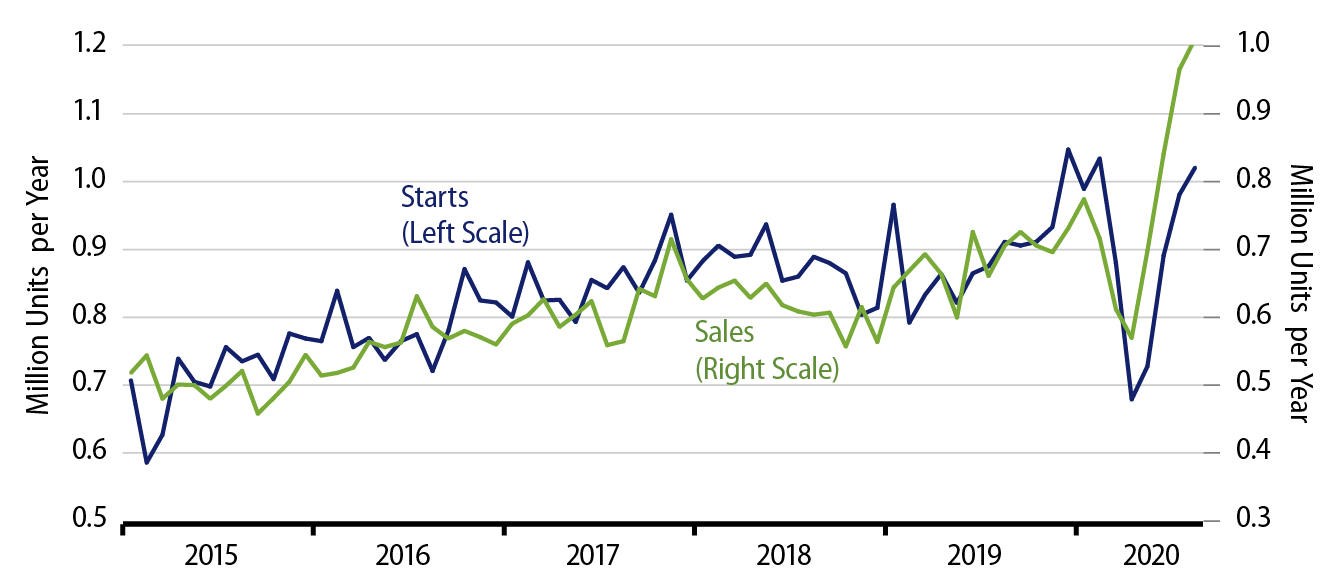

It is hard to find any negatives within the details of this report. Sales were especially strong in the South, which is the epicenter of US new-home construction. New-home sales there in August were a whopping 50% above pre-Covid levels, even while single-family housing starts in the South in August were only about equal to pre-Covid levels.

Similarly, inventories of unsold new homes dropped for the fifth straight month. With inventories well under control and home sales ahead of starts, there is every reason to think that both housing starts and residential construction spending will be rising strongly and steadily over the rest of the year.

The only semi-negative we could find in the report was that median new-home sales prices declined. Still, that August median sales price was about equal to the prevailing levels of the last year, and average new-home sales prices are a bit elevated relative to the levels of the last year. So, even here, it is accurate to say that builders have been able to sustain demand for their product without having to resort to concessionary pricing.

Of course, the US recovery is still lagging in those service sectors still affected by shutdown strictures and Covid fears. However, in the vast majority of the economy not still subject to strictures, the economic recovery is outpacing expectations and is nearly complete.