Headline retail sales rose 0.4% in April, while the widely watched “control” sales measure was up 0.7%. (Control sales abstract from car dealers, building material stores, service stations and restaurants, as those vendors are frequented by businesses as much as by consumers.) While both gains sound impressive, they were more than fully offset by downward revisions to February and March data and by rising goods prices in April, as reported here last week.

The revisions included benchmark changes going back a number of years. The net effect on recent data was to reduce cumulative nominal sales growth over February and March by -0.2% for headline sales and by -0.6% for control sales, in other words, almost as much as nominal sales rose in April. Meanwhile, again, Consumer Price Index (CPI) data showed prices for merchandise other than food and energy up 0.6% in April. On net, then, sales in real terms in April actually ended up lower than the March sales estimates released a month ago.

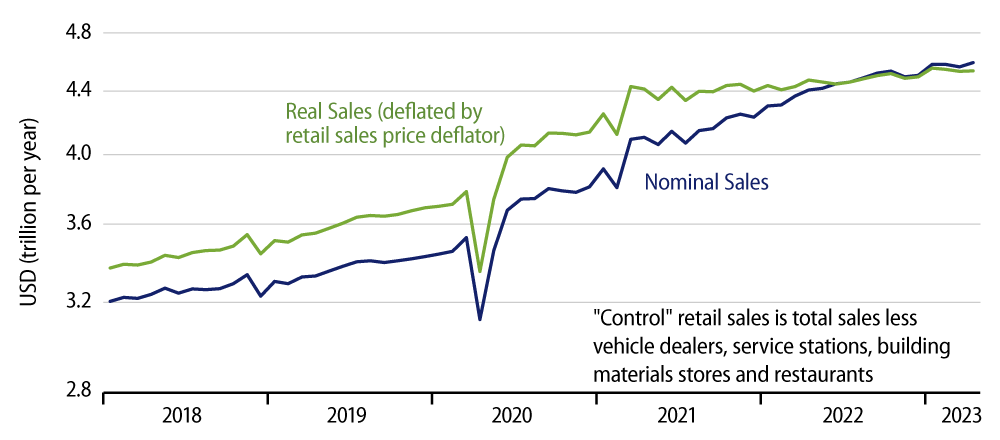

Control sales are shown in both nominal and (estimated) real terms in the chart. The indications there are that retail sales are generally moving along the same trend path that we have seen for the last two years.

This is not strong growth. As you might be able to discern from the chart, real retail sales are gradually pulling back toward the same trend growth path as was followed in 2018 and 2019, just prior to Covid, after sales activity had jumped well above pre-Covid trends in 2020 and early-2021. At the same time, however, general retail activity is NOT exhibiting the type of ongoing deceleration—or even declines—that one might expect in response to the Fed’s tightening moves.

In other words, recent retail data are likely to frustrate everyone, both those thinking ongoing economic strength necessitates further Fed hikes and those thinking a weakening economy dictate the Fed relenting from its hiking regimen. “Goldilocks” in this case is not very edifying.

Looking at individual store types, sales are growing in real terms at electronics stores, nonstore (online) vendors, personal care (drug) stores and, possibly, restaurants. Sales are declining noticeably in real terms at building material stores, furniture stores, book and sporting goods stores, clothiers and groceries.

So, consumers are cutting back on household items, but still buying iPhones. They’re scrimping on food at home, but still eating out. Similarly, despite the lack of any recent, general slowing in retail sales, thus in consumer spending on merchandise, there are various signs that consumer spending on services is slowing.

Needless to say, this is a torrent of conflicting trends. The effects of Fed hiking are manifest in a number of areas, but within the consumer sector, things are more scattered.