Fixed-Income Offers Compelling Return Potential

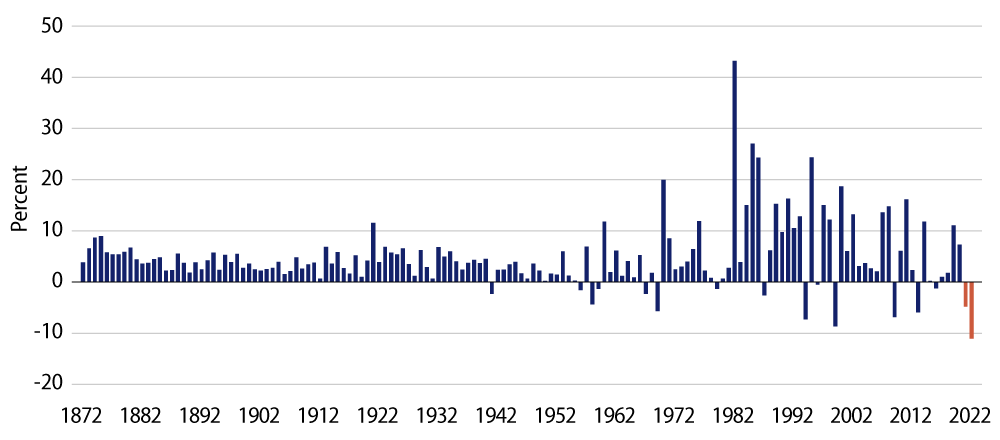

Shiller data going all the way back to 1870 confirms that 2022 was the worst calendar year for US Treasury (UST) total returns and only the second time that USTs posted back-to-back negative annual total returns. Will this trend extend into 2023?

No. We believe a third consecutive year of negative UST returns is highly unlikely. Our rationale is that in 2022 an unforeseen worldwide inflation shock combined with an aggressive and rapid response by central banks globally to make 2022 the worst year on record for the bond market. We don’t envision a repeat of this scenario given the magnitude of rate hikes already executed and increasing evidence of moderating global growth and inflation. This backdrop should support lower yields and healthier bond returns.

Fixed-Income Offers Diversification Benefits

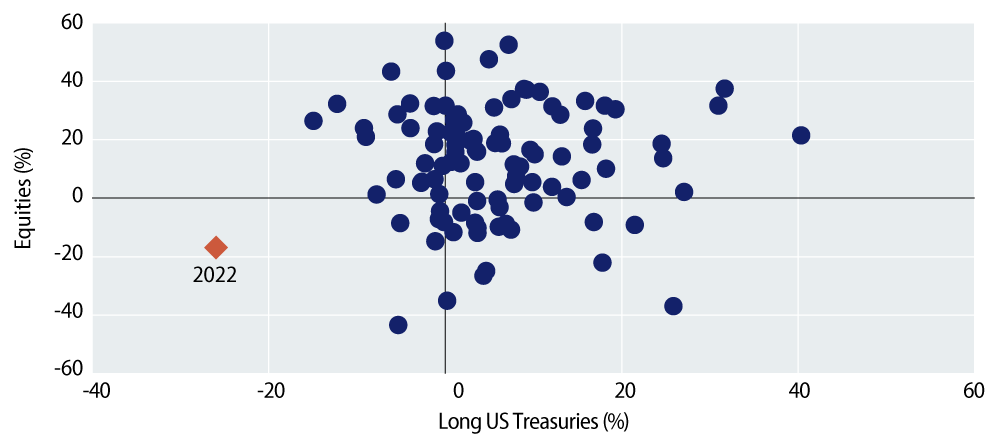

The classic 60/40 (stocks/bonds) portfolio completely failed to provide its historical diversification benefits as correlations all moved positively together in 2022. Do we expect this anomaly to persist?

No. Fixed-income’s diversifying properties are already reasserting themselves as fundamentals take center stage. The sharp decline in bond yields (notably at the front end of the yield curve) seen in March due to heightened concerns over US and European banking system stability is one indication that stock and bond market correlations are normalizing.

Fixed-Income Now Offers Less Volatility

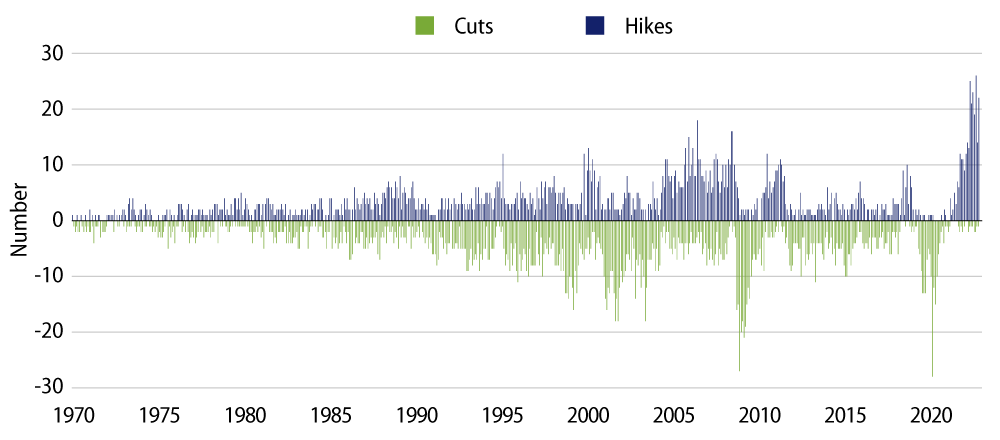

In 2022, we witnessed a historic period of monetary tightening over a very short span of time which resulted in record-breaking episodes of bond price volatility. The Federal Reserve (Fed) alone hiked short-term rates by more than 400 bps in 2022, which is unprecedented in its speed. Do we expect central banks to continue on this path?

No. The market is now looking forward to global central banks pausing (or even cutting) given the backdrop of softening global growth and inflation. This should temper fixed-income volatility going forward.

Fixed-Income Now Offers Investors More Choice

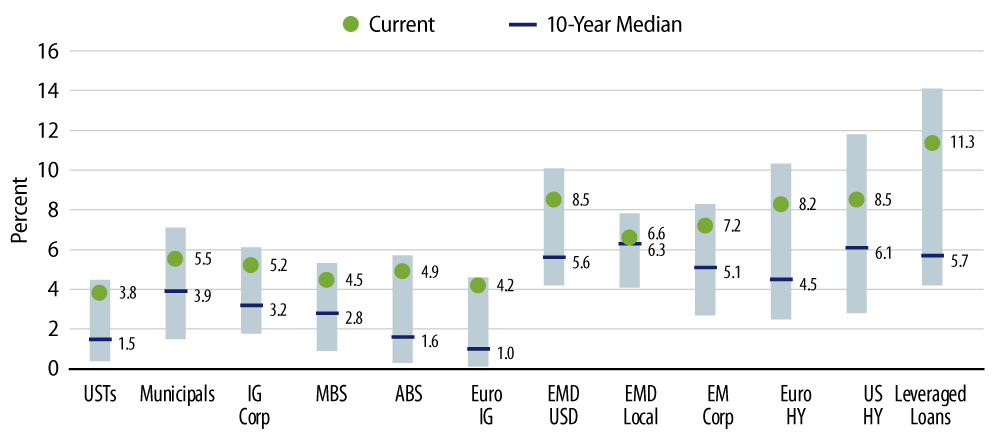

With the combination of higher rates and wider spreads having restored the forward-looking prospects for fixed-income yields, what’s a fixed-income investor to do?

Get involved. We haven’t seen this level of all-in yields going back a decade, reinforcing the idea that the starting point for fixed-income—with an emphasis on credit—in 2023 appears very attractive.