Welcome to the inaugural edition of the weekly Western Asset Municipal Monitor. Given the recent market volatility and ever-changing market conditions, we hope this new publication will provide muni investors with relevant and useful content. Our goal is to highlight the most valuable and timely information available from the 50,000+ obligor and 50+ sector muni market, while also providing our unique insight. Please contact your Western Asset representative for any questions or feedback.

Last week the municipal market was spared the pain associated with the jump in Treasury rates, as it was supported by strong flows into municipal mutual funds and bolstered by the Fed extending its reach into smaller municipalities and revenue-backed liens. This alleviated liquidity concerns for many municipalities dealing with budgetary challenges related to the economic impact of COVID-19.

The Muni Market Was Relatively Unchanged Last Week, Underperforming Treasury Strength

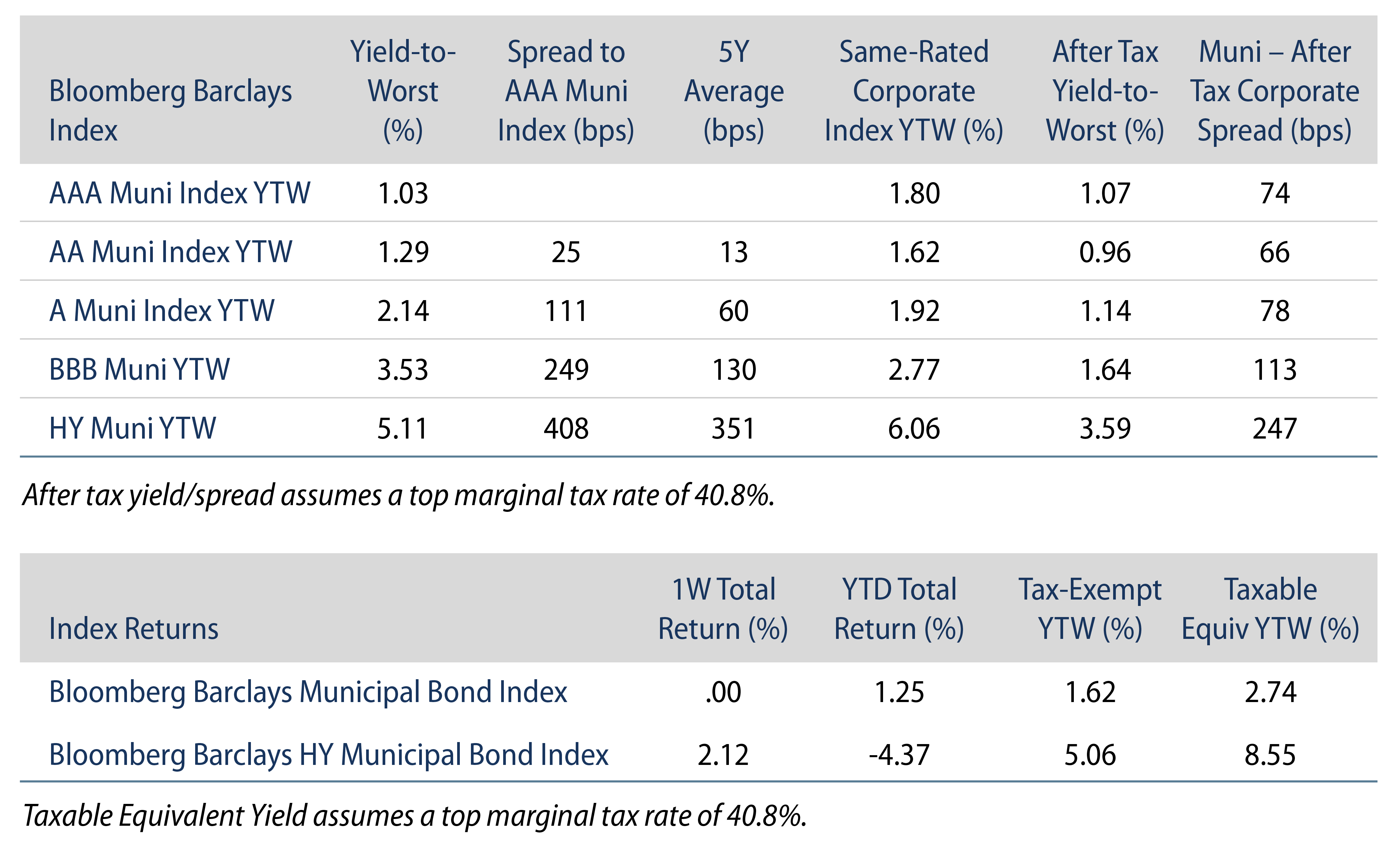

During the week ended June 5, the Bloomberg Barclays Municipal Index was unchanged from the prior week, while the HY Muni Index returned 2.12%. AAA municipal yields moved modestly higher in intermediate and long maturities. Treasuries increased 16-26 bps and brought the Muni/Treasury ratio back to normal levels after rising to nearly 500% in some maturities in March, highlighting the volatility of this widely used metric at low levels of nominal Treasury rates.

Muni Technicals Were Balanced, Considering Above-Average Supply and Fund Flows

Municipal mutual fund flows were supportive of valuations as funds reported $1.2 billion of inflows, a fourth consecutive week of inflows. Long-term funds recorded $349 million of inflows, HY funds recorded $195 million of inflows, and intermediate-term funds recorded $125 million of inflows. Year-to-date (YTD) municipal fund net outflows now total $16.6 billion.

From a supply perspective, the municipal market recorded $10.4 billion of new-issue volume last week, up 21% from the prior week. YTD municipal issuance of $162 billion is 24% above last year’s pace, primarily driven by taxable supply which is over 3x last year’s levels. We anticipate another ~$10 billion calendar next week, led by $3.5 billion of DASNY Revenue Anticipation Notes and an $800 million taxable University of Michigan transaction. We believe elevated supply conditions, paired with rate volatility, could offer attractive entry points, but will likely be met with seasonally high coupon and principal reinvestment.

The Fed Expands MLF, Opening the Door for Smaller Munis and Revenue Liens

On Wednesday, the Federal Reserve expanded the eligibility of its $500 billion Municipal Liquidity Facility (MLF) to municipalities of all populations and started carving a path for certain revenue-backed liens to access the facility.

The MLF initially had strict terms for both who can access it (counties with two million residents, and cities with one million residents) as well as pricing, which was well above market rates. The facility effectively provided a ceiling on short-term borrowing rates for the largest borrowers, and inspired confidence across the muni market. The Fed later relaxed the population standards to 500,000 and 250,000 residents for counties and cities, respectively.

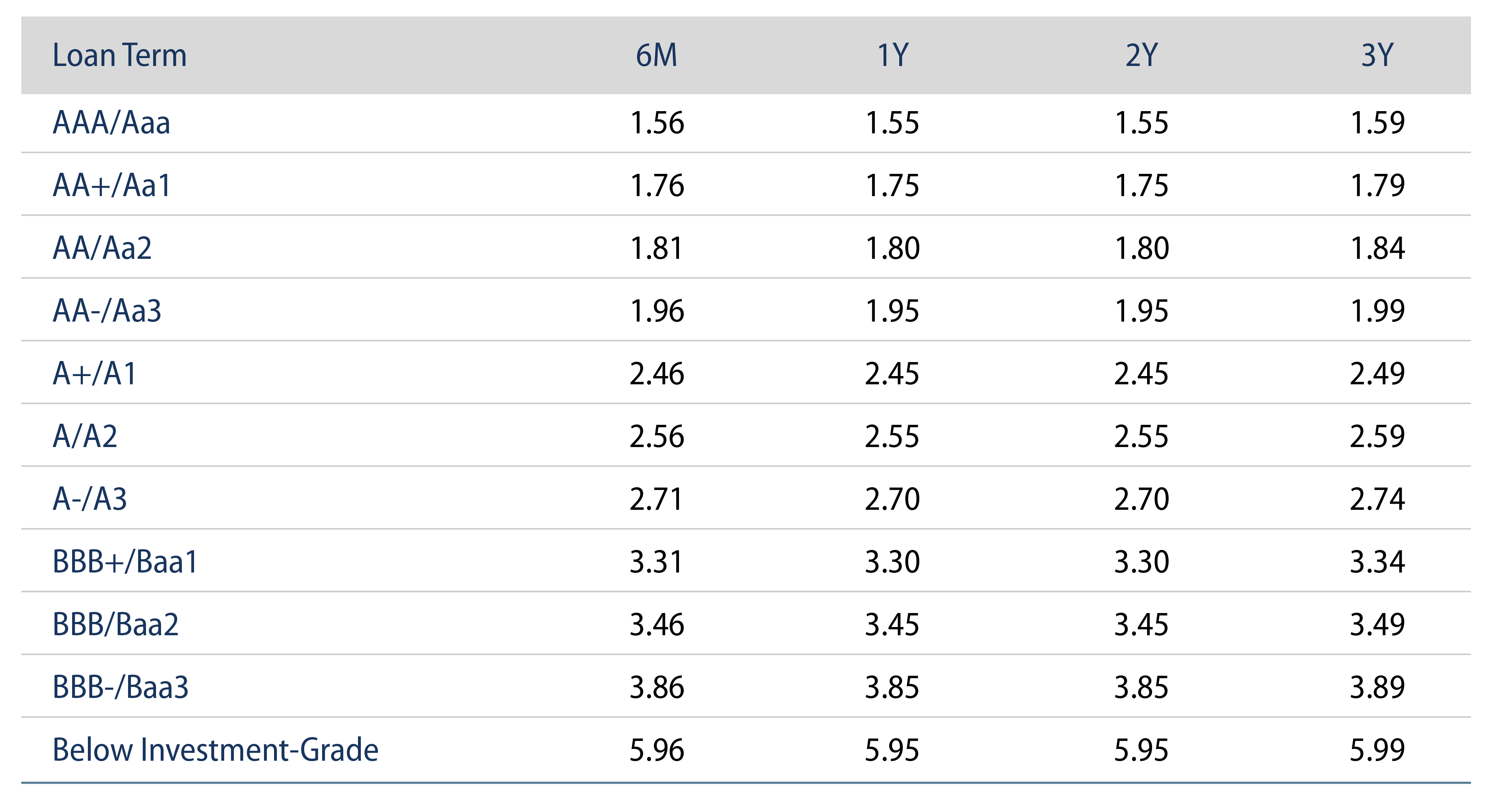

The State of Illinois was the first municipality to tap the facility this week, receiving a $1.2 billion, 1-year term loan at approximately 100 bps lower than the new-issue market offered a couple weeks ago.

This loosening of MLF standards is significant and highlights the Fed’s willingness to ease borrowing pressures on state and local governments during this crisis, and should extend the ceiling on short-term borrowing rates to large revenue issuers. For stressed municipalities with cash needs, the MLF can provide funding relief and extend any near-term liquidity challenges to the medium term, but it is not a forgivable loan nor will it be a cure for structural challenges for some municipal entities.

Considering currently low nominal borrowing rates, debt service costs are less critical than direct aid needed to weather budgetary challenges associated with COVID-19. From a policy perspective, we are more focused on the HEROES Act to ascertain the degree of direct aid municipalities will receive and inform the level of austerity measures that will take place.