Overview

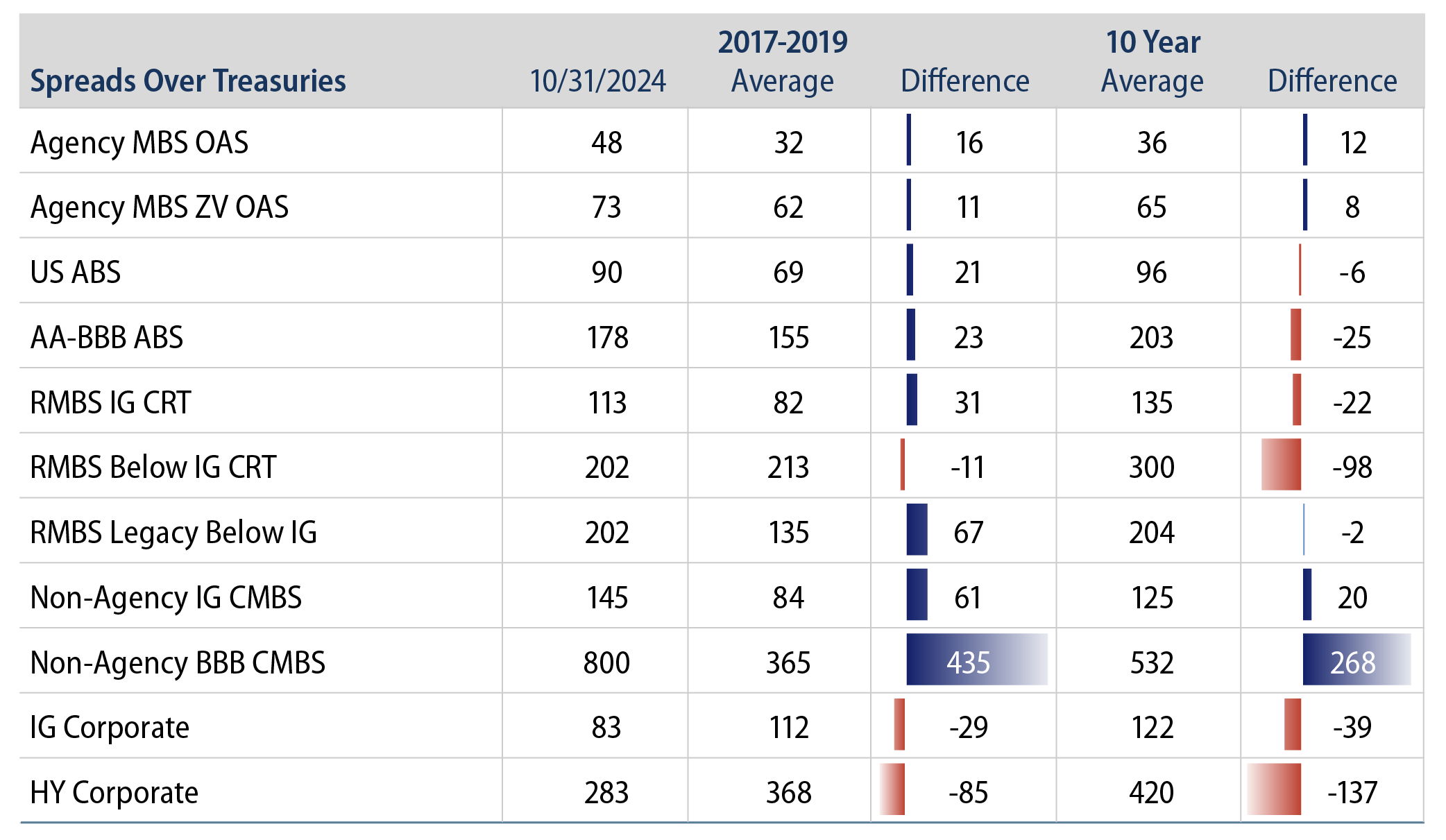

Agency mortgage-backed securities (MBS), with over $11 trillion outstanding and non-agency securitized credit markets with more than $2 trillion in size, represent almost a quarter of the US investable fixed-income universe (approximately 23%). While most investors are familiar with agency MBS, US securitized credit markets include many categories of investment opportunities with diverse structures and collateral types that offer investors the benefits of income diversification and higher yields compared to traditional fixed-income sectors. Here we highlight the reasons why investors should consider US securitized credit in their asset allocations. Currently, the spreads and fundamentals available in these sectors appear attractive in a historical context compared to corporate bonds, which offer investors the potential to achieve broader portfolio diversification and a higher source of income.

Pursue Income Beyond Corporate Bonds

US securitized credit markets represent a liquid and scalable way to express views on residential and commercial real estate loans, consumer credit and other types of receivables that may not be directly captured in corporate credit markets. In the current environment, US mortgage and consumer loan-backed securities offer attractive spreads and income advantage potential compared to corporate bonds across the credit spectrum. The diversity of collateral backing these securities and the levels of credit support, including the government-backed guarantee of agency MBS, differentiate them from corporate debt markets.

Agency MBS Are the Bedrock of US Securitized Credit

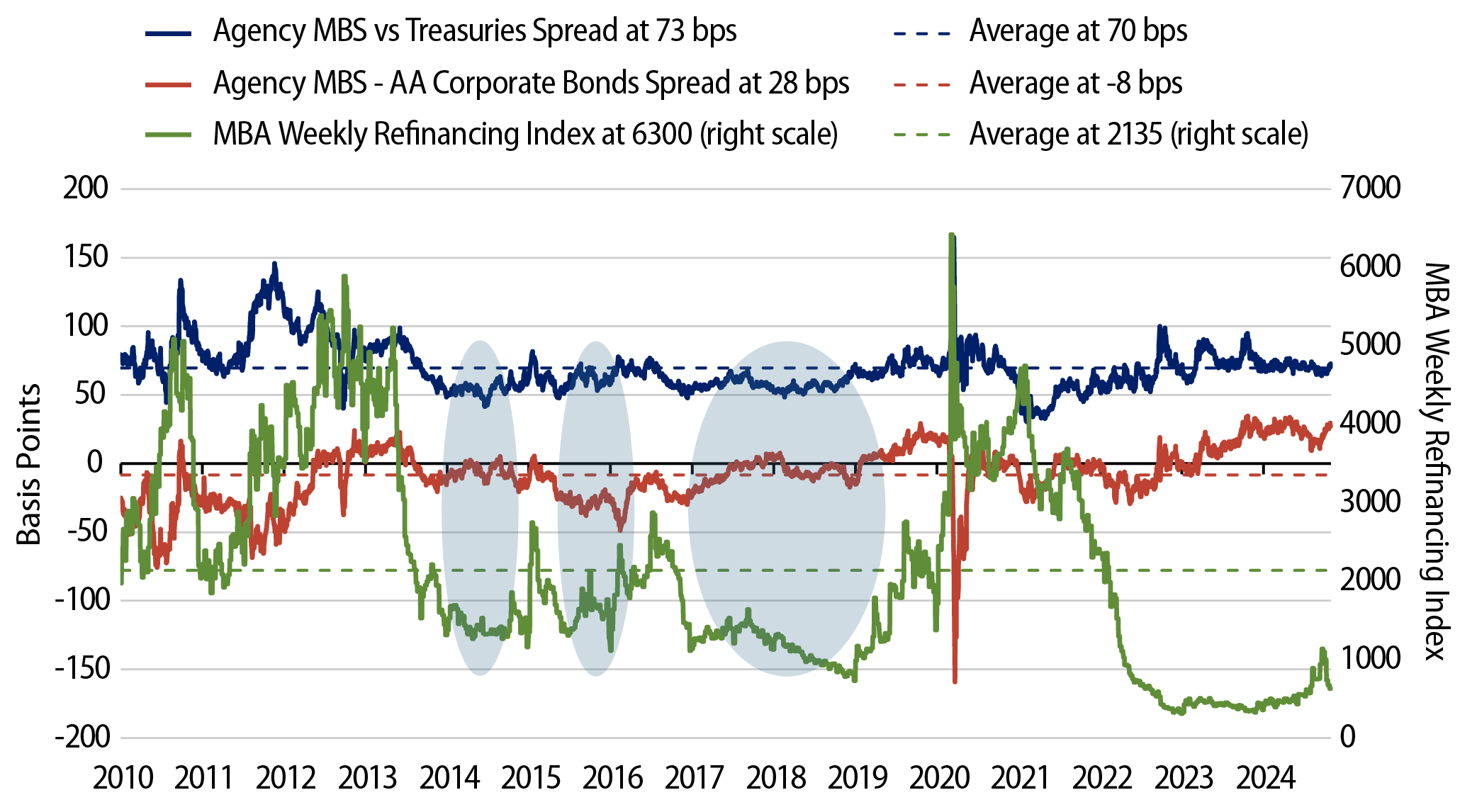

Agency MBS are issued and guaranteed by US government agencies. These agencies include Ginnie Mae, which is part of the US government (i.e., “full faith and credit”) as well as Fannie Mae and Freddie Mac, which are government-sponsored enterprises. The yield advantage agency MBS offers over US Treasuries (USTs) compensates for prepayment risk, as mortgage borrowers may prepay their loans at any time, while the agency guarantee feature removes credit risk for investors.

Going back over two decades, the present yield advantage of agency MBS relative to USTs and high-quality corporate bonds looks compelling relative to the low level of mortgage borrower refinancing activity (Exhibit 2).

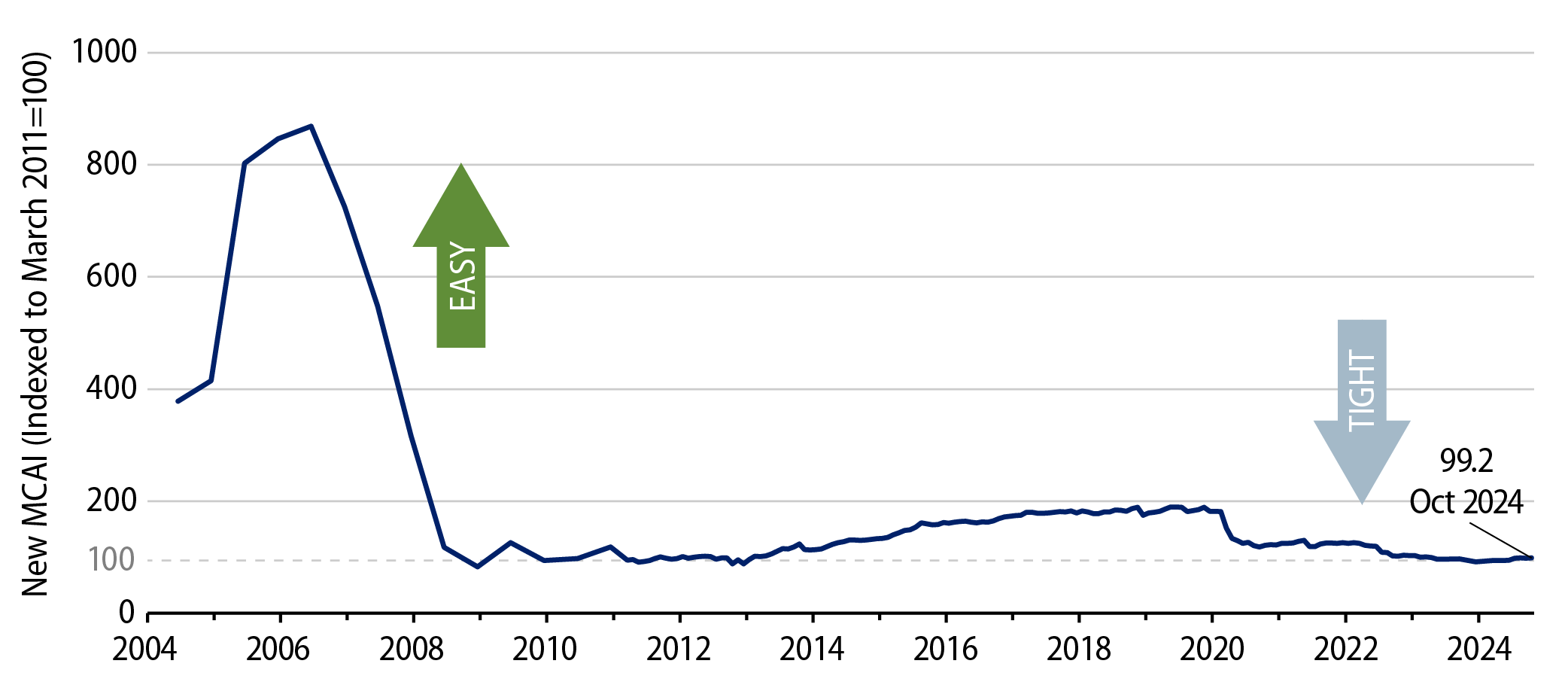

The Fundamental Drivers of US Securitized Credit Appear Sound

Since the global financial crisis of 2008, lending standards for US households and commercial real estate have been conservative. They require more equity from borrowers and higher credit and income verification—especially in mortgage lending, which necessitates a higher-quality asset class. A backdrop of economic growth, low unemployment and strong wealth effects on consumer balance sheets support delinquency and recovery profiles for US household loans while prepayment risk is limited, as most mortgage borrowers locked in historically low rates during the Covid pandemic. With prevailing 30-year mortgage rates around 6.8%, less than 10% of US mortgage borrowers have a higher rate. Limited supply of homes on the market and low affordability constraining demand underpins the outlook for residential real estate prices. On the other hand, commercial real estate markets are diverse across property types with stable to improving rent and vacancy fundamentals for apartments, hotels, industrial and retail properties, while the office sector faces headwinds.

US Securitized Credit Offers Portfolio Diversification Benefits

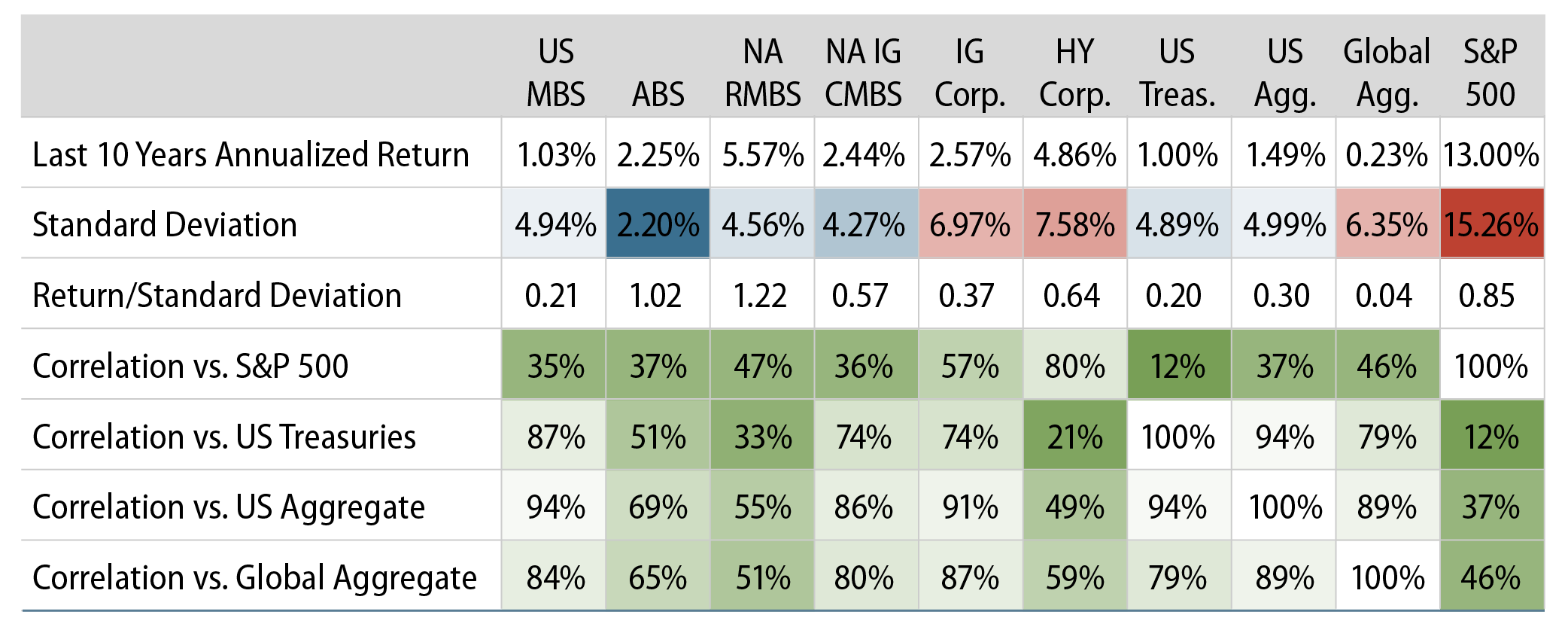

With relatively low correlations to other fixed-income sectors, US securitized credit can play an important role in optimizing a broader portfolio through diversification benefits, lower volatility and the potential for higher risk-adjusted return outcomes. Agency MBS investors exchange credit risk for prepayment and interest-rate volatility exposure. In non-agency securitized sectors, collateral backing, credit enhancements (subordination and overcollateralization) and amortization deleveraging structurally support these types of securities relative to corporate bonds.

The US Securitized Credit Universe Is Broad and Diverse

The large investable universe of US securitized credit allows for active sector rotation and security selection opportunities. With more than $11 trillion outstanding in agency MBS and over $2 trillion in non-agency residential MBS (RMBS), commercial MBS (CMBS) and asset-backed securities (ABS), subsector rotation and security selection opportunities abound with diversity in terms of structure, credit quality, yields, maturities and collateral types. With a lack of passive ETF options for US securitized credit exposure, investors can focus on active managers who emphasize collateral and structural research. Active management can shift portfolio construction to adjustable floating-rate and interest-only securities in an effort to achieve higher risk-adjusted returns in rising-rate environments or emphasize the resilience of fixed-rate agency MBS in lower-rate environments by focusing on coupon selection.