Labor markets in May turned in another month of healthy growth, with private-sector payroll jobs rising by 283,000, boosted further by a +23,000 revision to the April job level estimate. We have been projecting that job growth would soften as Covid-reopening momentum waned and as the effects of Fed tightening bit in. We’re still waiting for that development.

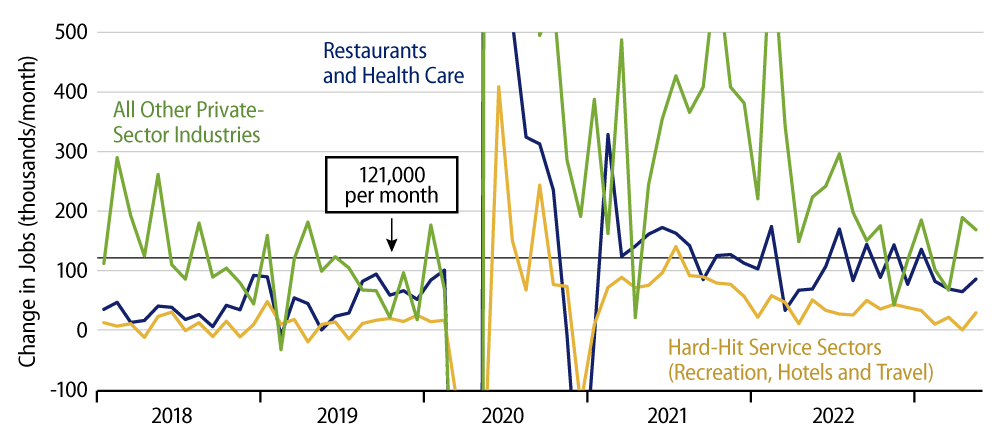

As you can see in the chart, job growth in various sectors still looks to be on a downward trend. However, the May data show a widespread bounce against that trend and even the trend rates of preceding months suggest modest growth rather than out-and-out weakness. For all three slices of the private sector shown in the chart, even abstracting from the May bounces, preceding months’ growth was right in line with pre-Covid growth trends, and, yes, the economy was doing just fine prior to the pandemic.

We don’t like being perceived as positioned against folks finding employment, but that is the position the Fed has put the markets in. Fed officials’ remarks indicate they want to see actual labor market softness before they reverse their tightening course. Recent data give no real indication of this, hence the dilemma for the Fed and Fed watchers.

There were some soft “patches” in the release, but they all were in indicators that we have denigrated in the past as being less reliable. Thus, the unemployment rate rose as the household employment series showed a decline of -310,000 jobs in May. However, we have always judged the payroll job number (taken from a survey of payroll establishments rather than a survey of households) to be a better short-term indicator of job growth trends, and its still-healthy growth is clear in the chart.

Similarly, we have paid more attention to workweek and hourly earnings data for production workers rather than for all workers, because production workers are actually paid by the hour. Well, for all workers, workweeks declined more than jobs rose, so that total hours worked declined in May, whereas for production workers, workweeks were steady and production hours worked increased 0.2%. Similarly, for all workers, hourly wages rose only 0.3%, but production workers saw a 0.5% gain.

Fed officials have recently suggested that they would hold policy rates steady at the next FOMC meeting, but that further hikes were possible in subsequent sessions. Today’s employment report had some muddy waters, but nothing to argue against a hike later this summer. We’ll see if upcoming data paint any different a tone.