Securitized products constituted approximately 37% of fixed-income securities issuance in 2021, according to data published by SIFMA.1 Despite this, securitized products are often not included in the traditional ambit of ESG (environmental, social, governance) discussion. While one reason for this could be the wide array of securitized products available, another notable consideration relates to the lack of adequate coverage by third-party data vendors.

While investors have historically applied ESG considerations to credit issuers, Western Asset recognizes that these factors are material to the evaluation of structured products as well. As such, we have created a proprietary assessment methodology for both mortgage-backed securities (MBS) and asset-backed securities (ABS). Our methodology incorporates material considerations of E, S and G factors into the credit assessment of the underlying product and allows us to identify securities with a positive impact while seeking to mitigate the risks posed by those with a negative impact. This is based on assessment of the underlying loans and ESG risks posed to the collateral along with evaluation of governance criteria for the lender and the transaction structure.

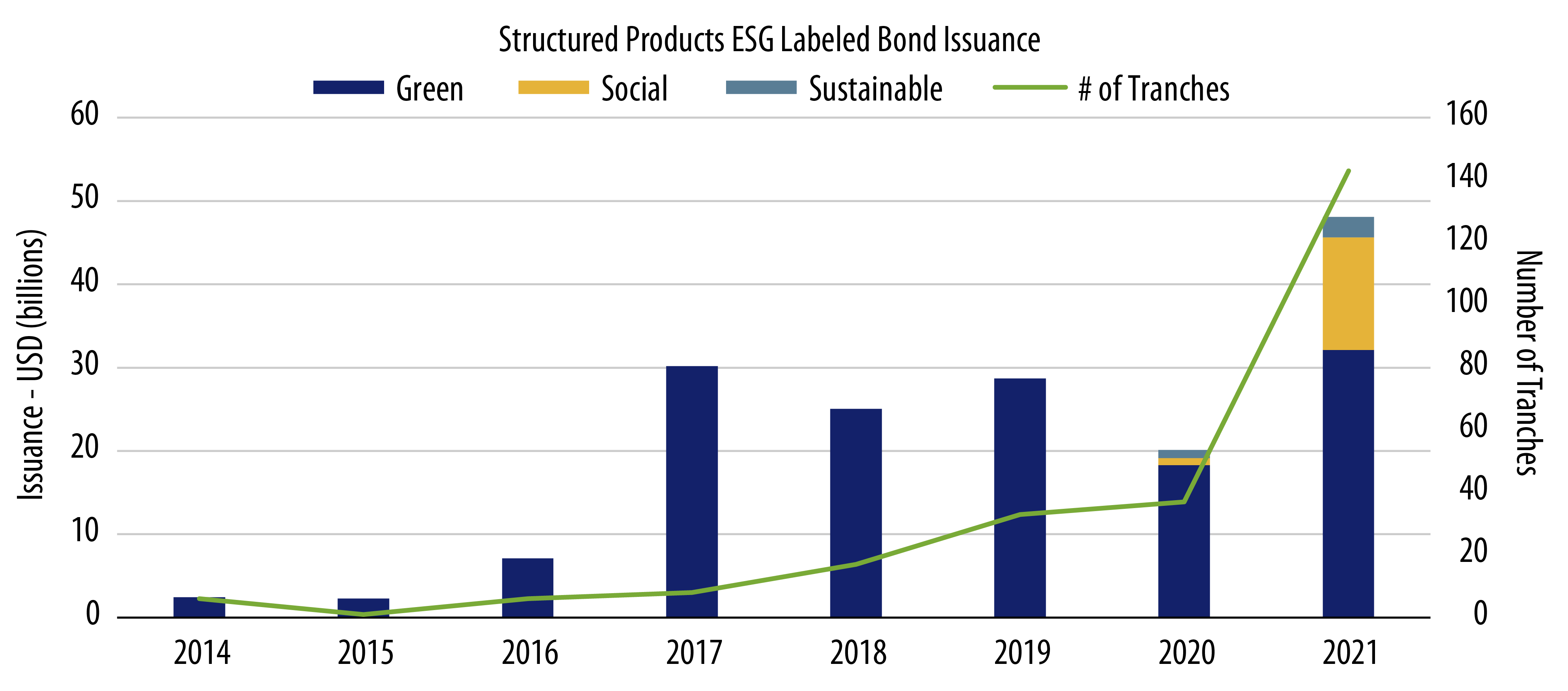

Illustrated in Exhibit 1, there has been a strong interest in Green ABS as demonstrated by issuance, which is expected to increase with time.

Environmental

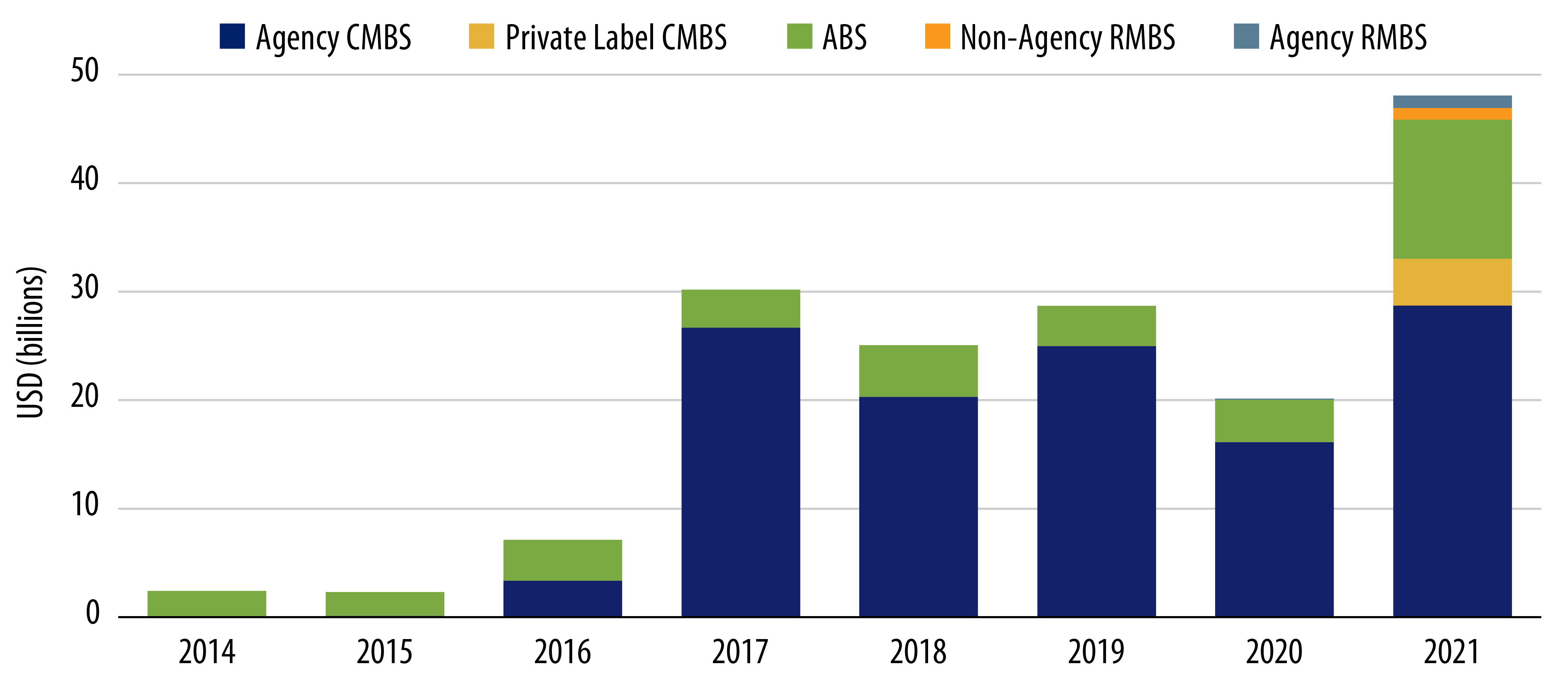

Environmental considerations include assessment of both the risks posed by physical and transition effects of climate change and any potential impact of the underlying securitized product. These include positive impact products such as Solar ABS loans, PACE (Property Assessed Clean Energy) finance or LEED (Leadership in Energy and Environmental Design) Certified commercial properties. When evaluating exposure to climate change, we also seek to assess susceptibility to natural disasters. Where we believe the concentration of collateral exposed to climate change is high, we penalize issuers or transactions with high emission collateral or negative climate impact. When seeking to understand the transition to Green ABS we note the strong issuance in multifamily CMBS and growth in areas such as Solar ABS. Residential solar loans and leases provide a strong value proposition for both the customer and the solar company. Solar loans had seen a growing demand pre-pandemic and an even stronger demand post-Covid.

Social

Western Asset also seeks to evaluate the social impact, e.g. whether the proposed development or source of financial growth is fundamentally equitable or how the additional debt impairs the consumer’s balance sheet, such as investments related to student loans. Secular shifts in consumer behavior based on evolving trends such as a rise in online shopping and the consequent impact on regional malls, are also a key consideration. The theme around demographics particularly when it comes to assessing housing affordability for low income or underserved borrowers or discriminatory lending practices such as subprime auto loans is also factored into our evaluation. While the positive impact of low-income housing through wealth built out via equity is identified and assessed, our ESG framework for structured products also allows us to evaluate susceptibility to adverse economic conditions such as the pandemic. Our framework identifies collateral that could be more susceptible to a natural disaster, by considering factors such as quality of consumer credit, built-in leverage and robustness of underwriting.

Governance

From a governance standpoint, we split our assessment into evaluation of both the lender and the transaction structure while incorporating the impact of regulatory oversight and established lending platforms. When assessing the lender, we seek to understand the management teams’ experience and track record particularly any instances related to unresolved fines, negative lending, servicing or underwriting practices. This includes seeking to assess servicing practices related to clear and verifiable compliance policy, modifications policy and practices to avoid foreclosures. From the perspective of the transaction structure, we seek to understand the strength of representation and warranties to protect against fraud, underlying collateral structure and its ability to protect from adverse tail events, as well as alignment of interest between borrowers and lenders, to mention a few key facets.

In Summary

ESG considerations form a central part of our assessment of issuers based on our proprietary ESG framework for securitized products. We believe that our approach allows us to identify securities/transactions that exhibit strong positive environmental and social characteristics with robust governance criteria while seeking to avoid those with high exposure to the risks outlined earlier. As a long-term investor in one of the largest segments within the fixed-income market, Western Asset believes that our proprietary methodology differentiates our approach from other investment managers and appeals to clients seeking to invest in securitized products with positive ESG outcomes.