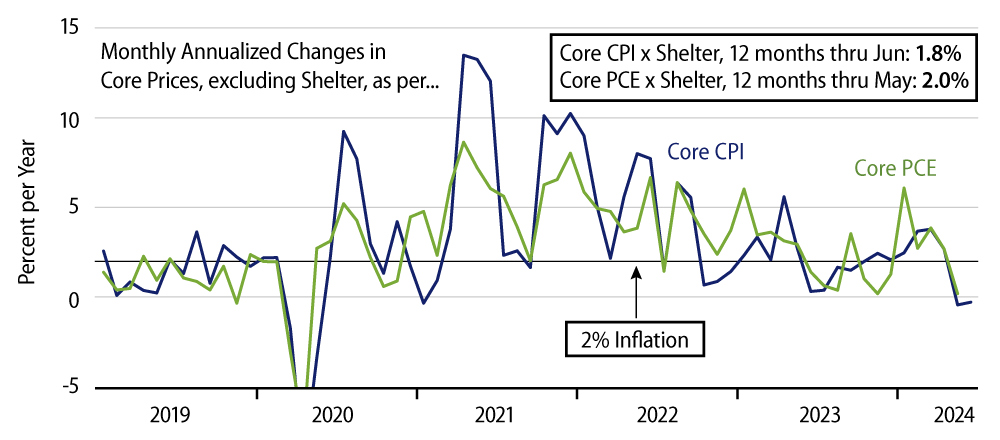

The headline Consumer Price Index (CPI) declined by -0.06% in June, with price declines occurring across a wide range of goods and services. Yes, energy prices dropped a sharp -2.0% (-21.9% annualized), and that might be credited with the decline in headline CPI, as core CPI—prices excluding food and energy—rose 0.06% (0.8% annualized). However, first, that core CPI rise is way below the 2% target the Fed has announced for core inflation, and, second, as we have emphasized continually, the core inflation figure includes reported shelter prices, which, as Fed Chair Powell has recognized, substantially lag ''on the ground'' real estate market pricing.

Excluding shelter costs, core CPI inflation also was negative in June, as it was in May as well. In fact, core CPI inflation excluding shelter has been only 1.8% over the last 12 months, so this is not a momentary phenomenon. Furthermore, the decline in core CPI ex shelter occurred within both goods and services, with core goods prices declining -0.1% (-1.5% annualized) and core services excluding shelter showing a -0.1% decline (-0.6% annualized).

When Mr. Powell first pointed out the reporting lags in shelter prices over a year ago, he acknowledged that goods inflation was already well-contained, but that services prices were still a problem, even upon excluding shelter. In response to these remarks, financial market analysts have touted core services prices excluding shelter as ''supercore'' inflation. After a January bounce, supercore CPI has been decelerating steadily this year and posted negative monthly readings in both May and June.

Speaking of shelter, after reported prices had held steady for some months at readings of 5% to 6% per year inflation, we saw moderation here as well in June. Both homeowners’ and tenants’ shelter costs were reported as rising 0.3% in June (or at 3.4% and 3.2% annualized rates, respectively). Even these rates look to be higher than what has been reported recently by private-sector real estate market analysts, so there is reason to believe reported shelter costs will moderate further in months to come.

In sum, all aspects of inflation have moderated. The components of inflation that Mr. Powell has professed to follow have been within Fed targets for over a year, and even reported shelter costs have slowed enough to bring overall core inflation within (annualized) targets over the last two months.

It is fair to say that much of the Fed’s rhetoric is intended to give wiggle room to its policy deliberations, to prevent itself from being forced into a particular response by financial market reactions. Thus, the Fed was deliberate in recognizing rising inflation two to three years ago. Its late-2021 policy pronouncements did not project any rate hikes in 2022. Instead, the fed funds rate rose 425 bps. Similarly, just two months ago, Fed officials warned that there was more work to do in restraining inflation, and current Fed pronouncements look for just two rate cuts this year.

As Mr. Powell himself said this week, there are risks to waiting to cut just as there are risks to cutting too soon. With this caveat on the table, with the recent economic data hinting at softer growth and with the broad-based moderation in inflation described here in place, the Fed has all the justification it needs for a cut—should it decide to accept it. This is not a Mission Impossible.