Municipals Posted Negative Returns During the Week

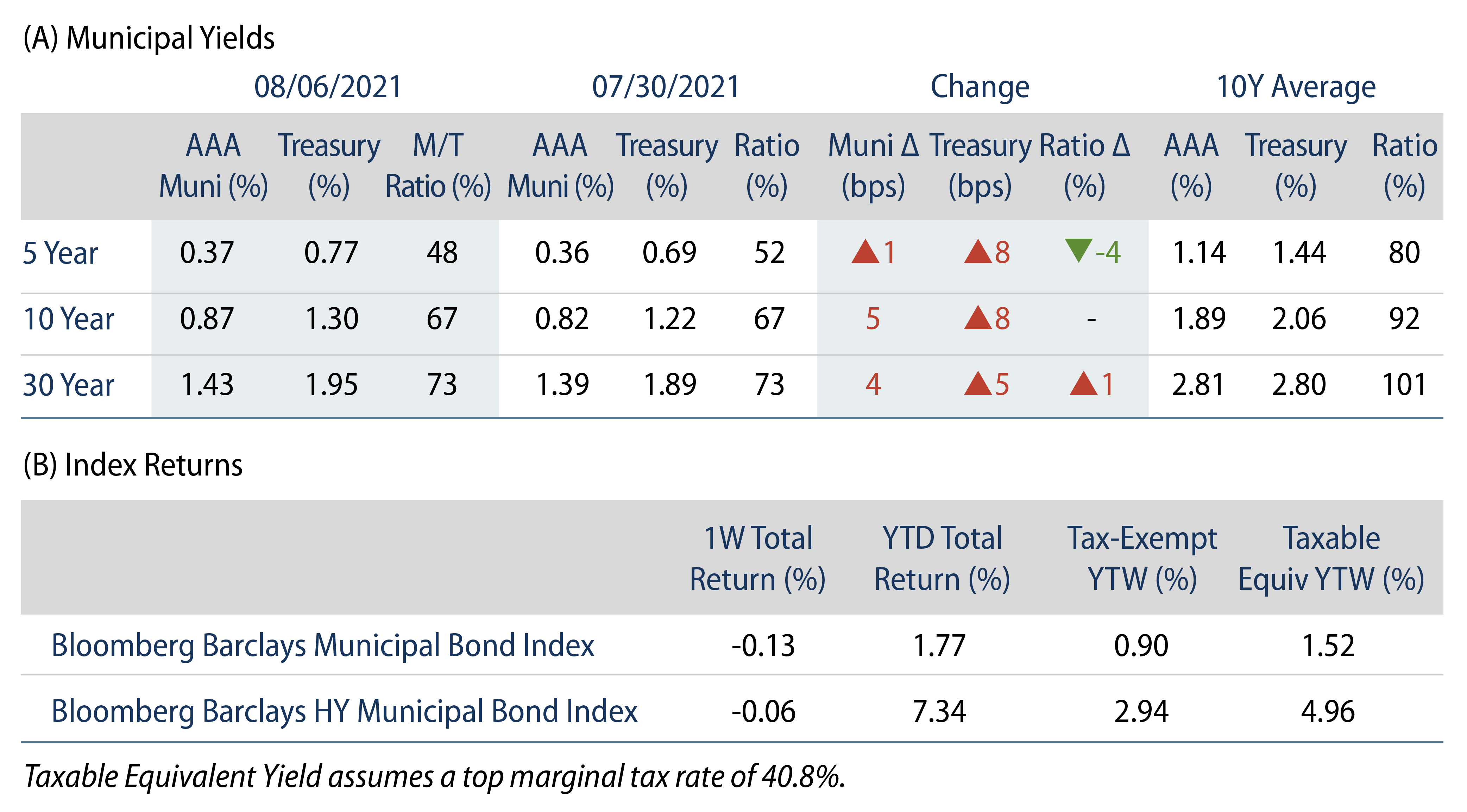

AAA muni yields moved higher across the curve which continued to steepen; yields moved 1 bp higher in 5-years and 4 bps higher in 30-years. US munis outperformed Treasuries across the curve, bolstered by persistently strong technicals. The Bloomberg Barclays Municipal Index returned -0.13%, while the HY Muni Index returned -0.06%. This week, with the summer travel season upon us and with COVID-19 in the midst of a concerning resurgence, we highlight recent trends and the outlook for the transportation sector.

Fund Flows Continue to Drive Strong Technicals

Fund Flows: During the week ending August 4, municipal mutual funds recorded $1.2 billion of net inflows. Long-term funds recorded $648 million of inflows, high-yield funds recorded $492 million of inflows and intermediate funds recorded $120 million of inflows. Municipal mutual funds have now recorded inflows 63 of the last 64 weeks, extending the record inflow cycle to $133 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $72 billion.

Supply: The muni market recorded $9.8 billion of new-issue volume during the week, up 37% from the prior week. Total issuance YTD of $270 billion is 9.5% higher from last year’s levels, with tax-exempt issuance trending 17% higher year-over-year (YoY) and taxable issuance trending 9% lower YoY. This week’s new-issue calendar is expected to decline to $8.0 billion of new issuance. The largest deals include $824 million Allegheny County Airport Authority and $450 million Triborough Bridge and Tunnel Authority transactions.

This Week in Munis: Summer Travel

The transportation sector was undoubtedly one of the most impacted sectors of the pandemic-driven lockdown, and perhaps one of the most significant as the sector is the largest revenue-backed sector of the municipal market (representing 16% of the municipal bond index). In March and April of 2020, the transportation sector was one of the most challenged sectors during the market drawdown.

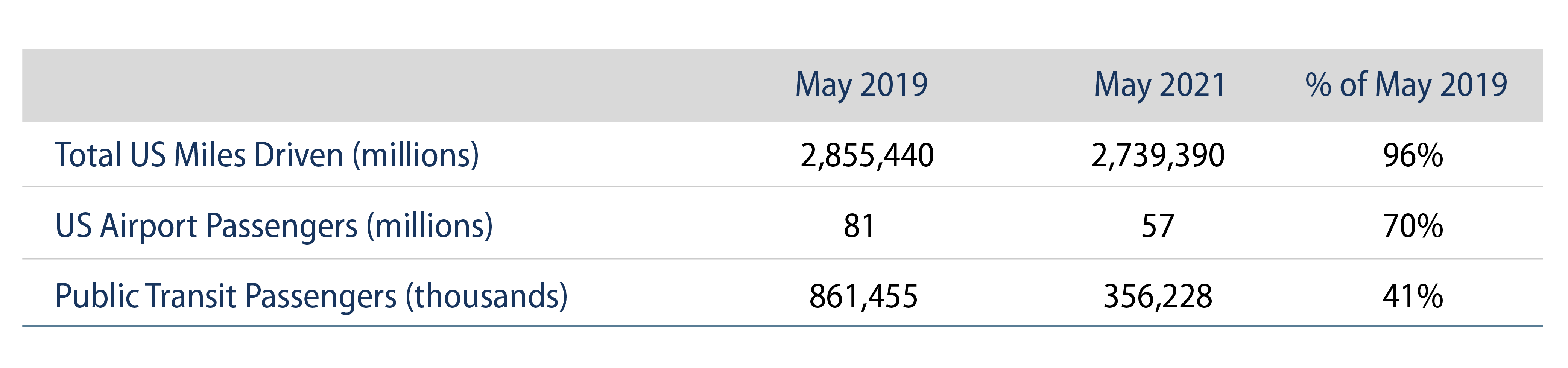

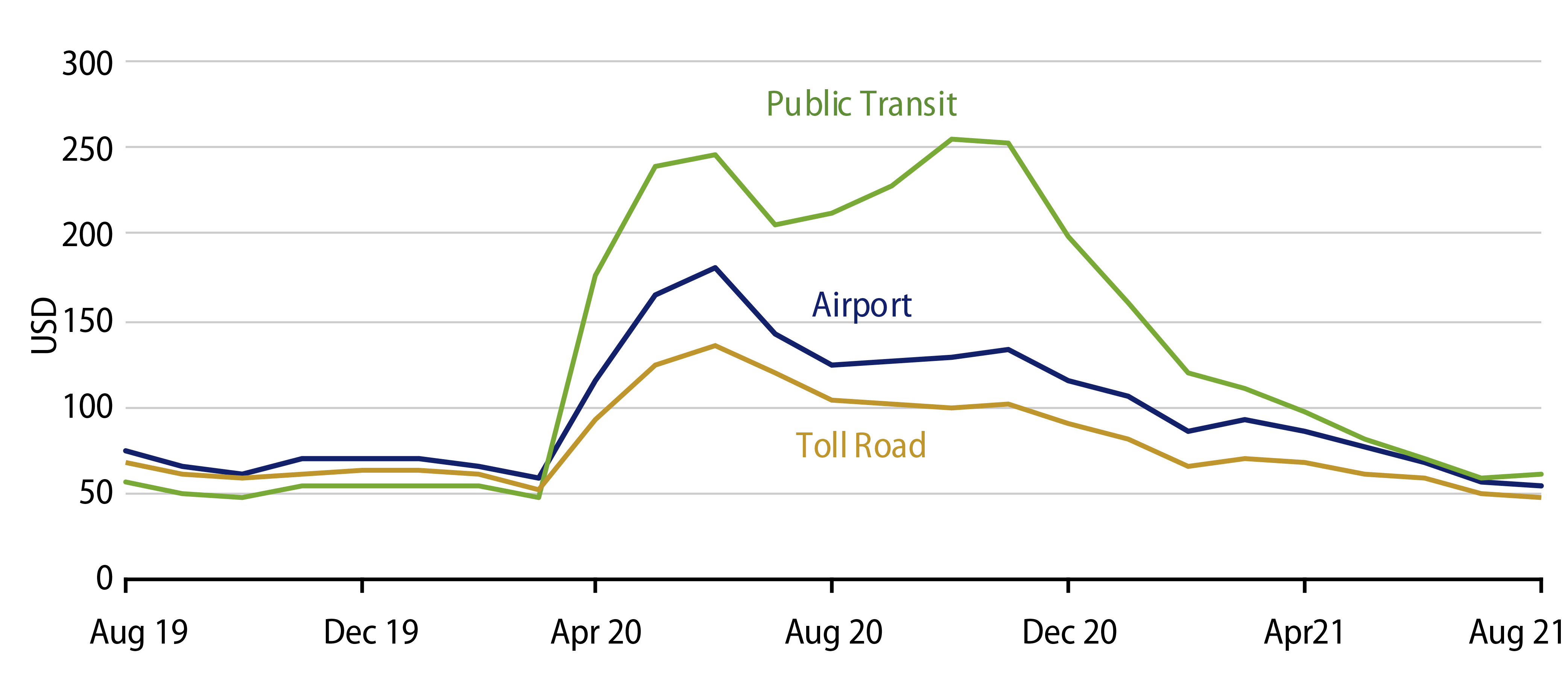

While the transportation sector as a whole comprises a relatively high portion of the municipal bond index, the sector is comprised of diverse subsectors including mass transit systems, toll roads and airports. As overall mobility and transportation utilization rates significantly declined in the spring of 2020, it was clear that within these subsectors there would be relative winners and losers in both the downturn and the recovery phases. We expected toll roads and surface transportation utilization to recover first, followed by airport and public transit travel due to individual preferences and public safety concerns.

Looking back over a year later, our fundamental expectations were confirmed as May 2021 surface travel has largely recovered to May 2019 levels. Meanwhile, airline and public transit significantly lag pre-pandemic levels (Exhibit 1). Valuations have also reflected this trend. Toll roads spreads were the least impacted through May 2020, at which point they began a consistent grind lower, while mass transit spreads continued to fluctuate to new highs throughout the fourth quarter of 2020 (Exhibit 2).

With transportation sector credit spreads now mostly recovered to near pre-pandemic levels, and with mass transit and airport spread compression clearly outpacing their respective rebounds in traffic, individual credit surveillance is increasingly important. Western Asset continues to actively stress-test individual issuers’ credit profiles, considering implications of additional COVID-19 spikes and public policy responses. However, we also recognize that the scope of federal stimulus is unprecedented, and may be further extended by the current infrastructure bill circulating through Congress which seeks to provide relief to the urban transit systems specifically. Our focus will remain on individual issuers with favorable long-term fundamentals that we expect will outperform through the uneven fits and starts of the recovery and process of normalization.