Munis Posted Negative Returns Last Week

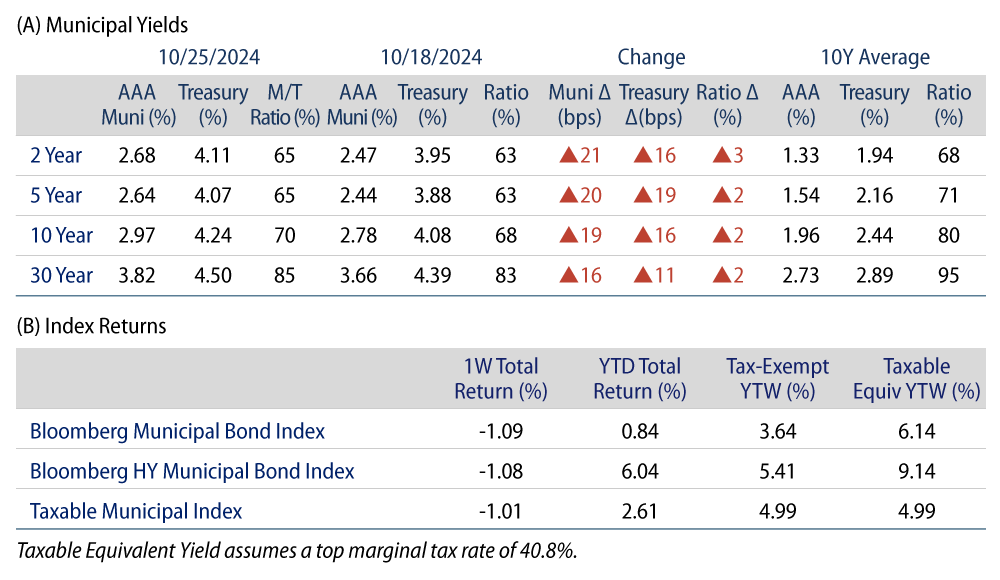

Municipals posted negative returns last week as yields moved higher in sympathy with Treasuries, but modestly underperformed on elevated supply conditions. Treasury yields moved as high as 19 bps higher in short maturities and 11 bps higher in the longer end. Last week’s macro data highlights continued economic strength, as the Purchasing Managers’ Index (PMI), initial jobless claims and consumer sentiment data all came in above consensus expectations. Rates moved higher and repriced the magnitude of potential rate cuts for the remainder of the year, but markets continued to price a high probability of the Federal Reserve cutting rates in November and December. Meanwhile, muni mutual funds recorded a 17th consecutive week of inflows. The Bloomberg Municipal Index returned -1.09% during the week, the High Yield Muni Index returned -1.08% and the Taxable Muni Index returned -1.01%. This week we highlight potential election implications of municipal securities subject to the Alternative Minimum Tax (AMT).

Muni Supply Levels Remained Elevated

Fund Flows (up $515 million): During the week ending October 23, weekly reporting municipal mutual funds recorded $515 million of net inflows, according to Lipper. Long-term funds recorded $426 million of inflows, intermediate funds recorded $115 million of inflows and high-yield funds recorded $272 million of inflows. This represents the 17th consecutive week of inflows and led estimated year-to-date (YTD) net inflows higher to $32 billion.

Supply (YTD supply of $427 billion, up 46% YoY): The muni market recorded $13 billion of new-issue volume last week, down 15% from the prior week. YTD issuance of $427 billion is 46% higher than last year’s level, with tax-exempt issuance 49% higher and taxable issuance 13% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $13 billion. The largest deals include $1.6 billion Washington State General Obligation and $1.0 billion California Community Choice Finance Authority transactions.

This Week in Munis: Election in Focus—Alternative Minimum Tax

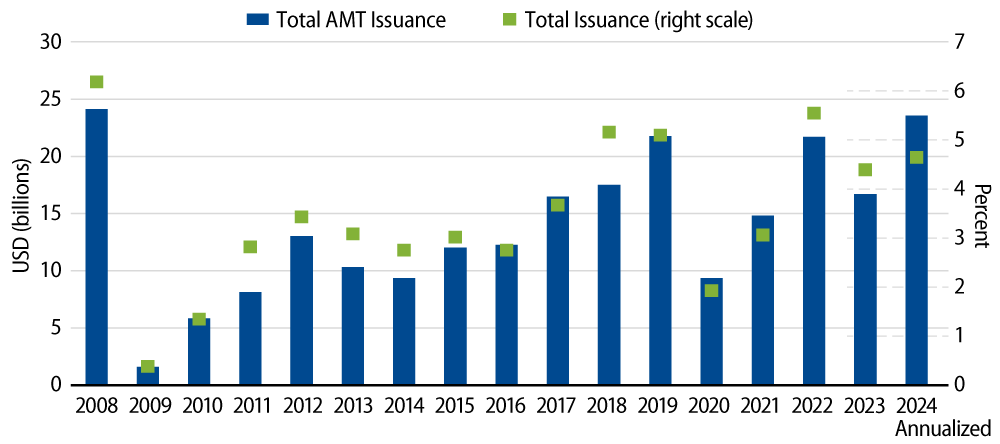

When a municipal bond is used to fund certain private activities, which can include airports, housing and industrial developments, bond interest can be fully taxable for taxpayers subject to the AMT and can result in less favorable after-tax outcomes compared to traditional tax-exempt issuance. Over the past 10 years, annual AMT issuance has averaged approximately $15 billion, or 4% of annual municipal bond issuance.

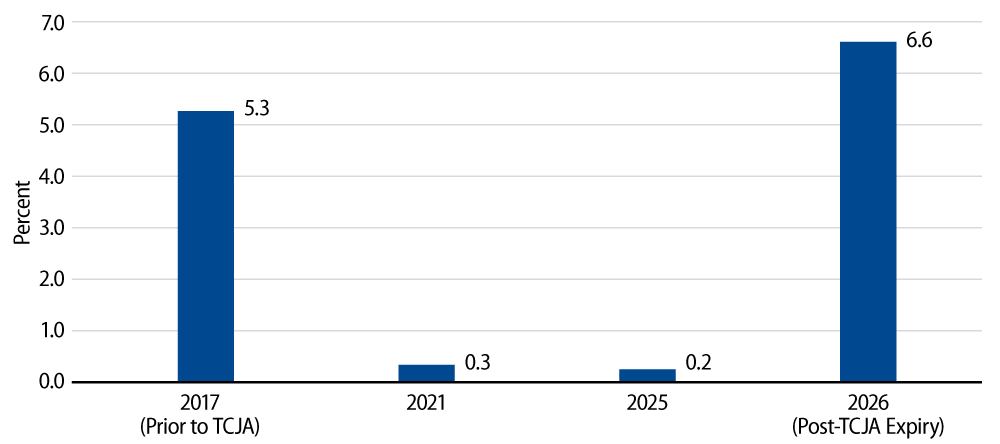

When the Tax Cuts and Jobs Act was passed in 2017, the number of individuals subject to the AMT declined significantly. According to the Tax Foundation, the percentage of taxpayers subject to the AMT dropped from 5.3% in 2017 to 0.3% in 2021. Along with other individual tax provisions that are slated to expire in 2025, the current AMT thresholds are also slated to expire. The proportion of taxpayers subject to AMT will then increase to approximately 6.6%, according to estimates from the Tax Policy Center.

As discussed in Western Asset’s 2024 Election Outlook, a Trump administration would likely seek to extend the provisions that lowered the number of individuals impacted by the AMT, whereas a Harris administration would likely welcome the reversion to prior levels, if not potentially extend the impact of the AMT to increase tax burdens on wealthier individuals.

The outcome of policies surrounding the AMT can significantly impact taxpayers invested in the municipal market. On average, securities that are subject to the AMT within the Bloomberg Municipal Bond Index offer a tax-exempt yield advantage of 0.60% compared to the broader municipal index, implying that taxpayers not subject to the AMT could find value in these securities. However, a reversion to the prior tax regime would likely fully erode this after-tax value proposition for taxpayers subject to the AMT. Western Asset seeks to navigate these dynamics throughout its actively managed strategies, considering potential client-specific implications.

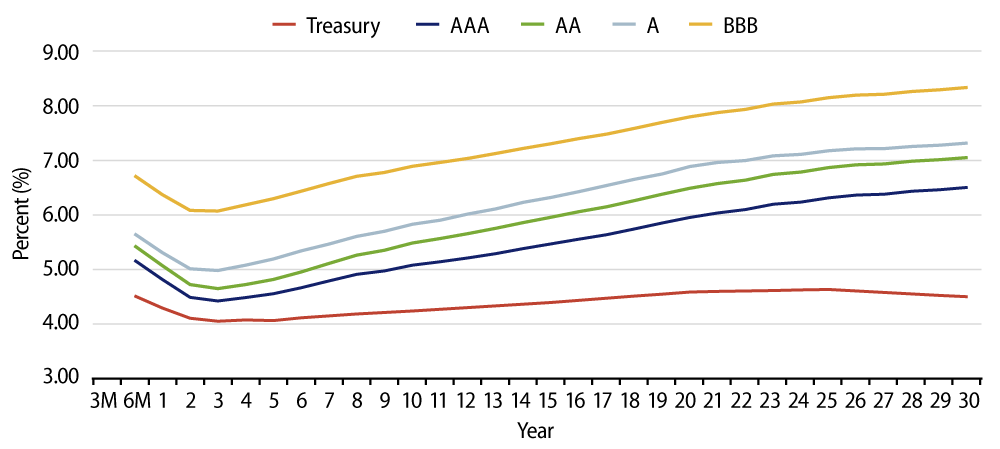

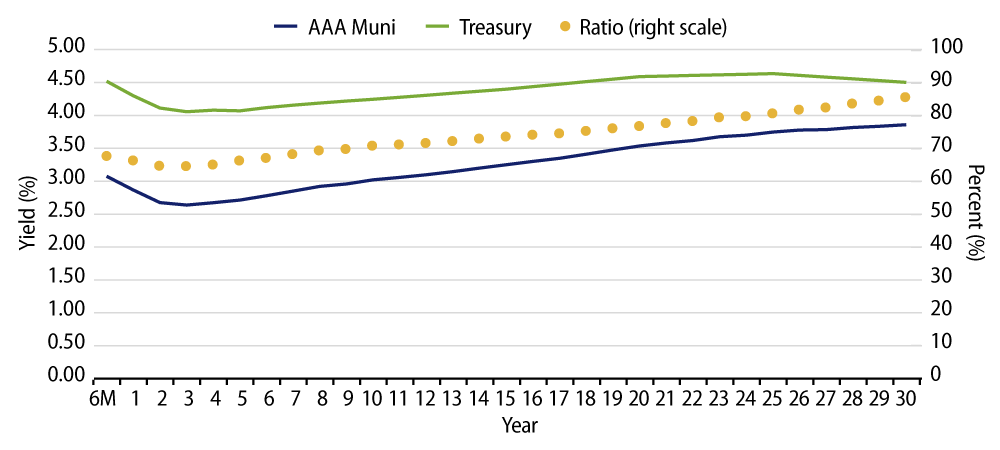

Municipal Credit Curves and Relative Value

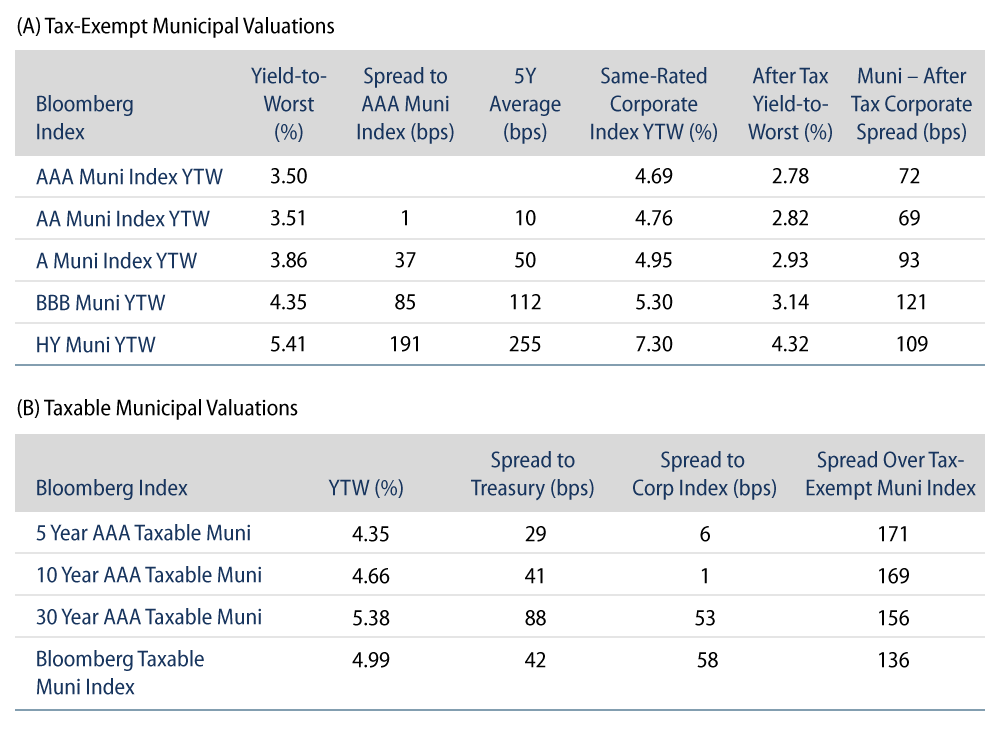

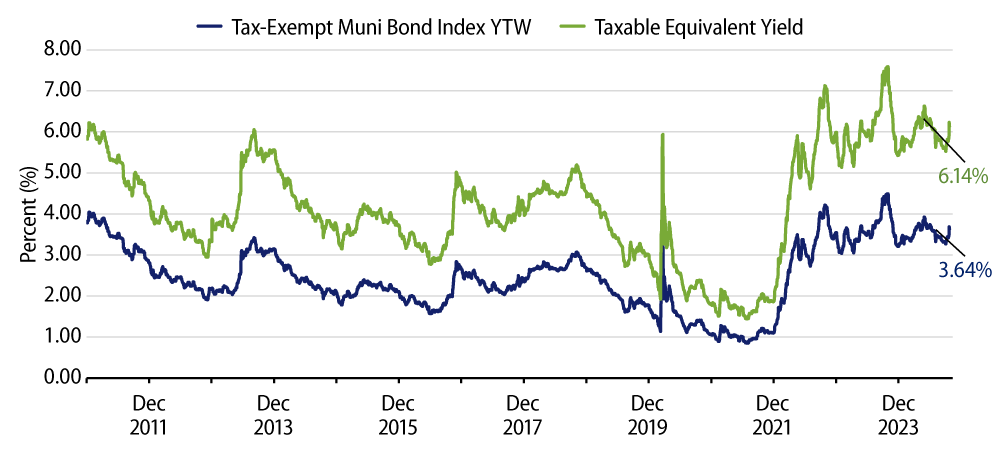

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

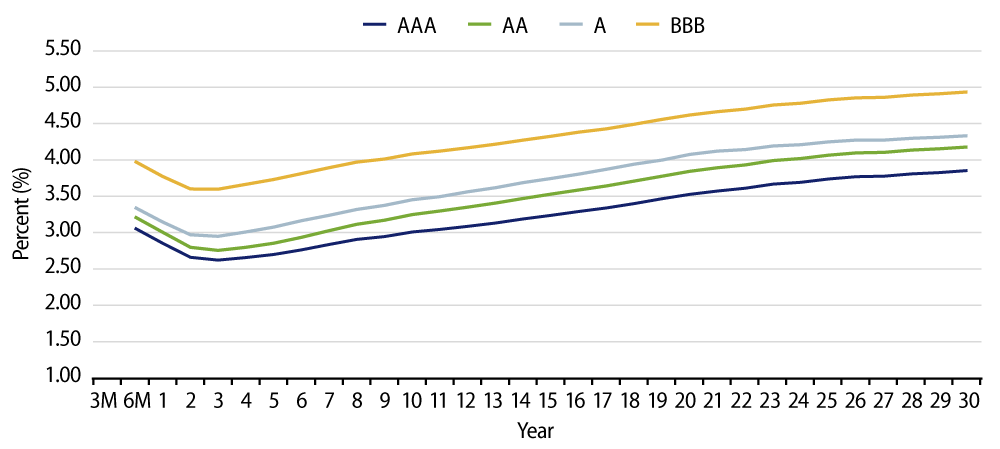

Theme #2: The muni yield curve has largely disinverted, offering better rolldown opportunity in intermediate maturities.

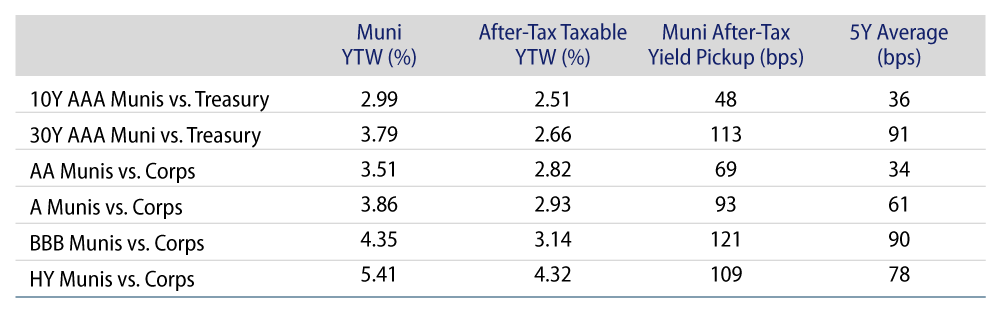

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.