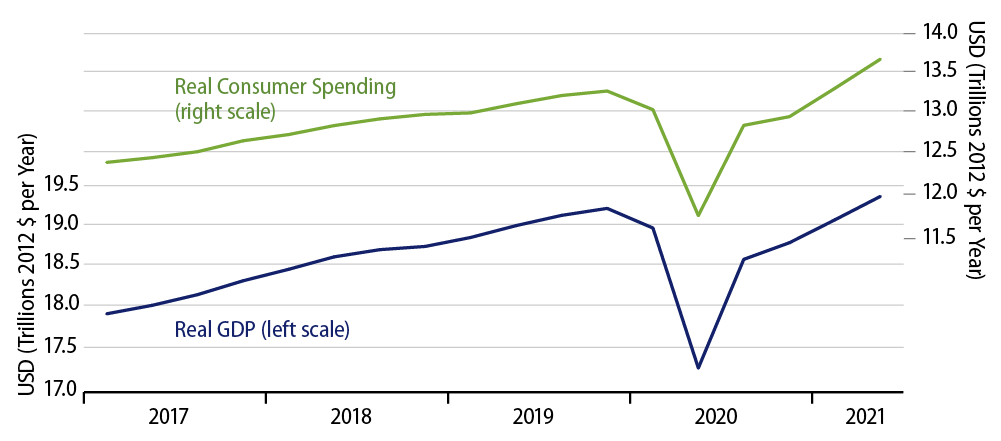

The Bureau of Economic Analysis within the Commerce Department today released its “advance” estimate for 2Q21 GDP. That release showed estimated 2Q growth of 6.5% (annualized). The release also contained benchmark revisions to the GDP components stretching all the way back to 1999, but said revisions had no visible effect on reported growth contours.

While 6.5% growth is considerable, that print is well below market expectations that appeared to be centered on 8% growth. Different analysts obviously had different components to their forecasts, but there are three likely common sources for the downside surprise: 1) a sharp drop in the growth of government services, 2) substantial across-the-board declines in construction activity, and 3) increases in price which reduced “real” growth compared to the increases apparent in “nominal” versions of various components.

The drop in government services growth reflects a flattening in the pace of Covid vaccination activity. This has increased sharply in 1Q and single-handedly added more than a percentage point to reported 1Q growth. There was a slight decline in vaccination activity—thus in government services in 2Q, so that the boost seen in 1Q turned into a slight drag in 2Q.

For construction, for example, a 3.0% rate of increase in nominal homebuilding morphed into a -10.0% rate of decrease in real homebuilding when price effects were factored in. Similar effects were seen in nonresidential and government construction.

Price effects also worked to reduce “real” growth in consumer spending, business investment and other GDP components. As we will argue in a forthcoming blog piece, the price increases seen in 2Q largely reflect catch-up from price declines experienced during the shutdown, that and the effects of rising car prices triggered by supply chain issues. Still, it should be noted that these worked to restrain real growth in 2Q21, just as price declines worked to cushion the decreases in real GDP in 2Q20.

While the headline print was below expectations, there were some interesting upside surprises within the GDP details. Consumer spending on services was noticeably higher than we expected. This suggests services spending will rise sharply in June, when said data are released tomorrow. This, in turn, suggests that reopening of various service sectors is occurring more briskly than previous data had shown.

Furthermore, investment in business equipment within the release was also much stronger than we expected. Business investment is the epitome of supply-side growth and a helpful antidote to inflation worries. It is admittedly hard to understand exactly why business equipment investment is as strong as it is, government policies being what they are, but there is no reason to look this gift horse in the mouth.

On net, the level of real GDP finally re-attained its pre-Covid peak in 2Q. Average growth since 4Q19 is only 0.5% per year, so recovery from the shutdown is not yet complete, but it is in progress.