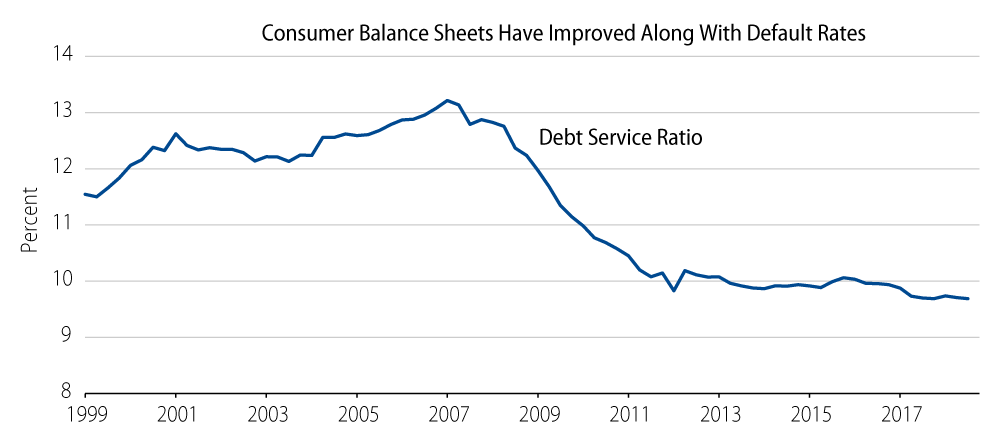

With interest rates hovering around all-time lows in the US, the balance sheet of the average US consumer is generally stronger as lower rates reduce the cost of debt servicing. Exhibit 1 illustrates how the ratio of consumers’ financial obligations relative to disposable income declined meaningfully and is now at nearly the lowest level observed over the last 20 years. While consumers have in general remained disciplined over the last decade by avoiding taking on new debt (excluding student loan debt which has grown dramatically during this time period) there is no guarantee that this will remain the case.

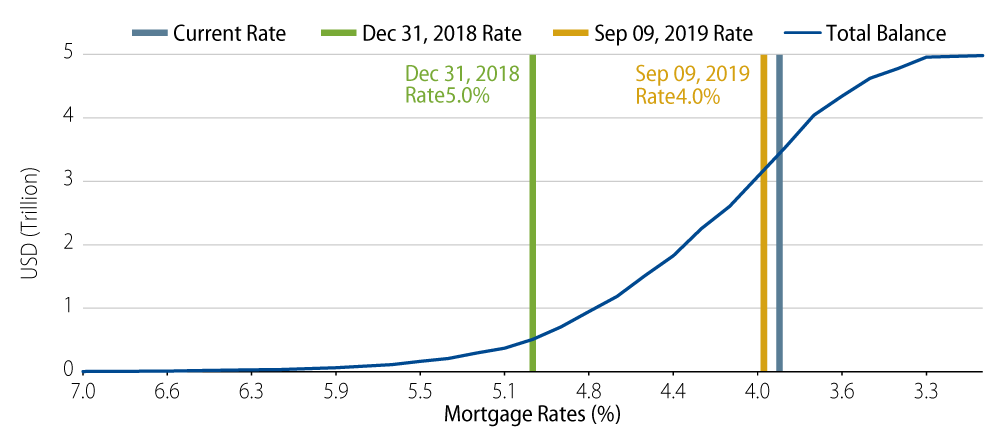

But given this backdrop, we see a potential scenario carrying enormous implications for economic growth and mortgage fundamentals: that consumers may begin to aggressively take advantage of the historically low rates and refinance their current mortgages en masse. In our view, this would be readily accommodated by loan originators looking for sources of new supply, but would be detrimental to mortgage investors.

Is a Surge of Mortgage Refinancing Ahead?

As of January 29, 2020, the current average US mortgage rate has declined to 3.85%. That means a whopping 72% of all outstanding mortgages in the US have rates higher than the current average. A little more than a year ago, only about 10% of outstanding mortgages were above the average interest rate at the time. The magnitude of the increase (from 10% to 72%) and related concerns about a sustained pick-up in the number of mortgages that will be paid off early (as borrowers take advantage of lower mortgage rates) has led the agency mortgage securities market to underperform most other fixed-income markets.

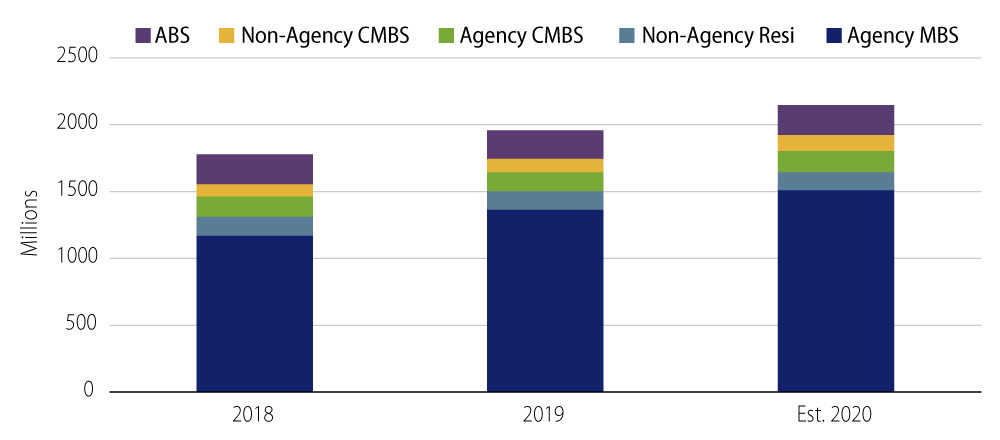

Another byproduct of the decline in interest rates has been a sustained increase in bond issuance across every part of the mortgage and consumer credit universe (Exhibit 3).

We expect gross issuance this year to increase again and cross over the $2 trillion mark. In relative terms the most significant growth has been in the non-government guaranteed residential mortgage sector. Western Asset has taken advantage of this growth by participating as both an investor in new subsectors as well as an issuer of securitizations. We have been particularly focused on non-qualifying mortgages as we view this sector to offer both compelling credit attributes as well as growth potential. In general, we expect to continue to find compelling value opportunities across the mortgage market irrespective of whether interest rates go up or down, or remain where they are today.