Global banks have not been spared by the COVID-19/coronavirus-induced fears of a global economic recession and a potential repeat of the 2008 global financial crisis. We believe that bank stakeholders have learned from the painful lessons of the past and memories of the great financial crisis (GFC) remain very much alive. However, investors now seem to be taking an extremely bearish view, expecting the rare 2008 type of financial crisis to reappear over the near term instead of a much more common economic recession. Bank stocks in both the US and Europe have fallen over 40% and bank spreads have widened to levels not seen in many years. Unlike the 2008 crisis, we expect policymakers in the US and Europe to use banks as tools to support economies. Banks are in a different place today given the adoption of a lower-risk business model, multi-decade balance sheet strength (i.e., much-improved capital, liquidity and asset quality) and the various forthcoming policy initiatives aimed at partnership with banks to help ensure economies are supported. We believe that since the GFC policymakers have learned that maintaining a functioning banking system is essential to providing the credit and confidence necessary to stabilize economies.

Bank Credit Fundamentals Today Are Arguably the Strongest in Decades

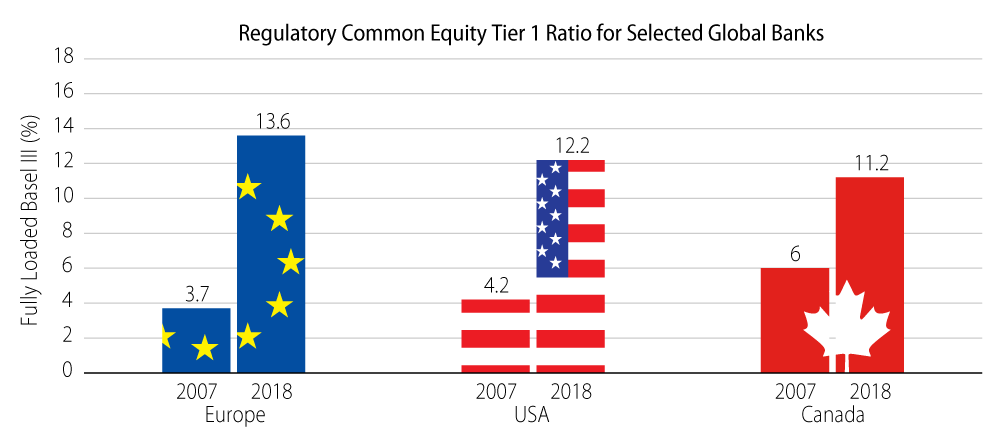

Driven by the much stricter Basel III post-crisis regulatory framework, banks have been on a journey of de-risking and balance sheet strengthening over the last decade. For example, European banks added more than €1 trillion of capital since 2007 and US banks increased their capital base by more than $700 billion, which has led to a dramatic improvement in capital ratios (Exhibit 1). We believe the comprehensive overhaul of regulation has also led to much lower risk and a bondholder-friendly business model by endorsing and rewarding lower growth, better underwriting, more conservative capital management and fewer acquisitions.

De-Risked Does Not Mean No Risk

Economic recessions remain the most significant risk banks are facing, but we believe that banks can fare much better in a downturn today than they were able to in 2008. As a result, we believe that the new, lower-risk bank business model combined with stronger bank balance sheets can hold up much better than market expectations in the event of an economic downturn scenario. A deep and prolonged recession or a replay of the GFC would of course be challenging, but global regulatory best practices and conservative stress tests over the last decade provide strong pillars to our thesis that banks have grown into a stronger, safer and simpler industry.

Our Outlook for Bank Investments

At Western Asset, we follow a highly selective and conservative investment thesis and process for identifying attractive bank investments based on the following: (1) we try to invest in the strongest banks in the lowest-risk countries that have healthy banking systems; (2) banking system results are closely linked with economic growth, standards of living, quality of regulation and market structure; (3) banks generally fail following excessive balance sheet growth from loans, acquisitions or expanding into new areas or businesses; and (4) most large bank acquisitions have failed to live up to expectations for investors, rating agencies and regulators. As a result, we remain constructive on our exposure to high-quality global banks.