KEY TAKEAWAYS

- Bank stakeholders learned painful lessons during the great financial crisis and those memories remain very much alive.

- Investors and rating agencies now seem to be overly bearish, expecting the rare financial crisis to reappear over the near- to medium-term instead of the relatively common economic recession.

- We see significant investment opportunities in both US and European banks given the continued skepticism and concerns by both investors and rating agencies.

- Due to bank stakeholders’ post-crisis caution, we believe that the new, lower-risk bank business model is here to stay.

- We believe today’s lower-risk banking business model will outperform expectations—even in an environment of slower global GDP growth and rising political risks.

- After a number of years of record earnings, we think US banks are well positioned for another record year in 2019.

Our Stronger, Safer, Simpler investment thesis has played out over the last decade since the global financial crisis (GFC), but we continue to see significant investment opportunities in both US and European banks given the continued skepticism and concerns by both investors and rating agencies. The concerns fall into four general categories: (1) the depth of business model changes, (2) downside economic risks and global growth fears, (3) improved regulation and (4) the reduced riskiness and higher quality of bank earnings. In this paper, we are revisiting and testing our constructive fundamental investment case for European and US banks.

Bottom-up Fundamentals—Stable to Improving Across the US and Europe

Stronger: Significant Balance Sheet Improvement in Capital, Liquidity and Asset Quality

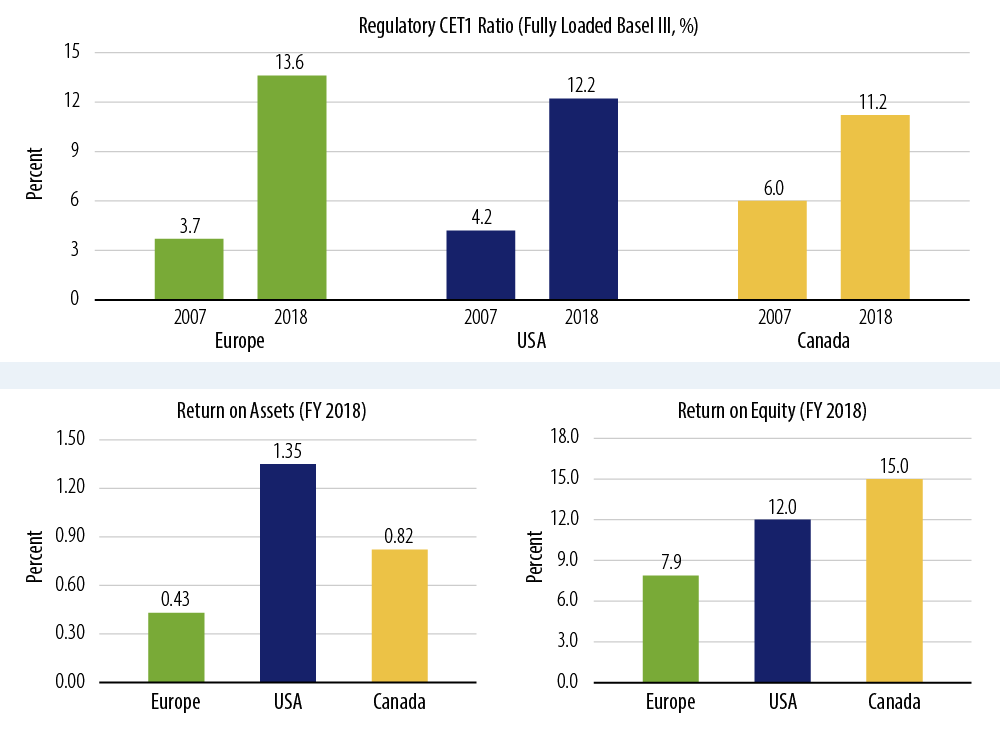

US bank earnings are currently at post-crisis highs, but underwhelming European bank profitability is gradually heading in the right direction. Driven by the much stricter Basel III post-crisis regulatory framework that requires banks to hold more and higher-quality capital, banks generally and European banks in particular, have improved their fully loaded Core Equity Tier 1 (CET1) ratios to roughly 13.6% compared with an estimated 3.7% in 2007 (Exhibit 1). In absolute numbers this means that the largest European banks have increased their common equity capital bases by more than €1 trillion between 2007 and 2018, which indicates the absolute amount of capital in the system has almost doubled since 2007. At the same time, risks from weak asset quality (the non-performing loans ratio has improved materially to 3.4% at the end of 3Q18, down from 6.5% at the end of 2014) have receded substantially and the loan/deposits ratio has fallen from 150% in August 2007 to a much healthier level close to 100%.

Capital build at the US banks has also been strong with $700 billion added between 2008 and 2018 (+54%). This translates into an increase in the fully loaded Core Equity Tier 1 (CET1) ratios of roughly 12.2%, compared with an estimated 4.2% in 2007 (Exhibit 1). In addition, balance sheet vulnerabilities from asset risks have also declined materially. Between 2008 and 2018, the Texas ratio (calculated as Non-Performing Loans ÷ [Common Equity + Loans Loss Reserves]) has fallen dramatically to 4.7% from 15.7% and the non-performing loans ratio has fallen to 1% from 3% over the same period. On the liquidity side, loan/deposit ratios for US banks have fallen from 87.2% in 2008 to a very healthy 73% in 2018.

Beyond the impressive balance sheet strengthening that has occurred over the last 10 years, the record profitability of the US banks provides another layer of protection for credit investors. In addition, we believe that based on business model changes, the quality of profits has further increased. For example, the US banks experienced their first quarterly loss in 18 years in 4Q08 with -$32.1 billion (full year net income: $10.2 billion).

US banks reported post-crisis highs in 2018 for:- Return on Equity: 12%

- Return on Assets: 1.35%

- Nonperforming Loan Ratio: 1.0%

- Net Charge-Off Ratio: 48 bps

- Efficiency Ratio: 56.3%.

Looking ahead, we believe that after a number of years of record earnings, US banks are well positioned for another record year in 2019, for which we expect earnings of around $250 billion.

Simpler: Back-to-Basics Business Models Are Well Entrenched

In the two decades before the GFC exposed the banking business model as high risk and unsustainable, banking essentially had morphed into a casino-like business. At the time, banking emphasized size, scale, high growth, diversification, globalization, transformational acquisitions with opportunistic managements exploiting questionable or weak assumptions, poor accounting practices, limited disclosure and ambivalent regulation. Size, scale and diversification were viewed as false safeguards fueling double-digit asset growth, AA credit ratings, excessive stock prices, overly generous credit spreads and bad business practices.

Banks can fare reasonably well with low economic growth or during a mild recession, but that’s not the case during a full-blown financial crisis. Importantly, investors and rating agencies now seem to be overly bearish, expecting the rare financial crisis to reappear over the near- to medium-term instead of the relatively common economic recession. We believe that bank stakeholders have learned painful lessons and memories of the GFC remain very much alive. As a result, we believe that the new, lower-risk bank business model is here to stay and we expect bank balance sheets and earnings to hold up much better than expected when the next inevitable economic downturn takes place. The requisite ingredients for another financial crisis are also missing as we have positive economic growth, relatively dovish central bank policies, conservative regulatory policies, balance sheet strength, positive earnings trajectory, minimal consolidation and lackluster balance sheet growth in recent years.

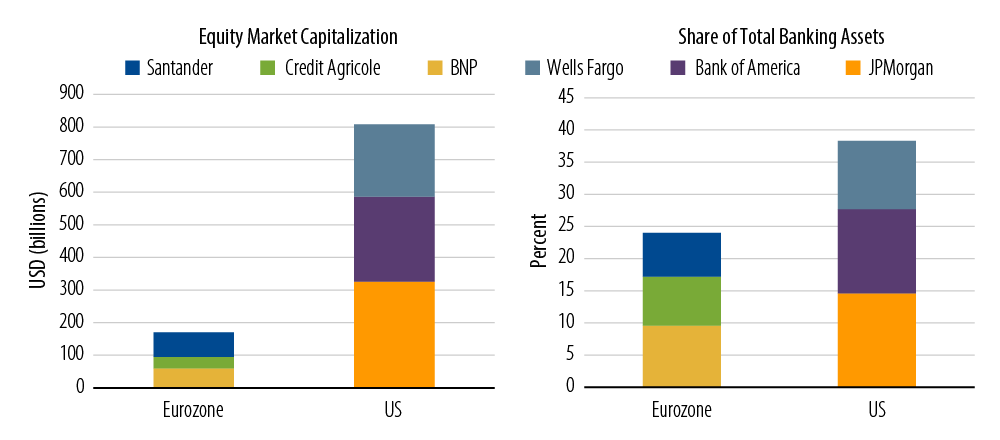

Large-scale consolidation in Europe and the US played a major role fueling the GFC a decade ago given the faulty notion that big and diversified national champions would be more valuable, lower risk, and easier to regulate and manage. Rather than adding complexity and size to their businesses, management teams remain focused on extracting the full value from the franchises they already have without pursuing rapid balance sheet growth, but instead by keeping costs to a minimum for credit, operations, funding and litigation. Rating agencies also remain skeptical of the benefits of large-scale combinations given the disappointing historical track record and apparent diseconomies of scale. Beyond simple business rationale, there are also structural as well as regulatory features such as the lack of capital fungibility, difficulties to cut costs to extract maximum synergies as well as potential increases to capital surcharges that make large-scale, cross-border M&A much less attractive.

In this context, despite continuing noise and rumors, we believe that large-scale bank consolidation will remain elusive given the troubled history of disappointing large bank mergers. While we believe that the fragmented nature of the European banking market (when compared with the US) will continue to negatively affect the system’s profitability, we continue to see little to no appetite by any of the banks’ major stakeholders to support large-scale combinations. We do, however, expect to see ongoing consolidation of smaller banks in overbanked markets, regional bank consolidation in the US as well as consolidation of weaker second-tier banks in Italy and Spain. Our view is that banks are sold, not bought, and putting together troubled banks makes their stand-alone problems even worse.

Safer: Comprehensive Overhaul of Regulation Has Dramatically Increased Bondholder Protection

In the decade following the GFC, which laid bare the shortcomings of an inadequate regulatory framework, regulation has evolved from a relatively narrow and light touch regime to a robust and comprehensive framework. This framework now covers all aspects from prudential regulation to governance standards, risk management as well as enhanced disclosure requirements. Consequently, we believe that today’s regulatory framework acts as a key safeguard for bondholders and financial stability more broadly by endorsing stronger balance sheets, lower growth, better underwriting, more conservative capital management and fewer acquisitions. We believe that financials generally benefit from “positive event risk” given today’s heavy regulation.

With the regulatory jigsaw puzzle now nearing completion, regulators have (in varying degrees) shifted their energy from over-regulation to pragmatism with more of a focus on supporting economic growth. Regulators in the US are generally relaxing regulatory requirements (especially for smaller banks), but risks of a meaningful roll-back in regulation are overstated. In Europe, we continue to see the regulatory cycle lagging the US and while we believe that “peak regulation” is now in sight, we also believe that there is little to no appetite in the regulatory community to ease regulations or to reduce capital requirements in the banking system. In this context, in Europe, authorities, regulators and the banking industry itself are still focused on solving “legacy” issues surrounding problem loans (around €714 billion for EU banks at the end of 3Q18, down from a peak of well over €1 trillion in 2015) and fixing inefficient banking system structures that exist in many European nations. As a result, we expect any change in regulation in Europe to be seen as the regulator “rounding off rough edges” (i.e., making different parts of the quickly rolled out regulatory framework more coherent) rather than interpreting these as regulatory roll-backs. When compared with Europe, US banks are generally in better shape in terms of fundamentals as the system has well overcome its legacy issues and under the Trump administration deregulation has become a major policy focus. Thus, we expect a gradual roll-back of regulation, more pragmatism and less unfriendly regulatory enforcement in the US will be inevitable.

Regulators and regulation globally continues to be driven by two major objectives:- Do not allow another financial crisis, and

- If a financial crisis occurs, shift losses away from taxpayers to investors.

Example: 2018 Bank of England stress tests are a useful exercise to gauge economic vulnerability of UK banks to a disorderly Brexit.

Stress tests have significantly gained in prominence since the GFC and are now an established part of bank regulators’ toolkits and the supervisory process. With improving credit fundamentals, stress tests have changed from primarily being a tool to identify undercapitalized banks to providing useful insights into how fundamentals are modelled to behave in a stress scenario. To illustrate the very significant resilience to economic shocks, we believe that the Bank of England stress test from 4Q18 provides an interesting and topical example given the economic uncertainties presented by Brexit.

For context, despite the uncertainties that the 2016 vote to leave the EU has caused, the UK economy has continued to expand since that decision. Unemployment is at a multi-decade low and banks’ loan losses remain at very low levels. As a result, in many ways, the UK economy could potentially enter a “no-deal” exit scenario from a position of strength. Based on what we consider are harsh assumptions (GDP falls 4.7%, unemployment rises to 9.5% and residential and commercial real estate prices fall by 33% and 40%, respectively), UK banks’ CET1 ratio would decline from 14.5% to a low of 9.2%, which would still be significantly higher than the 6% core tier-1 capital ratio (calculated under Basel II rules) that the system reported in 2007. Based on the outcome of the stress test, the Bank of England concluded that the UK banking system was resilient to deep simultaneous recessions in the UK and global economies that were more severe overall than during the GFC. As a result, we believe that financial contagion and systemic risks would be contained in a disorderly Brexit scenario.

Banks Continue to Be Arguably the Most Underrated Industry

Banking has gone from arguably the most overrated industry to one of the most underrated. One can place blame on many participants for the GFC, including the global banks. The credit rating agencies are often singled out for their part in the GFC, given their generous ratings of the full spectrum of entities—from the banks themselves to their investment conduits. Inevitably, the pendulum has swung back, maybe even too far in most cases. Large global banks are perhaps fundamentally much more resilient today than they were prior to the crisis, when they were rated much higher.

We argue that banking is one of the few industries to have become less risky over time without being upgraded from meaningfully lower levels and we would not be surprised to see these apparent inconsistencies corrected with future rating upgrades. It remains our suspicion, however, that rating agencies may be punishing US and UK banks for the past instead of rating them for the present or future. For example, when we look at the spectrum of ratings from Moody’s and S&P, we are puzzled why US bank ratings have dropped from solid AA levels for the major US banks and brokers in 2007 to high BBB+/A- ratings consistent with the world’s highest rated airlines. Interestingly enough, the major US banks and brokers are rated six to seven notches below the US sovereign Aaa rating and several notches below the senior debt ratings of A1 for Banco Santander Chile. Likewise, the UK’s Royal Bank of Scotland (RBS) was downgraded by Moody’s from Aa1 in 2007 to Baa2 currently and its senior ratings are also seven notches below the Moody’s rating of Aa1 for the UK sovereign.

Investment Thesis and Issuer Selection Process

We have a conservative investment thesis and process for identifying bank investments which is based on the following building blocks: (1) banks are riskier than sovereigns and the least risky asset on a bank’s balance sheet is a government bond; (2) banking system results are closely linked with economic growth, standards of living, quality of regulation and market structure; (3) banks generally fail following excessive balance sheet growth from loans, acquisitions or expanding into new areas or businesses and (4) most large bank acquisitions have failed to live up to expectations and investors, rating agencies and regulators will greatly limit further cross-border or transformational acquisitions by large, complex banks.

Three painful lessons learned from past experience:- The purpose of financial statements is to obtain cheap capital and rating agencies are paid by issuers;

- Bank analysts should not rely too heavily on the numbers, credit ratings or upbeat management comments;

- Scale and diversification are vastly overrated as safeguards and most bank mergers have destroyed value for both bondholders and shareholders.

Our process for choosing bank investments has a quality bias and involves the following:

- Avoiding weak countries, unprofitable and poorly regulated banking systems and second-tier banks;

- Removing tail risks upfront by identifying roughly 25 investible countries, 20 profitable banking systems within the 25 countries and roughly 50 top banks globally;

- Considering only relative value and capital structure for the top 50 banks and deeply subordinated investments only for the strongest of those 50 banks.

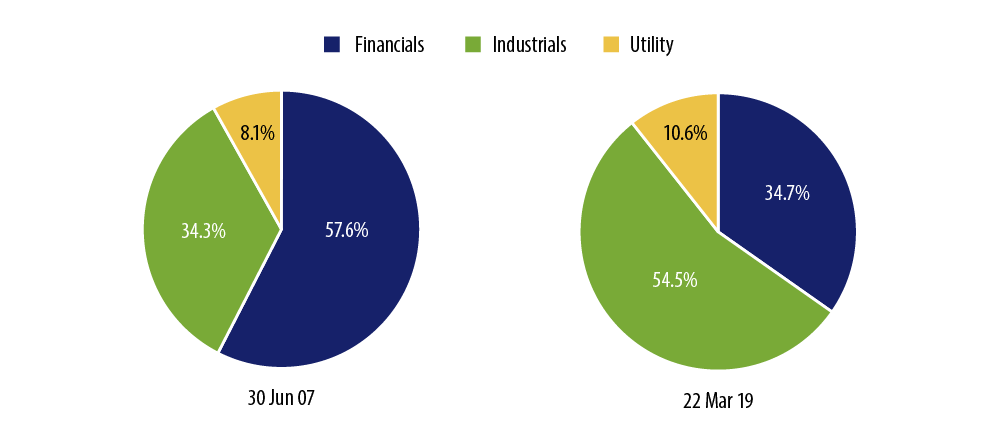

Technicals

Bank technicals for both US and European banks should be supportive of tighter spreads given that virtually all of the major banks either meet or surpass their respective requirements for capital, leverage, liquidity and TLAC/MREL. Despite heavy financial issuance in recent years, financials have fallen from roughly 58% of the ICE BofAML Euro Corporate Index in mid-2007 to 35% currently. We would expect financials to shrink further from here on a percentage basis given the following:

- Banks have dramatically shifted their funding mix from wholesale funding to deposits;

- Much of the issuance in recent years was regulatory driven and one-time in nature;

- The new business models discourage large size, acquisitions, rapid growth and high risk activities.

Not surprisingly, we expect issuance to fall from current levels and be below market expectations.

Risks to Our Thesis: De-risked Does Not Mean No Risk

“It’s the Economy, Stupid” ~James Carville, 1992

Economic recession and/or a sharp drop in economic growth—The economy is cyclical and banks are highly leveraged to economic growth. Both the US and global expansion should continue, albeit at a slower pace.

Excessive balance sheet growth driven by rapid loan growth, large acquisitions or growth in new regions or non-core businesses—Balance sheets have been relatively stable, no major consolidation expected for the largest banks and in Europe banks are still shrinking back to their core businesses and a number of major banks are still in the phase of completing extensive business restructuring programs.

Regulation and Litigation—The global financial ecosystem and regulatory jigsaw puzzle are essentially complete. Investors should benefit from stronger global bank regulation standards and less regulatory uncertainty. We expected fewer litigation- and conduct-related issues in the future; however, regulators and authorities will punish bad conduct more harshly than in the past.

Central Bank Policy Mistake/Financial Accident—Fears relate to a potential crisis of confidence and financial contagion.

Political Risk—Political risk is generally overstated, but politicians play a key role in economic growth, regulatory policies, investor risk “animal spirits” and industry market structure.

Shareholder-Focused Behavior—Regulators play a key role in protecting bank bondholders from destructive leveraging strategies (e.g., LBOs) and in limiting banks from making excess shareholder payouts via increasingly difficult stress tests for the largest banks. This is particularly important in Europe where bank returns are still below the cost of capital and bank managements face increased shareholder pressure to increase the risks banks take.

Outlook and Relative Value

We believe that the secular de-risking of the global banking business model since the GFC has been successful and that as a result, banks have become stronger, simpler and safer. Together with tighter regulation, closer supervision, better internal risk controls and our view that risks of regulatory roll-back are overstated, we remain more constructive on bank fundamentals than the market and rating agencies. We believe that today’s lower-risk banking business model will outperform expectations—even in an environment of slower global GDP growth and rising political risks.

Furthermore, our constructive fundamental view is supported by the following:- US bank earnings should reach record levels in 2019 given the following tailwinds: solid economic backdrop, lower corporate tax rates and friendlier/more pragmatic regulation.

- European banks’ asset quality dynamics should remain positive, driven by slow but continued positive economic growth, continued investor appetite for large scale NPL disposals, very low interest rates supporting debt affordability and the regulators’ strong focus on banks to further reducing non-performing exposures.

- Upward ratings pressure (e.g., Moody’s and S&P US bank ratings).

- Benign technicals (i.e., lower US bank issuance) and attractive valuations.

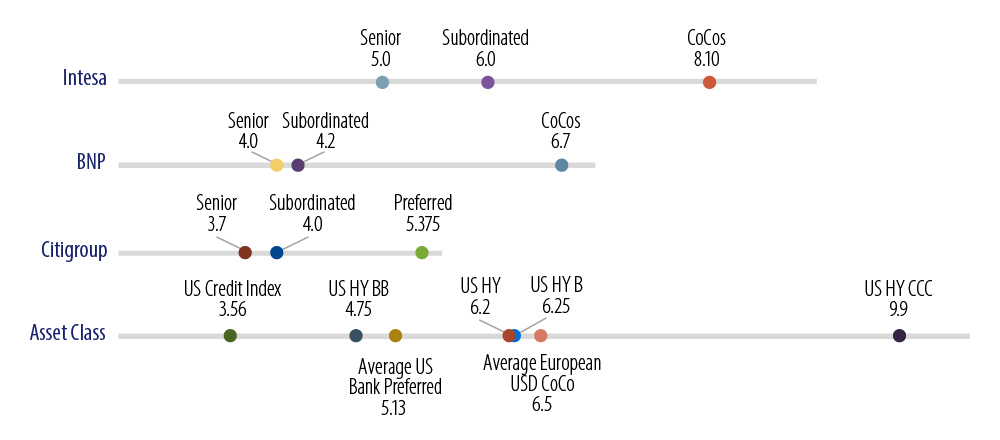

Given these factors, we believe that banks in the US and Europe offer significant investment opportunities across the capital structure (Exhibit 4). We favor a selective overweight position across the capital structure for the highest-quality US and European banks.