US Liquidity and US Short Duration Strategies

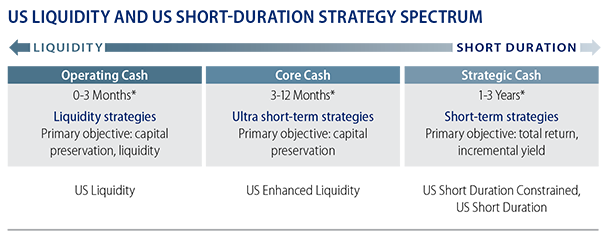

The Western Asset US Liquidity and US Short Duration suite of strategies provides solutions for Operating Cash, Core Cash and Strategic Cash needs. These strategies span the liquidity, maturity and risk spectrum from extremely conservative (US Liquidity and US Enhanced Liquidity) to those that combine a conservative base with the intention of generating returns incrementally higher than just cash (US Short Duration Constrained, US Short Duration). Maturities range from extremely short (0-3 months) out to the 1-3 year range for US Short Duration Strategies. Whereas the most conservative strategies will mostly be comprised of US Treasuries and government securities, those further out the risk spectrum may utilize a broader investment set.

US Liquidity

- US Liquidity Strategy Summary

- Liquidity and Short Duration - ESG Brochure

- US Money Market Funds

- WA USD Liquidity Fund

US Enhanced Liquidity

US Short Duration Constrained

US Short Duration

- US Short Duration Strategy Summary

- Liquidity and Short Duration - ESG Brochure

- WA Short-Term Bond Fund

- WINC: WA Short Duration Income ETF

- WA Ultra Short Income Fund

Thought Leadership

- Changes Are Coming to Money Market Funds (Again)

- Short Duration Strategies at Western Asset, an Interview with Nick Mastroianni

- A Look at the Fed’s Reverse Repo Agreement

- LIBOR Transition Update—When Does the New Term Begin?

- LIBOR Transition Update—Final Dash to the Finish Line

- Federal Reserve Policy and Front-End Rates—How Low Can We Go?

- Segmentation and Horizons Within Short-Term Investment Strategies

- Breakeven Forecasting for Prime Money Market Funds

- The Role of Asset-Backed Securities in Short-Term Portfolios

- A Long-Term Plan for Short-Term Investing