KEY TAKEAWAYS

- ABS are financial notes backed by the income stream generated from a pool of assets, such as credit card receivables, automobile loans and leases, and student loans.

- Different tranches issued from a single ABS trust can be structured so that they offer different risk and return profiles, allowing investors with different risk tolerances and return objectives to benefit from the same pool of assets.

- ABS can be an effective complement to government bonds, commercial paper and corporate bonds due to their quality, liquidity, diversification and risk/return characteristics.

- Western Asset believes that AAA rated credit card, automobile, equipment and student loan ABS are the most appropriate sectors to add to short-term investment-grade fixed-income portfolios, although other senior ABS may also be considered for greater diversification and return opportunities.

- Western Asset has been managing short-term fixed-income portfolios since 1975, and our proprietary research and consultative approach with clients distinguishes our Firm in this area.

At Western Asset, we believe that adding asset-backed securities (ABS) to our short-term fixed-income portfolios is in line with our key objectives. Namely, these objectives include the preservation of principal, maintaining adequate liquidity and generating a competitive level of yield. ABS also offer several additional benefits when compared with more traditional sectors, including diversification, payment stability and market liquidity; this can help enhance the overall risk and return framework of portfolios.

What Are Asset-Backed Securities?

Asset-backed securities are financial notes backed by the income stream generated from a pool of assets, such as credit card receivables, automobile loans and leases, and student loans.

ABS programs are created by lenders such as banks or other financial institutions to diversify their sources of funding, free up capital for additional lending and reduce their borrowing costs. Assets are transferred from the originator or lender’s balance sheets into a trust that issues one or more notes sold to investors. This enables lenders to raise funds to finance the purchase of more assets, typically in a more cost-effective way than would be possible on the strength of the originator’s balance sheet alone. One mechanism that helps accomplish this is credit enhancement.

Credit enhancement, a feature present in all ABS deals, is designed to raise the credit quality of an ABS tranche above that of the sponsor’s unsecured debt or that of the underlying asset pool, enabling them to issue debt at a lower cost of funds than in the unsecured debt market.

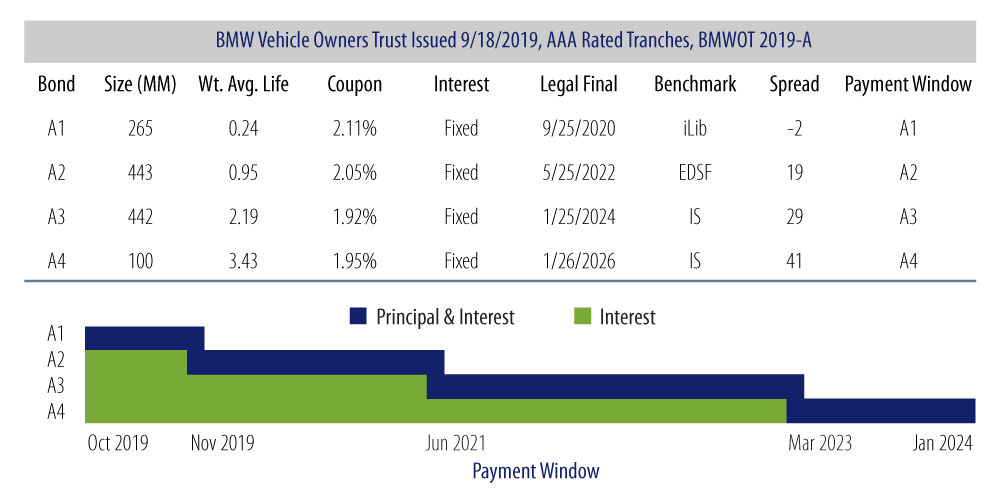

Different tranches issued from a single ABS trust can be structured so that they offer different risk and return profiles. This allows investors with different risk tolerances and return objectives to benefit from the same pool of assets. Each note has its own coupon, maturity and expected cash flow characteristics. Securities are grouped into tranches based on expected payment window and credit quality. The payment streams from the underlying assets (e.g., credit card receivables, loans, leases) are used to pay interest and principal on the securities based on a schedule that dictates priority of payments among the various tranches.

Benefits of ABS Securities

As an asset class, ABS can offer an array of benefits to short-term portfolios. The asset class can be an effective complement to government bonds, commercial paper and corporate bonds due to its:

- Quality: AAA rated ABS has low credit risk. Securities are relatively well protected through credit enhancements and are designed to withstand losses of multiple times those expected on the underlying assets. In most cases, the level of losses that can be withstood is in excess of the worst historical experience for each respective issuer, which in many cases was during the financial crisis a decade ago.

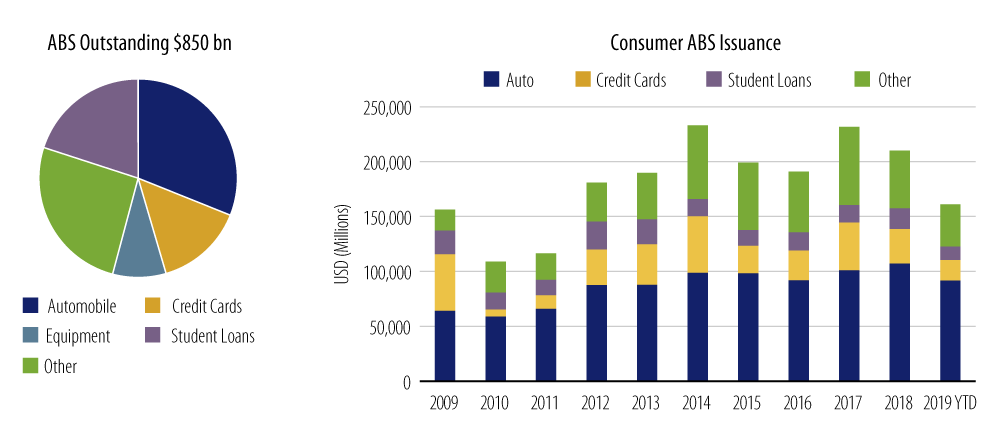

- Liquidity: The ABS market is large and liquid. ABS issuance was $235 billion in 2018, and is expected to be $240 billion in 2019 (see Exhibit 1). Issuance has been on a generally rising trajectory since 2010. The ABS market is made up of large asset classes that trade with large volumes (approximately $10 billion per month) and has a relatively small bid-ask spread.

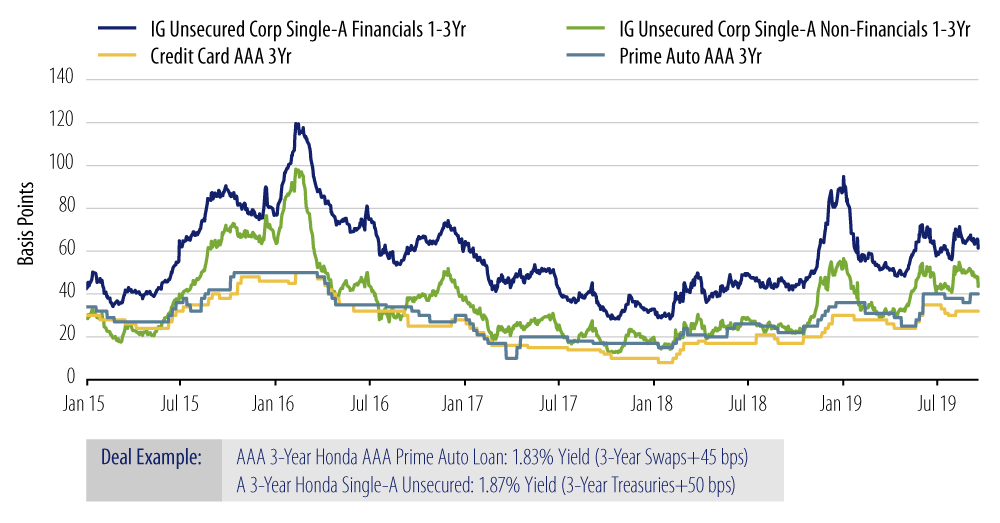

- Risk and return: Investing in AAA rated ABS can provide attractive yields versus comparable investment-grade unsecured corporate bonds. In addition, the market yield of ABS is generally more stable than corporate bonds resulting in lower marked-to-market price volatility. One reason for this is that the ABS market is less reactive to broad market or issuer news, such as earnings releases, industry events and credit concerns, than the corporate and Treasury markets.

- Diversification: Investing in AAA rated ABS raises the quality of the portfolio without giving up yield, while the stability of spreads in ABS can help reduce the level of overall systemic risk in a portfolio (see Exhibit 2).

Which Parts of the ABS Market Should Be Considered for Short-Term Portfolios?

We believe that AAA rated credit card, automobile, equipment and student loan ABS are the most appropriate sectors to add to short-term investment-grade fixed-income portfolios, although other senior ABS may also be considered for greater diversification and return opportunities. These ABS sectors have the most liquidity, issue frequently and offer the highest level of credit stability in the ABS universe. We favor a focus on high credit quality, well-established sponsors, asset classes with strong investor protections and attractiveness relative to other sectors. We evaluate the appropriateness of other ABS sectors on an individualized basis. The credit card and automobile sectors are the largest by issuance volume in ABS.

Credit Card ABS

Credit card companies issue multiple classes of bonds backed by a single vehicle which houses all credit card receivables used as collateral for the outstanding securities, regardless of when they are issued. The outstanding bonds differ by term, interest type and rating. When the sponsor has funding needs and is in the market to issue securities, it adds more receivables to the same trust to provide protection to new investors. Credit card ABS trusts typically issue bonds that repay principal in one lump sum within a period of six months of the expected repayment date.

Auto Loan/Lease ABS

Each ABS deal that is backed by auto loans or leases houses assets in a separate trust that contains unique collateral. Prepayment uncertainty in the underlying assets can be mitigated by tranching bonds into different average life buckets and keeping the principal payment window short. For example, the standard structure of a typical deal backed by auto loans will issue four different AAA rated bonds. These bonds are paid principal and interest as shown in Exhibit 3.

How Has the Market Changed Since the Crisis?

Despite the depth of the global financial crisis, senior highly rated tranches of ABS did not experience losses, and saw few downgrades. Post-crisis, the ABS market also experienced a number of favorable changes including:

- ABS issuers are required to maintain an economic interest in the securitization. As a result, ABS issuers and investor interests are better aligned.

- The investor base is deeper, well established, and more stable (60% of ABS is held by asset managers, with the remaining held by insurance companies, banks, pension funds).

- Deal structures are simpler and collateral information is more transparent and readily available to investors.

Western Asset’s Approach to Analyzing ABS

Western Asset has managed short-term fixed-income portfolios since 1975. Our liquidity business is distinguished by the length of its tenure, its dedicated team, its consultative approach to clients within this space, and its deep and experienced research professionals.

Our approach of including ABS in short-term portfolios also sets us apart. We go beyond simply accepting credit agency ratings as proof of creditworthiness and acceptability. Instead we perform fundamental research to analyze the sponsor, servicer and historical performance of the issuer as well as analyzing similar deals. We focus on key aspects of the issue such as collateral quality, motivations of the sponsor, relative value versus similarly sponsored deals, underwriting criteria, diversification of pool loans, and we evaluate robustness of deal structure under different economic conditions. This detailed level of analysis certainly does not stop at the time of purchase. We continue to monitor the ABS on an ongoing basis to ensure that the securities remain suitable for the conservative nature of our liquidity portfolios.

ABS Terms to Know

Tranche: The different classes of bonds issued as part of a single ABS deal.

Average life: The weighted average length of time the principal is expected to be outstanding.

Credit enhancement can take the form of:- Overcollateralization: The value of collateral assets in the trust that are in excess of the value of ABS bonds issued.

- Excess spread: The difference between the interest rate received on collateral assets and the interest rate offered on the securities.

- Subordination: Subordinated ABS bonds have a higher priority in absorbing excess losses from the collateral assets (i.e., they will reflect losses earlier than more senior bonds). They are lower rated, have higher yield requirements and provide additional protection to senior noteholders.

- Reserve account: This a fund set aside by the issuer to provide additional liquidity for ABS bondholders.