Bad Loans Are Made During Good Times

There’s a saying about credit markets: “Good loans are made in bad times, and bad loans are made in good times.” The years of the Federal Reserve's (Fed) Zero Interest Rate Policy (ZIRP) and the post-Covid fiscal response were prosperous for borrowers, marked by low credit premiums, lenient underwriting and easy capital market access. The good times in the latter part of 2020 and 2021 saw high asset valuations, aiding debt and equity capital raising.

However, the landscape shifted post-2021 as the Fed tackled inflation, which impacted access to credit and equity capital markets. We’ve discussed how monitoring asset multiples in this new interest rate environment are crucial for gauging economic risks and private sector balance sheet strength. A tipping point looms where credit market pressures could nudge a slowing economy into recession, hastened by waning confidence or falling asset values. Now, as interest rates stay elevated, we're witnessing the widening of cracks in the private sector, with net worth issues leading to recession-level default rates among floating-rate borrowers.

The Net Worth Problem

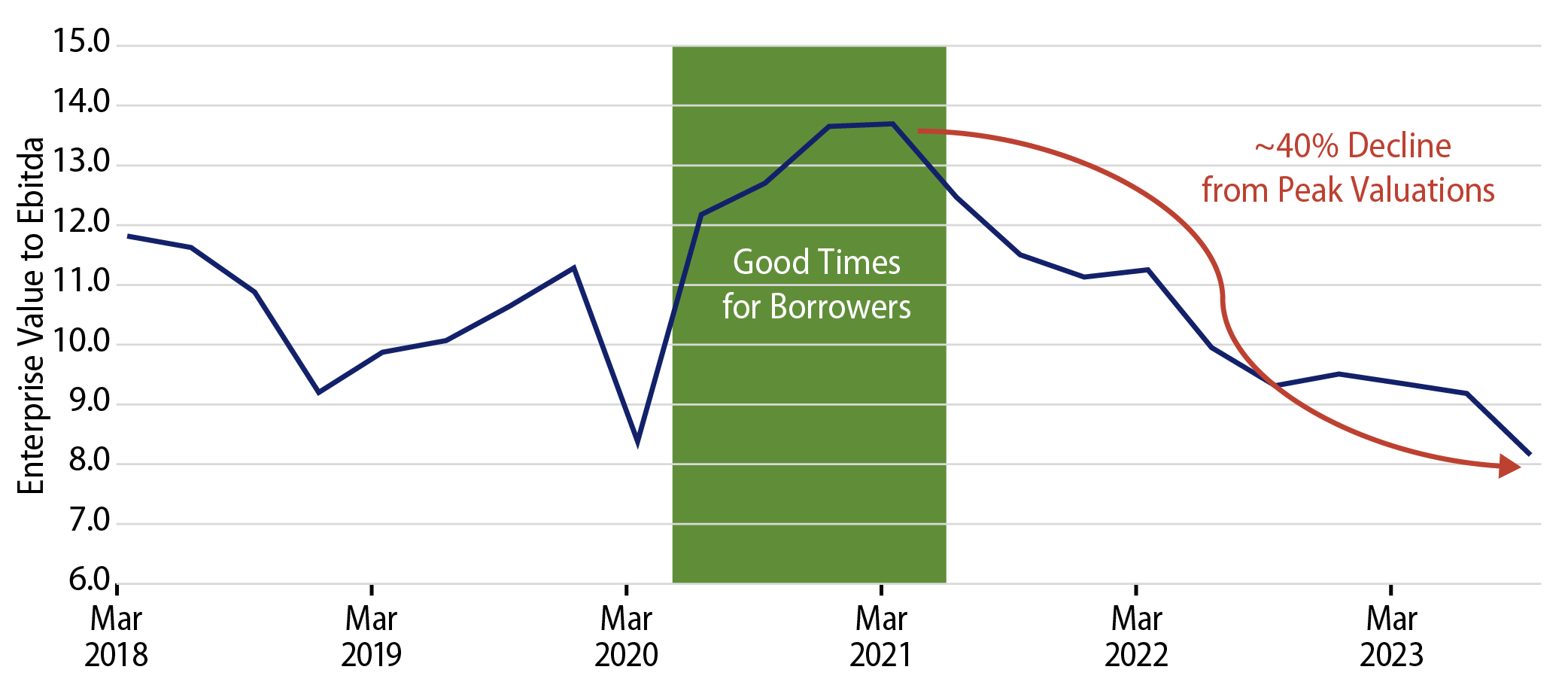

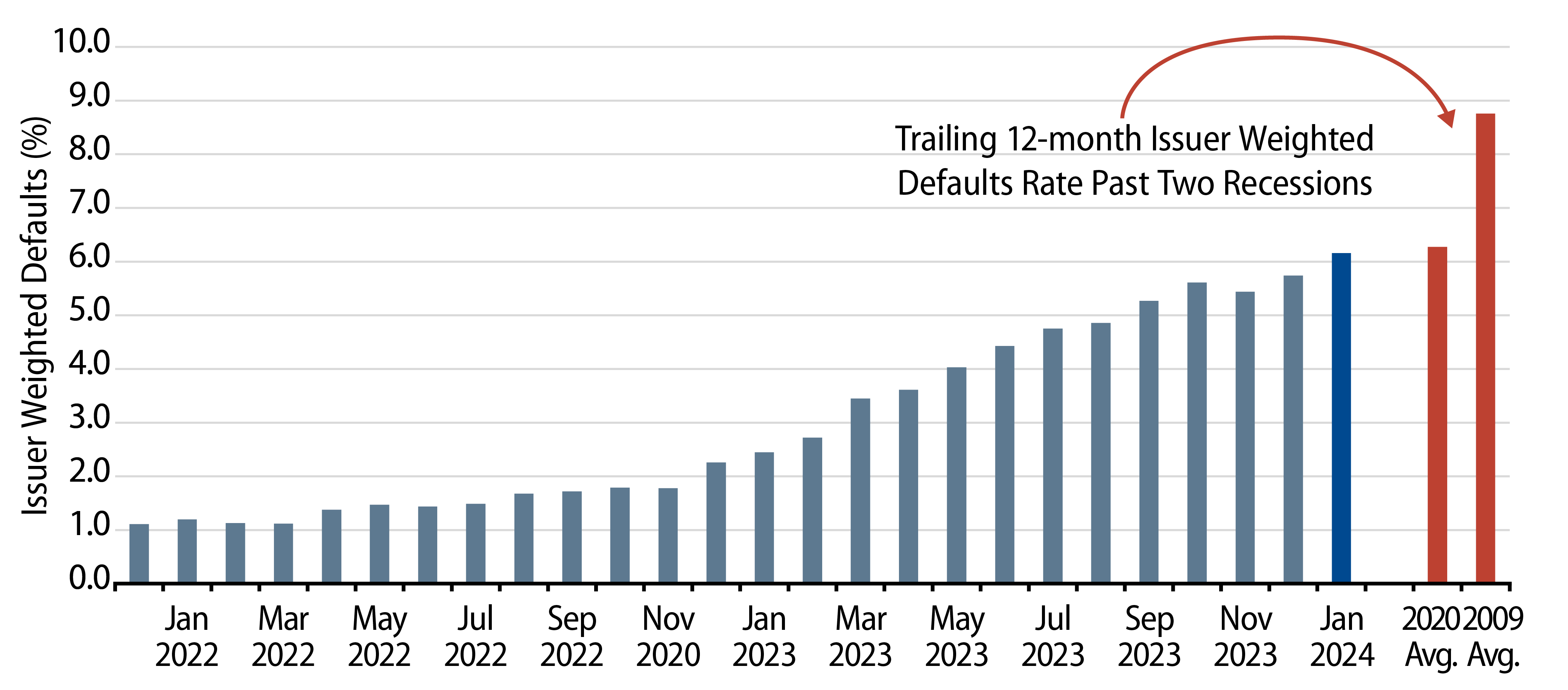

The current credit market issue isn't about slowing growth or earnings; it's about declining net worth. Since 2021, the average issuers in the syndicated bank loan market had a significant decline in asset valuations. Higher interest and expenses, coupled with reduced company valuations, have led to increased leverage, particularly for B rated and lower bank loans. Taking a large sample of B rated issuers in the floating-rate loan market saw valuations plummet from nearly 14.0x (Enterprise Value/EBITDA) to about 8.0x, a decline of over 40% (Exhibit 1). The decline in the value of the assets relative to the amount of debt outstanding means there is less equity or net worth in a company, which is why defaults are on the rise (Exhibit 2). This net worth decline may provide insight for the private credit/direct lending market too, which is very similar to the B rated and lower syndicated bank loan market, but where valuation data and default statistics are less transparent.

The sample of B rated loans was used in this analysis because it removes the BB and higher-rated issuers, and it’s likely a better reflection of similar risk to private middle markets (aka direct lending).

Long and Variable Lags

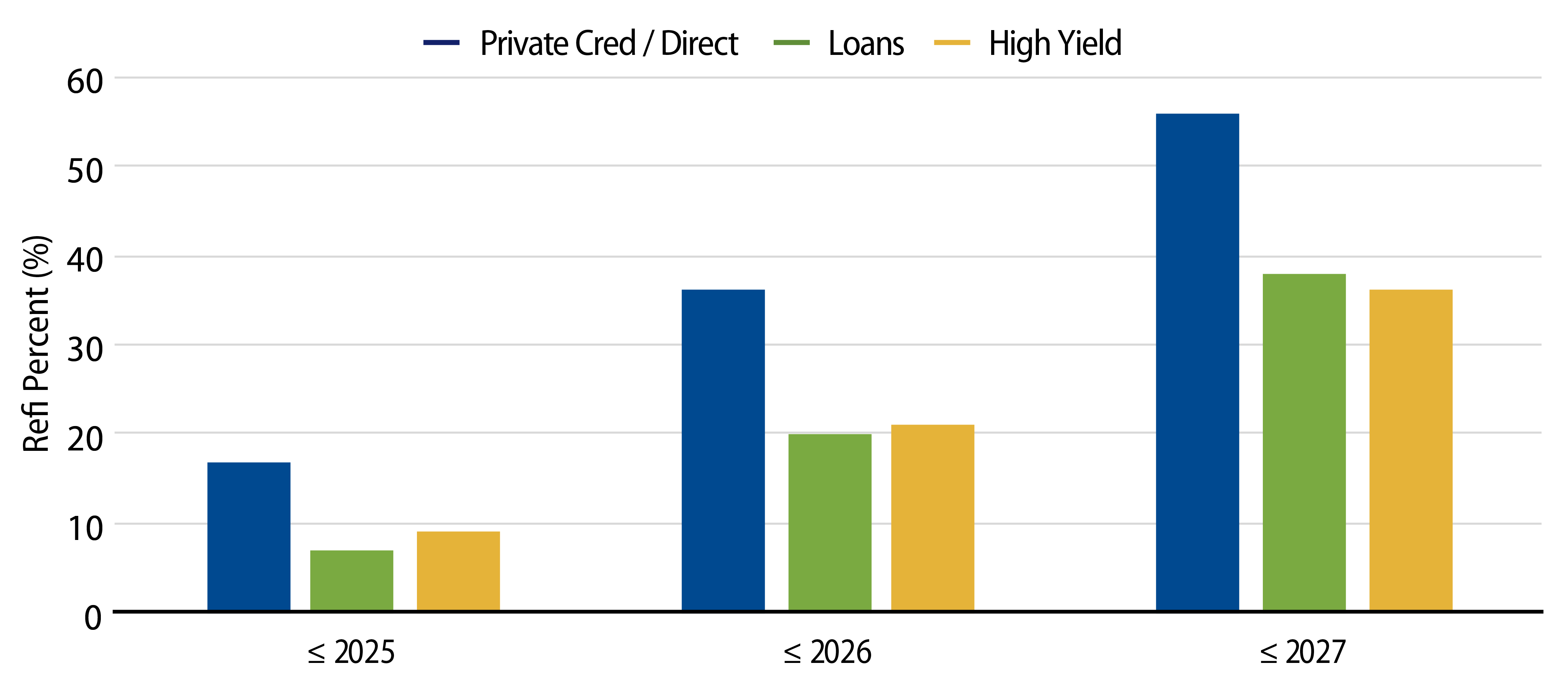

The tipping point for companies to address cost-cutting initiatives can be closer as loan maturity approaches. While negotiations often precede maturity payments, decisions frequently come down to the wire. With 20%-30% or more of floating-rate bank loans and private credit middle market loans facing maturity in the next few years, many borrowers may need more equity or debt restructuring if valuations don't improve (Exhibit 3).

Many diversified credit investors may not see a meaningful impact on their investment returns given the relatively high yields in the market, and many of these smaller companies don’t reflect large issuers in traditional indices. However, these smaller companies in aggregate could be relevant to the employment and corporate investment outlook. Should asset valuations and net worths decline further, we may see more cuts in CapEx and more layoff announcements once companies confirm their ability to refinance.

When Bad Economic Times Become Good Times for Investors

With US interest rates near decades highs, investment opportunities are growing in both public and private credit markets. As more bad loans from good times are restructured, companies may sell assets, cut investment spending or lay off workers. While this isn't ideal for the economy, it can benefit new lenders, as bad economic times can yield great loans for investors. Opportunities are emerging in less liquid public credit markets with potential yields exceeding 10% and higher in middle-market private credit. Improved underwriting can help mitigate downside risk for credit investors as growth slows. Independent research teams that span public and private markets to evaluate relative value and funding technicals may be well positioned to enhance investor returns or reduce risks in the current environment where the lines between public and private markets are closer to intersecting.