We’re now seeing the highest interest rates in decades, which are creating both risk and opportunities in public and private credit markets. Former Federal Reserve (Fed) Chair Dr. Ben Bernanke’s presentation last year at the Nobel Prize lecture in economic science is more relevant than ever:

“According to the credit channel of monetary policy hypothesis (Bernanke and Gertler, 1995), monetary policy

can raise or lower the EFP (external finance premium) by (1) affecting borrowers’ net worth and cash flows,

and (2) affecting bank capital and banks’ cost of funds.”

For background, the EFP is essentially represented by the credit spreads or additional premium of a bond or loan relative to similar-maturity US federal government interest rates.

And for those less familiar with credit markets, the borrower’s net worth is one of the most significant factors that determines the premium that lenders will charge. In addition, lenders charge higher premiums when there is more volatility or uncertainty regarding the borrower’s net worth. On the second point, if the lender or bank’s net worth also declines while the cost of funding increases, that can accelerate the negative impact of monetary policy on asset valuations and the economy.

If lender confidence declines and the expectations around borrowers’ assets tip closer to their debt levels (i.e., net worth approaching zero), defaults will accelerate and economists will likely revise their growth and employment estimates downward. Keep in mind that the tipping point that drives asset valuations lower can be gradual at first, then sudden. This could make the benefits of taking an actively managed approach to credit markets more appealing, especially as a passive approach doesn’t focus on avoiding default losses.

Higher Rates and Lower Net Worth of Borrowers

This is the first time in roughly 15 years that the fed funds rate has been above 5%. The direct impact the policy rate has on the private sector varies, but looking at the syndicated bank loan market can offer some insight into both public and private companies’ cash flows and net worth sensitivities to monetary rates, as referenced in Dr. Bernanke’s Nobel lecture. For background, the bank loan market reflects floating-rate securities of over 1,000 issuers across 18 industries, according to the S&P LST S&P/LSTA Leveraged Loan Index as of September 29, 2023. Also, it’s common for private companies that borrow directly from non-bank lenders (instead of through bank syndication) to pay floating or adjustable interest rates, making some of the analysis applicable to both private and public markets.

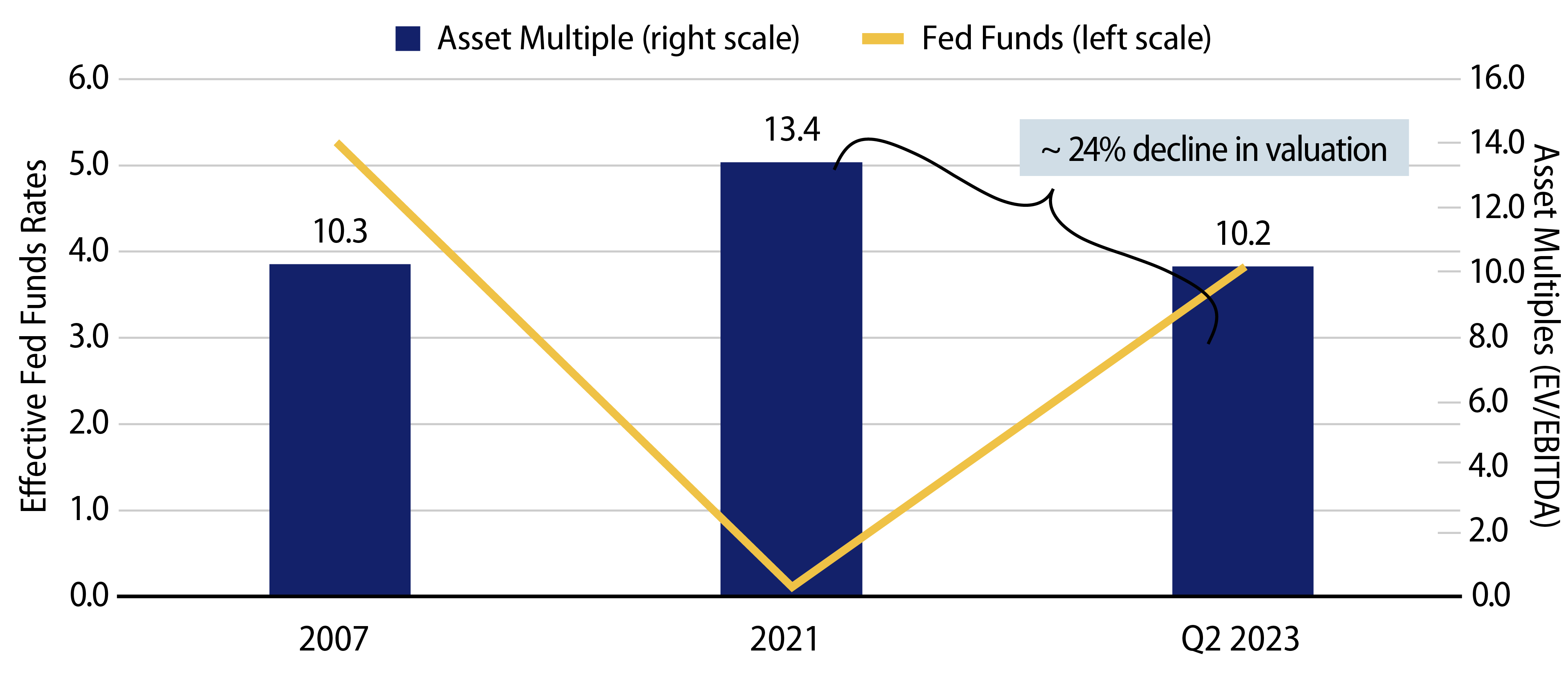

While the Fed was increasing the policy rate during 2022 and 2023, some companies were able to pass along higher interest expenses and other costs onto their customers, but on average a company’s net worth declined despite some stability of their cash flows. Looking at a large sample of issuers that have publicly traded equity, the average company’s valuation as measured by enterprise value (EV) to EBITDA declined from 13.4x to 10.2x from 4Q21 to 2Q23. This 24% decline in valuations happened while the average quarterly fed funds rate rose from around 0% to 4% during the period, which will likely soon average 5% in the coming quarters if it maintains its current level or rises higher.

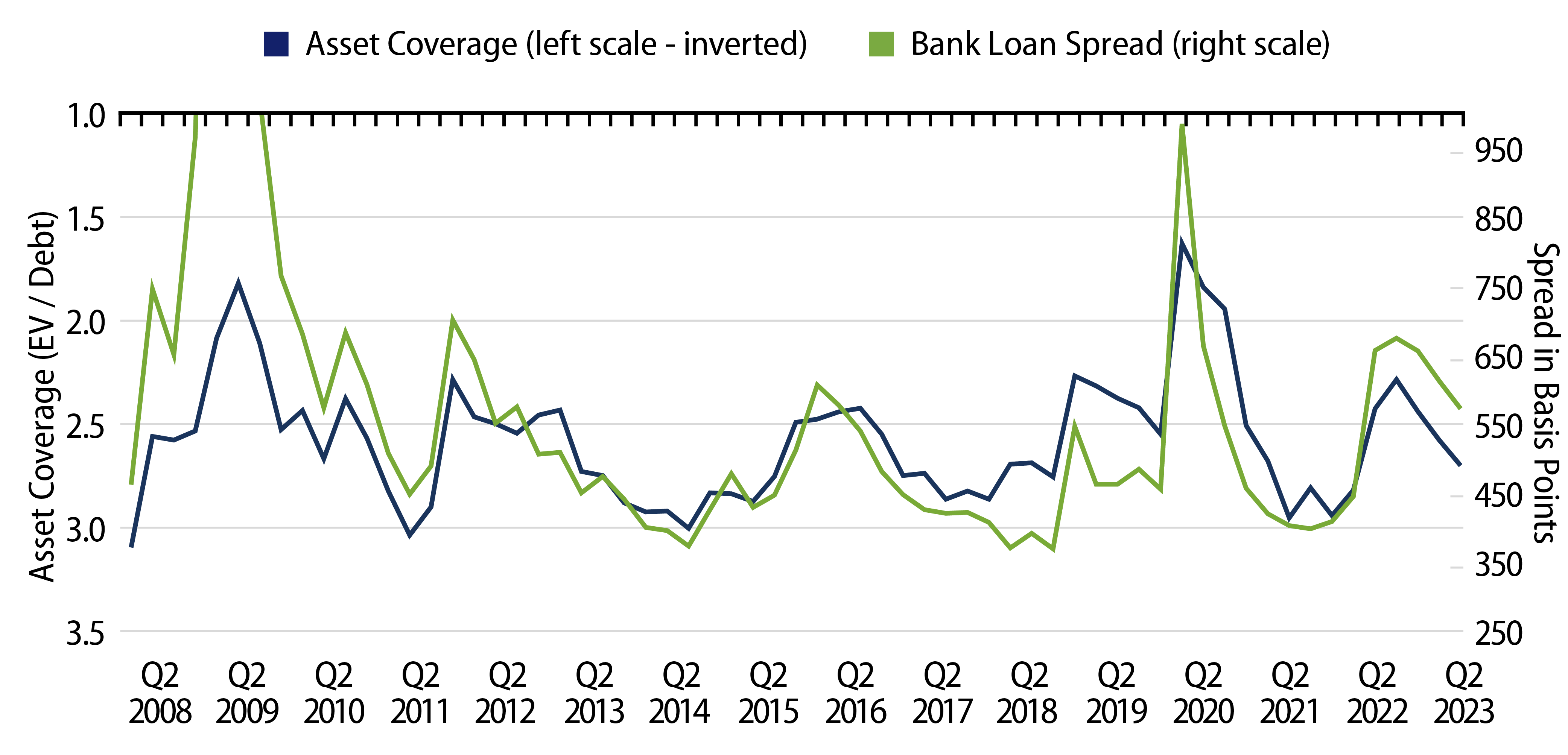

While asset multiples in 2007 were similar to today’s levels, when the average policy rate was 5%, the average asset coverage is lower today given higher levels of debt. For background, asset coverage is shown as the enterprise value (EV) of the firm relative to the firm’s debt. If the firm’s EV falls due to declining equity multiples or earnings and its debt remains constant, its net worth also declines. Exhibit 2 illustrates that there is a strong relationship between asset coverage and the premium lenders charge. As you can see in Exhibit 2, asset multiples declined from 4Q21 as investors grew concerned about how much growth would slow, but asset coverage has improved recently as confidence and multiples improved.

What Are the Risks?

In public credit markets, it can be a little more transparent to investors when the valuations of a company’s asset decline closer to the amount of its debt. The tipping point—when default risk is very high—is when the valuation of assets falls below the amount of debt, which implies negative net worth. Without new equity capital, the borrower will typically negotiate with its lender or default. It’s worth noting that defaults have picked up meaningfully, especially for smaller companies that must refinance their near-term debt.

As mentioned in a previous blog that applied Minsky’s framework to asset prices and the economy, many of the larger companies in the public bank loan market have less of a need to refinance their debt before the end of 2024; by comparison, smaller companies that reflect private markets had almost 3x more refinancing needs. The refinancing can be a catalyst for lenders to adjust terms from loans initiated years ago but can also be a catalyst for higher defaults. According to Proskauer’s index as of 2Q23, default of smaller companies that reflect middle-market borrowers were over 7% on average for the last four quarters, which compares to Moody’s data of defaults in the bank loan market of about 4% for the same period.

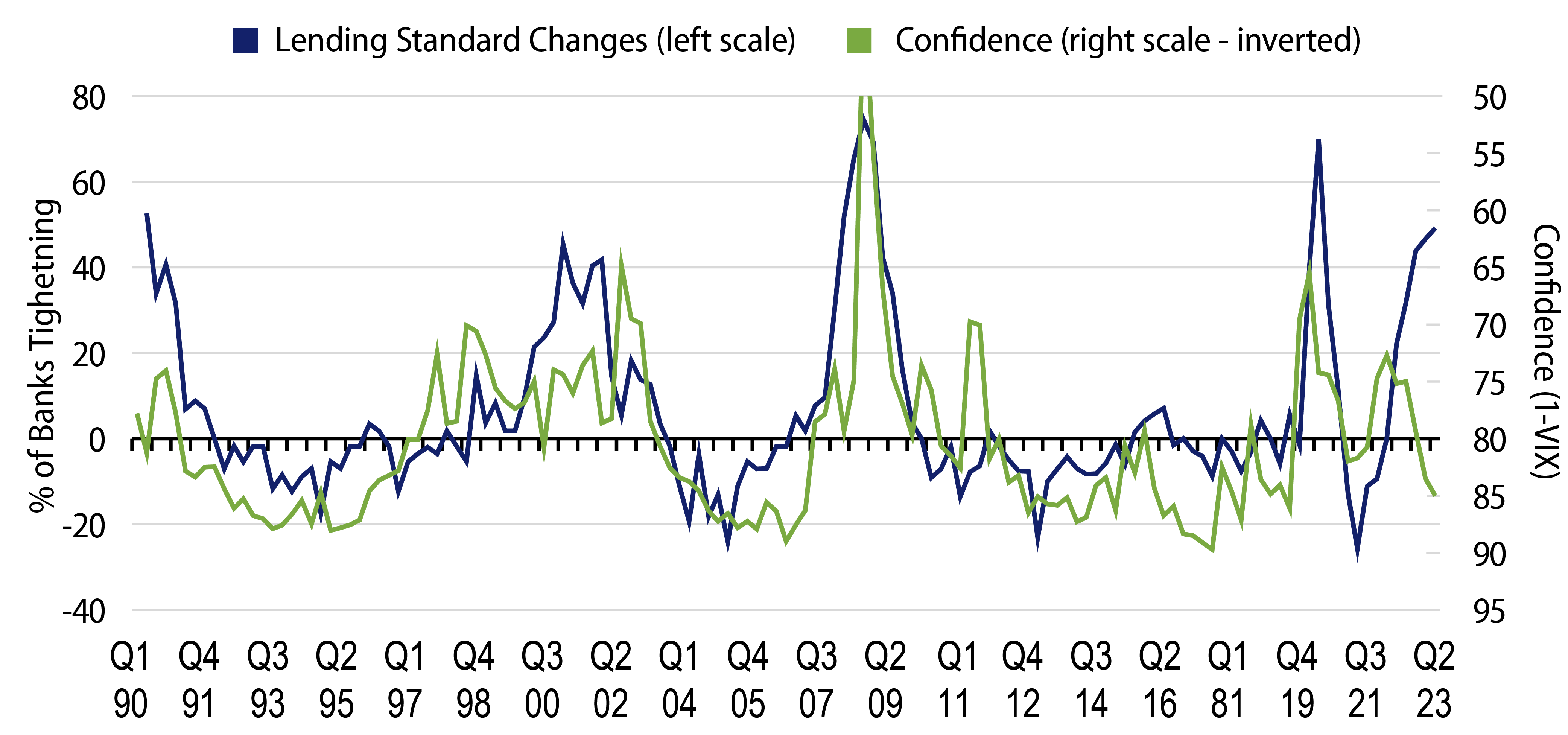

As it relates to banks’ funding costs and bank capital—the other factor referenced in the Credit Channel of Monetary Policy Hypothesis—the increase in defaults for borrowers hasn’t been large enough to accelerate tight credit conditions in the rest of the economy. As referenced in a previous publication, which was focused on the impact of higher rates and loan losses in real estate, many of the multinational and large regional banks have substantially more equity capital than in previous decades, which reduces the risk that they are unable to make loans because of limited equity capital. While higher funding costs for banks and potentially higher regulatory burdens for regional banks have made access to capital harder for some borrowers, it created more opportunity for non-bank lenders to find investment opportunities. The growth of non-bank lenders in credit intermediation, and their confidence in refinancing existing borrowers and making new loans, may help to explain some of the divergence in banks reporting tight lending standards relative to confidence in the volatility of companies’ net worth (Exhibit 3).

What Are the Opportunities?

The higher yields in fixed-income, and in credit particularly, are still providing a one in 15-year opportunity for long-term investors to get equity-like returns from credit markets, and likely with much lower risk. Our top-down and bottom-up analysis suggests there is still meaningful net worth, cash flow generation and capital availability to avoid recession—using the framework provided by last year’s Nobel winners. In other words, asset coverage remains relatively high so if valuations on assets or confidence decline modestly, that may not accelerate the impact of already tight monetary policy and push the economy into a recession.

We think the benefits of active management may be undervalued in credit markets given the current environment, especially as defaults are rising and a modest shift in confidence could result in: higher equity risk premiums, lower asset coverage, rising defaults and challenge perceptions of how resilient the US economy is to higher real interest rates.

We see more opportunity in sectors with good asset coverage, pricing power and those that are less sensitive to higher real rates. In the public credit market, we see better opportunities: in shorter maturity high-yield and investment-grade corporates, non-qualified mortgages and high-quality collateralized loan obligation (CLO) debt.

In private credit, we see opportunities across real estate, asset-backed securities (ABS) and CLO equity. Also, we are seeing growing opportunities to partner with insurance companies to finance smaller private companies where access to capital from venture firms and banks has become relatively expensive.