Market Insights at a Glance

As global growth slows amid tariff uncertainty, geopolitics and fiscal issues, inflation is trending toward central bank targets. Despite these challenges, fixed-income fundamentals remain strong, supporting a constructive outlook. The yield curve steepening seen globally is driven by factors such as fiscal concerns. Valuations remain rich across a variety of non-Treasury sectors due in part to strong fundamentals. We see attractive relative value in certain structured products like CLOs and CMBS. Active management remains crucial in fixed-income markets.

This summary is intended to aggregate the Firm’s current overall views and present an at-a-glance dashboard.*

Growth

Convictions

- US growth has slowed but remains positive in line with our base case view. We are keeping an eye on any further deterioration in growth or signs of a possible recession.

- The eurozone’s growth has been temporarily boosted by trade and tariff front-loading, but risks remain due to rising unemployment in Germany and industrial threats in France.

- Emerging market (EM) economies are benefiting from attractive real yields and supportive technical inflows.

Rationale

Inflation

Convictions

- Global inflation is expected to keep trending downward, ultimately converging toward central bank targets.

- The US inflation trajectory is also anticipated to be downward, although achieving the Federal Reserve’s (Fed) 2% target may be challenging and take longer than expected.

- Near-term downward inflation momentum may stall or rise slightly due to companies passing on higher tariff costs to consumers.

Rationale

Rates

Convictions

- US Treasury yields have moved lower in response to slowing US growth, a potentially weaker labor market and the beginning of the rate cut cycle by the Fed.

- Despite recent cuts, US policy rates remain well above the Fed’s long-term neutral rate. The yield curve steepening is a consistent global phenomenon, driven by factors such as fiscal concerns, lower front-end yields, policy uncertainty and term premiums.

Rationale

Monetary Policy

Convictions

- The Fed and other major central banks have cut rates in response to declining inflation, slowing growth and softening labor markets.

- The Fed’s focus has shifted from inflation to labor market risks, especially after recent payroll revisions and signs of employment weakness.

- Western Asset expects central banks to continue lowering policy rates, with the Bank of Japan being an outlier as it continues to hike and normalize rates.

Rationale

Credit Markets

Convictions

- Credit spreads are considered tight, but an overweight position is maintained due to supportive corporate fundamentals and a strong technical backdrop.

- Investment-grade credit fundamentals remain solid, with increasing M&A activity presenting mixed risks, including potential credit downgrades.

- Collateralized loan obligations (CLOs) and commercial mortgage-backed securities (CMBS) offer select relative value opportunities, supported by improving underlying quality.

Rationale

Labor

Convictions

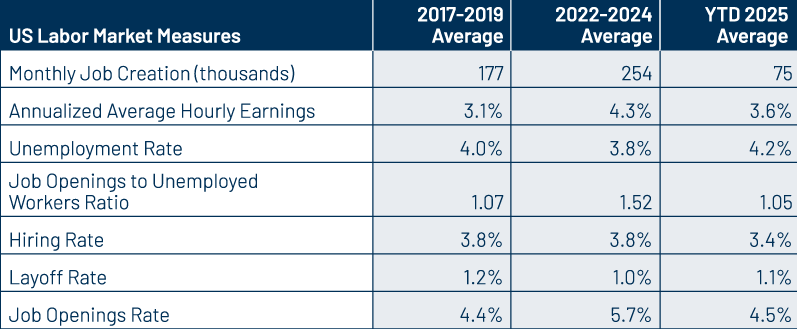

- The US labor market has softened, with unemployment up slightly primarily due to increased labor supply, indicating normalization rather than contraction.

- The eurozone has achieved a historically low unemployment rate of 6.2%, driven by recoveries in Southern economies and immigration, which have mitigated the decline in the working-age population.

- Regional labor market challenges vary widely among EM economies, requiring tailored policy responses.

Rationale

*As of 30 Sep 25

Fixed-Income Outlook: Labor Market Shifts Drive Credit Opportunity

The current macroeconomic landscape is characterized by significant shifts in global labor markets driven by cyclical and secular factors. The US labor market has softened, with a modest rise in unemployment and moderation in wage growth, indicating normalization rather than contraction. The eurozone has achieved a historically low unemployment rate, driven by recoveries in Southern economies and immigration. These labor market dynamics will have profound effects on politics, economic growth, central bank policy and capital markets.

The macroeconomic environment is complex, with sub-trend growth, softening labor markets and declining inflation prompting central banks to examine and adjust monetary policies. Credit markets present opportunities, with investment-grade credit fundamentals remaining strong and structured products like CLOs and CMBS offering relative value. Active management is crucial in navigating these complex dynamics. By closely monitoring economic trends, labor market dynamics and credit market fundamentals, investors can make informed decisions to optimize their portfolios. The current environment demands careful analysis and adaptability to navigate the challenges and capitalize on opportunities in fixed-income markets.

Global Labor Market Trends and Implications

As described in our recently published 4Q25 edition of Macro Market Trends, global labor markets are experiencing significant shifts driven by both cyclical and secular factors. The post-pandemic economy has been characterized by strong labor market performance, with job creation and reduced unemployment rates. However, recent trends indicate a slowdown in job creation and a gradual increase in unemployment rates.

- United States: The US labor market has seen a modest rise in unemployment due to increased labor supply and job losses. Wage growth has moderated and layoff rates have increased, indicating normalization rather than contraction.

- Eurozone: The eurozone has achieved a historically low unemployment rate of 6.2%, driven by recoveries in Southern economies and immigration. Demographic challenges, such as aging populations, continue to pose significant policy challenges.

- Japan: Japan faces labor shortages due to a declining population. Despite this, labor force participation has increased, driven by the increased entry of women and the elderly into the labor market.

- Australia: Australia’s labor market is navigating cyclical, structural and geopolitical forces. Unemployment remains low, but job growth has slowed. Immigration has helped fill labor gaps, particularly in health care and construction.

- Latin America: Latin American countries have diverse economic and labor market characteristics. Most LatAm countries have relatively high real rates with moderating inflation, allowing for potential rate cuts to stimulate growth.

Implications

These labor market dynamics will have profound effects on politics, economic growth, central bank policy and capital markets. Policymakers face challenges balancing declining working-age populations, growing public spending burdens and hostility toward migrant labor. We believe active management is essential to help navigate these complex environments.

The normalization of monetary policy is expected to progress further, particularly in Japan. In the US, the Fed faces the challenge of supporting a cooling labor market while guiding inflation lower.

As global labor markets continue to evolve, understanding these trends is essential for making informed investment decisions. The current environment requires careful analysis of labor market dynamics and their implications for interest rates and economic outlook.

Western Asset Investment Themes

| Asset Class | Our View |

|---|---|

| Investment-Grade Credit | Fundamentals remain strong, but accelerating M&A activity presents mixed risks, including potential credit downgrades; close monitoring of covenants is essential. |

| High-Yield Credit | Higher-quality issuance and a bias toward refinancing are positive trends; M&A activity generally benefits high-yield, which also features stronger protections. |

| Private Credit | Stress signals are increasing, such as increased pay-in-kind interest payments and rising defaults; lower-quality issuance is migrating to private credit, warranting close monitoring. |

| Structured Products | CLOs and CMBS offer relative value opportunities, supported by improving underlying quality, but selectivity remains paramount. |