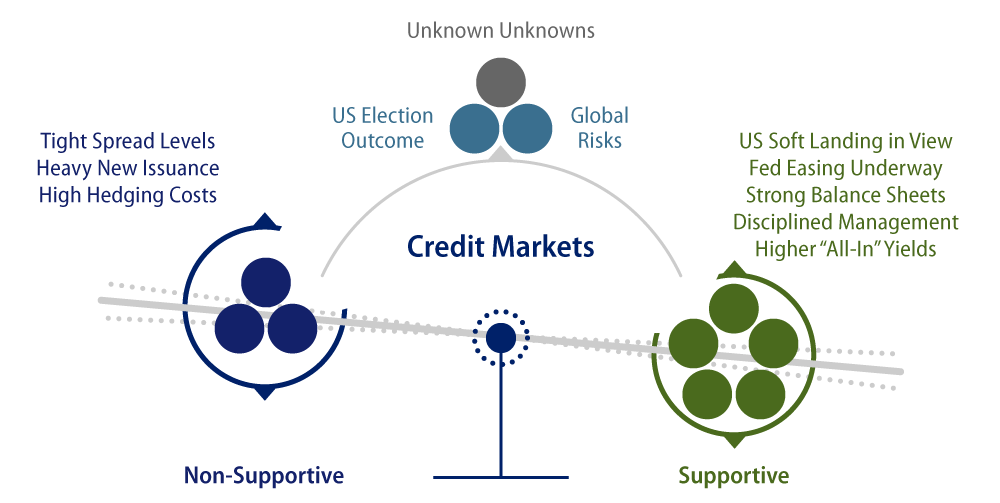

In recent months, credit markets have defied expectations despite ongoing US Treasury volatility and global political uncertainties. As spreads across several areas of the credit market hover at or near historical tights, is the resilience of the credit market a mirage at this stage of the market cycle? Our conclusion is a clear and emphatic no.

As we approach year-end, we acknowledge that the upcoming US presidential election, concerns over another global trade war and unexpected headline risks could add more uncertainty. However, it is important to remember that corporate balance sheets are much stronger today, global financial conditions remain accommodative and yields across credit markets are still above decade averages. Moreover, the Federal Reserve and other central banks in developed and emerging markets have started cutting rates after much anticipation—a trend likely to continue amid the ongoing global economic slowdown and subdued inflation. While some investors remain cautious about potential spread widening, we believe holding a diversified portfolio of credit asset classes is prudent given the presence of meaningful fundamental and technical supportive factors.

Here’s where we’re currently finding value in credit, and why, in the context of a multi-sector bond portfolio:

High-Yield Credit

Spreads reflect balance sheet strength, prudent management behavior and supportive demand for higher-yielding securities relative to supply. We see opportunities in service-related sectors still recovering from the pandemic (e.g., reopening trades like cruise lines and lodging), energy (E&P), and potential rising stars. We are more cautious about consumer product, retail and home construction sectors.

Bank Loans

Spreads appear relatively attractive. We expect a stable carry profile for BB loans with strong underlying credit quality and remain selective in single B loans for total return potential, as lower interest rates may significantly reduce their interest expense burden. We remain cautious on certain industries such as chemicals and communications.

Non-Agency Residential Mortgage-Backed Securities (NARMBS)

The continued relief in mortgage rates, along with easing inflation, is expected to alleviate pressure on US housing affordability. Home prices are expected to remain constrained nationally, moving toward long-run average annual increases of 3%-5%. We are opportunistic on credit risk transfer (CRT) securities as well as non-qualified mortgage (QM) deals.

Non-Agency Commercial MBS (CMBS)

The market has reopened with tight underwriting, and year-to-date issuance volume on pace with the 2013-2020 average. Valuations have bottomed out, and capital is being deployed to take advantage of the reset basis in both debt and equity markets. High-quality underwriting with low leverage, strong cash flow and robust structural protections are prevalent across the new-issue market, providing support for new origination credit risk with high current yields, while discount priced seasoned bonds offer intriguing total return opportunities.

Collateralized Loan Obligations (CLOs)

We see more opportunities in AAA, BBB and select BB rated CLO debt tranches invested in broadly syndicated bank loans. We believe that AAAs and BBBs should continue to perform well in either bullish or bearish bank-loan-spread environments, given strong structural protections.

Investment-Grade Credit

Valuations may appear stretched from a historical perspective, but they are pricing in a soft landing and reflect resilient underlying fundamentals along with confidence in management teams that are largely exercising balance sheet discipline and defensive behavior. Meanwhile, the technical backdrop remains supportive as demand remains robust from yield-based buyers even as supply has surprised to the upside.

Emerging Markets (EM)

We believe that frontier market sovereigns continue to represent a compelling carry and total return opportunity, given still-wide valuations and key idiosyncratic credit stories. Investment-grade-rated EM sovereigns remain tight and can be considered a source of cash for trades with better relative value across EM and other sectors.