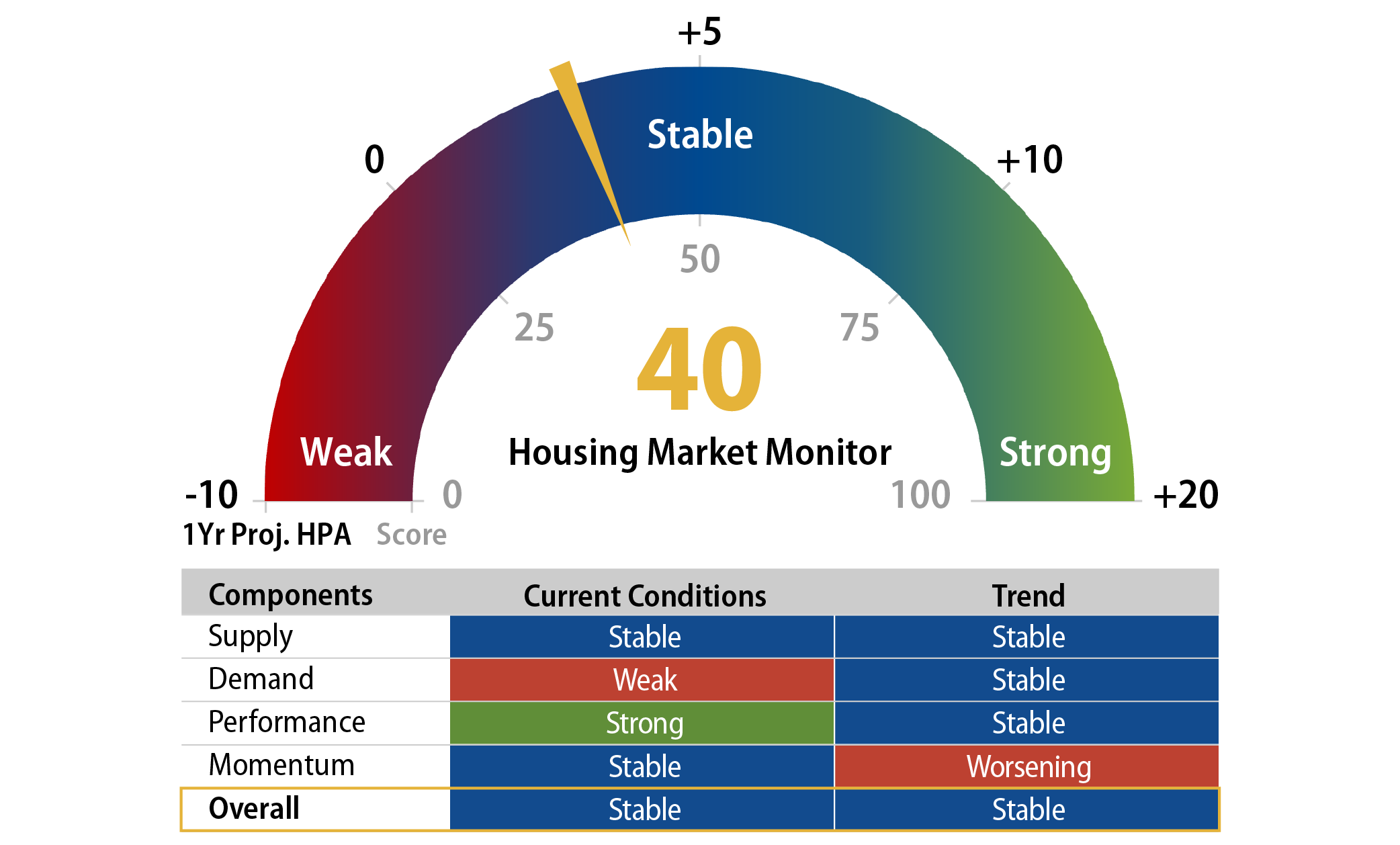

The third quarter concluded with the 30-year mortgage rate at 6%, which is roughly 150 basis points (bps) lower than April’s mortgage rate peak and 60 bps lower than rates at the beginning of the year. Thanks to the start of the Federal Reserve’s (Fed) easing cycle, measuring from any point during this year, mortgage rates are now materially lower. In the struggle toward housing affordability, the mortgage rate is one key input that has finally started to move in the right direction. However, the other major factor, the price level of homes, has not been so quick to drop. While lower mortgage rates will most certainly help today’s homebuyers, without a material drop in home prices (which is not part of our base-case projections), housing affordability will remain strained. The Western Asset Housing Market Monitor produced a reading of 40 to end the third quarter of 2024, virtually unchanged from the end of the second quarter and 5 points lower than the reading at the start of 2024. An index reading of 40 corresponds to a projected 2% annual appreciation in home prices.

Supply

- The months of supply of existing homes remained mostly unchanged over the quarter, ending 3Q24 at 4.2 months of supply. The months of supply for new homes dropped to 7.8 months from 8.2 months last quarter.

- Housing starts increased 9.6% month-over-month (MoM) in September, and housing permits increased 4.6% MoM.

Demand

- The Mortgage Banker Association Purchase Index finished September at a reading of 149.3, which is up from 132.8 at the start of the quarter. It’s important to note that today’s mortgage rates take a couple of months to work their way through the system as borrowers go through the process of completing purchases and refinancings.

- The National Association of Home Builders Traffic of Prospective Buyers Index was 27 at the end of the quarter, which is unchanged from the start of the quarter. We expect mortgage rates to improve homebuyer traffic and anticipate a higher reading for the upcoming quarter.

Momentum

- The CoreLogic Home Price Index (HPI) was up 4.2% year-over-year (YoY) in August, from an increase of 4.7% in July. The Federal Housing Finance Agency (FHFA) and Case-Shiller indices had readings of 4.6% and 5.0% in July, respectively.

- CoreLogic HPI was down slightly at -0.2% MoM in August compared to -0.1% in July.

As we head into the last quarter of the year, many economic factors weigh on the US housing industry. Lower mortgage rates will finally provide borrowers with increased options for both mobility and purchase opportunities. On the supply side, while inventory levels are elevated based on the past 10 years of data, the US is still millions of homes away from desired levels of housing stock. With the Fed declaring that inflation has improved, the other side of its dual mandate—employment—comes to the forefront. Since the beginning of this housing cycle, we have held that one of the biggest dangers to home prices in the US is the labor market, not home prices. If employment takes a turn for the worse as the economy cools, we could see stress to borrower performance and small dips in home prices. We contend that even if the lower segment of homeowners encounters payment difficulties, the build-up of equity across the housing landscape would be enough to prop up any meaningful drop in home prices.