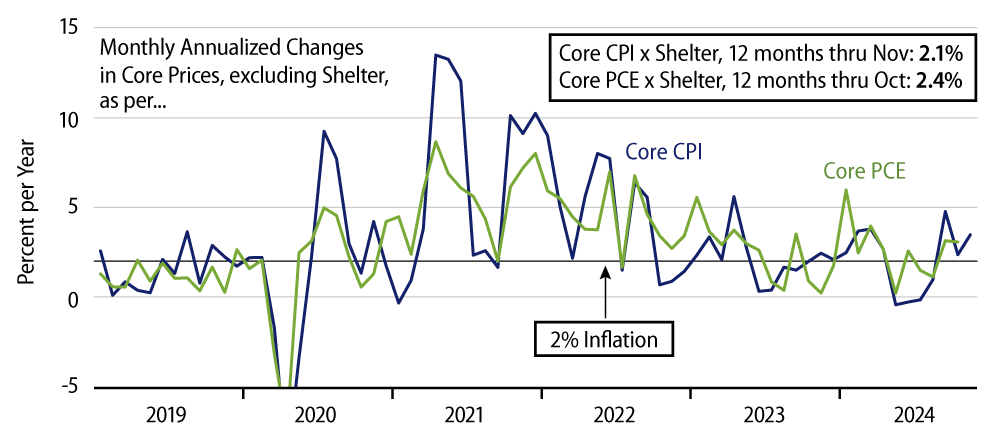

Consumer Price Index (CPI) inflation registered a 0.3% increase in November, which is a 3.8% annualized rate. The core CPI registered an identical increase. We have been tracking a core CPI measure that also excludes shelter because reported shelter prices within the CPI have seemed at odds with on-the-ground real estate pricing since 2023. That measure showed a 3.6% annualized rate of increase in November.

This marks the third straight month of relatively elevated inflation readings after some very low inflation readings between April and July (Exhibit 1). The recent elevated inflation rates may reflect the hurricanes that buffeted the Southeast between August and October, a point we have made with respect to most of the economic readings since August. Within the November CPI report, price gains were especially large for such items as food, windows and flooring, small appliances, cars and lodging. This is consistent with the possibility of hurricane effects on the CPI, though of course it does not directly prove that assertion.

Meanwhile, as mentioned earlier, we have been focusing on the elevated readings for shelter costs over the last two years. And despite higher inflation readings for the goods and services recounted here, shelter costs have moderated in recent months. Both homeowners’ and renters’ costs posted an annualized rise of 2.8% in November, well below the 5%-6% readings that were in place earlier this year. Shelter costs have retreated from the 5%-6% range in each of the last three months. Given similar readings in home sales prices and market rents, it is arguable that shelter costs will remain at low rates in the coming months.

The irony, of course, is that the moderation of shelter costs has been accompanied by higher readings for goods and services inflation, hence our whack-a-mole reference in the title. We expect lower inflation as we move into 2025, but the elevated inflation since August outside shelter is disappointing.

This is all likely troublesome for the Fed. We haven’t seen anything in the recent data pointing to aggressive Fed easing from here. Granted, as discussed last week, we think that labor market readings are softer than the markets have perceived, but you’d have to look pretty deeply to see that softening. Meanwhile, consumer spending and capital spending data have held up fine. Given these facts and also the recent bump in inflation, it wouldn’t be surprising to see the Fed pause its easing efforts for a while.