While we expect inflation to recede in the coming quarters as central banks shift to less accommodative—and potentially restrictive—policy, investors are searching for strategies to help them protect their portfolios from inflation.

One investment class that could provide generous income in excess of inflation is collateralized loan obligations or CLOs. For background, a CLO issues debt and equity securities, then uses the proceeds to purchase floating-rate secured loans of corporations across many industries. What a CLO earns on the loans (i.e., the assets) after interest costs and other expenses are paid is mostly paid to the equity holders each quarter. Since 2014, CLO equity averaged 4.4% in quarterly distributions—providing an annual income well above the rate of inflation, potentially in the mid-teens after fees and expenses, according to JPMorgan and Intex as of December 31, 2021.

For those less familiar with the basics of CLOs but who understand common stocks, an investment in CLO equity has some similarities to investing in a bank’s stock. Like a bank, a CLO effectively makes loans to many different industries and issuers for diversification purposes, although a CLO does this by purchasing collateralized floating-rate securities that can be traded instead of making direct loans. Both a bank and CLO issue debt and equity securities to finance their businesses and both typically have 10% or more equity capital, which provides a large buffer against defaulted loans assuming average default rates, while still earning an attractive return on their equity.

An Essential Element of CLO Equity: Optionality

Unlike other investment alternatives, CLOs have “optionality,” which provides advantages in both bullish and bearish market conditions. In bullish markets, when credit spreads are declining, a CLO will capitalize on its option to refinance borrowing costs lower. This can improve the spread between where the CLO borrows and where it invests, leaving more return to be distributed to equity holders. In bearish markets, when credit spreads are widening, an actively managed CLO can reinvest its securities at even higher yields, which also increases the difference between its income and borrowing costs—these gains ultimately can be distributed to equity holders to increase returns. It’s this optionality that historically produced positive abnormal returns for CLO equity, according to a study from Larry Cordell at the Federal Reserve Bank of Philadelphia and Michael Roberts and Michael Schwert at the Wharton School, University of Pennsylvania.*

Who’s Buying CLO Equity and Where Does It Fit in Asset Allocations?

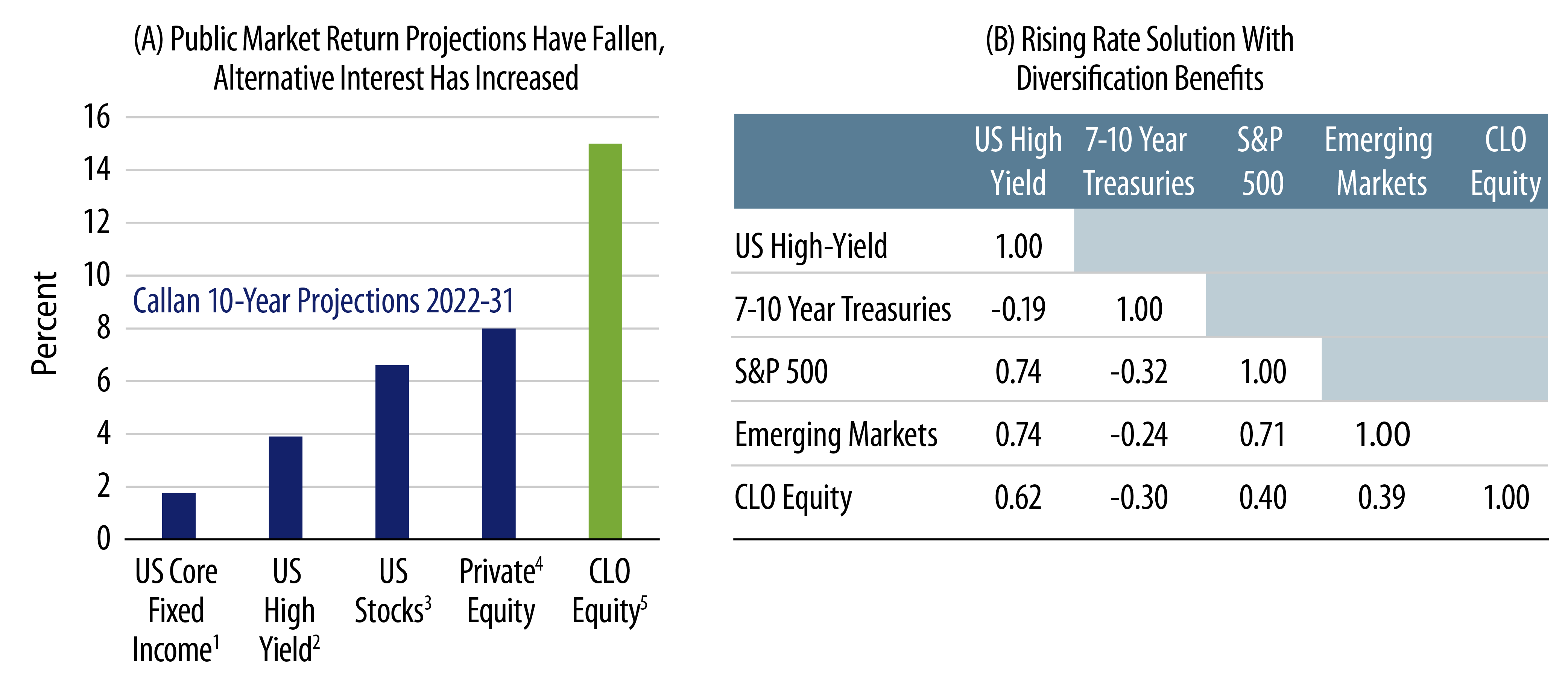

Pensions, multi-family offices and insurance companies are among those investors reportedly allocating to CLO equity. There are three sources of funds in investors' asset allocations to purchase CLO equity: alternatives, fixed-income investments and stocks.

Alternatives

Two common funding sources for CLO equity within alternative strategies are private equity and private credit. As it relates to private equity, CLO equity is a good complement as it can provide a more immediate and high income that offsets the J-curve from other private equity positions (a J-curve is a trendline that shows an initial loss immediately followed by a dramatic gain). Relative to private credit strategies that use leverage, CLO equity is a good substitute that likely provides a more stable return without the risk of refinancing. Keep in mind that a CLO issues debt that meets or exceeds the maturity of the assets, whereas many private credit strategies rely on short-term repo markets for leverage—which creates refinancing vulnerabilities especially when liquidity premiums rise.

Fixed-Income

Investors may find CLO equity a good substitute to “opportunistic credit” or other enhanced cash strategies. CLO equity provides a high and relatively stable quarterly cash flow, and offers diversification benefits from traditional bonds as returns are typically negatively correlated with US Treasuries. That said, CLOs have lower liquidity than some other strategies.

While average monthly volume was about $300 million in 2021, according to BAML, investors may be better off on a buy-and-hold-to-maturity basis given CLOs relatively high transaction costs.

Equity

As mentioned in an article in Institutional Investor in January 2022, “CLOs Are More Popular Than Ever With Institutions. Here’s Why,” some investors have found CLO equity to be a valid substitute for sector-specific stocks that pay relatively high distributions, such as REITs or Master Limited Partnership (MLPs). Relative to these strategies, CLO equity will likely have a higher and more stable distribution of approximately 4% per quarter, though CLO equity is typically less liquid.

CLO equity can provide investors who have a buy-and-hold mentality with a high and relatively stable source of income. Within investors' asset allocations, CLO equity can provide an increase in returns, reduce the J-curve of other private equity strategies and offer diversification benefits. The return and volatility profile for a 5% allocation to CLO equity can potentially enhance an investor’s return with limited to no increase in volatility when the sources of funds come from equity and alternative strategies. For those investors reducing fixed-income allocations, keeping in mind that CLO equity historically has been negatively correlated with Treasuries, the impact on asset allocation strategies will likely increase returns but also volatility.

As investors are seeking income, especially enough to offset the impact of higher inflation, an investment in CLO equity managed by an active manager could be a reasonable solution.

Endnotes

*Cordell, Larry and Roberts, Michael R. and Schwert, Michael, CLO Performance (December 14, 2021). Jacobs Levy Equity Management Center for Quantitative Financial Research Paper, Journal of Finance, Forthcoming Available at SSRN: https://ssrn.com/abstract=3652124 or http://dx.doi.org/10.2139/ssrn.3652124