Performance Overview

Municipals posted negative returns and underperformed taxable fixed-income in March.

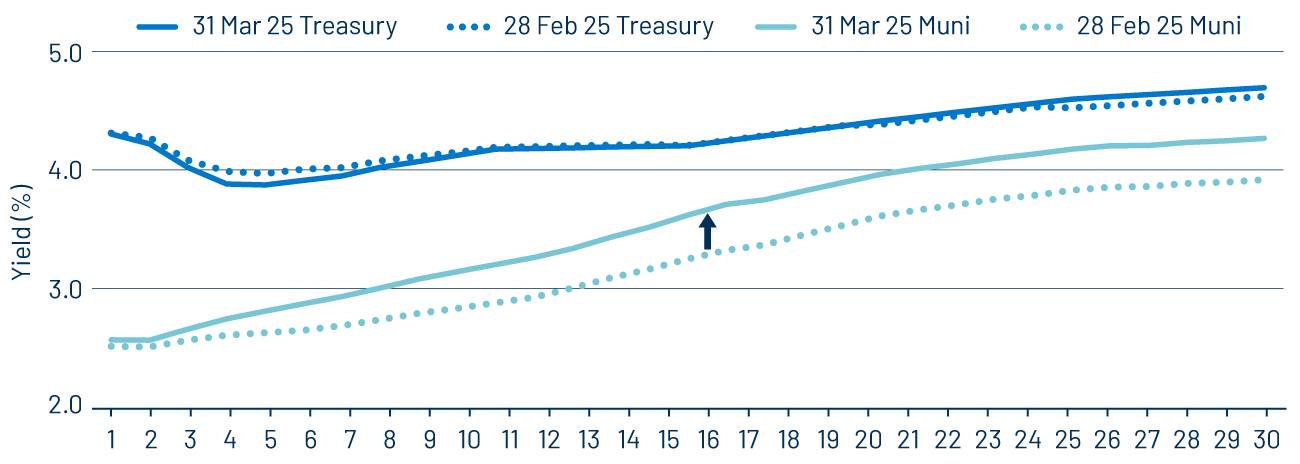

Market volatility was heightened in March amid the Trump administration’s tariff rhetoric ahead of an imposed April 2 deadline when sweeping tariffs of at least 10% were to go into effect on most goods coming into the US. Meanwhile, weaker economic data was released during the month, including lower-than-expected nonfarm payrolls, inflation and consumer confidence data—all of which came in below expectations. The Federal Reserve kept rates steady, but revised growth forecasts lower. All told, Treasury yields remained relatively steady, while municipal yields moved higher across the curve, underperforming amid weaker supply and demand technical conditions.

Supply and Demand Technicals

Supply continued at a record pace in the first quarter.

Municipal supply remained elevated in March. Total issuance of $43 billion in March was 15% higher than March 2024 levels. Year-to-date issuance of $119 billion now exceeds 2023’s record pace by 18%, with tax-exempt issuance 19% higher at $93 billion, and taxable issuance 14% higher at $7.6 billion. Municipal demand softened during the month of March due to seasonal tax-related selling pressures. The Investment Company Institute (ICI) reported that March fund flows slowed to $252 million, including outflows toward month-end, down from $5.8 billion in February.

Fundamentals/Outlook

State and local revenue collections remain near record levels.

Municipal fundamentals remained strong and support an attractive risk-adjusted value proposition for the asset class. The Census released updated state and local tax collection estimates, which indicated continued revenue growth for traditional municipalities. Calendar-year 2024 collections increased 4.5% to $2.1 trillion year-over-year (YoY), marking a record high level according to the Census data. Individual income tax collections increased 4.9% YoY, corporate income tax collections declined 0.4% YoY and sales tax collections increased 1.5% YoY. Property tax collections also recorded a strong trend higher, growing 7.7% YoY. We expect that a strong labor market and consumer spending should support tax collections and municipal credit conditions over the medium term. We also anticipate these direct revenue sources will play a more critical role in state and local budgets, particularly if federal spending reductions extend more broadly to municipal credit.

Valuations

Tax-exempt municipals offer above-average after-tax yield pickup versus taxable counterparts.

Elevated supply conditions contributed to higher income opportunities and improved relative valuations in the municipal market. The Bloomberg Municipal Bond Index average yield-to-worst (YTW) ended the year at 3.85%, up over 50 basis points from the start of the year and equivalent to 6.50% on a taxable-equivalent basis. The municipal yield curve has steepened meaningfully this year, offering more attractive opportunities in intermediate and longer maturities. These attractive tax-exempt income levels, along with favorable fundamentals, underscore the risk-adjusted value proposition of tax-exempt munis amid broader economic uncertainty in 2025.