Headline retail sales rose a healthy 0.6% in November, but that was partly offset by a -0.2% revision to the October sales estimate. Meanwhile, financial market analysts pay more attention to the “control” sales measure, which excludes sales at car dealers, service stations, building materials stores and restaurants. (These sectors are frequented by businesses about as much as by households, and so the control measure focuses on retail sectors frequented predominantly by consumers.) That control measure rose a decent 0.4% in November but was fully offset by a -0.4% revision to the October sales estimate. As a result, November control sales were little different from the original October estimate released last month.

Then again, October sales growth looked strong a month ago and remained so even after the revisions. The fact is that retail sales data have been choppy across the past few months, with control sales registering strong gains over June-August, a decline in September, another strong gain in October, and then the relatively modest gains in November.

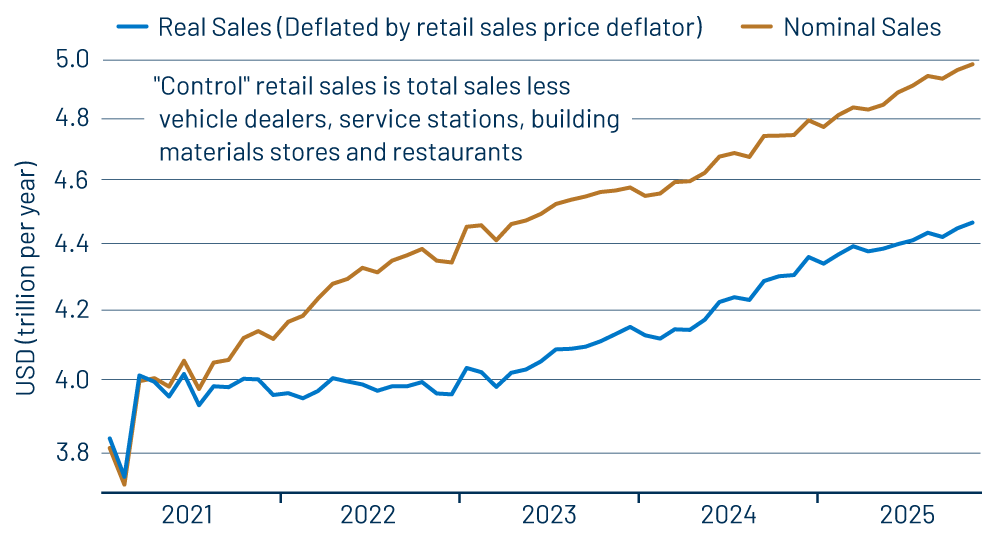

The net result of all these swings is a decent growth trend beneath the monthly chop. You can see this in Exhibit 1. In both nominal and real terms, control sales have shown steady growth for the past three years, so no improvement under the new Administration but no deterioration either. And as you likely have heard, consumer spending has been the main linchpin of the current US expansion over its five years.

At this point, we should mention some technical aspects of our estimates. First, thanks to the government shutdown, no consumer price index (CPI) data were estimated for October. So, the data shown here for real sales in October are based on an interpolation between September and November price level estimates, assuming equal inflation rates in October and November. Second, government budget cuts led to a cancellation of retail price data in the summer of 2024 that had previously been released. Our estimates since then are based on the presumption that retail price inflation for control sales has proceeded at the same rate as shown by the CPI for these items.

Based on all these factors, real control sales are on pace to register a 4.2% annualized rate of growth in 4Q25, up from a 3.2% annualized growth rate in 3Q25. We expect real consumer spending on merchandise (a component of GDP) to register similarly strong 4Q growth. Combined with a sharp decline in the trade deficit in October, this points to robust 4Q GDP growth. Thus, the current estimate from the Atlanta Federal Reserve GDP Now tracker is for a rocking 5.3% growth rate in 4Q.

All these statements and estimates are, of course, preliminary. Thanks to shutdown-related delays in data transmission, we do not yet have any official consumer spending data for 4Q. October and November consumption data are due to be released later this month, and we will cover those data in a January 26 post. Similarly, foreign trade data can vary wildly from month to month, and for 4Q, we now have data only through October. Finally, also thanks to the shutdown, no 4Q construction data is as yet available.

The data we do have point to a steadily healthy consumer sector, despite the softer labor market growth trends discussed last week. Barring a disaster in construction or business investment activity, the economy is set to register good or very good growth to finish out the year.