This is our first post since before Christmas, and today’s jobs report was also the first release with “normal” data delivered on the usual day since before the long government shutdown (i.e., since September 30). So Happy New Year to you, and here’s hoping that at least the release of economic data will follow a smoother path this year than last.

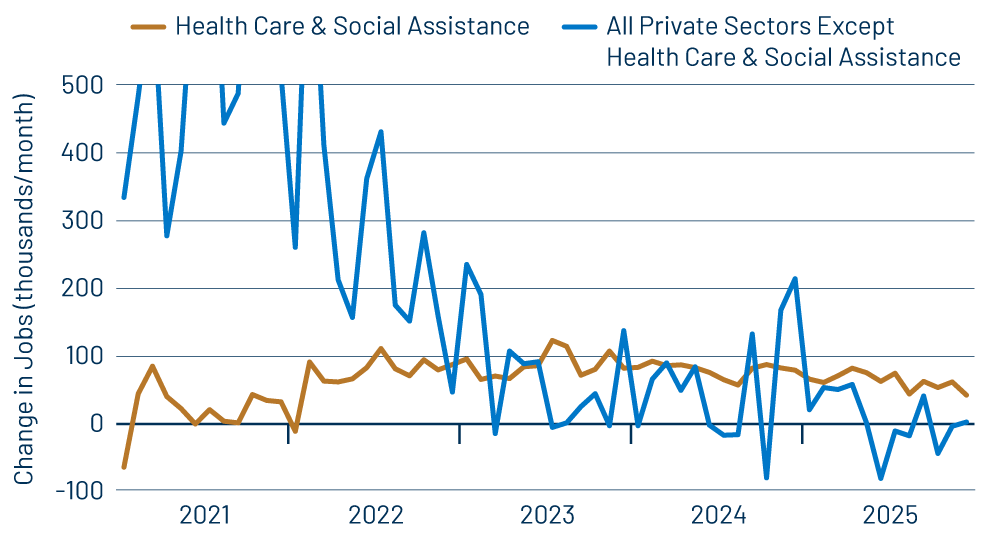

Alas, today’s jobs news was less than happy. Private-sector payroll jobs were reported as rising 37,000 in December, less than expected. Furthermore, all of that growth and more occurred in health care and social services, two sectors that largely reflect government largesse and that have been accounting for most or all of monthly job growth since mid-2023 (more on this point to follow). Yet further, there was a very large downward revision of -70,000 to the November jobs estimate, which obviously more than offsets the reported growth for December.

You can blame the weak growth (no growth?) on Mr. Trump and his tariffs if you wish, but the fact is, again, that today’s data merely continues a trend that has been in place since mid-2023. As Exhibit 1 shows, outside of health care and social assistance, job growth has essentially flat-lined for the last three years. Yes, there were some flare-ups of positive growth in December 2023 and at year-end 2024, but these look like random blips, and they may not survive the benchmark revisions that the Labor Department will announce next month. (Labor has already previewed a downward revision of hundreds of thousands of jobs for the data through the March 2025 benchmark date.)

Meanwhile, even in health care and social services, job growth has been decelerating steadily though slightly since mid-2023. In the rest of the private sector, we have seen recently positive job growth in food services, but zero or slightly negative growth everywhere else.

Interestingly enough, the ongoing softness in job growth does not look to have put a damper on economic growth. As remarked in our December 23, 2025 post, GDP growth in 2025 (through Q3) was slightly faster than what we saw in 2024, and there was no apparent decline in GDP growth in 2023-2024, despite softening job growth then.

Details of today’s report contained some swings that we think are random blips. For all workers, average workweeks declined and average hourly wages grew at a relatively rapid, almost 4% per year rate. However, these swings merely offset November swings in the opposite direction. November workweeks rose as much as December workweeks fell, and November average hourly wages rose only slightly.

Furthermore, it is perhaps noteworthy that workweeks and average hourly wages for nonsupervisory workers failed to show the November swings and December reversals that all-worker data showed. Nonsupervisory workers are actually paid by the hour, while supervisory workers draw a salary, so the workweek and average wage data for supervisory workers are guesses at best.

In any case, our point is that the (hopefully) “bankable” data within today’s report are the job numbers, and there the signal is that private-sector payroll jobs continue essentially flat outside health care and social assistance, a trend that has been in place for almost three years.