The government shutdown ended nearly 11 weeks ago, and the release of government data has now almost caught up from shutdown delays. Federal Reserve releases of industrial production data are fully caught up. Commerce Department data on consumer spending, manufacturing and construction are now just a month behind and will likely be fully back on schedule next month. Of course, another possible shutdown looms, but that is a story for another time.

Today, we will focus on the latest data on consumer spending and manufacturing activity and what it means for the overall economy. Headlines indicate two positive trends: first, consumer spending is growing at a decent rate; second, data releases since the shutdown show an improvement in manufacturing activity and business investment in new equipment, which has boosted overall US growth. Add in the sharp improvement in the US foreign trade balance reported for October, and we could indeed have a very strong GDP report for 4Q late next month. Details on all these points follow.

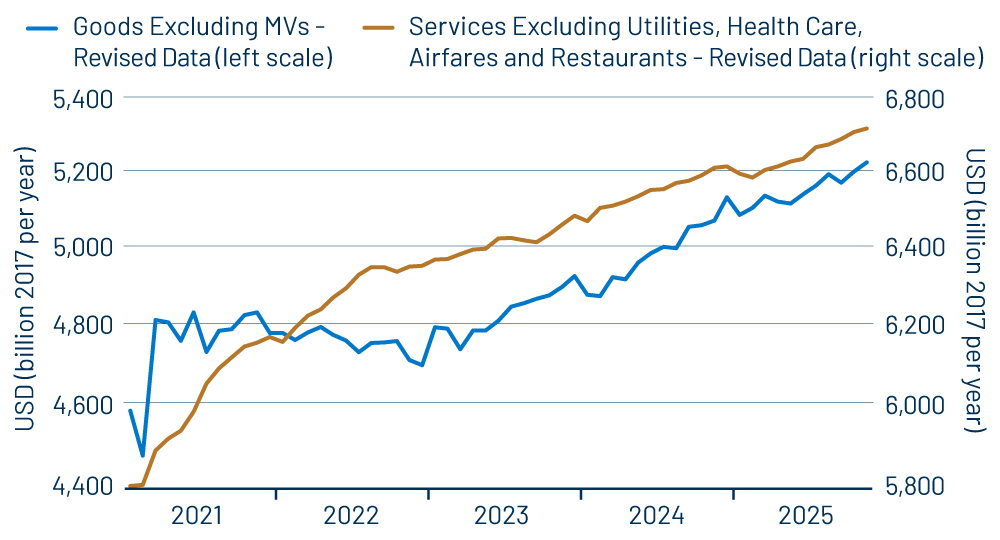

Exhibit 1 summarizes consumer spending trends. As you can see there, spending on both merchandise and services is proceeding nicely. No, there hasn’t been any acceleration lately, but neither has slower job growth curtailed consumption. (For that matter, personal income growth has remained steady/favorable despite sluggish job growth.) And the early-2025 slowing in services spending that concerned us some months ago has been fully reversed.

The series shown in Exhibit 1 abstract from four components of consumption: health care, because it is actually paid for largely by insurance companies and the government; motor vehicles and utilities, because of their volatility; and restaurants because of lingering Covid effects. The fact is that all four of these components are behaving right in line with our depiction of consumption in general.

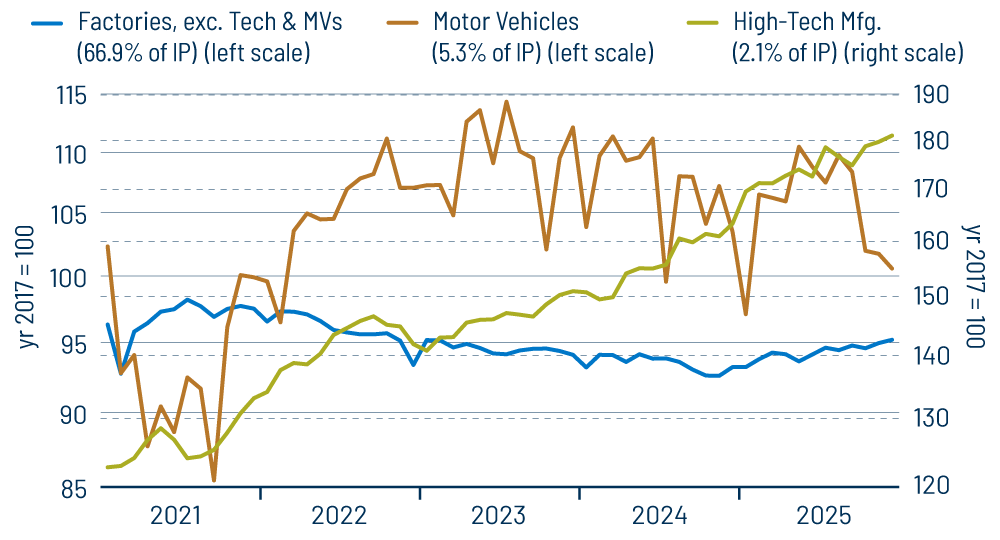

Turning to the manufacturing sector, Exhibit 2 summarizes things succinctly. High-tech manufacturing has been growing steadily throughout this expansion and has seen a further boost in growth this year. The new wrinkle is a rebound in output of lower-tech industries, after three years of decline. Data prior to the shutdown had hinted at some upturn, but the six months of data released since the shutdown document this more reliably. Output has rebounded for industrial metals, petroleum products, business equipment and even textile products.

Not shown here is the fact that business investment in “basic” equipment—that is, machinery other than computers and related tech—also started turning up around December of last year. This underlies the 2025 rebound in factory output. Meanwhile, last week’s post discussed the continued mild softness in construction activity, with residential construction trending lower, office and commercial construction still suffering from Covid effects and manufacturing construction elevated, but no longer growing.

Finally, it appears 4Q25 GDP is going to get a big boost from a sharp decline in the foreign trade deficit. This is mostly a reversal of a sharp increase in the trade deficit in 1Q25. Merchants feverishly ramped up imports to try to beat the Trump tariffs, and imports have fallen back more recently with the tariffs in place.

In truth, the early-2025 surge in imports led to increases in merchant inventories and so should not have affected 1Q GDP growth. Similarly, the offsetting decline in imports presently is leading to a decline in inventories and should similarly have no effect on 4Q GDP growth. However, with real world data collection techniques and all their flaws, 1Q GDP was reported as coming in negative, and 4Q is likely to show growth upwards of 4% (as did 3Q GDP).

The most accurate depiction of the US economy will be gained by looking at growth across the four quarters of 2025, that is, growth in 4Q25 GDP over 4Q24. That rate is still likely to show some improvement over 2024, reflecting steady growth in consumption, steady declines in construction and the rebound in manufacturing, but not as sharp an improvement as one might guess from the tone of the 3Q and 4Q releases.

In sum, the economy is not booming, but neither have tariffs had the deleterious effects that many warned of. And as recent trends in business investment and consumption continue, 2026 could show growth at least as good as that of 2025.