KEY TAKEAWAYS

- We expect defaults to rise in CRE markets, particularly in the office segment.

- The impact of CRE defaults is not meaningful to large multinational and regional banks, but we expect more challenges to smaller regional and community banks where potential losses are a larger part of their equity capital.

- The problems in segments of the CRE market are an additional negative for the US economy, but not a huge one.

JH: Simon, what’s going on in the commercial real estate (CRE) market?

SM: The global CRE market in aggregate is valued at roughly $11 trillion, with roughly $4.5 trillion of debt against it. As a levered asset class with characteristics of fixed-income, CRE valuations are sensitive to rising interest rates. Sectors with longer-term leases such as offices or retail properties can function like long-duration instruments, while properties with lease rates which reset more rapidly, such as hotels or apartments, are shorter duration in nature. As the Federal Reserve (Fed) raised rates last year, it impacted both the cost of financing and equity return requirements, which flowed through to collateral valuations.

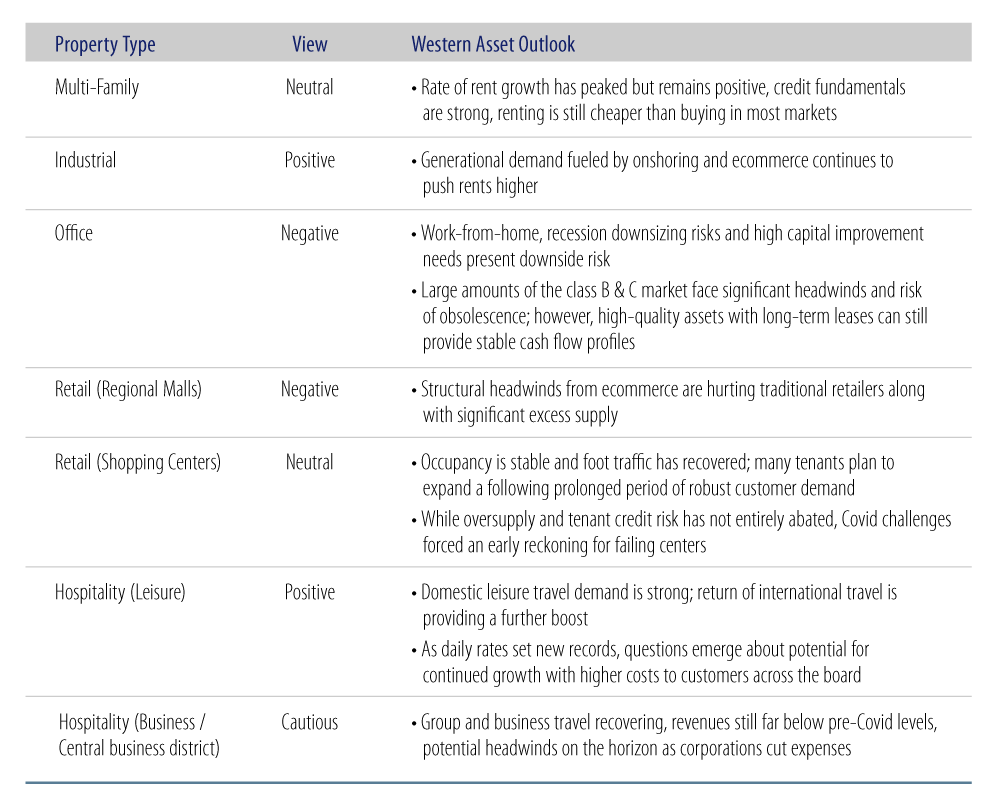

Property and market fundamentals underpin those collateral valuation assumptions. We roughly categorize the current health of sector fundamentals into the “haves” and the “have nots.” For example, the “haves” continue to see growing demand trends that provide support for valuations despite higher borrowing costs. This includes property types that benefited from post-lockdown economic growth such as multi-family housing, industrial distribution centers and leisure resort hotels. On the other hand, the “have nots” have seen declining demand and excess supply that are headwinds to asset values and will likely lead to rising defaults—sectors such as office properties or regional malls.

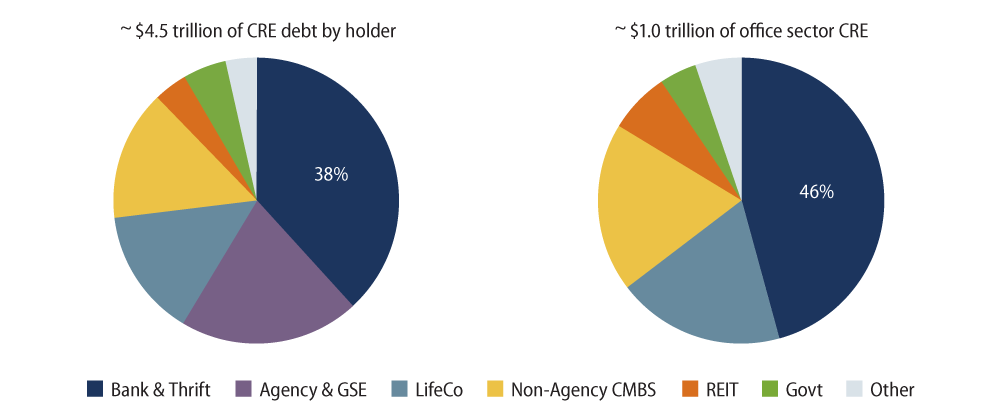

While access to credit for the entire sector has been tightening since mid-2022, recent volatility enhanced by bank deposit runs has led to a worsening outlook for parts of the CRE market as capital availability and underwriting standards tighten further. Given that banks (and more specifically the smaller regional and community banks) are relevant holders of sizable CRE exposure, it’s no surprise to us that confidence in regional bank asset quality has been questioned recently. While other participants may step in to provide capital should regional banks pull back from lending, it’s worth noting that more than one-third of the $4.5 trillion CRE debt market is held by banks. In addition, almost 50% of the $1 trillion outstanding office debt is held by banks (Exhibit 1).

JH: Ivor, are the regional banks prepared for the risks of declining CRE values and potentially higher defaults?

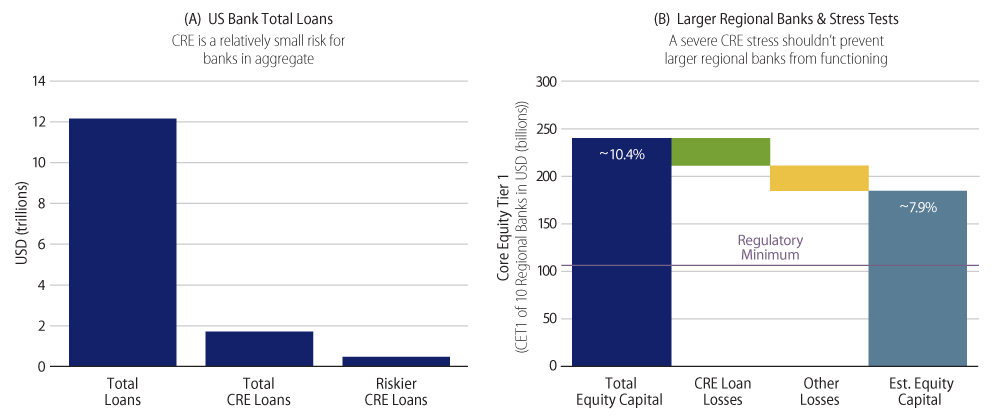

IS: The US banking sector fundamentals are the best they have been in decades. For context, US banks have about $12 trillion in total loans. On average, 16% are CRE loans—approximately $2.0 trillion. The riskiest loan type within CRE for banks is construction and land development lending. These loans represent 4% of loan books or $470 billion, with higher concentrations for small regional and community banks.

For background, post-global-financial-crisis (GFC) regulation has left the broader banking system with materially more equity capital, more liquidity and less risk. That said, the smaller regional banks are not as diversified as the larger systemically important banks that have been coerced out of a lot of their riskier lending. Although banks tightened credit significantly several quarters ago, it’s reasonable to assume that conditions will tighten further. In addition, the cost to keep deposits for smaller banks may erode their net interest margins and the potential for more regulatory oversight of smaller banks may add to the headwinds.

That said, it’s worth noting that the Fed’s Comprehensive Capital Analysis and Review (CCAR) stress tests have already provided some transparency for many of the larger regional banks. For background, the assumptions in the Fed’s Severe Adverse Scenario include declines in real estate of 25%-40%, and 10 of the regional banks with average assets of over $200 billion are seeing Core Equity Tier 1 ratios declining from ~10.2% to ~7.9%, and remaining well above regulatory minimums. Because of the post-GFC regulations, most of the banks are in a position where they are able to continue to lend to businesses and households despite potential losses on loans—assuming there is still willingness to borrow in those circumstances.

While the assumptions are draconian, they may be realistic, and of course not all banks’ underwriting standards are the same. So as a bank analyst, it remains critical to understand a bank’s lending process, risk management and asset quality to determine if it makes sense to invest in their debt. That said, we see a lot of value in the debt of larger banks and remain selective in regional banks.

JH: Mike, as an economist, how do you see the supply and demand trends in real estate that Simon mentions are impacting prices? Also, will additional bank failures depress credit availability and negatively impact growth?

MB: For background, CRE construction has already declined by 21% since the onset of Covid in 2020, so levels of construction are already depressed. Within real estate, commercial construction represents about 1% of GDP presently, and for comparison, residential construction was almost 4% of GDP at the end of 2005 before its collapse.

Will this push the economy into recession? Well, I’m not too sure of that. Even the much larger homebuilding plunge of 2006-2010 failed to drive recession by itself. It was only when foreclosures and losses on mortgages had generated systemwide banking problems (in the summer 2008 and after) that the US economy was pushed into a general slump. As I have been saying for several quarters, I do see some real trouble in parts of the real estate markets.

In terms of the impact on the banking system and subsequent impact on the economy, it’s an additional negative. While one could take issue with some aspects of the Fed’s and Treasury’s actions, at present, they look to have succeeded in preventing a system-wide banking crisis. Individual banks have failed, and we expect it’s likely that more will fail, but we don’t expect a financial system liquidity crisis even remotely like that of the GFC.

However, CRE problems will take a long time to work through. Don’t expect these issues to leave the financial headlines for a few years. The burgeoning defaults will lead to losses for shadow-banking lenders, perhaps failures of these, but commercial banks large and small are generally extremely well capitalized, which will serve to limit systemic implications from the CRE problems.

I think the current situation is an additional negative for the US economy, but I don’t think it’s a huge one.

JH: Simon, Ivor and Mike, any additional thoughts on these headwinds and/or the situation generally?

SM: We see further downside risk in the office space, particularly among older un-renovated buildings and within the regional mall space, which has been oversupplied for years. In the office segment, the ongoing impact of flexible work arrangements, especially in major coastal markets, continues to impact leasing demand. In addition, high capital improvement needs for renovating class B & C properties require additional equity investment. On a positive note, domestic leisure travel demand has been very supportive for the recovery of the hotel sector; the limited supply of homes for sale is providing a floor for apartment landlord pricing power, and supply-chain re-shoring coupled with online shopping trends is fueling explosive growth in demand for well-located distribution centers. While rising rates have been a valuation headwind to all segments, we see relatively attractive yields, good asset quality and opportunities for clients to invest in segments of the CRE market that have been negatively impacted by recent uncertainty (Exhibit 3).

IS: I agree. Similarly, we have seen premiums rise meaningfully in the banking sector. We think a few idiosyncratic events have created an opportunity for investors to take advantage of the back-up in yields based in US banks and selectively in the UK and Europe. We expect loan losses to pick up and credit conditions to tighten, but these yields are the most attractive I’ve seen in years across the capital structure. We favor being selective by country, bank and capital structure. Since the regional banks have been more in focus given declining confidence in their liquidity and asset quality, I expect there will be some changes. Specifically, we believe the US regional bank business model will evolve in three ways: (1) much more regulation with an emphasis on deposits, liquidity, interest-rate risk and commercial real estate loan exposures, (2) increased consolidation and (3) more ratings dispersion as the small to medium-sized regional banks face downward ratings pressure.

MB: As I’ve mentioned before, I see some real headwinds in real estate markets. I just don’t see an event like 2008 pushing the economy into a deep recession.