KEY TAKEAWAYS

- Our view on inflation is that the decline we have seen in both headline and core inflation rates, already one of the fastest on record, has further to go and will be long-lasting.

- The labor market and fiscal issues are immediate impediments to the interest-rate outlook. The recent JOLTS report has declined sharply and the quits rate has returned to pre pandemic levels, suggesting a moderation in labor pressure.

- Outside of the US, we remain optimistic about the prospects for EM, particularly in Latin America. While China has become a source of mild deflationary global pressure, we continue to believe that the Chinese economy will prove resilient.

In 1981, the Federal Reserve (Fed) under Paul Volcker famously broke the back of inflation. The 30-year Treasury bond peaked at just over 14%. The bond market, however, remained deeply skeptical of any fundamental improvement in inflation and the 30-year Treasury revisited 14% in the spring of 1984. The economy had proven remarkably resilient, the Reagan tax cuts and military buildup provided a strong fiscal thrust, and the possibility that the decline in inflation could prove more than temporary was widely dismissed. As both the 80s and 90s wore on, the economy performed with very robust growth. Even so, this proved to be an exceptional buying opportunity as the diminution in inflation remained, and long-term rates steadily declined.

Consider now the past year; the post-Covid Core Consumer Price Index (CPI) spike peaked in September of 2022, and bonds appeared to have bottomed in November. The sources of inflation were many—Covid monetary and fiscal stimulus, massive supply shocks, and the commodity surge combined with the Ukraine war. And now, monetary policy has turned from a tailwind to a gale force headwind, while supply chains are close to being fully restored and commodity prices are near their pre-war levels. But the economy remains resilient. Fiscal thrust continues despite a firm labor market. And market sentiment has coalesced around the view that the improvement in inflation has run its course and will remain “sticky.” Against this backdrop, long-term yields have now surged back to their highs.

The labor market and fiscal issues are immediate impediments to the interest-rate outlook. Looking forward, though, there is room for optimism on both fronts. The labor market is tight with an unemployment rate of 3.5%. The Fed has been unified in voicing anxiety about the prospects of a wage price spiral if the labor market doesn’t loosen. But Fed Chair Jerome Powell‘s oft-cited JOLTS report has declined sharply (Exhibit 1). Just as importantly, the quits rate has returned to pre-pandemic levels. In his Jackson Hole speech, Powell emphasized the Indeed Wage Tracker, which has also showed a meaningful decline. These trends strongly suggest moderation in labor pressure.

On the fiscal front, the increased expenditures from the ironically named Inflation Reduction Act, combined with the student loan forgiveness and absence of capital gains tax receipts, have increased the deficit and in concert the level of Treasury bond issuance. Next year, all three of these factors will have abated meaningfully.

Our view on inflation is that the decline we have seen in both headline and core inflation rates, already one of the fastest on record, has further to go and will be long-lasting. Fiscal policy is too loose and labor markets are firm. Fed policy remains restrictive. Yet longer-term, tighter credit conditions, a more challenged consumer, weaker global growth and inflation all together reinforce the already decelerating inflation trends. Add back the pre-Covid disinflationary drivers of heavy global debt loads, demographics and technology, and the possibility that we are going to encounter quite a different dynamic as the years unfold is more than merely plausible. But just as we saw in the great inflation unwind in the 80s, this process will be very uneven and take time. Similarly, the fear of inflation works its way out of market psychology only very slowly.

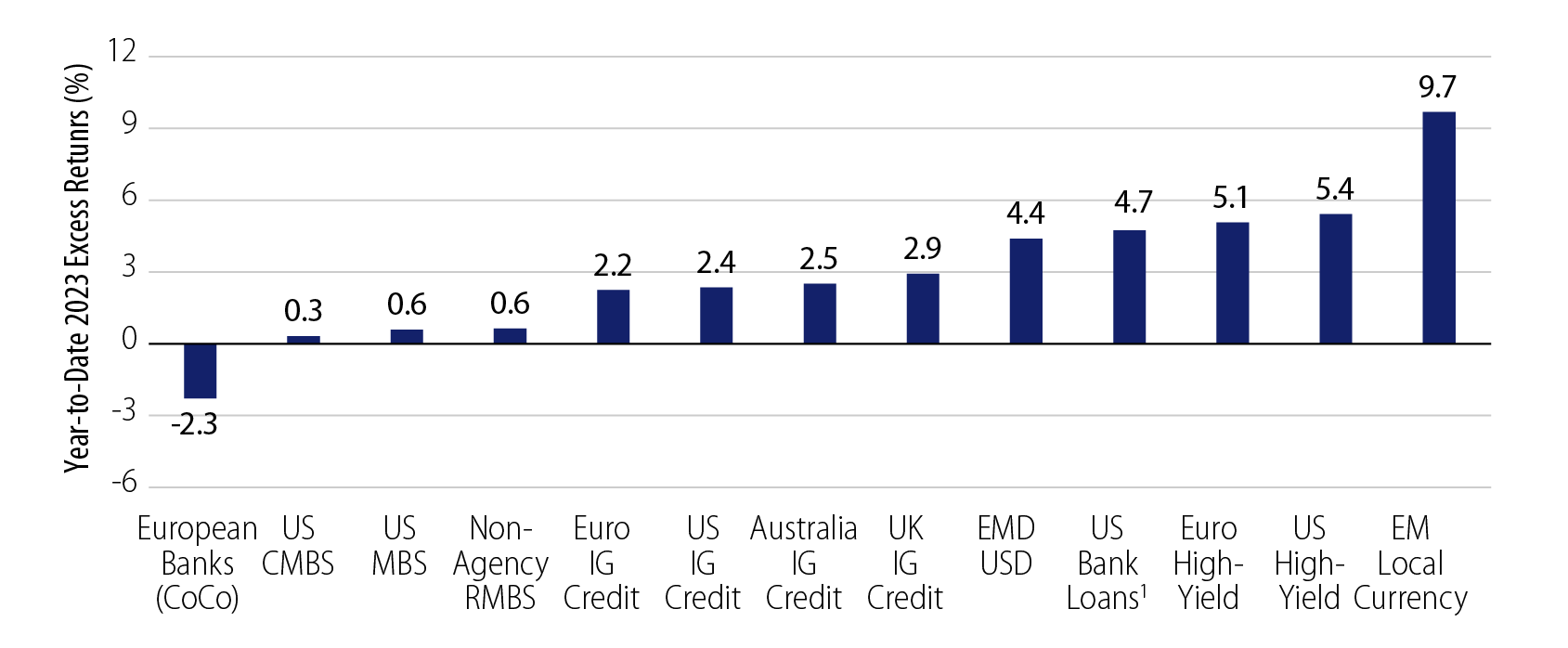

At the beginning of the year, the consensus view of a growth slowdown suggested to many that spread products should be avoided. Yet with the downshift in inflation has come US growth resilience, and the performance of spread sectors has been excellent (Exhibit 2). In particular, we would note the exceptional performance of emerging market (EM) local currency debt. We have remained optimistic about the prospects for EM, particularly in Latin America. The EM country complex tightened policy well in advance of developing countries in this cycle. High interest rates, the prospect for interest rate declines, and most importantly, potentially improving currencies, have all been beneficial.

The key to this outlook is China. Even with a weakening of the yuan versus the dollar of roughly 15%, Chinese producer prices are falling sharply and consumer prices are also falling. Policymakers’ inability to arrest property sector woes has stymied investor confidence. Government policy remains firmly pro-growth, but the magnitude of the steps taken so far have been meaningfully insufficient. Thus, China has become a source of mild deflationary global pressure.

Our view has been that China faces significant secular growth challenges that will keep it from achieving anywhere near the growth rates of the past. But cyclically, coming off the low base of last year’s Covid shutdown, growth of close to 5% is not unachievable. We continue to believe that the Chinese economy will prove resilient, but not buoyant.

A slower China also presents challenges for European growth. Germany is already teetering on the edge of recession. Yet Europe’s inflation rate remains above trend and the possibility of one more European Central Bank (ECB) hike remains in play. Still, we think that we are at or past the last Western economy rate hikes. Subdued global growth and declining inflation present an opportunity for US, UK and European rate pauses.

Over time, as the backdrop of receding inflation continues, short rates will eventually be reduced. In this context, the outlook for a broad variety of fixed-income sectors is favorable.