KEY TAKEAWAYS

- The Fed remains fixated on the lagging indicators of labor market and inflation data.

- Inconsistent communication and messaging from the Fed have elevated our concern for a policy error, thus increasing the likelihood of more negative economic outcomes.

- The Covid-related inflation spike should prove in retrospect to have been an anomaly.

- We believe a longer-view perspective necessitates taking advantage of the declining inflation trajectory by embracing today’s yields.

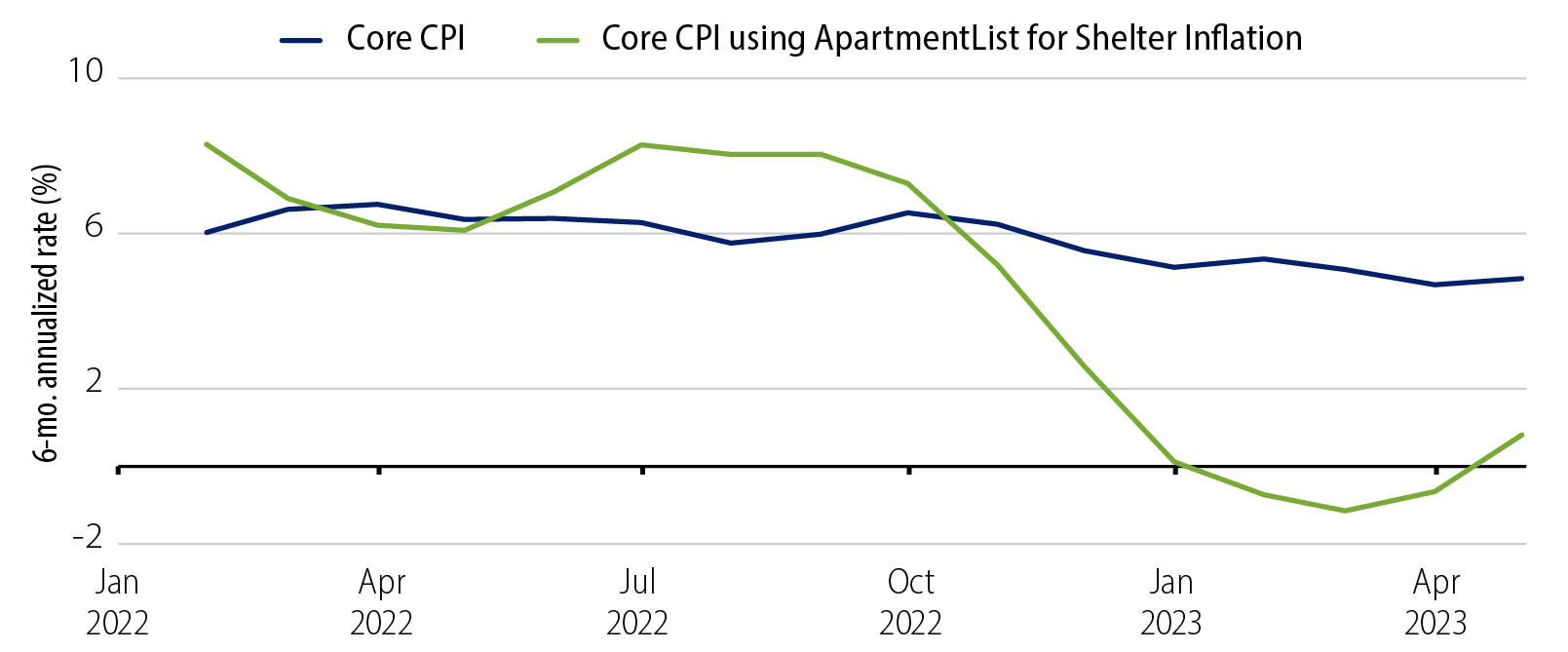

Our contention has been that both inflation and the economy were gradually softening and that the cumulative effects would be sufficient to induce the Federal Reserve (Fed) to pause its tightening program. The downward path of inflation has been uneven but persistent. The rate of inflation has moved from 9.1% year-over-year (YoY) to 4.9% YoY since last fall, making back over half the distance to the Fed’s ultimate 2% target. Using current rental and housing data, core CPI has been running between 0% and 2% over the last six months (Exhibit 1). And this comes even as the lags from the enormity of the Fed’s interest rate tightening campaign are still before us. The economy has proved reasonably resilient with only a modest slowdown to date. But downside risks are becoming more dominant, as credit conditions tighten in the wake of the regional banking crisis.

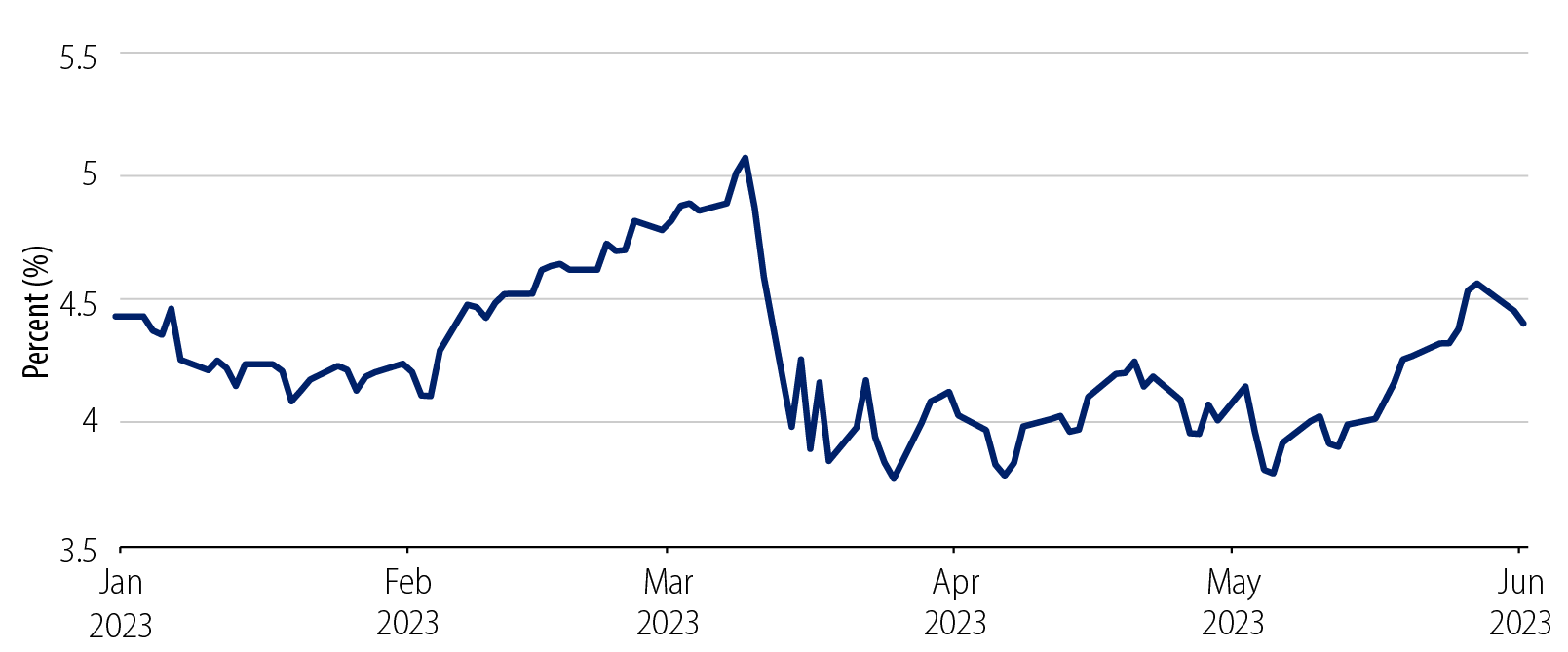

The Fed has signaled a willingness to stop hiking—but has conditioned this as a “hawkish pause.” This means market participants are still at the whim of monthly data prints as the Fed’s lip service to “long and variable lags” continues to be more form than substance. This is extremely unfortunate for two reasons. The first is simply that there are long and variable lags in monetary policy and the massive Fed interest rate shock of 500 basis points (bps) of tightening may already be too much. Second, the violence in the fixed-income markets has become enormous. Exhibit 2 shows the change in yield on the 2-year note just this year. We had a 35-bp rally in early January as inflation data ebbed, and the Fed intimated it might be done. On February 8, Powell said, “ ... it is gratifying that the disinflationary process is getting underway. We’re going to be cautious about declaring victory ....” So the Fed’s message was that it could, but wouldn’t declare victory.

Four weeks later, the yield on the 2-year note had risen by 65 bps. Powell then completely reversed, testifying before Congress that the Fed would need to accelerate to 50-bp hiking moves because inflation was now dangerous and the Fed might be behind the curve. As the regional banking crisis perhaps not coincidentally exploded the day afterward, 2-year note yields fell virtually 112 bps on just five trading days. Market reactions signify the clear understanding that the enormity of this tightening campaign could give way to a downside break, but if not, even further Fed tightening cannot be ruled out.

Such is now the case. The 2-year note yield has risen 78 bps from its low. Why? The economy has remained resilient, and inflation continues to be “sticky,” which is code for not coming down fast enough. The Fed remains fixated on the labor market and monthly inflation data. While both are lagging indicators, and would reasonably be expected to face the downward pressures from policy lags and tightening credit conditions, Fed policy tightening continues to be a month-by-month decision. Markets are beset by both the direct upside yield risks of tightening, and the downside yield risks from potential economic damage.

The inconsistent communication and messaging from the Fed has elevated our concern for a policy error, thus increasing the likelihood of more negative economic outcomes. Although our base case remains a moderate slowdown, we have biased our credit positioning toward higher quality. We maintain that a higher-quality credit profile will still capture meaningful upside in our base case scenario, but prove resilient should more challenging economic headwinds prevail. Additionally, we have moved our duration more to the front end of the yield curve. We still believe the fundamentals strongly suggest a hard landing is both improbable and unnecessary.

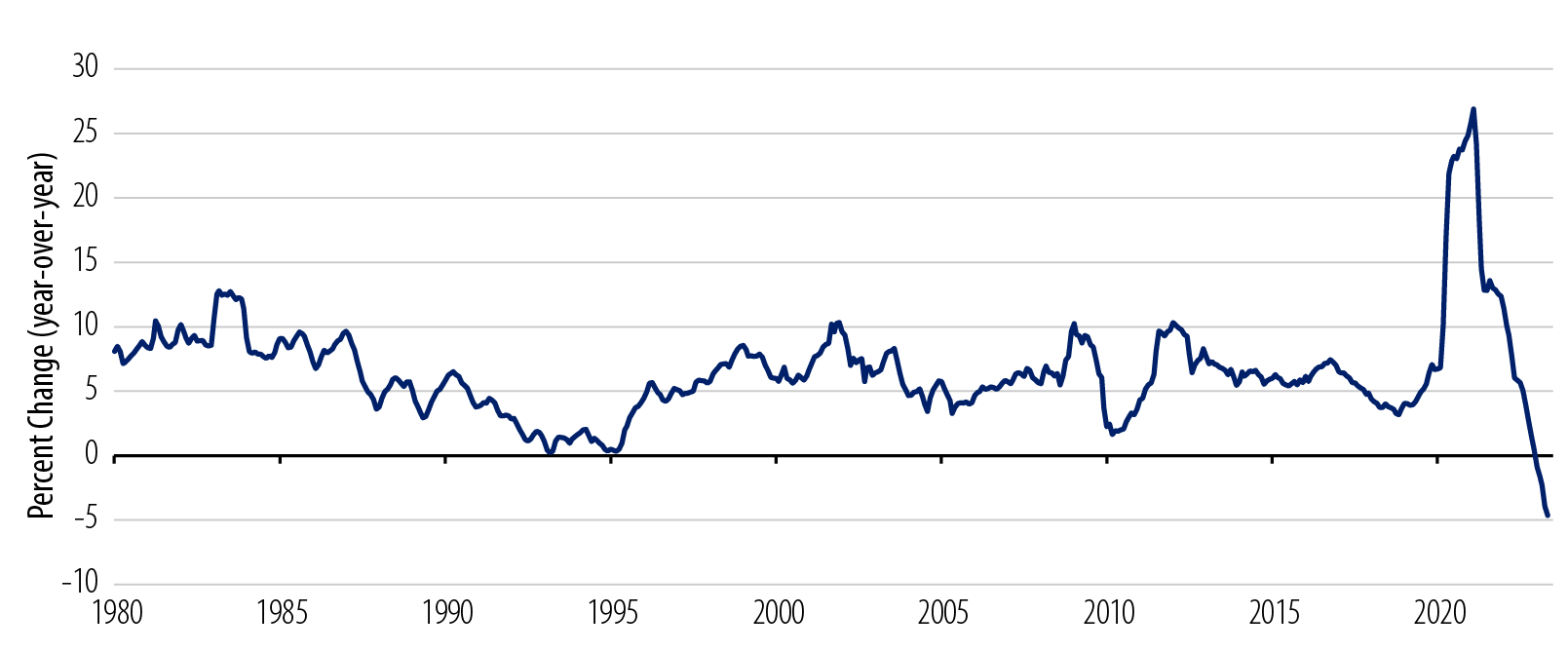

On a brighter note, our contention remains that when the history books are written, the Covid inflation spike will prove to be an anomaly. The enormity of both the Covid and Ukraine war supply-side disruptions are now past. Commodity prices have been falling broadly and steadily. The fiscal policy expansiveness has reversed and future forays have been shelved by the debt limit compromise. Most importantly, monetary policy is straightforwardly contractionary. Exhibit 3 shows that M2 growth has now contracted at a 4.63% rate, which is the greatest contraction since the Great Depression. Granted, M2 was expanded spectacularly, swelled by the enormity of transfer payments related to the pandemic, but the speed of this reversal suggests future inflation will be much lower.

Last week, Ben Bernanke and Olivier Blanchard presented a new paper at the Brookings Institution entitled, “What Caused the U.S. Pandemic-Era Inflation?” Their conclusion was that supply-side issues were the predominant drivers of the inflation, rather than demand policy overreach. Pushing back against the idea that inflation was policy-driven, they wrote, “The critics’ forecasts of higher inflation would prove to be correct—indeed, even too optimistic—but in substantial part, the sources of the inflation would be different from those they warned about.” We have steadfastly articulated the supply-side challenge of the inflation bulge. While it is nice to be in such august company, more importantly, the supply shock unwind should be beneficial to both sturdier growth and lower inflation.

Additionally, to get out of our lane, the market preoccupation with AI should also have a disinflationary note. As Jeremy Siegel puts it, “While gains from AI will be uneven throughout society and the economy, it has the potential to be very deflationary by reducing costs and the need for labor.”

Across the fixed-income spectrum, investors have choices that offer much more yield than has been generally available over the course of the last 15 years. But investors are reasonably nervous about today’s potential downside economic risks and upside yield risks as the Fed tightening campaign threatens to rumble on. However, we believe the longer view mandates taking advantage of a declining inflation trajectory by embracing today’s yields.