KEY TAKEAWAYS

- The Fed has pivoted to making inflation its top priority, committing to get the fed funds rate back to its estimation of the neutral range at 2% to 3%.

- Consumers globally are beset by sharply lower real incomes, but this is showing up particularly acutely in emerging markets.

- The bond bear market of both higher rates and wider spreads continues to be daunting, but this may very well lead to the restoration of a better yield structure.

- Fear that Fed tightening will persist to and through a potential economic downturn has prompted most income investors to trim their credit holdings.

- It’s during times like this when Western Asset’s adherence to our fundamental, relative value disciple has been of most benefit.

The great secular disinflation trend of the developed world that has been in place for the greater part of 40 years has been severely interrupted. Monetary and fiscal largesse combined with Covid reopening demand set against severely constrained supply was already a tailwind to inflation. The Ukraine/Russia conflict has acutely amplified the problem. The Federal Reserve (Fed) has pivoted to making inflation its primary priority, as it commits to getting the fed funds rate back to the neutral range (characterized by Chair Powell as 2%-3%). The strategy, outlined by Vice Chair Williams, is to bring core inflation to below 4% this year, 3% next year and 2% in 2024.

Market pessimism about the achievability of these results abounds. Specifically, the strength in the labor market, housing prices and commodity prices has not yet abated. But markets are forward-looking, and the tailwinds to inflation, as daunting as they have been, are giving way to the headwinds facing global and US growth. China is struggling mightily to get growth restarted even as it retains its zero-Covid lockdown program. The war in Ukraine continues to weigh heavily on European growth. Consumers globally are beset by sharply lower real incomes, but this is showing up particularly acutely in emerging markets. In the US, the hawkish Fed pivot increases the odds of a slowdown.

Our contention is that monetary policy is focused on demand destruction. Severe supply imbalances, despite the setbacks from developments in Ukraine and China, will slowly but surely heal. Fiscal policy is tightening. Housing supply in the US is accelerating sharply even as mortgage rates have dampened demand. Real incomes are challenged, and the anecdotes from Amazon, Walmart and Target suggest inventories are close to being fully replenished even as consumption growth appears to be stalling. All this augurs for a significantly lower glide path for inflation as the year progresses.

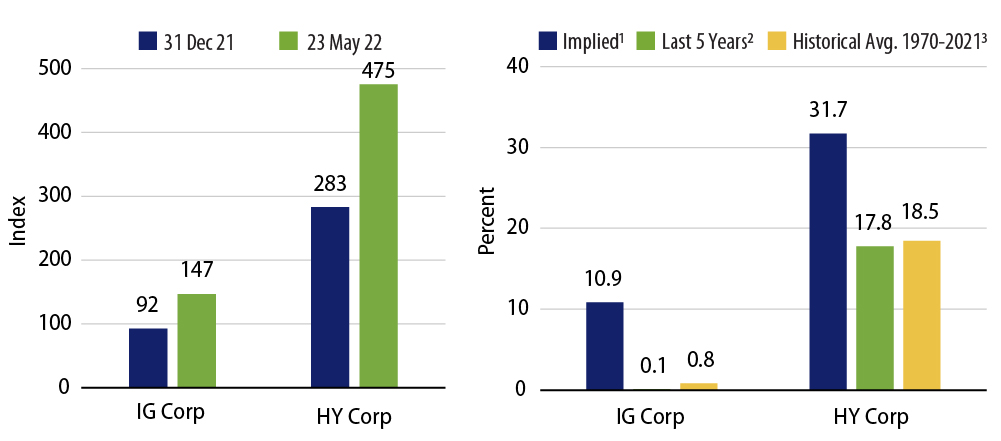

Credit markets have become besieged by creeping recession fears. Despite very solid fundamentals, market-implied forward default probabilities are rising well above historical averages and certainly in excess of anything suggested by the current supportive fundamental backdrop. The five-year implied probability for defaults on investment-grade credit stands at 10.9%, while for high-yield credit it has moved to 31.7%. These numbers stand in extremely sharp contrast to the current five-year default rates of 0.1% and 17.8%, respectively. While current debt metrics such as leverage and interest coverage (Exhibit 1) along with free cash flow generation and general balance sheet health suggest otherwise, credit markets are bracing for a severe transition to more difficult times.

Once again, the fear that Fed tightening will persist to and through a potential economic downturn has prompted most income investors to trim their credit holdings, while even the most bullish remain on the sidelines. Fear seems to have replaced optimism across all credit markets.

It’s during times like this when Western Asset has benefited the most. Adhering to our fundamental, relative value discipline, we recognize that opportunities are created when apprehension and concern drive valuations well beyond fair value. We believe such a time is upon us now. Risk aversion appears to be at an extreme level. Investment-grade credit is suffering its largest drawdown ever, currently -12.04% year to date (as of 24 May 22), while the high-yield market is on track to post its second worst year in a 40-year history, only to be surpassed by 2008. While some might suggest that the dramatic move higher in interest rates is the sole culprit, we would counter that the more recent spread-widening move has also significantly contributed to credit’s dismal performance.

Furthermore, a general defensive theme with respect to credit seems to be echoing across the credit markets. High-yield dealer inventories are at all-time lows, while high-yield mutual funds faced $43 billion of outflows in recent months and mutual fund cash balances are well above historical averages. In a recent Bank of America survey, global fund managers reported that “cash” was their top overweight, and the pace of high-yield issuance has slowed to a level we haven’t witnessed in years.

The bond bear market of both higher rates and wider spreads continues to be daunting. The other side of the bear market coin, though, is the restoration of a better yield structure. In a long-term portfolio context, bonds provide income, and they inherently have less price volatility than equities (present year notwithstanding). As an investor, the Fed’s commitment to re-attaining its 2% inflation objective is actually a good thing. Only in a persistently high and rising inflation environment can investors confidently sit on the sidelines secure in the knowledge central banks will continue to move short rates higher. In a moderating inflation environment, even from high levels, the prospect of short rate increases coming to an end comes into view.

Before the pandemic—and even during the zero-interest-rate Powell policy time period—the question on investors’ minds was, “How do I get safe yield?” As far from the recent market tumult as that question seems, there will come a day when it comes front and center again. Locking in attractive spreads against very pessimistic default assumptions in the context of government bonds priced to levels above central bank inflation forecasts has merit. It may take time for inflation to be reined in—but this task is by no means insuperable. Indeed, this could be sharply aided by positive developments such as the dissipation of Covid or a ratcheting down of the Ukraine/Russia conflict. Neither is in immediate sight, but given time, neither is out of the question.

The Fed unleashed its grand experiment in response to a global pandemic. Now it is attempting an abrupt unwind to that experiment. The Fed was originally convinced that inflation would prove transitory, but now is convinced the potential for its permanence justifies taking increasing recession risks. Our view is that as the fed funds rate approaches the 2% level, a more cautious approach would be appropriate in light of slowing growth and inflation, as well as in acknowledgment of unforeseen consequences. Ultimately the path of inflation will prove dominant. We are optimistic on that score.