Market Commentary

The only investors who shouldn’t diversify are those who are right 100% of the time. ~John Templeton

Executive Summary

- In the last two years, market sentiment has swung from pessimistic “secular stagnation” to today’s “reflation trade” enthusiasm.

- As optimists, we have focused on investing in the higher-yielding spread sectors that benefit from improving economic fundamentals, and we believe EM debt continues to provide the greatest opportunity.

- Our core theme has been that the process of inflation and interest-rate normalization would be very slow to develop, which is counter to the current market consensus expectation of higher inflation.

- Despite market optimism about accelerating growth, the need to protect against unpleasant surprises remains a crucial portfolio priority.

- If our outlook proves broadly correct, spread sectors and EM particularly should do well; if there are any setbacks, Treasury bond gains should help provide a cushion.

A little under two years ago the market and academic financial commentary were focusing on “secular stagnation.” This was the idea that global growth and inflation were so constrained by secular forces that policymakers and investors should focus on the need to protect against the persistence of downside risks to growth. Today, the ebullient market is celebrating the “reflation trade”—a synchronized global recovery buttressed with super-charged US fiscal policy that must mean risks to growth and inflation are only to the upside.

As optimists about the global and US recoveries over the course of the expansion, we have focused on investing in the higher-yielding spread sectors that benefit from improving economic fundamentals. This year the challenge to such an approach is that yield spreads are narrower than at any other time previously in this expansion. That reduces the margin for error and our overweights in developed country spread sectors have been substantively reduced. The area of greatest opportunity, in our view, is emerging market (EM) debt, particularly local-currency-denominated debt. Here, yield spreads are historically attractive at a time when global growth fundamentals have reversed from the headwinds of prior years into a powerful tailwind.

Both the good and bad news about portfolios utilizing diversified strategies is that some can be winning while others can be losing. That is the hallmark of our diversified strategy philosophy—not all of our risks are aligned or pointing in the same direction. The key to success is not only hopefully to have more winners than losers, but also to set the proportions such that the money won on the winners is more than the money lost on the losers. As if establishing a majority of strategies on the plus side isn’t hard enough, trying to gauge the aforementioned proportions is every bit as difficult. Relative volatilities change dramatically in different market environments. What might have seemed a modest-sized position can turn into a meaningful winner or loser if the volatility erupts dramatically.

This year is a particularly good one for an example of this kind. Volatility across all asset classes was subdued for almost all of last year, only to jump sharply in February. Now, most everyone appreciated that volatility was historically, perhaps unnaturally, low. So in building portfolios, not only was your assessment of the economic and financial environment central to your sizing decision, using more normal volatilities as the basis for your decision was also important.

Exhibit 1 displays the performance of a wide variety of spread sectors relative to Treasury or sovereign bonds (excess returns). Our concentration in spread sectors proved favorable as virtually all sectors performed positively. Most notably, the performance of local currency EM was truly outsized, providing at least an early-year validation of our positioning.

Spread Sectors Excess Returns (Year-to-Date Ending 26 Feb 18)

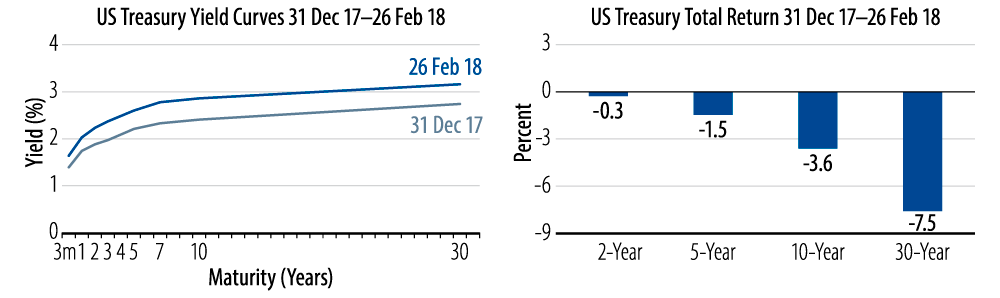

While our focus on spread sectors has been a beneficiary of the positive market sentiment toward future economic growth, our use of macro strategies, supported by our belief that central banks will be slow to remove accommodation, has been challenged by market sentiment toward quickly rising future global and US inflation. Exhibit 2 shows the behavior and performance of the Treasury yield curve since the start of the year. Rates have moved up, and the long end of the curve has suffered the most. Our decision to retain an overweight to duration was a distinct negative. Our decision to split our overweight between the very front end and the very back end of the yield curve was a modest mitigating factor.

Our core theme has been that the process of inflation normalization, and hence interest-rate normalization, would be very slow to develop. Markets, on the other hand, have shifted quickly and sharply to higher inflation expectations. The change in US fiscal policy in combination with already full employment conditions has led many to extrapolate current improvement in the inflation data to affirm that interest rates will have to move up meaningfully. Our view is that the short-term pickup in cyclical inflation doesn’t remove the long-term secular challenges to this bottoming process. It was only two months ago, at her last press conference following a Federal Open Market Committee (FOMC) meeting, that Janet Yellen had the following exchange:

Yellen: “What’s on my ‘undone’ list, you ask? We have a 2% symmetric inflation objective, and, for a number of years now, inflation has been running under 2%...”

“...but I have tried to be straightforward in saying that this could end up being something that is more ingrained and turns out to be permanent.”

It should be remembered that the core Personal Consumption Expenditure (PCE) annual rate never reached 2% during Janet Yellen’s entire term as Federal Reserve (Fed) Chair. If 2% is a target and not a ceiling, how concerned should the Fed or investors be if we do finally reach this level later this year? The Fed has declared its expectation that the terminal fed funds rate—once the inflation target of 2% has been achieved on a sustained basis—should be 2.75%. Currently, the market is already priced for a higher rate. Maybe the US expansion will go on longer and be more vibrant than the Fed is currently thinking it will. Maybe the Fed’s estimate of the terminal funds rate will have to be raised. But those are some pretty big ifs to be already priced in.

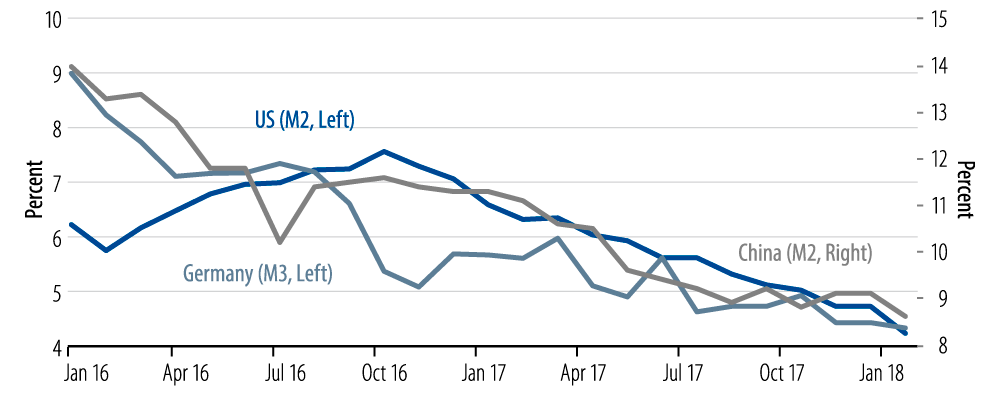

The failure of core inflation to achieve central bank objectives is also a global phenomenon. Both the European Central Bank and the Bank of Japan have endeavored mightily with extraordinarily accommodative policy initiatives to raise core inflation to the 2% bar, and without success. This means the process of removing policy accommodation globally will be occurring amidst below-target inflation rates. It will also be occurring amidst sharply declining rates of money supply growth (Exhibit 3). This suggests a meaningful degree of caution by policymakers is warranted. We resisted the secular stagnation view that inflation was down for the count. Now, we resist the current view that inflation is fully restored to vigor (without needing a period of rehabilitation).

Money Supply Growth Decelerating

More important than the specific outcome of either of the spread sector or inflation themes is the need to consider portfolio construction in its entirety. Our portfolios are built not because we see the future clearly, but because it is so damned difficult to see the future clearly. The reason we focus so heavily on diversified strategies is because forecast error is rampant. You need strategies that not only benefit in your base case, but also those that help the portfolio weather more adverse scenarios. In our case, a portfolio focused on beneficial global growth and the continued outperformance of spread products, particularly the volatile EM sector, can be challenged by downside risks to growth. And while current optimism about growth is pervasive, the need to protect against unpleasant surprises remains a crucial portfolio priority.

Owning duration based on the market’s confidence that the fed funds rate will ultimately exceed the Fed’s goal of 2.75% has the benefit of asymmetry in our view. If downside risks occur, the Fed is unlikely to continue its expected path of tightening. This brings a profitable position outcome, but will occur most likely under conditions that would result in causing the broader portfolio stress. If our more favorable view of the world develops, the Fed can persist in its tightening path of raising rates roughly once per quarter. If this occurs in the context of a healthy and lengthy economic expansion, even if the terminal expectation is exceeded, the benefits of such an economic outcome to the broader portfolio is likely to be considerable.

The Fed and other central banks are unwinding the greatest monetary experiment of all time. The Fed is not only raising interest rates, but shrinking its balance sheet. This process of liquidity withdrawal based on both quantitative tightening and steadily raising short-term interest rates is being implemented while inflation remains below target. Tightening monetary policy in a low-inflation environment to offset cyclical strength must be done cautiously, as it is replete with downside risks.

We are steadfast believers that the low inflation world we inhabit is not going to change quickly. Portfolios need buffers against adverse events, and Treasury securities remain the best diversifying hedge. During the long recovery since 2009, there have been several periods of market optimism that the economy had accelerated sufficiently (escape velocity) to bring about a surge in inflation. There have been other periods when market pessimism has led to concerns over portfolios with insufficient holdings in sovereign and Treasury debt, as well as strategies offering downside protection. We believe the global economies are mending, and that central bankers should finally but gradually be able to withdraw stimulus. It is not a sure thing by any stretch. If this outlook proves broadly correct, spread sectors and EM particularly should do well. If there are any meaningful wobbles, Treasury bond gains should help provide a cushion.