Western Asset has a truly global focus, with investment professionals around the world seeking out the best fixed-income investments for the benefit of our clients. In this Q&A, one of our leading regional investors—Desmond Soon, Portfolio Manager and Head of Investment Management, Asia (ex-Japan)—answers questions about the local bond market in China.

DS: China is now the world’s second-largest economy. We believe the current stable political environment is supportive of greater political/macroeconomic stability, policy continuity and a coordinated policy execution by the Chinese government.

China’s local onshore bond market is also now the third-largest bond market in the world, just behind those of the US and Japan, with approximately US$10 trillion in market value. This large bond market can provide global fixed-income investors with a wide and deep investment universe to diversify and generate alpha. Given that China local bonds offer attractive valuations versus similarly rated peers, we believe this sector will eventually play a more significant role in global bond portfolios.

Foreign ownership of China local bonds has historically been low—at present, it is approximately 5%—primarily due to long-standing capital controls imposed by the government. China has been gradually relaxing the rules of its capital markets and has been making foreign ownership incrementally more accessible over the past 15 years. This more relaxed access evolution has allowed the Chinese yuan to be included into the International Monetary Fund’s (IMF) Special Drawing Rights (SDR) basket as a recognition of China’s economic clout.

China local bonds will be entering major global fixed-income indices moving forward. In March 2018, Bloomberg announced the inclusion of onshore China government bonds (CGBs) and policy financial bonds (PFBs) to its flagship Bloomberg Barclays Global Aggregate Index starting April 2019. Inclusion is expected to occur gradually over a 20-month period and end with a weighting of approximately 5.5% of the widely followed index. While this is still dependent on a number of operational enhancements being implemented by the Chinese authorities, we are confident that Chinese authorities will resolve these technical issues. The announcement from Bloomberg also recognizes the country’s continued efforts to enhance access to the world’s third-largest bond market. According to Michael Bloomberg, the founder of Bloomberg LP: “It is a testament to China’s firm commitment to financial reforms and the pace of change taking place in its bond market, and another important step for China’s integration with global financial markets.”

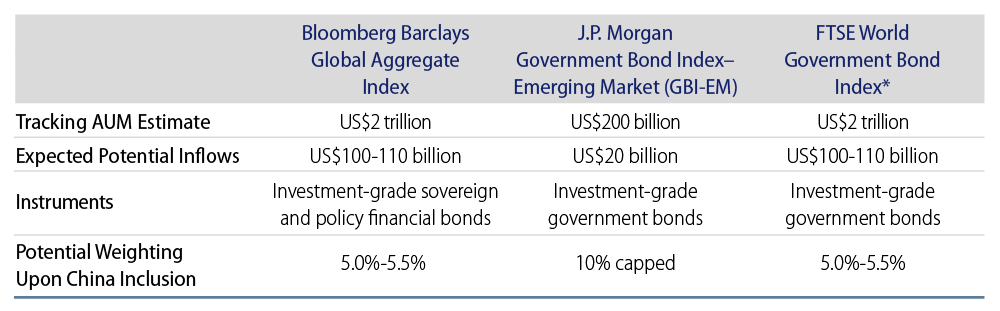

In addition to the Bloomberg Barclays Global Aggregate, China local bonds are also being considered for inclusion in other major bond indices such as the FTSE World Government Bond Index (formerly the Citi World Government Bond Index before July 31, 2018) and the J.P. Morgan Government Bond Index—the emerging markets (EM) family of indices and the representative benchmarks for local-currency-denominated emerging market sovereign bonds.

As I noted earlier, while China’s bond market is the third largest in the world, the level of foreign participation remains extremely low at about 5% due to long-standing quota restrictions imposed by China. This is expected to change following the recent policy relaxation, which will make the China Interbank Market (CIBM) almost fully accessible to foreign institutional investors, thus paving the way for sizable foreign inflows into the market over the long term. In an environment that still has low government bond yields in developed markets (DM), CGB yields provide an attractive pickup. Indeed, analysts have estimated the potential passive/tracker fund inflow into the China onshore bond market from mainstream bond index inclusion to be as much as US$240 billion. This will provide an environment for index sponsors to include such bonds in various other indices so that we may eventually see indices with a primary focus on China going forward. We believe initial investors will benefit from a first-mover advantage and index inclusion activity will provide a strong technical tailwind for China local bonds in the future.

Major Global Indices That Are Most Relevant for the Inclusion of China Bonds

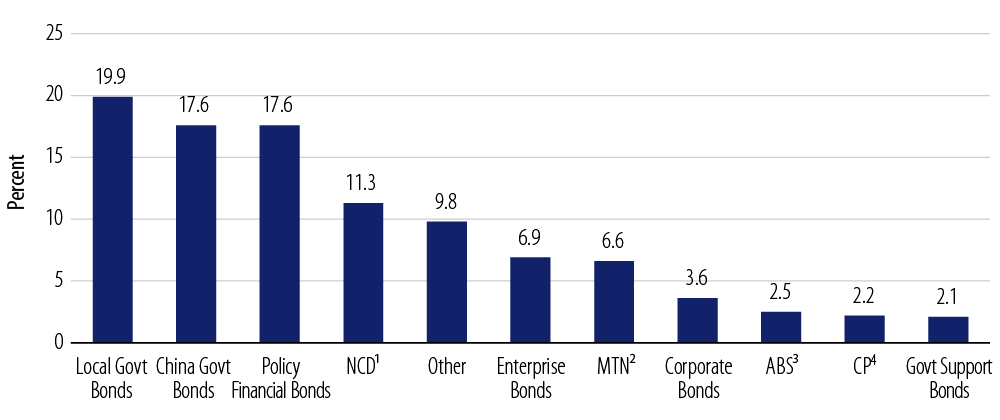

Over 55% Issued by Governments and Policy Banks

1NCD–Negotiable Certificates of Deposit 2MTN–Medium Term Note 3ABS–Asset-Backed Securities 4CP–Commercial Paper

DS: The US$10 trillion China local bond market can be segmented into three broad categories, each representing roughly one-third of the overall market, as follows:

- Government and municipals bonds are issued by the central government and local governments throughout China.

- Financial sector bonds include PFBs issued by the three so-called “Chinese policy banks”—the China Development Bank, the Export-Import Bank of China and the Agricultural Development Bank of China. This category also includes bonds issued by commercial banks, insurance companies and security houses.

- Corporate sector bonds are those issued by state-owned enterprises (SOEs) as well as privately owned corporations.

DS: In the early stages, back in 2002, foreign investors had the ability to access the China local bond market via the use of a quota-based system that required obtaining a Qualified Foreign Institutional Investor (QFII) license from the Chinese government. In 2010, Western Asset, along with its parent company Legg Mason, applied for and obtained a QFII quota from the Chinese government that allowed the Firm to obtain onshore Chinese government bond exposure for its clients. In 2011, QFII was enhanced to facilitate foreign investment in mainland China via offshore renminbi (RMB) accounts. RMB QFII, also known as RQFII, was limited to only Hong Kong subsidiaries of Chinese financial institutions but was expanded to include other institutions in subsequent years.

In 2015, the People’s Bank of China (PBoC) further relaxed its rules for investing in the CIBM without quota limits by allowing foreign central banks and sovereign wealth funds to trade directly by registering with the government. More recently, similar CIBM access was granted to a much wider range of institutional investors and asset managers like Western Asset have sought to adapt to the evolution of capital account liberalization by accessing the local markets via the CIBM. Finally, in mid-2017, access further evolved via another channel called Bond Connect, allowing all types of foreign institutional investors the ability to invest in China via Hong Kong. While accessing Chinese local markets may appear daunting for investors seeking a “DIY” or do-it-yourself solution, Western Asset believes its clients can leverage the experience and knowledge gained by Legg Mason and Western Asset over the past several years to stay on the cutting edge of these ongoing developments.

We believe that as the Chinese capital and currency markets continue to mature and open up, we can successfully exploit attractive value opportunities in both Chinese onshore and offshore markets.

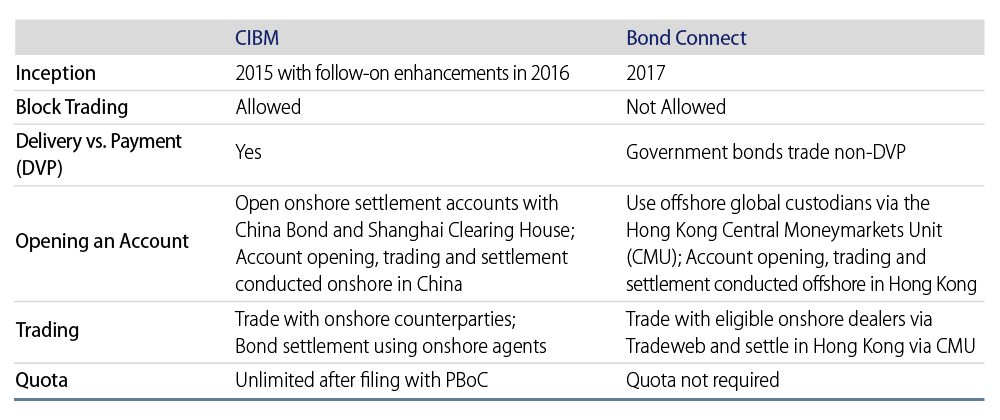

DS: At this stage, Western Asset plans to access China’s local markets directly via CIBM Direct. While Bond Connect is the access channel that has been rolled out more recently (in July 2017), based on due diligence conducted by the Firm, we believe access via CIBM Direct is more effective at the present time. In Western Asset’s view, and amongst several factors the Firm has evaluated, Bond Connect has certain deficiencies. For example, Bond Connect does not allow block trading; this poses potential compliance issues with fair trade allocation. Also, government bonds trade non-DVP (delivery versus payment) under Bond Connect and currently it is unclear who will be responsible for tax collection. The PBoC has announced a future resolution to these Bond Connect technical issues. Western Asset plans to leverage the experience of our parent company, Legg Mason, which has valuable experience in successfully applying for CIBM Direct access for their global funds complex and their Wholly Foreign Owned Enterprise (WFOE or WOFE) in Shanghai. The landscape to access China’s local markets continues to improve and we will continue to regularly monitor the efficiency and effectiveness of local markets access via new schemes such as Bond Connect.

CIBM vs. Bond Connect

DS: Western Asset continues to lie in the soft-landing camp, meaning that the Firm is expecting China’s headline GDP growth to decelerate to 5%-6% over the next few years as the economy makes a structural transition away from low-end manufacturing and investments toward services and the information technology sector. The journey will undoubtedly be bumpy; headline growth indicators may at times be weak, but in our opinion, the probability of a hard landing remains low as China’s per capita GDP is still at EM levels and the government has considerable policy levers to boost economic growth. China’s contribution to the world’s economy remains significant given its growing base. For example, 6% growth in China now contributes the same amount to world GDP as 10% China growth did just five years ago.

The moderation in China’s growth rate is a continuation of the ongoing trend evident since 2012, as workers’ wages have risen and demographic headwinds have emerged. A calibrated China economic slowdown is both necessary and welcome, underscoring the transition of the economy from an investment-driven growth model to one based more on services and consumption. The IMF has commented that China’s structural transformation will prove to be more healthy and sustainable in the long run.

While credit growth has been aggressive by many measures, it’s crucial to understand that China’s debt is predominantly financed domestically, primarily by Chinese households underpinned by very high levels of personal savings. The high financial leverage is built up by state-owned banks lending to state-owned companies and local governments. Due to this construct, lending can be directed and debt reconfigured in difficult circumstances. Hence, in our assessment, the risk of a “Lehman-type” freezing of the financial system in China is remote despite the high debt-to-GDP ratio.

DS: In our view, the two greatest risks to China are accelerated capital outflows and a full-scale trade war with the US.

Accelerated Capital Outflows: At US$3.2 trillion, China’s foreign reserves are the world’s largest, but the size of capital outflows following the Chinese yuan fixing reform/devaluation on August 11, 2015—estimated by Bloomberg to be US$740 billion—is ingrained in the minds of Chinese policymakers and deeply concerning if repeated. However, since the 2015 episode, the State Administration for Foreign Exchange (SAFE) has instituted more stringent enforcement of capital controls and a crackdown in large overseas M&A activity. To anchor market confidence, the PBoC has been keeping the Chinese currency’s fixing at a relatively stable level and has enhanced communications and transparency to the market. The effectiveness of these measures has successfully reduced capital outflows and anchored the Chinese yuan. In our view, a repeat of large capital outflows is unlikely.

A Full-Scale Trade War: A large trade war between the US and China would affect the global economy significantly and unsettle financial markets. This can lead to a sharp slowdown in global economic growth. Today, global manufacturing supply chains are highly integrated. As the famous iPhone manufacturing study showed—focusing on bi-lateral trade statistics can be misleading. The study found that for every $229 iPhone sold in the US, the US trade deficit with China increased by the same amount. Yet the value captured from these products through assembly in China is around $10. Hence, to reduce the bilateral trade surplus with the US iPhone the assembly plants would have to be moved to other countries, which would re-configure and disrupt Apple’s supply chain. This could adversely impact Apple as much as Chinese assembly plants. Further, there is a risk that the trade war could morph into a currency war, whereby countries weaken their currencies to gain an export advantage to mitigate higher US import tariffs. Last, a full-scale trade war could severely weaken financial markets, which could cause a credit crunch. In our base case, we believe that all the countries involved will take very thoughtful and calibrated action to reduce the trade tensions.

DS: Fundamentally, we think the Chinese yuan should remain relatively firm on a trade-weighted basis, buoyed by China’s trade surplus and relatively high economic growth. Given the diverging monetary policies of the US and the rest of the world, a modest weakness of the Chinese yuan vis-à-vis a strong US dollar backdrop is possible, but we expect the Chinese yuan to remain an outperformer compared with other EM currencies.

As part of its foreign exchange reforms, the Chinese government clearly wants market forces to play a larger role in determining the exchange rate and for the currency to exhibit two-way flexibility instead of a one-way bet on either depreciation or appreciation. Hence, we have seen the PBoC’s daily fixing mechanism move toward a trade-basket-based foreign exchange regime instead of bilaterally referencing the US dollar only.

In addition, the Chinese yuan’s inclusion into the IMF’s SDR basket was a recognition of China’s economic influence and a boost to the currency’s international status. This, along with inclusion in major global indices, should generate increased demand for Chinese yuan-denominated assets over the medium- to long-term, as global reserve and asset managers gradually diversify their currency allocations. In addition, we believe the Chinese government is aware that SDR inclusion requires capital account liberalization and this should encourage them to continue carrying out the necessary financial reforms and a gradual opening up of China’s capital markets.

As noted earlier, foreign ownership of onshore China bonds is extremely low at about 5%. This makes the Chinese bond market primarily driven by domestic interest rate trends and one of the least sensitive to US interest rates (US Treasury beta of 0.09 over the last three years). Further, for EM debt in general, there exists a misperception within the investor community that US monetary tightening will be negative for EM under all scenarios. Although EM fared poorly during the 1994 and 2013 changes to US monetary policy expectations, there are also examples in which EM has performed well under tightening regimes of the past several decades. Notably, during the 2004-2006 rate hiking cycle, the JP Morgan GBI-EM Global Diversified index (EM local currency sovereign bond index) returned 36.8% (14.9% annualized). Hence, China local bonds could offer attractive diversification in the context of a global portfolio.

DS: We think the Chinese onshore bond market presents a good diversification and yield enhancement opportunity relative to very low yields in DM fixed-income. Given SDR entry, we believe CGBs and PFB bonds are a good entry point to express a medium-term constructive view of the Chinese economy and the Chinese yuan without taking significant credit risk.

DS: Western Asset has delivered value to investors over the long-term using the Firm’s time-tested investment philosophy: long-term fundamental value-driven investing that deploys multiple diversified strategies for prudent risk management. We believe there are several key strengths that will enable the Firm to retain its leadership position in the Chinese fixed-income space as it continues to grow and evolve.

First, Western Asset maintains a highly effective globally integrated platform that possesses strong Asia research capabilities led by our Asian Bond Team based in our Singapore office. Investment management and research capabilities in Asia leverage the views of the broader global investment management team, primarily the Emerging Markets Debt Team based in our Pasadena, California headquarters.

Second, Western Asset has been managing dedicated Asian bond strategies since 1994 and has maintained a presence in the region since the late 1990s. We have been investing in both the onshore and offshore Chinese fixed-income markets since June 2011.

Finally, Western Asset has been on the cutting edge of Chinese bond market developments required to ensure investors have access to the full scope of potential alpha-generating opportunities within China. As I mentioned earlier, the Firm, along with our parent company Legg Mason, applied for and obtained a Qualified Foreign Institutional Investor quota from the Chinese government back in 2010. This allowed Western Asset to obtain onshore Chinese government bond experience and exposure for our clients. More recently, the Firm has begun accessing the China local markets directly via CIBM Direct and is likely to have dedicated personnel in China to extend and enhance our coverage of the world’s third largest bond market.