KEY TAKEAWAYS

- Asset owners are increasingly focused on the need to manage assets sustainably while mitigating investment risk.

- The first step for asset owners incorporating ESG into their investment mandates is to define their investment goals and beliefs.

- An increasingly popular type of instrument is the sustainability-linked bond, which has key performance indicators linked to the achievement of pre-defined sustainable metrics.

- Asset owners can better integrate their responsible investment beliefs by effectively partnering with external asset managers to reform and update investment management mandates and guidelines.

- At Western Asset we have always believed it is imperative to understand client investment expectations when negotiating mandate guidelines and aligning to clients’ ESG beliefs is consistent with this approach.

The Need for Asset Owners to Consider Sustainable Investment

Asset owners are increasingly focused on the need to manage assets sustainably. A survey conducted by FTSE Russell1 found that 84% of asset owners globally are either implementing or evaluating sustainability in their portfolios. Over the past three years, there has been a marked increase in asset owners incorporating responsible investing considerations into their investment portfolios, though there is variance across investors with respect to the types of strategies, datasets and methods used to integrate environmental, social and governance (ESG) factors in their decision-making.

The clear and growing trend toward incorporating material ESG considerations is driven by a combination of prudent risk (including reputational) management, beneficiary preferences, as well as policy and regulatory decisions, all of which play a role in asset owners’ embrace of sustainable investment policies.

A key rationale for asset owners incorporating material ESG considerations is to mitigate investment risk. Research2 continues to suggest that issuers with superior ESG practices have a lower cost of debt, favourable future bond spreads and tend to experience lower drawdowns during periods of market stress. Conversely, issuers that are deemed to be lower in ESG quality tend to have higher risk affecting their future ability to meet debt obligations and must compensate investors with a higher premium.

Asset owners are also attuned to the exponential increase in interest and awareness by their beneficiaries who are keen that their fiduciaries ensure portfolios incorporate sustainability considerations to “do good as well as do well.” The UN Principles of Responsible Investing (PRI) notes3 that many beneficiaries value sustainability as a key component and expect their preferences to be incorporated in terms of how their investments and savings are managed.

Perhaps the greatest drivers of change for asset owners are national and regional regulations and policies on sustainability and climate change. Some of these include:

- In the European Union, the Sustainable Finance Disclosure Regulation (SFDR)4,5, provides general guidelines and mandates disclosure requirements for labelled sustainable products and asset managers. These include the requirement for Article 8 labelled products to “promote environmental and social considerations” while Article 9 labelled products which have “sustainable investment as its objective”6 that the EU Taxonomy7 criteria lists as environmental objectives. Additionally, the European Central Bank8 recommended incorporation of climate change into its monetary policy framework.

- In the United States, the Federal Reserve9 (Fed) acknowledges and has begun to explore the cascade of consequences stemming from risks to economic activities and financial risks resulting from climate risks. Like many central banks, the Fed is now a part of the Network for Greening the Financial System10, a group created to explore ways to deploy capital toward a sustainable economy.

- In the United Kingdom, regulations by the Government Department for Work and Pensions11 mandate pension trustees to incorporate climate risk assessment and report on metrics. The UK Government has also made it mandatory for companies to disclose metrics in alignment with the Taskforce on Climate related Financial Disclosures (TCFD)12.

- The Bank of Japan13 talks of lending support to efforts by the private sector on climate change to help with long-term macroeconomic stability.

- The Deputy Governor of the Reserve Bank of Australia14 has described c limate change as a first-order risk with broad impact on businesses and households.

- The Banco Central do Brasil15 has initiated a sustainable agenda and has embraced the importance of socio-environmental sustainability for the Brazilian economy.

Asset Owner Preferences on Responsible Investment Frameworks

The first step for asset owners to consider when designing an investment mandate that incorporates ESG factors is to develop a responsible investing (RI) policy that defines their investment goals and beliefs. This policy will inform their approach to RI and will help toward fulfilling their fiduciary duty. Importantly, the policy should provide guidance on the importance of financial materiality of ESG factors. Asset owner fiduciaries have a duty to ensure that they generate sustainable long-term returns on a risk-adjusted basis for beneficiaries. In the context of fixed-income, RI policies should therefore steer mandates to focus on ESG risks that are material to borrowers’ financial health and evaluate if their bonds provide adequate compensation for those risks while engaging issuers for positive change.

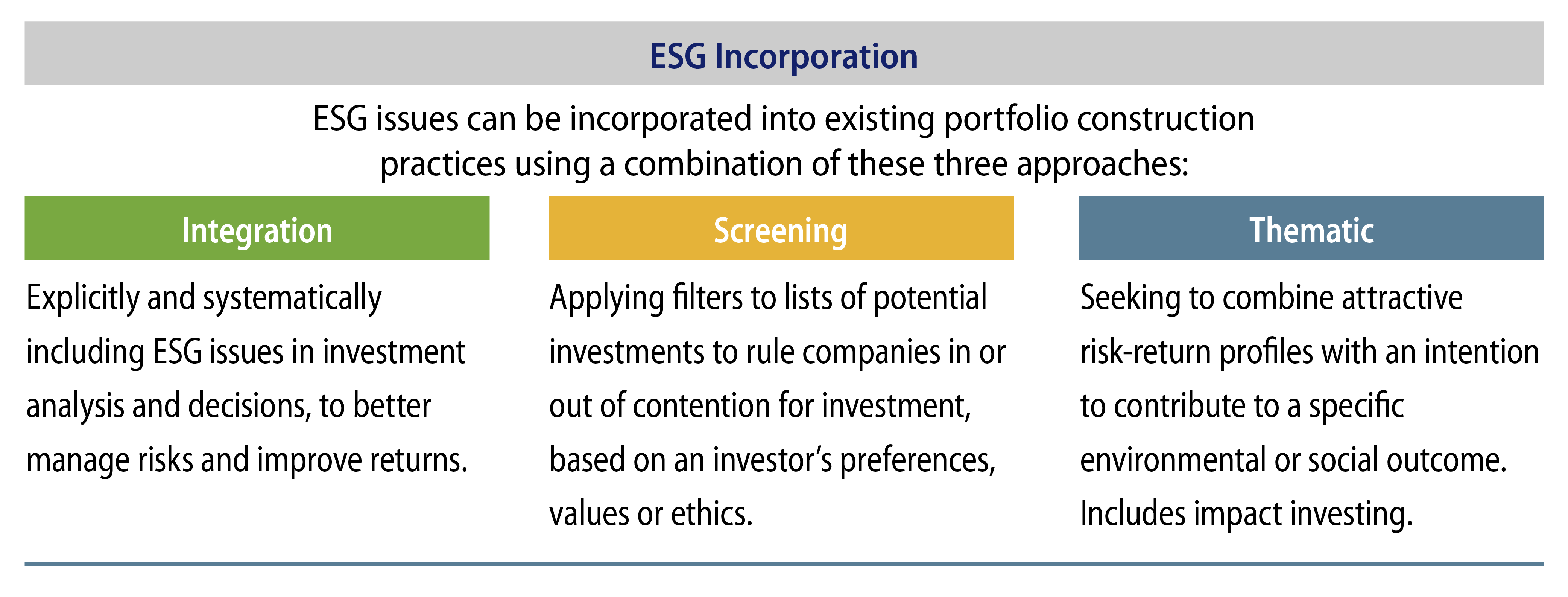

For some asset owners, this RI policy may imply an integration of ESG considerations while for others this may entail enhanced ESG criteria that include exclusions, best-in-class, thematic investment or impact investments. These can be based on stakeholder principles, premise of risk mitigation and return or a combination of all. The PRI summarises the range of these approaches in Exhibit 116.

Asset owners such as California State Teachers Retirement Scheme (CalSTRS) identify human rights, political and property rights, environmental and climate change and corporate governance considerations as ESG risk factors among others17. In the same vein, Brunel Pension Partnership, in the UK18, recognises the linkage between “the economy, civil society and the physical environment’ but is clear that it is ‘not an ethical investor”19 and that “ESG risks and opportunities are evaluated in relation to investment risk and return objectives”20. Japan’s Government Pension Investment Fund (GPIF), published a report into Realization of a “sustainable, human-centred society”21 and achievement of UN Sustainable Development Goals (SDGs).

On the other hand, for Dutch Pension giant APG ESG criteria are just as important as traditional financial metrics and therefore environmental, social impact and good governance risks/elements/considerations must be evaluated for every investment22. For superannuation schemes such as Australian Super, responsible investment means being “active on ESG issues today” such as climate change, human rights and gender diversity to ”deliver performance in the future.”23

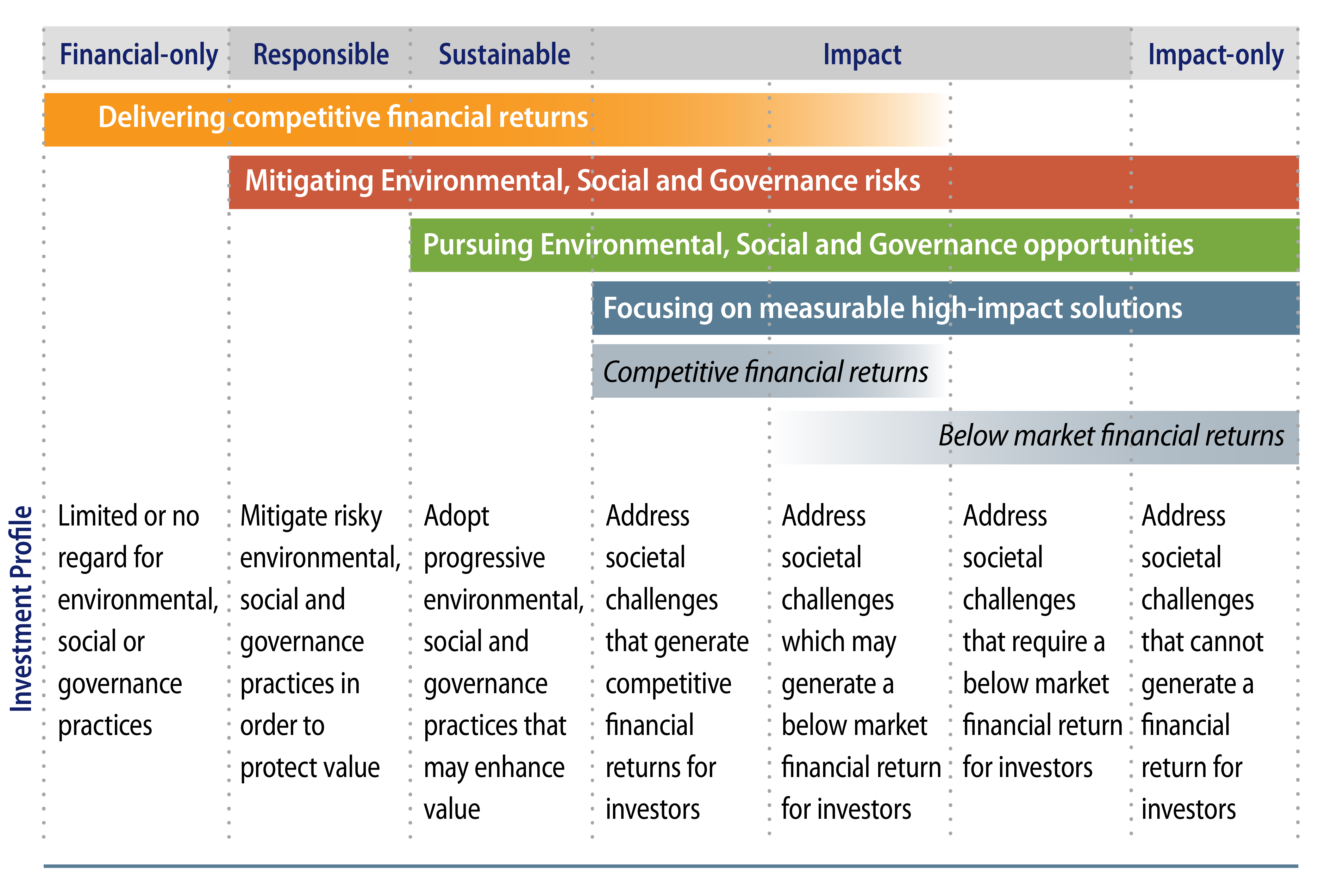

It thus follows that asset owners based on their varying philosophies and approaches must decide where they want to position themselves on the spectrum of competitive financial returns and impact-only focused solutions. As illustrated in Exhibit 2, incorporating ESG criteria into Responsible and Sustainable solutions does not automatically imply foregoing financial returns. Rather, it entails incorporation of material ESG practices to seek to mitigate risk, protect and enhance value. On the other hand, unlike the aforementioned solutions, asset owners focused on Impact – only solutions should be aware of the financial trade-offs that this type of impact focused solution is likely to entail.

Aligning Asset Managers with Asset Owners’ RI Policies

The next step in mandate design is to assess how well asset managers align their investment approach to the asset owner’s RI policy and investment beliefs. Given the breadth of asset owners’ adherence to ESG principles ranging from broad principles to focus on risk and return, it is imperative that asset managers understand and align with client expectations on ESG. As outlined by the PRI, this includes “…ensuring that ESG issues are fully integrated into investment decision making, and ensuring that the manager engages with companies and issuers…”. Alignment is also important in the timeframes over which manager performance is evaluated within an investment mandate and of the managers’ organisational culture.

For this alignment to be effective, asset owners must ensure that responsible investing is integrated into manager selection in a comprehensive and transparent manner. This should include an assessment of ESG governance and resources, philosophy and process on engagement and stewardship and industry collaboration on ESG issues. Asset managers that demonstrate an ability and willingness to work collaboratively with asset owners to design mandates that reflect the asset owner’s RI policies and investment beliefs are more likely to form successful long-term partnerships.

Quantifying Clients’ ESG Philosophy into Measurable Attributes

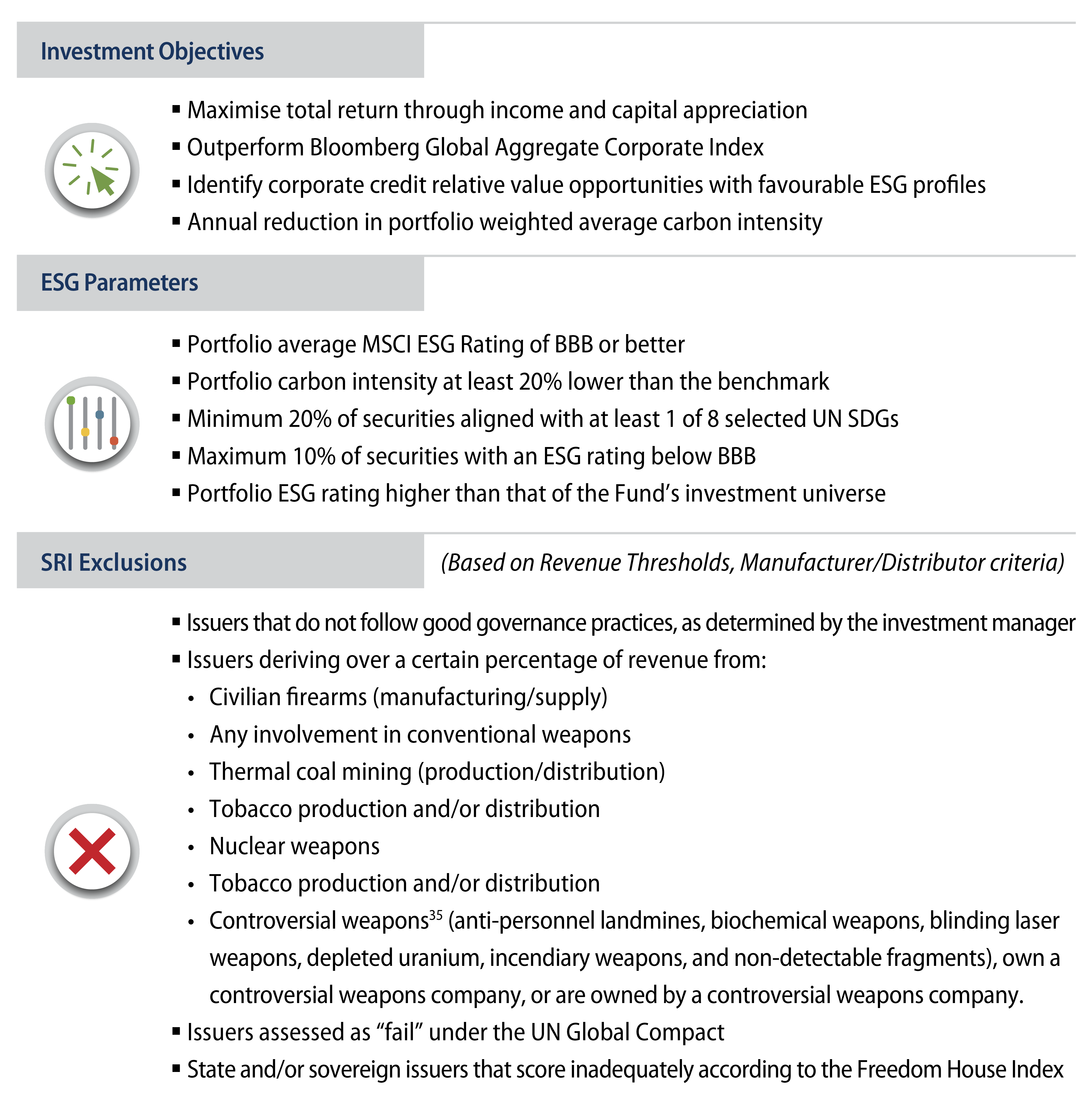

The final step in mandate design is in drafting ESG guidelines that distil asset owners’ overarching ESG principles into tangible goals. To do so effectively, it is important for asset managers to understand and clarify with the asset owner the precise investment return and risk implications of these beliefs on mandate design and portfolio construction. Mandate guidelines need to be clear and transparent on the definitions of ESG metrics, ESG rating and data providers, ESG (including climate-related) targets, ESG performance measurement, as well as portfolio and security-level ESG metric and engagement reporting. It is also important for asset managers to outline a method to identify and measure progress on these ESG characteristics over time. These include helping asset owners understand the limitation of data availability, greater understanding of ESG factors by issuers and the ongoing evolution of these issues.

Socially Responsible Investment (SRI) Exclusions

A popular consideration around asset owners’ ESG principles tends to involve SRI exclusions. This could either entail complete exclusions of certain sectors (e.g., controversial weapons) or be based on revenue thresholds (e.g., excluding any company that generates more than 5% revenue from tobacco manufacturing or distribution). When incorporating exclusions, it is important for asset owners to understand the implications on the investment universe and the corresponding impact on alpha and tracking error. SRI screens that are designed poorly may inadvertently remove significant segments of the investable universe resulting in larger concentration risk in remaining issuers and lower portfolio diversification benefits. On the other hand, SRI screens that seek to affect sectors or issuers that are not representative of the benchmark may be counterproductive.

Decarbonisation Goals

Many asset owners are seeking to adopt decarbonisation solutions. When setting decarbonisation targets for the portfolio a metric that could be used is the portfolio’s Weighted Average Carbon Intensity (WACI), which is recommended by the Taskforce on Climate-related Financial Disclosures (TCFD)24. More recently asset owners are also evaluating incorporating Portfolio Temperature Rating25 or Implied Temperature Rise metrics and metrics outlined under Partnership for Carbon Accounting Financials (PCAF)26. While some may prefer decarbonisation relative to an index (such as 10% or 20%) or an annual decarbonisation in absolute terms, others have sought to align with Paris Aligned Net Zero solutions, such as signatories to the Net Zero Asset Owner Alliance.

When constructing decarbonisation solutions, it is important to help clients understand the implications of such strategies. While the number of corporate bond issuers setting decarbonisation strategies or aligning with explicit net zero targets has increased, these numbers still need to increase further. For instance, around 30% of the Bloomberg Global Aggregate Corporate Index has issuers aligning with Net Zero goals and around 15% for the Bloomberg US High Yield - 2% Issuer Cap USD Unhedged Index.27 Around 60% of the investment-grade and 20% of high-yield corporate universe, represented by the two aforementioned benchmarks, have set decarbonisation targets. Moreover, only seven of the G20 countries have legislated pledges to decarbonise.28

To adhere to 1.5°C scenario, carbon emissions would need to drop by 7.6% annually while reducing by 2.7% annually to adhere to the 2°C Scenario.29 Net Zero aligned portfolios would need to be constructed such that the portfolio’s WACI adheres to these targets. Additionally, the lack of data availability around Scope 3 emissions30 needs to be considered. Within corporate bond mandates with decarbonisation objectives, these portfolios typically tend to be overweight in lower carbon intensive sectors such as financials while being underweight high carbon intensive sectors such as utilities, energy and transportation. Within sovereign bond mandates, these portfolios are typically overweight developed market (DM) sovereigns while being underweight emerging market (EM) sovereigns in Asia, Latin America and Africa.

It is important to flag that a commitment to annual decarbonisation in bond mandates not only increases concentration risk but also reduces a manager's flexibility to invest on a fundamental value basis. If low carbon intensity sector spreads become rich relative to higher carbon sectors, managers are limited to allocating only to issuers in these higher carbon sectors that are explicitly aligned to decarbonisation targets. Additionally, to truly achieve decarbonisation would imply to not just completely exclude carbon intensive sectors or sovereigns but rather actively engage with issuers to reduce their carbon footprint. This highlights the trade-off on return and risk between impact investing strategies and those seeking to meet fiduciary obligations by focusing solely on financial factors.

ESG Principles on People, Planet and Prosperity

For clients that wish to align with general principles around environmental and social considerations, the UN Sustainable Development Goals (SDG) principles with their focus on “people, planet and prosperity”31 offers an option. Mandates can be designed with explicit targets for exposure aligned with SDGs as long as managers have a robust framework for reporting and analysing such exposure. Thematic portfolios could be constructed to invest in issuers whose business practices are either best in class for sustainability practices or align with one or multiple of the 17 goals enshrined under the UN SDGs. Portfolios could also invest in labelled thematic bonds such as green bonds, green asset-backed securities (ABS) and green commercial mortgage-backed securities (CMBS); social bonds, social MBS and sustainable bonds whose proceeds are used for green, social and sustainable projects, respectively. An increasingly popular type of instrument is the sustainability-linked bond, which has key performance indicators (KPIs) linked to achievement of pre-defined sustainable metrics. Failure to meet the KPIs ordinarily results in higher coupon payments.

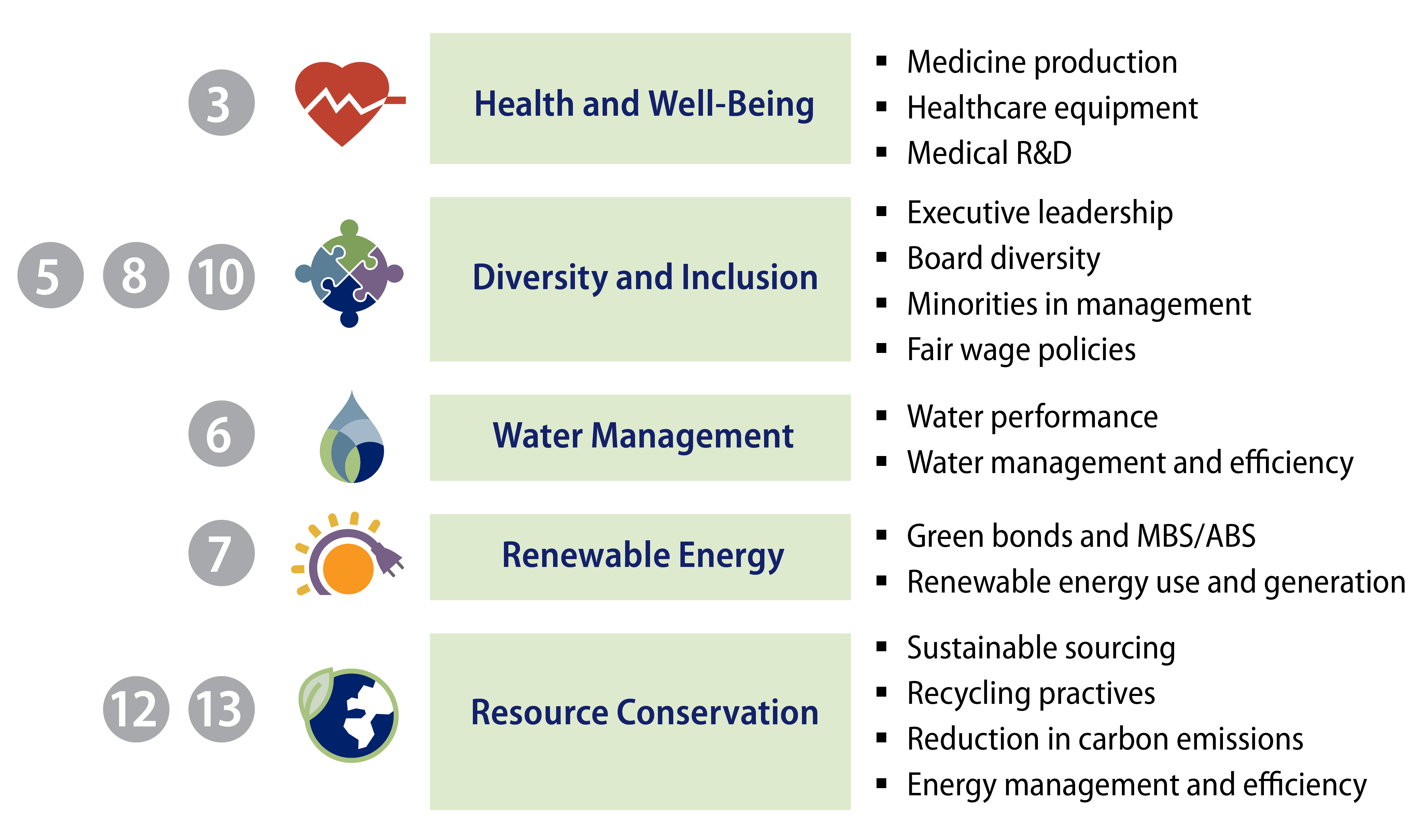

UN SDG goals range from having both an environmental focus and social focus and cover multiple themes. Western Asset as a debt investor focuses on the themes illustrated in Exhibit 3. Of the 17 UN SDGs, Western Asset has chosen to focus on eight specific SDGs, illustrated by their respective numbers, based on availability of data, ability to measure issuer-alignment and progress. It is important to adopt a meticulous approach when reviewing issuer alignment to SDGs.

Given their popularity, labelled bonds often trade at a premium to their non-labelled counterparts. While some clients may wish to include labelled thematic bonds, others may question the need to pay a premium to incentivise issuers to ring fence capital for specific ESG projects rather than having a holistic approach. Given the premium, it is imperative that asset managers help clients understand the impact that this may have on performance especially when setting guidelines on specific percentage allocation to labelled bonds. However, increased issuance of labelled bonds and in some cases the ability to “twin” a labelled bond with its conventional peer is expected to help reduce this premium in the long term. Exhibit 4 illustrates the growth of sustainable bonds.

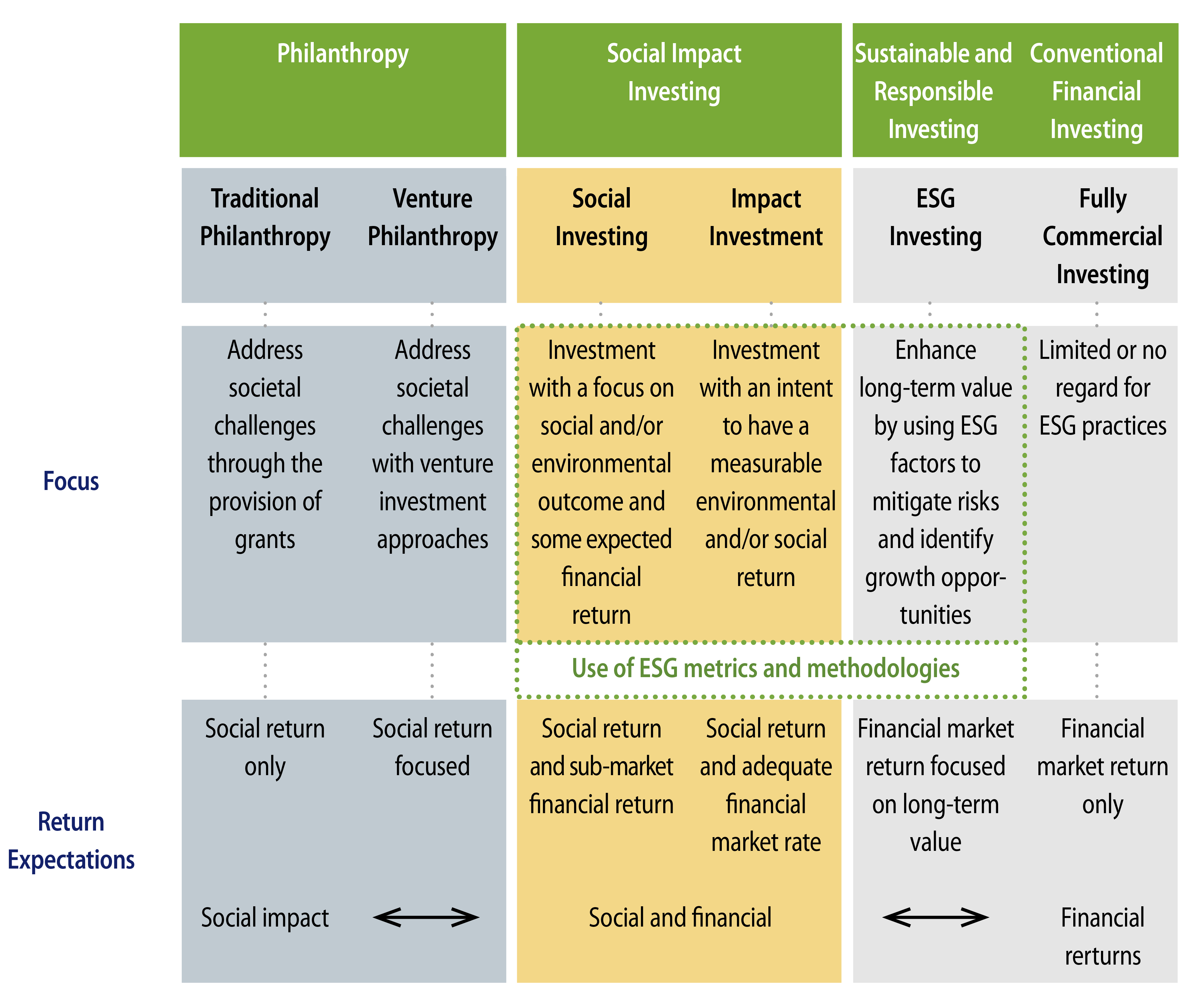

The following chart illustrates a spectrum of capital across strategies when implementing ESG guidelines.

Understanding Investment Implications When Drafting ESG Guidelines

When designing fixed-income mandate guidelines it is important to understand the nuances of the mandate and benchmark universe. Applying SRI screens designed for equity mandates may not be appropriate for aggregate fixed-income type strategies which include both sovereign and corporate bonds and therefore have a much smaller exposure to corporate issuers. Screens for sovereign issuers determined by ESG criteria based on GDP and purchasing power parity (PPP) could be incorporated to allow for a more holistic assessment to avoid a scenario where EM sovereigns are removed while tilting the portfolio heavily toward DM sovereigns.

Similarly, within the corporate fixed-income universe, it is important to understand the constitution of indices and how these differ among themselves and from their equity counterparts. For instance, a typical investment-grade corporate index such as the Bloomberg Global Aggregate Corporate Index comprises over half its allocation in industrials, over a third in financials and around 8% in utilities. On the other hand, a high-yield corporate index such as the Bloomberg US High Yield 2% Issuer Cap USD Unhedged Index has an even higher allocation to industrials at over 85%. The high-yield investment universe has a higher exposure compared to investment-grade credit to carbon-intensive energy names. Restrictions on exposure to oil and gas issuers or targets on WACI reduction could have a significant impact for a high-yield portfolio.

Exhibit 6 illustrates some of the differences between sample IG and HY indices and the differences in their WACI.

Once the client’s philosophy has been understood, both the asset manager and the client should work together to accurately quantify specific metrics against which to measure the portfolio’s ESG criteria.

Incorporating Good Stewardship Principles as Part of Fiduciary Duty

Engagement with issuers to ensure they deliver long-term financial and sustainable outcomes for clients is imperative for asset managers. This is because, importantly, stewardship needs to consider how non-financial ESG factors can impact the value of client assets. When drafting bond mandate ESG guidelines on engagement, asset owners need to be clear about their expectations around stewardship and take into account the different approach bond managers must take on stewardship given that influencing issuers via voting is not often at their disposal. Bond managers should be able to link the cost of debt capital with good ESG practices. Additionally, engagement guidelines could be drafted to work with issuers to set tangible goals. These goals could be principle-based such as those around the UN Global Compact or based on outcomes as outlined in the UK Stewardship Code 2020.

Helping Clients Understand the Policy and Regulatory Drivers for ESG Integration

When drafting bond mandate ESG guidelines, asset owners and managers need to engage to understand the policy and regulatory drivers that are needed for the integration of ESG parameters into investment portfolios. Regulators and policymakers acknowledge the vulnerabilities faced by the broader economy and businesses arising from climate change and other ESG-related risks. The COVID-19 pandemic and its ensuing effect on global supply chains, COP 2632 and the call to accelerate the commitment to reduce emissions and the global tax plan to improve transparency are all examples of ESG considerations that are changing the way business is conducted. It is therefore imperative for asset managers to work with asset owners to understand the impact on markets and to align mandate designs with ESG-related policies and regulations. A primary example is the UK Department for Work and Pensions regulation33 mandating pension trustees to incorporate climate risk assessment and report on metrics.

The Role of Asset Managers

Asset owners can better integrate their responsible investment beliefs by effectively partnering with external asset managers to reform and update investment management mandates and guidelines. At Western Asset we have always believed it is imperative to understand client investment expectations when negotiating mandate guidelines and aligning to clients’ ESG beliefs is consistent with this approach. In fixed-income mandates, investment management agreements (IMAs) and especially investment guidelines have changed little over the last many years and with the exception of the inclusion of some ethical-based issuer exclusions. Bond mandate guidelines currently make little direct reference to responsible investing parameters. By working in partnership with asset owners and understanding their sustainable investment goals and beliefs and how they intersect with their fiduciary obligations, asset managers can help customise IMAs and guidelines that more explicitly address non-financial factors.

Guidelines can include third-party and proprietary ESG ratings and scores, carbon emissions and intensities, SRI and other sector screens, alignment to SDGs and expectations for engagement activities. IMAs can also specify ESG metrics and engagement reporting requirements. Asset managers can also help inform the implications for returns as a result of incorporating sustainability parameters into guidelines and how risk management can incorporate material ESG considerations into valuations. Finally, a strong partnership between asset owners and managers requires transparency on how outcomes are measured and monitored (including the use of sustainable benchmarks) and how engagement will be deployed by the manager in improving and/or changing fixed income issuer behaviour.

A Final Note to Asset Owners

This paper offers asset owners a guide to help integrate ESG considerations into their investment mandates. We outlined the growing tide of regulations related to ESG integration facing asset owners and the need to consider material sustainability risks such as climate change impacting their asset portfolios. We laid out the three steps we believe asset owners need to adopt when designing investment mandates incorporating ESG factors: (1) Developing responsible investing policies that define their ESG investment goals and beliefs, (2) assessing the alignment of their asset manager’s investment approach with their responsible investing policies and (3) drafting asset class specific ESG guidelines that distil their overarching ESG principles into practical and measurable parameters such as SRI exclusions and decarbonisation targets. Finally, we explained the importance of understanding the investment, regulatory and stewardship implications of ESG guidelines and of the role asset managers can serve in partnering with asset owners to help them achieve their sustainability targets while meeting their fiduciary obligations to their clients/beneficiaries.

- https://content.ftserussell.com/sites/default/files/sustainable_investment_is_now_standard_according_ to_global_asset_owner_survey.pdf?_ga=2.111116805.1486500956.1636910269-153374882.1631542426

- https://www.msci.com/www/blog-posts/esg-and-the-cost-of-capital/01726513589

- https://www.unpri.org/download?ac=13321

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019R2088&from=EN

- https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/sustainability-related-disclosure-financial-services-sector_en

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019R2088&from=EN

- https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-sustainable-activities_en

- https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708_1~f104919225.en.html

- https://www.federalreserve.gov/econres/notes/feds-notes/climate-change-and-financial-stability-20210319.htm

- https://www.ngfs.net/en/communique-de-presse/us-federal-reserve-joins-ngfs-and-two-new-publications-released

- https://www.gov.uk/government/consultations/taking-action-on-climate-risk-improving-governance-and-reporting-by-occupational-pension-schemes-response-and-consultation-on-regulations/taking-action-on-climate-risk-improving-governance-and-reporting-by-occupational-pension-schemes#chapter-6-scenario-analysis

- https://www.gov.uk/government/news/uk-to-enshrine-mandatory-climate-disclosures-for-largest-companies-in-law

- https://www.boj.or.jp/en/announcements/press/koen_2021/data/ko210727a.pdf

- https://www.rba.gov.au/speeches/2021/sp-dg-2021-10-14.html

- https://www.bcb.gov.br/en/financialstability/sustainability

- https://www.unpri.org/mandate-requirements-and-rfps/embedding-esg-factors-in-investment-mandates/8563.article

- https://www.calstrs.com/sites/main/files/file-attachments/calstrs_esg_policy.pdf?1544651199

- https://www.brunelpensionpartnership.org/responsible-investment/responsible-investment-policy/

- https://www.brunelpensionpartnership.org/wp-content/uploads/2020/08/Brunel-RI-Policy-2020.pdf

- https://www.brunelpensionpartnership.org/wp-content/uploads/2020/08/Brunel-RI-Policy-2020.pdf

- https://www.gpif.go.jp/en/investment/Report_Society_and_SDGs_en.pdf

- https://apg.nl/en/about-apg/asset-management/responsible-investment/

- https://www.australiansuper.com/investments/how-we-invest/esg-management

- https://www.tcfdhub.org/Downloads/pdfs/E09%20-%20Carbon%20footprinting%20-%20metrics.pdf

- https://cdn.cdp.net/cdp-production/comfy/cms/files/files/000/003/741/original/Temperature_scoring_-_beta_methodology.pdf

- https://carbonaccountingfinancials.com/files/downloads/PCAF-Global-GHG-Standard.pdf

- MSCI ESG, as of 30 October 2021

- https://climateactiontracker.org/documents/997/CAT_2021-11-09_Briefing_Global-Update_Glasgow2030CredibilityGap.pdf

- https://www.un.org/en/climatechange/science/key-findings#:~:text=Emissions%20must%20drop%207.6%20per,stay%20below%202%C2%B0C

- Scope 3 emissions arise from activities not owned or controlled by a corporate but that indirectly impact its value chain. One organisation’s Scope 3 emissions may be another organisation’s Cop often represent the majority of an organization’s Scope 1 and Scope 2 emissions and may represent the largest component of the total GHG emissions

- https://sdgs.un.org/2030agenda

- The 2021 United Nations Climate Change Conference, more commonly referred to as COP26, was the 26th United Nations Climate Change conference COP stands for Conference of the Parties. The summit was attended by the countries that signed the United Nations Framework Convention on Climate Change (UNFCCC) – a treaty that came into force in 1994.

- https://www.gov.uk/government/consultations/taking-action-on-climate-risk-improving-governance-and-reporting-by-occupational-pension-schemes-response-and-consultation-on-regulations/taking-action-on-climate-risk-improving-governance-and-reporting-by-occupational-pension-schemes#chapter-6-scenario-analysis

- Note that these guidelines comply with the Western Asset Sustainable Global Corporate Bond Fund which adheres to the EU SFDR Article 8 requirements as of 10 January 2022. Other investment grade credit mandates may have different ESG guidelines.

- (a) Weapons according to (i) The Convention of the Prohibition of the Use, Stockpiling, Production and Transfer of Anti-Personnel Mines and on their Destruction and (ii) The Convention on the Prohibition of Cluster Munitions and (b) weapons classed as either B- or C- weapons pursuant to the United Nations Biological Weapons Convention and the United Nations Chemical Weapons Convention respectively.