KEY TAKEAWAYS

- EM local debt markets are expanding into supranational bonds that offer attractive yields with the safety of AAA ratings, simplified offshore settlement and strong legal investor protections.

- Leading supranational issuers like development banks are tapping EM currencies to diversify funding sources, achieve reasonable pricing comparable to USD debt and finance local projects.

- For investors, supranationals provide an accessible EM investment without exposure to local taxes, policies, sanctions or liquidity squeezes during crises seen in sovereign bonds.

- Asset managers such as Western Asset utilize supranationals for better portfolio optimization around taxes, returns, durations and targeted exposures across dedicated EM and multi-asset mandates.

RA: EM local debt markets continue to broaden and deepen with a new subsector—supranationals—increasingly gaining investor visibility and trading momentum. What should investors know about this area of the market?

KR: This fast-growing segment of the EM local market universe blends the most attractive attributes of local currency sovereign debt with triple A rated securities. Specifically, these securities typically offer high income and high total return potential with the relative safety of owning a AAA rated asset. To be sure, investors still have unhedged foreign exchange (FX) exposure. However, these assets are governed under New York or English law and pay/settle outside of local jurisdictions—a clear benefit from an ease-of-settlement perspective. There is a wide range of currencies and tenors to choose from, which allows for broad portfolio fits. Also, the environmental, social and governance (ESG) attributes of the issuers are favorable compared to the representative sovereigns and across the fixed-income opportunity set generally.

RA: How would you define supranational issuers?

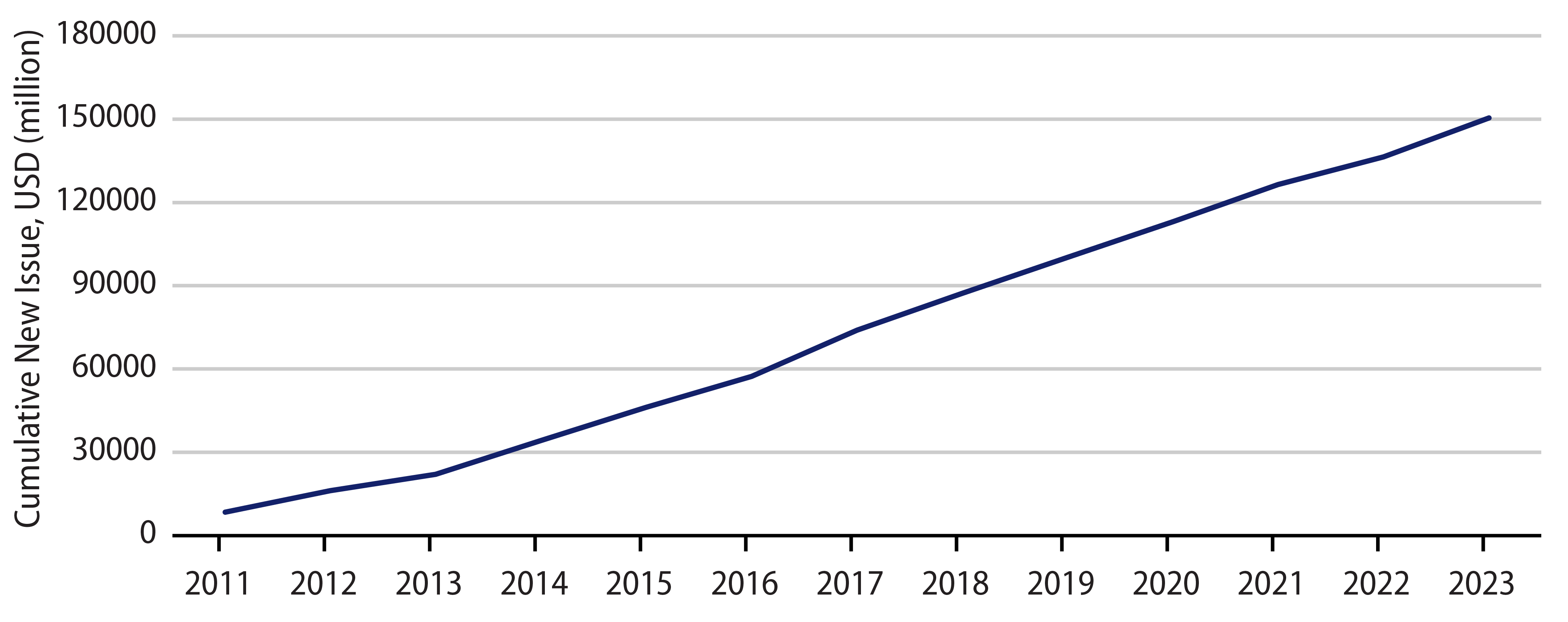

KZ: Supranational issuers are multilateral organizations with a mandate of promoting economic growth and enhancing regional integration among member countries. The largest issuers include the World Bank (IFC and IBRD), European Investment Bank (EIB), Asia Development Bank (ADB), European Bank for Reconstruction and Development (EBRD) and Inter-American Development Bank (IADB). According to estimates by Bank of America Merrill Lynch, supranationals’ outstanding debt denominated in EM currencies stands at roughly $100 billion across over 40 countries. This segment continues to grow, which provides an ample market size from which to construct a diversified portfolio to meet investors’ risk/reward targets.

RA: Is there a specific reason why supranationals raise capital in EM currencies?

KZ: Supranational issuers raise capital in EM currencies for three main reasons. First, they have large funding plans. Diversifying funding currencies outside of hard currencies helps broaden their investor base and tap into investors with different objectives and inflow/outflow cycles. Second, and despite the optically large coupons/yields, supranational issuers typically find EM currency issuance as reasonably priced. Issuers tend to swap the principal and local currency cash flows for US dollars upon issuance at a funding cost similar to borrowings under their USD funding programs. Finally, supranational issuers execute projects in EM countries, and raising proceeds in the target country’s currency allows issuers to fund those projects and minimize currency mismatches.

RA: What benefits can an allocation to supranationals provide to an EM local debt investor?

KR: There are multiple benefits. First, issuance from mainstream supranationals are rated Aaa/AAA/AAA by Moody’s, S&P and Fitch, respectively, implying extremely strong credit quality and financial support from these issuers’ member countries. Note that for EM currency supranational issuance, although you will receive the equivalent of local currency par upon maturity, the value of bonds in the investor’s base currency may be higher or lower than the stated par value.

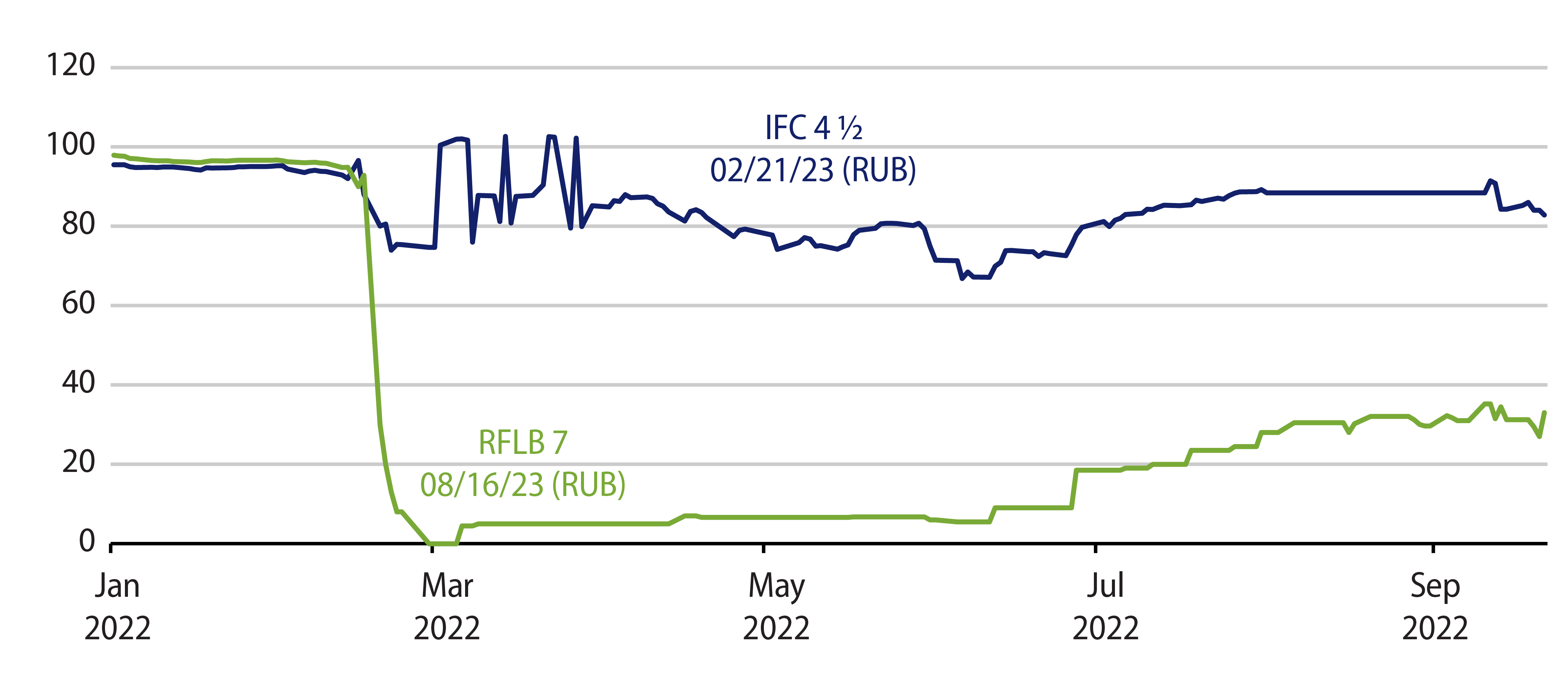

Second, supranational securities are governed under New York or English law, providing strong legal protections for creditors (i.e., payment terms cannot be changed unilaterally). These securities are traded offshore and typically pay coupons and amortizations in hard currency at a rate linked to the onshore spot FX. Moreover, typically they are not directly impacted by controls or sanctions, as recently demonstrated by Ukraine and Russia, respectively. As a result, issues of supranational securities in EM currencies have materially outperformed local government equivalents during times of stress. Recent examples include Argentina (2019) and Russia (2022).

Third, a majority of EM currency supranational issuance settles offshore and in US dollars. As such, local cash and custody accounts are not required. In addition, as these are offshore securities, local withholding tax and capital gains taxes are not applicable.

Fourth, in the primary market, supranational bonds can be structured to meet specific portfolio needs (e.g., maturity, coupon frequency, discount to par, etc.). With regard to secondary trading, dealers typically have little problem warehousing AAA risk, particularly once they hedge the currency. In addition, many of the supranational issuers have expressed a willingness to repurchase securities if needed to help maintain trading liquidity.

Last but not least, at the supranational issuer level, environmental and social sustainability objectives are at the core of how these entities lend. Separately, and in many cases, the actual use of proceeds is designated for sustainable or green objectives. Therefore, the alignment at both the issuer level and use-of-proceeds level is strong with regard to Sustainable Finance Disclosure Regulation.

Additional attributes are included in Exhibit 3.

RA: Who invests in EM supranational bonds?

KZ: Over time, the EM supranational bond investor base has expanded both by category and geographically. There is increasing interest in this asset class in the US, Europe and Asia from both dedicated EM managers as well as crossover strategies. In fact, in some cases, supranational bonds have become a preferred vehicle of investment by EM-dedicated and crossover investors alike. For instance, the Indian rupee had attracted substantial investor interest this year, but many restrictions for investing in onshore Indian government bonds limited foreign investor participation. Instead, investors turned to supranational bonds denominated in the INR, which also bypasses local withholding taxes, to get the exposure in INR assets. As a result, we saw more than $2.5 billion equivalent of INR issuance this year alone, a significant increase from previous years.

RA: How is the liquidity in this segment of the EM local market?

KZ: EM supranational bonds, in both primary and secondary markets, have sufficient liquidity as most major brokerage firms have allocated considerable resources in this asset class over the years. Large benchmark size issuances in the primary market ($200-$500 million outstanding) have historically been actively traded and typically quoted by five to 10 brokers. Daily trading volume in the secondary market would be determined by the cross-currency swap or non-deliverable forward (NDF) availability, but most core EM currencies can usually clear the equivalent of $50 million within one trading day under normal market conditions. A typical bid-offer spread for core EM currencies would be 0.25 to 0.75 points. It’s especially worth noting that the liquidity profile for EM supranational bonds can sometimes be even better than local government bonds during a crisis. For example, unlike Russian local government bonds (OFZ) that were sanctioned and frozen for trading to most foreign investors after the Russia-Ukraine conflict began, RUB-denominated supranational bonds remained active for trading at all times at price levels significantly better than OFZ.

RA: How is the EM Team exploiting opportunities in this growing segment of the EM local debt market?

KR: Western Asset is a first-mover in the EM currency supranational segment. In addition to managing a dedicated EM Supranational-only strategy, we’re using these securities to optimize other dedicated EM strategies. With regard to broader mandates, we see three important uses. First, we’re using these securities as access products where we can optimize tax costs and minimize friction costs. As the securities settle offshore, there are no local withholding taxes paid nor is there need to establish onshore custody and settlements. Second, these securities can trade at a yield pick-up over lower-rated sovereign securities; there may be technical dislocations for this yield pick-up which typically mean-revert over the investment horizon. Finally, we’re tailoring these securities to optimize our investment views. For example, we’ve participated in zero-coupon transactions to maximize duration/convexity. We’ve also structured securities in tenors where there is not a local government security equivalent in order to fit specific portfolio needs.

To sum up, this fast-growing segment of the EM local markets offers a unique combination of high yields and high total return potential with the attractiveness of customizable AAA rated securities, which allow for ease of settlement and more efficient tax solutions. We’re excited to have these opportunities in the broader EM toolkit.