KEY TAKEAWAYS

- Asia local debt performance was muted in 2023 due to lower yields and higher credit quality, but prospects look brighter for 2024 as inflation eases and central banks have room to cut rates.

- Asia is expected to outpace global economic growth in 2024, driven by domestic demand and positive demographic trends across the region.

- China has introduced coordinated monetary and fiscal easing policies to address economic headwinds, with the aim of boosting growth in 2024.

- India is a high-conviction pick given robust foreign investment flows, large FX reserves, attractive carry and index inclusion tailwinds.

- Indonesia also looks attractive with high yields on government bonds, while South Korea should benefit from likely rate cuts and index inclusion upside.

RA: US rate volatility and Federal Reserve (Fed) policy uncertainty rattled global financial markets last year. How did Asia local markets fare, and how do you expect them to perform in 2024?

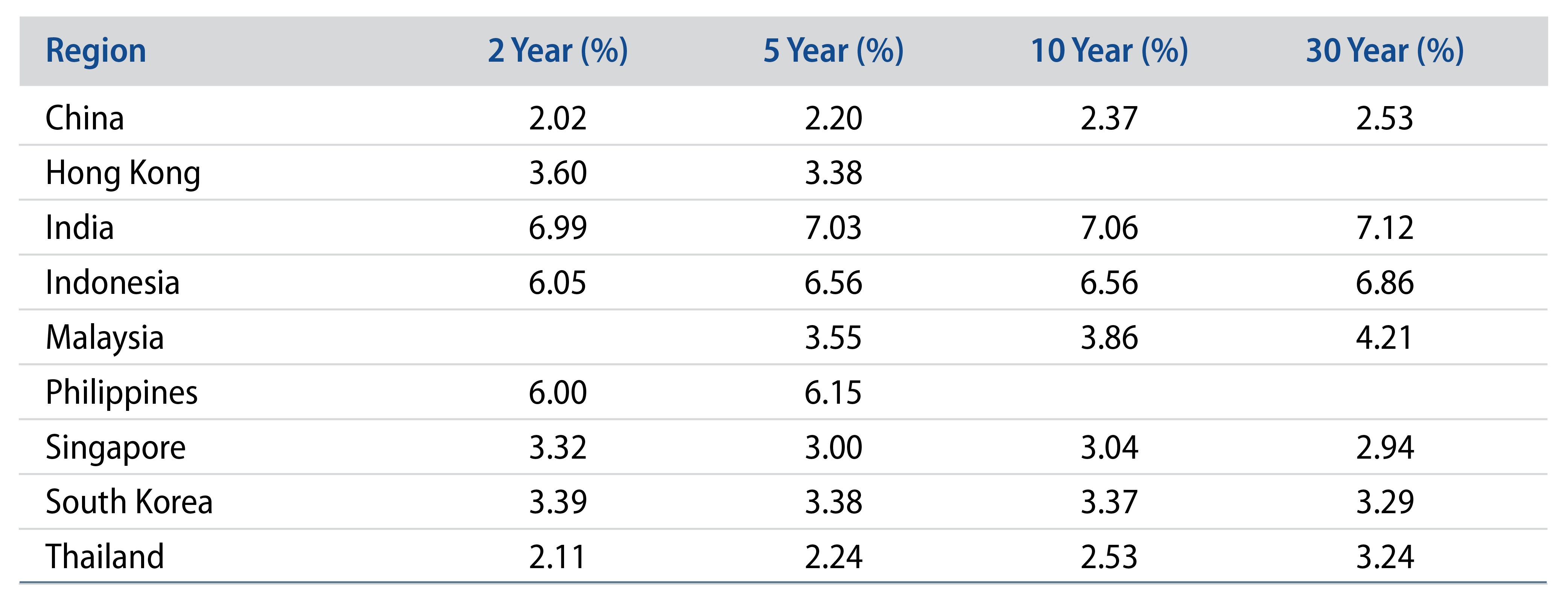

DS: Asia local debt performance in 2023 was muted relative to Latin America and Eastern Europe mainly because of Asia’s lower yield regime and higher credit quality profile. However, we see brighter prospects for the asset class this year. First, the general trend of easing core inflation is expected to continue in Asia, albeit at different speeds. This is most evident in core services inflation, which appears to be stickier in North Asia and developed Asian economies relative to emerging Asia economies. In our view, the central banks with policy space to ease earlier are South Korea, Indonesia, the Philippines and India. Second, Asian central banks, in aggregate, didn’t aggressively hike rates during the COVID-19 recovery phase, as regional inflation was well under control, and we don’t expect them to materially cut rates going forward. If anything, we expect Asian central banks either to lag or keep pace with the Fed’s easing cycle. We see value in the 5- to 10-year segments of most Asia local debt curves as expectations shift from a hold to an eventual easing. Third, a more dovish environment characterized by lower US rates and a modestly weaker US dollar bodes well for Asia local debt performance. We anticipate increased investor demand for the asset class given its diversification benefits, as well as the currency appreciation potential and attractive carry offered by higher-yielding countries such as Indonesia, India and the Philippines.

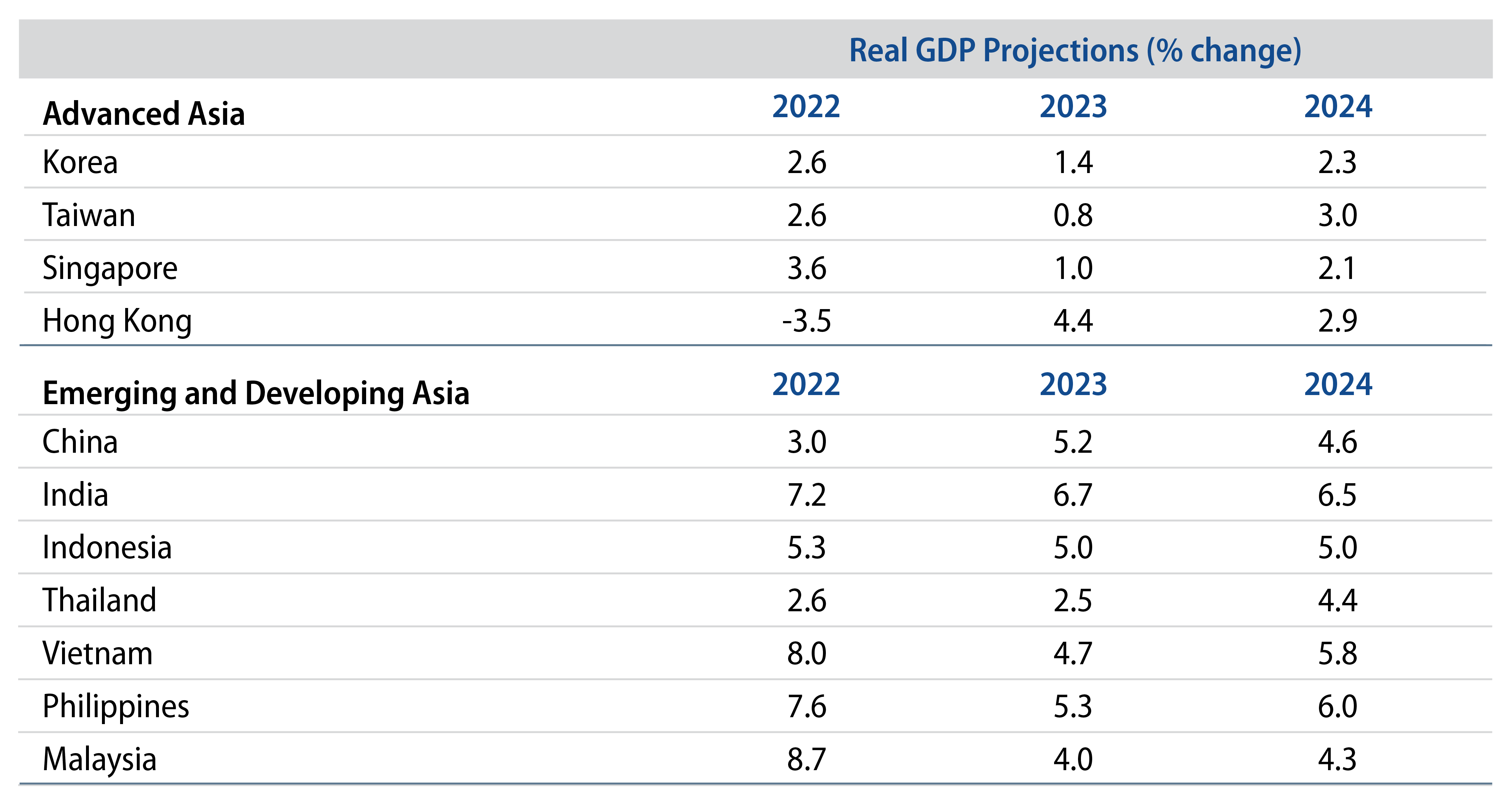

RA: According to the World Bank’s 2024 outlook, global growth is expected to slow for the third year in a row. Asia, however, is set to outpace all other regions. What’s driving this?

DF: Asia’s outperformance relative to other parts of the world is primarily driven by the region’s sheer size and scale, with steady domestic demand acting as a key growth anchor. Asia benefits from strong transportation linkages, a multitude of trade agreements, and positive demographics with a still growing middle-income base and a young population. Furthermore, the region is a key beneficiary of the diversification, de-risking intent of producers in the wake of geopolitical concerns and COVID-19 supply-chain bottlenecks. For instance, key South and Southeast Asian economies such as India, Indonesia and Vietnam are poised to benefit significantly from an increase in China Outbound Direct Investments within the region as well as from the China Plus One strategy, which encourages companies globally to seek alternative manufacturing and sourcing options in other Asian countries. These factors, in aggregate, should provide a buffer against a sustained China slowdown. For 2024, we expect Asia (ex-Japan) growth to rise to 4.5% from 3.5% in 2023 led by India and Indonesia, which maintain strong external accounts and healthy foreign exchange (FX) reserves, and exhibit a lower beta to China growth.

RA: China remains under the glare of the spotlight with concerns mounting over the country’s growth prospects, its relationship with the US and Taiwan, the ongoing stresses in its property market and, more recently, the selloff in Chinese equity. How do you see the China story playing out this year?

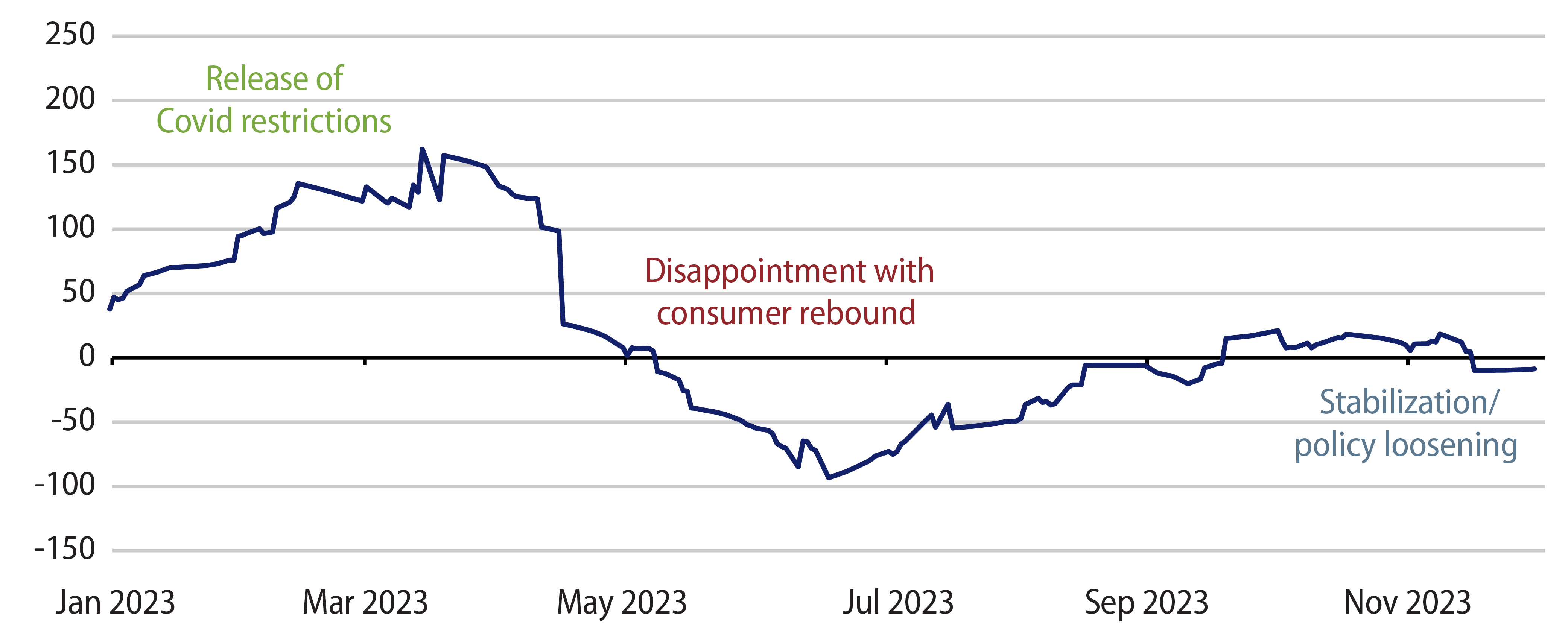

DF: Recent announcements on coordinated monetary and fiscal easing signal that a comprehensive policy package is underway to address China’s multi-faceted challenges—all of which have limited the country’s post-Covid economic rebound (Exhibit 3). Indeed, in the face of continuing pressure on the property sector and local government funding, China’s policymakers have begun taking meaningful steps to stabilize financial markets, including: injecting liquidity at levels not seen since 2016, intervening in FX markets to stabilize the yuan, allowing for more deficit spending, and initiating a plan to bring debt owed by local government financing vehicles (LGFVs) onto the balance sheet of local governments (to manage repayment risk of LGFVs and any spill over to banks). We believe these measures should help buoy China’s economic growth which has been weighed down by continued policy-driven deleveraging and supply-chain de-risking. For 2024, our base case calls for China growth to come in between 5.0% and 5.5%, with policymakers focused on using continued, targeted measures along with a more supportive monetary policy stance to meet their targets.

RA: Which countries in Asia are your highest-conviction picks and how are you expressing those views in portfolios?

DS: We’re constructive on India as it’s a strong economic story supported by robust foreign direct investment flows (on increasing friend-shoring benefits) and significant FX reserves (in the top five globally). We see value in being overweight India duration and the Indian rupee given attractive carry relative to peers (~7% yields for 10-year Indian government bonds) and strong technical tailwinds associated with its inclusion in JP Morgan’s main EM local bond index. We’re also constructive on Indonesia notwithstanding the presidential elections which took place on February 14, where incumbent President Joko Widodo could not stand for re-election due to term limits. The current administration has done an admirable job managing the economy and government balance sheet over the past eight years; we believe the new president will likely continue to maintain prudent economic policy. In our view, high yields on Indonesian government bonds (~6.5% yields for 10-year paper) make unhedged exposures attractive in Asia local portfolios. Elsewhere in the region, we see value in maintaining duration exposure in South Korea. South Korean rates have likely peaked as the economy has been hit by a double whammy of the weak recovery of its largest trading partner, China, and restrictions on exports of micro-electronics to China due to the US’ CHIPS Act. We specifically prefer South Korean Treasury bonds as they stand to benefit from rising downside growth risks and the combined impact of a likely rate cut by the Bank of Korea later this year as well as WGBI inclusion expected in September 2024.