In recent days, political circles have been abuzz with reports suggesting that President Joe Biden may withdraw from the 2024 presidential race as early as this weekend. Although these reports have been firmly denied by both the White House and Biden's re-election campaign, a growing number of senior Democratic congressional leaders and high-level donors are advocating for a change in leadership, insisting that it's time to ''pass the torch.''

The Call for Change

Those urging President Biden to step aside have pointed to recent polling data, which indicates a challenging path for Biden to defeat former President Donald Trump and retain the White House. Current national polling and presidential approval ratings for Biden are below the levels of any previous incumbents who have successfully won re-election. This has raised concerns among Democratic leaders about the viability of Biden's candidacy.

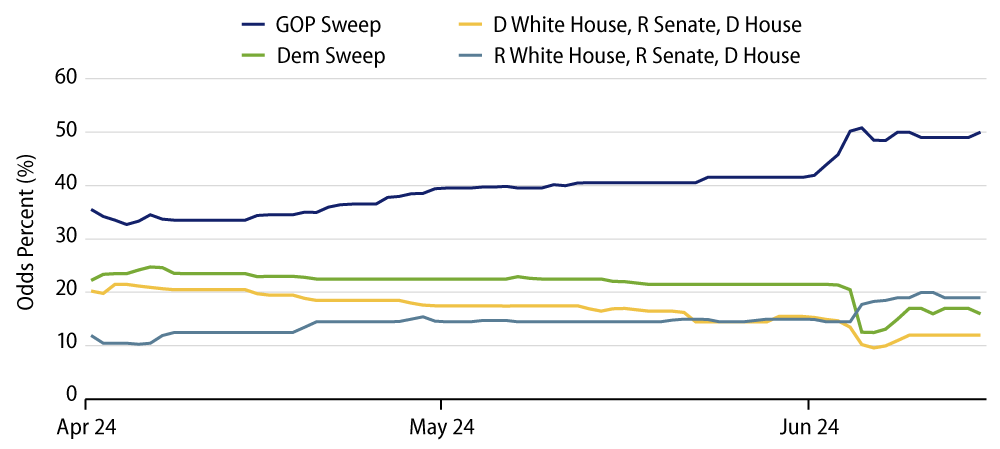

Beyond the White House, there is a significant worry about the potential impact a beleaguered Biden might have on down-ticket races. The term ''down ticket'' refers to other electoral races that occur simultaneously with the presidential election, such as those for the House of Representatives and the Senate. A struggling presidential candidate can often drag down the performance of candidates in these races, potentially jeopardizing the party's control of Congress. Betting markets have shown that Biden dropping out of the race could improve the chances of the Democrats taking the House. This suggests that market participants believe a different Democratic candidate might perform better in the general election, thereby boosting the party's overall prospects.

Potential Successors

Should President Biden decide to withdraw, Vice President Kamala Harris stands as the most likely nominee. However, other prominent figures such as Governors Gretchen Whitmer of Michigan, Gavin Newsom of California and Josh Shapiro of Pennsylvania could also emerge as potential candidates in an open convention.

We would note that if Harris becomes the nominee, all the campaign funds from the Biden/Harris ticket can be seamlessly transferred to her campaign. However, while there are avenues by which a Super PAC and the Biden campaign could transfer funds to a non-Harris ticket, the precise contours of that transfer are likely still open to legal interpretation. This flexibility in fund allocation could play a crucial role in shaping the Democratic campaign strategy moving forward.

Tying It Back to Markets

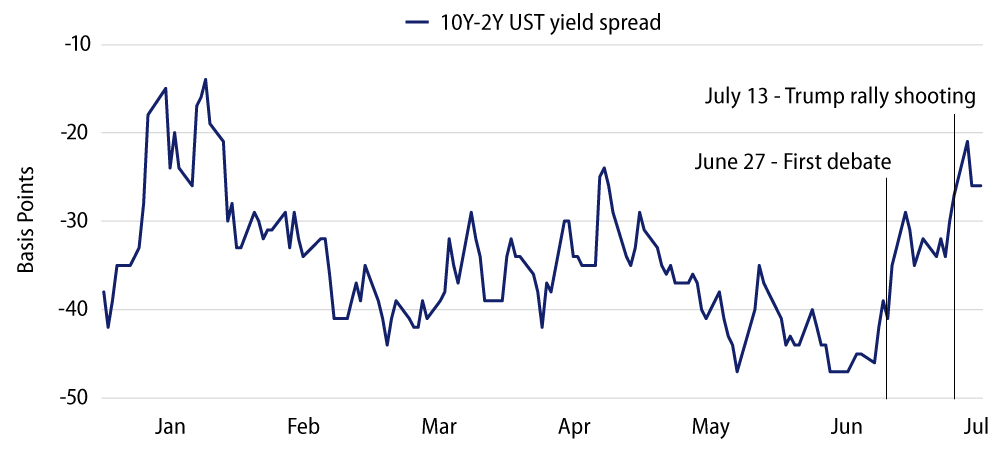

Immediate reactions to President Biden's debate performance on June 27 and the assassination attempt on Trump on July 13 pushed US Treasury (UST) yields higher and steepened the yield curve. Although these moves have been largely countered by moderating inflation, sentiment and labor market data, we believe the initial reactions align with our view that a Trump re-election would likely be perceived as bringing inflationary economic policies.

In addition to the changes in interest rates, the US dollar has strengthened with the increasing probability of a Trump presidency. While credit market performance has remained relatively muted, emerging markets (EM) have experienced some turbulence. It is important to note that Biden and Trump have significantly different trade policies, particularly concerning China. Under a Trump 2.0 scenario, we expect more trade frictions compared to a continuation of the Biden administration. Trump's proposed tariffs would likely boost the US dollar (weakening EM currencies), increase consumer prices and decrease margins and profits for exporters and producers.

If Biden drops out and Harris becomes the nominee, we expect UST yields and equity markets to retrace, EM assets to stabilize and the US dollar to weaken. This would occur as the Democrats look to regain lost momentum, the prospects of a GOP sweep diminish and the odds of a divided White House and Congress increase.

Conclusion

While the reports of President Biden's potential withdrawal from the 2024 race remain unconfirmed, the speculation has already sparked significant discussion and analysis. The Democratic Party faces critical decisions in the coming weeks, and the outcome will undoubtedly have far-reaching implications for the 2024 election and beyond. As the situation continues to evolve, all eyes will be on the White House and the Democratic leadership to see how they navigate this pivotal moment in American politics.