Investment-Grade Munis Posted Positive Performance Last Week

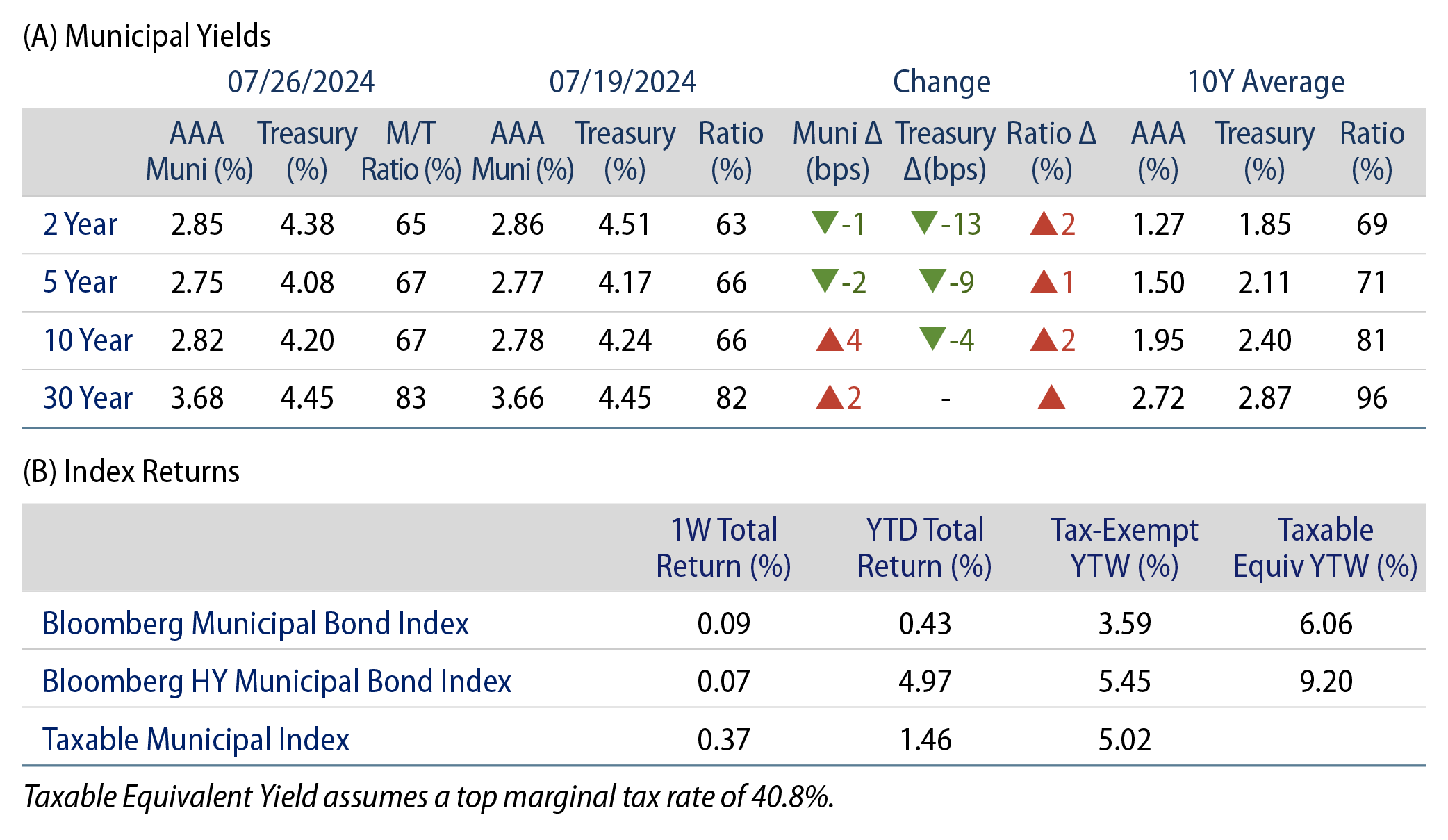

Investment-grade munis posted positive returns during the week as high-grade muni yields moved lower across the yield curve. Municipal yields underperformed Treasuries (which moved lower on dovish rhetoric) as earnings reports highlighted signs of slower consumer spending and inflation trends moving lower. Meanwhile, muni supply and demand remained elevated. The Bloomberg Municipal Index returned 0.09% during the week, the High Yield Muni Index returned 0.07% and the Taxable Muni Index returned 0.37%. This week we highlight recent yield curve reversion and the potential implications for muni investors.

Muni Supply and Demand Both Trended Higher Last Week

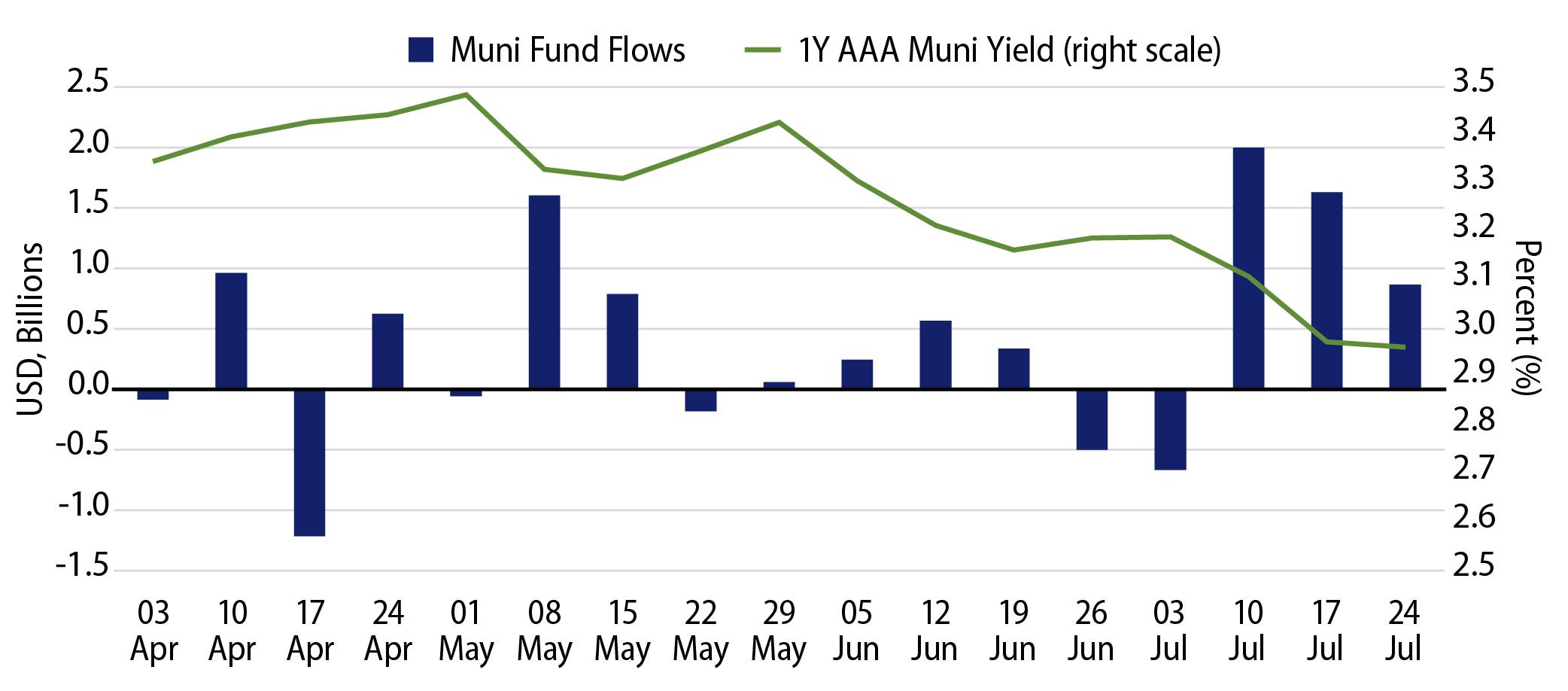

Fund Flows (up $866 million): During the week ending July 24, weekly reporting municipal mutual funds recorded $866 million of net inflows, according to Lipper. Long-term funds recorded $745 million of inflows, high-yield funds recorded $252 million of inflows and intermediate funds recorded $130 million of inflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $14 billion.

Supply (YTD supply of $273 billion, up 41% YoY): The muni market recorded $11 billion of new-issue volume last week, down 8% from the prior week. YTD issuance of $273 billion is 41% higher than last year’s level, with tax-exempt issuance 45% higher and taxable issuance 3% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $9 billion. The largest deals include $1.1 billion New York City General Obligation and $920 million Port of Seattle transactions.

This Week in Munis: Yield Curve Disinversion

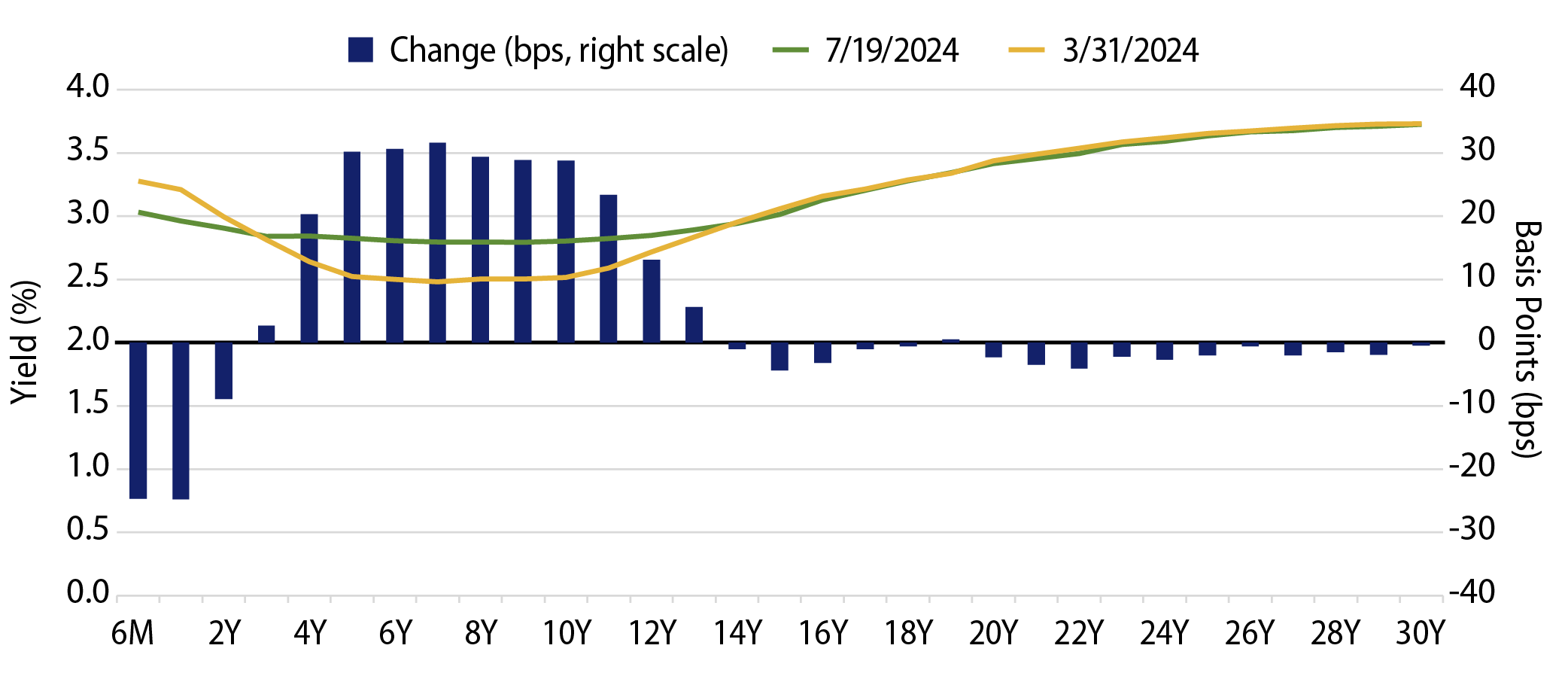

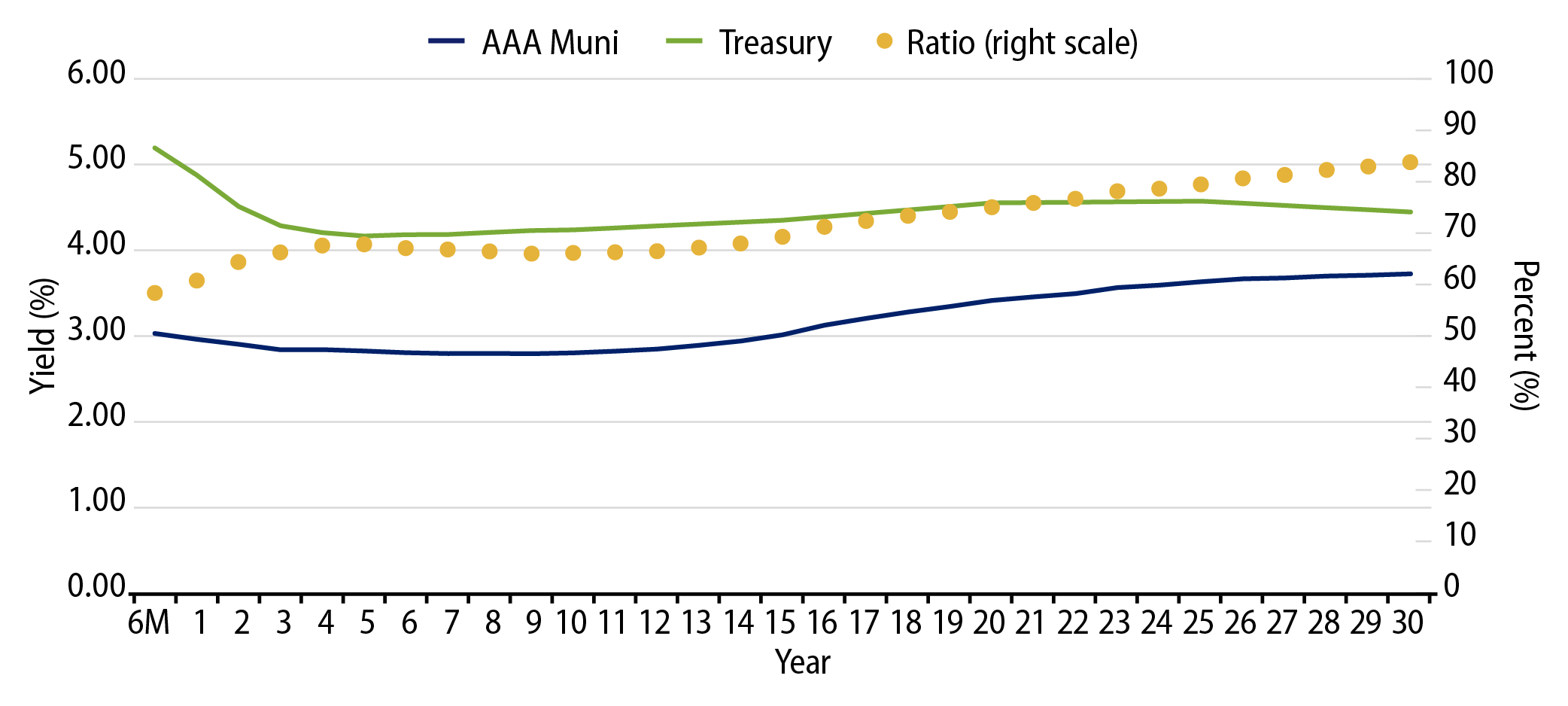

Throughout the majority of 2023 into 2024, the muni yield curve has remained stubbornly inverted. Shortest-term yields have been buoyed higher by the Federal Reserve (Fed) hiking cycle, coupled with short-term muni demand as many investors shifted shorter allocations to money market funds and other cash equivalents yielding greater than 5%. Meanwhile, intermediate maturities, particularly securities within five to 10 years, were anchored lower by expectations that the Fed would eventually cut interest rates but exacerbated by strong separately managed account (SMA) investment.

The front end of the municipal yield curve has materially disinverted since the beginning of the second quarter. AAA muni yields, which were as low as 2.48% from five to nine years, moved 27 basis points (bps) higher on average. Meanwhile, as inflation data moved lower and market expectations coalesced around a Fed cut later this year, maturities of one year and less moved over 30 bps lower.

The municipal bond yield curve inversion had challenged certain muni strategies, including SMAs which predominantly invest within 10 years, with relatively lower yield opportunities and rolldown benefits for bearing additional duration risk. As the yield curve reverts to more historical norms, Western Asset anticipates both income opportunities and rolldown benefits should improve. We also believe that curve normalization will contribute to a stronger technical environment, as we expect investors will continue to look to longer-duration income alternatives as short yields move lower. The heightened municipal mutual fund flows observed in recent weeks as the front end of the curve rallied could be an early indication of the increased demand that we could see if the curve continues to normalize.

Municipal Credit Curves and Relative Value

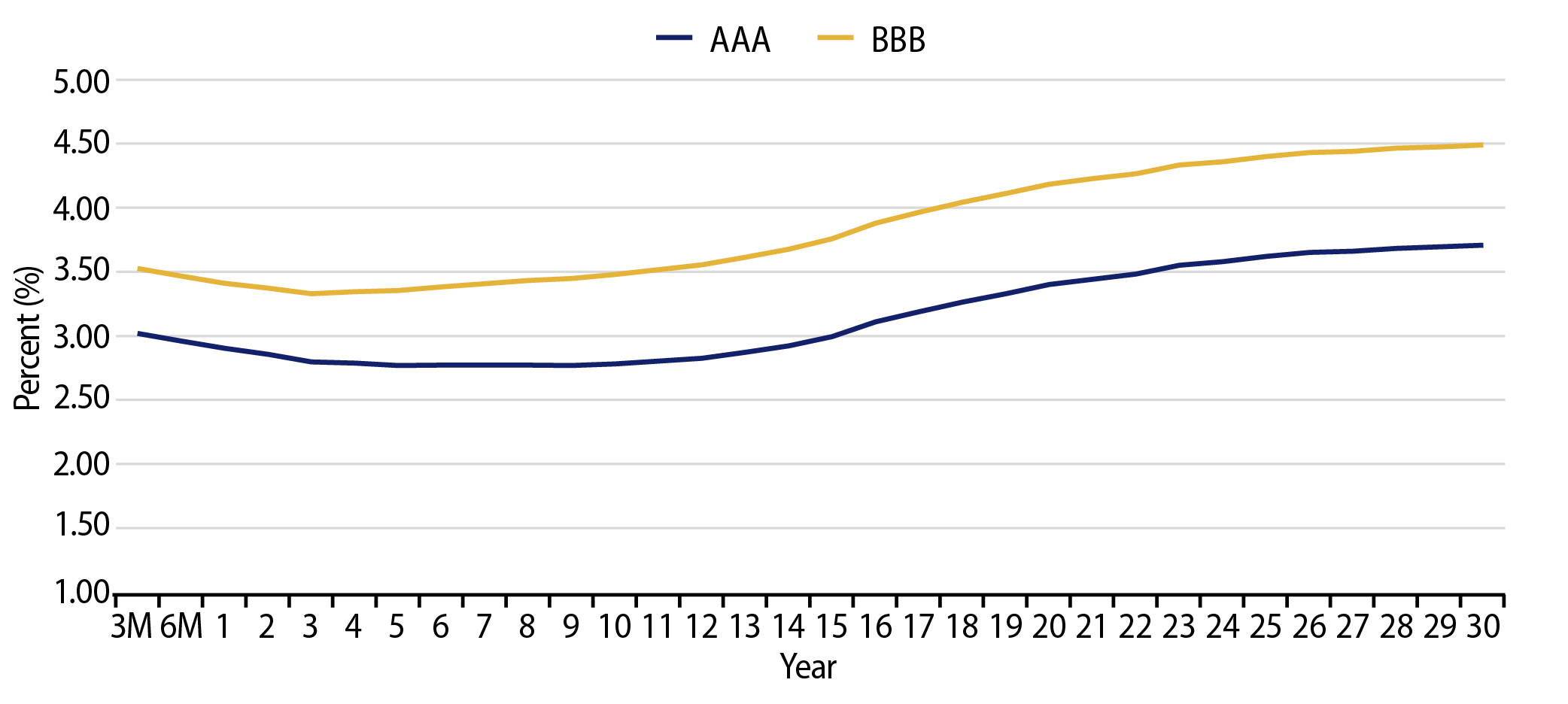

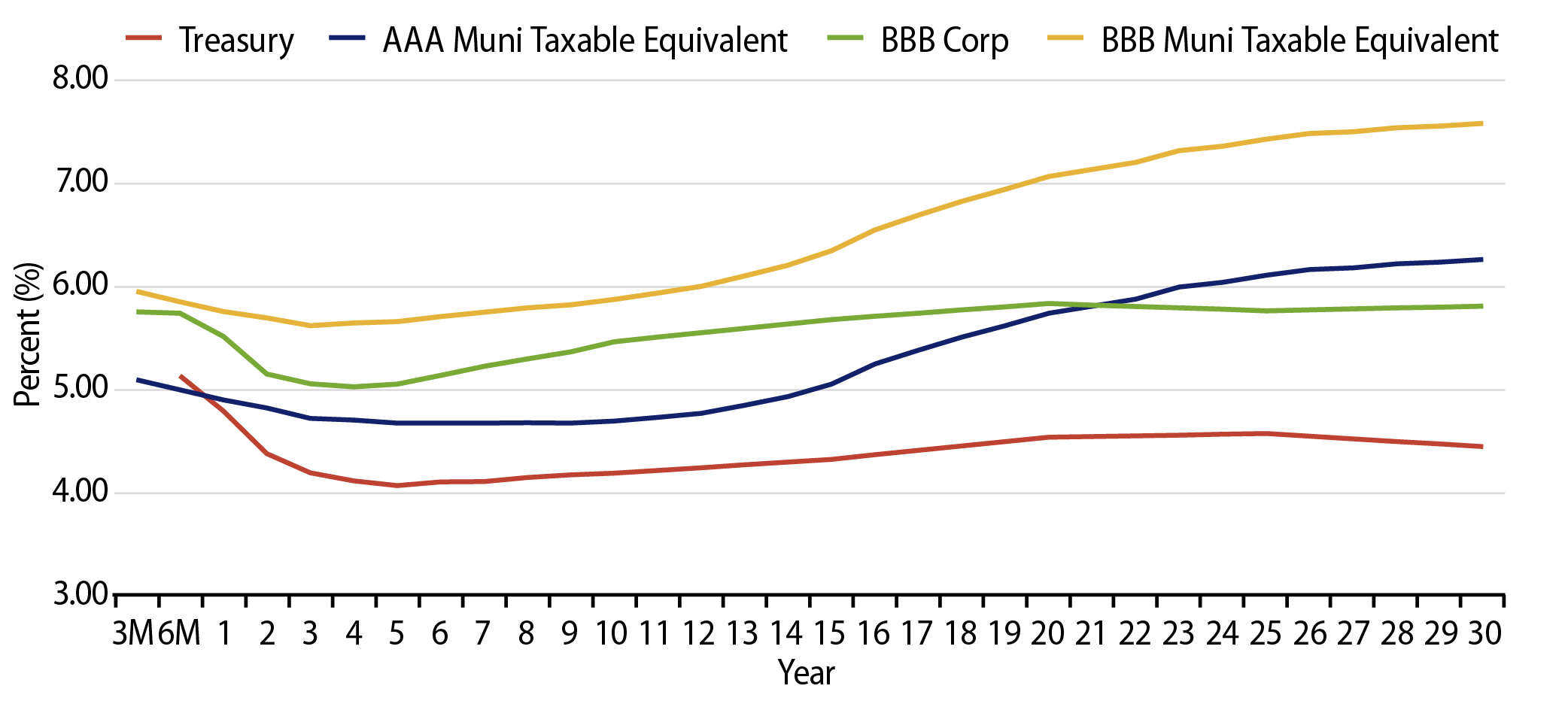

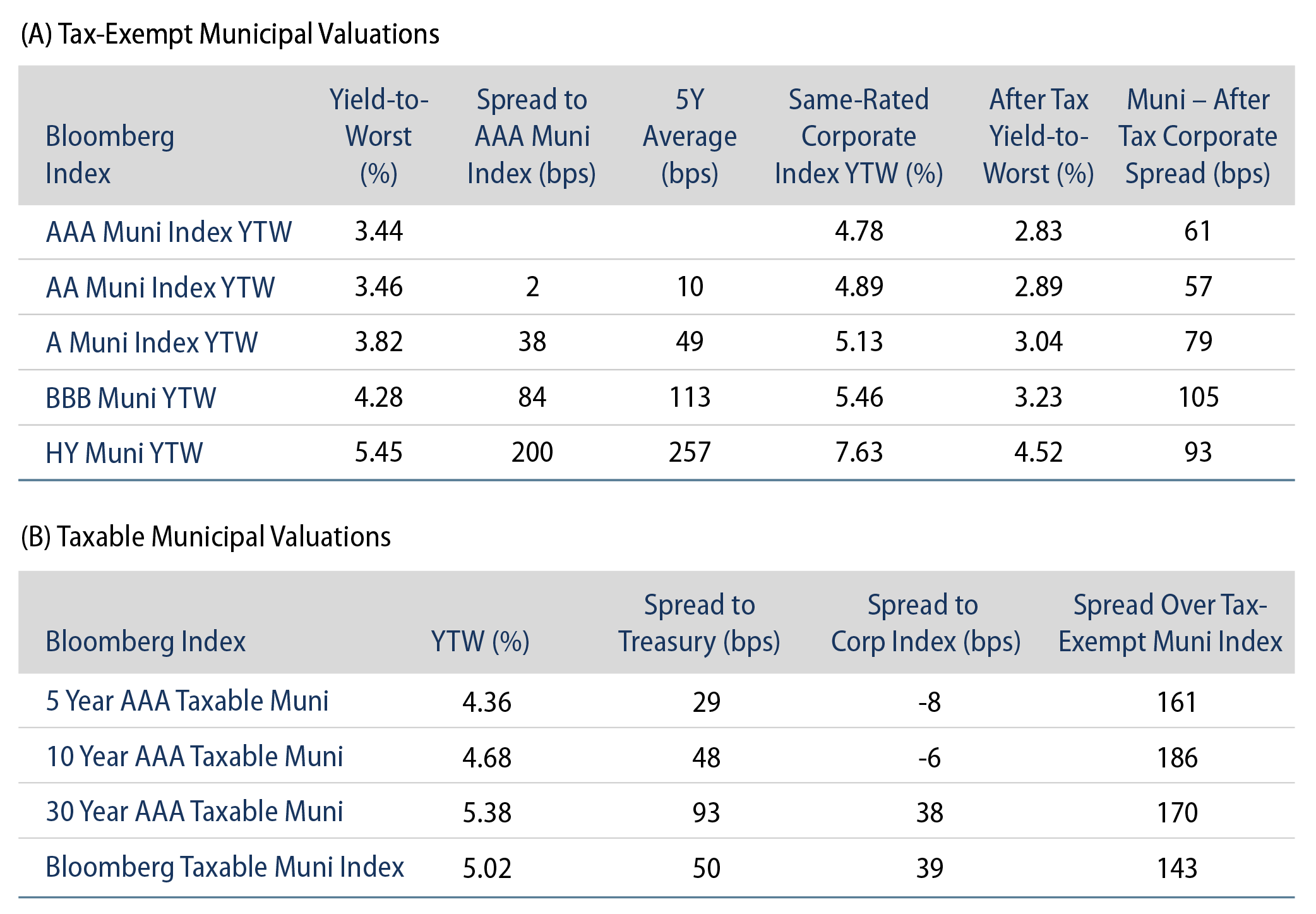

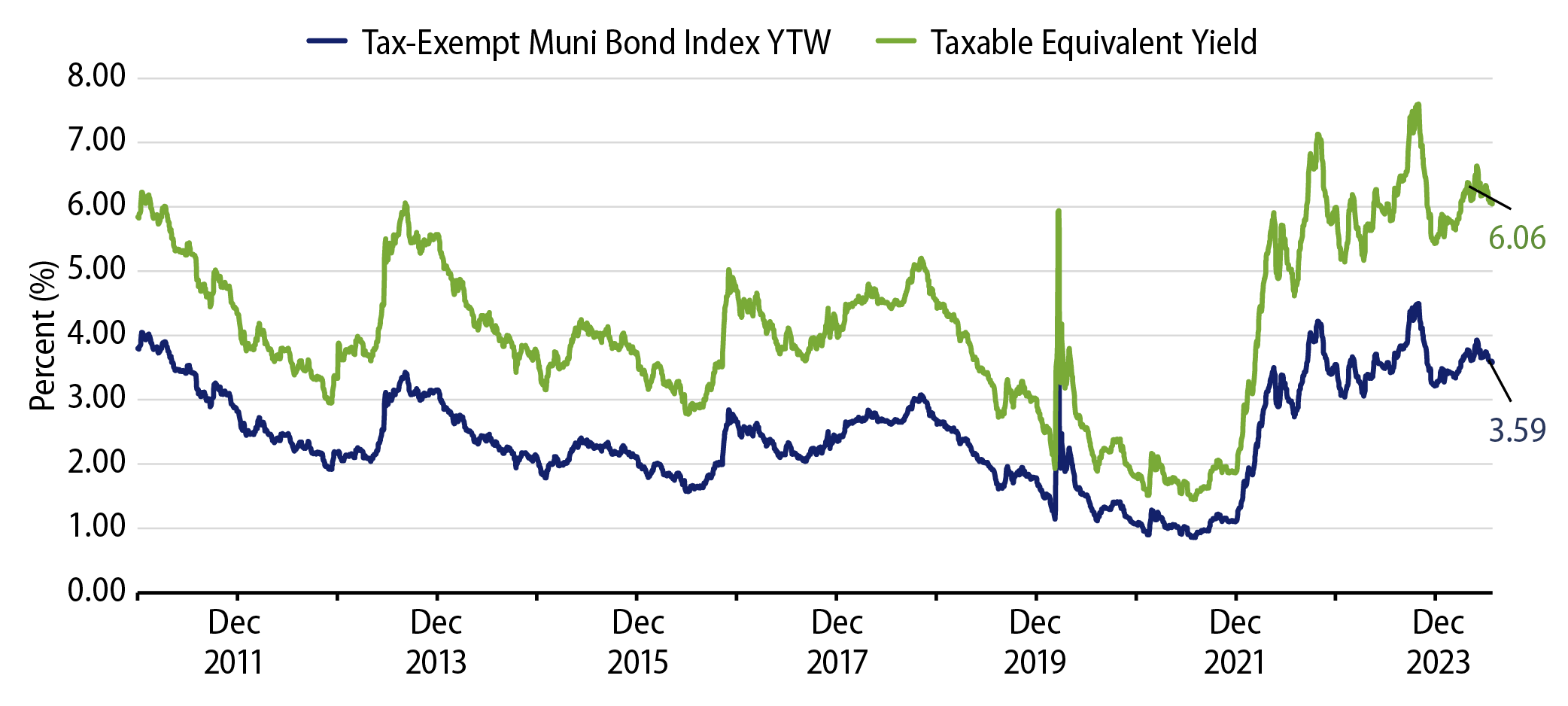

Theme #1: Municipal taxable-equivalent yields and income opportunities are above decade averages.

Theme #2: The muni yield curve has disinverted, offering greater value in extending maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.