Municipals Posted Positive Returns During the Week

The AAA muni yield curve steepened for the third consecutive week, moving 1 bp lower in 5-years and 3 bps higher in 30-years. US munis underperformed Treasuries across the curve as ratios moved 2% higher. The Bloomberg Barclays Municipal Index returned 0.04%, while the HY Muni Index returned 0.09%. This week we explore expected regulatory changes that could bolster demand for taxable municipals from life insurers.

Fund Flows Continue to Drive Strong Technicals

Fund Flows: During the week ending July 28, municipal mutual funds recorded $1.4 billion of net inflows. Long-term funds recorded $573 million of inflows, high-yield funds recorded $578 million of inflows and intermediate funds recorded $58 million of inflows. Municipal mutual funds have now recorded inflows 62 of the last 63 weeks, extending the record inflow cycle to $131 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $70 billion.

Supply: The muni market recorded $7.3 billion of new-issue volume during the week, down 34% from the prior week. Total issuance YTD of $261 billion is 9% higher from last year’s levels, with tax-exempt issuance trending 16% higher year-over-year (YoY) and taxable issuance trending 8% lower YoY. This week’s new-issue calendar is expected to increase to $8.2 billion of new issuance. The largest deals include $934 million New York City Transitional Finance Authority and $854 million state of Michigan transactions.

This Week in Munis: Upcoming Insurance Regulations to Impact Taxable Munis

The National Association of Insurance Commissioners (NAIC) released updated standards that would alter the risk-based capital charge framework for life insurance companies, which will change the economics across their fixed-income asset allocation. Historically, insurance companies are significant buyers of municipal securities due to the natural alignment of relatively longer-dated liabilities with the longer duration of municipal debt. With the new regulations, higher quality municipal securities could become more attractive relative to other fixed-income alternatives.

As part of the new NAIC framework, AAA and AA fixed-income would offer higher after-capital charge spreads versus single-A rated fixed-income. On a return-on-capital basis, a life insurer should be better off in AAA and AA municipal and corporate allocations, whereas previously insurance companies were compensated for taking on risk with A rated munis.

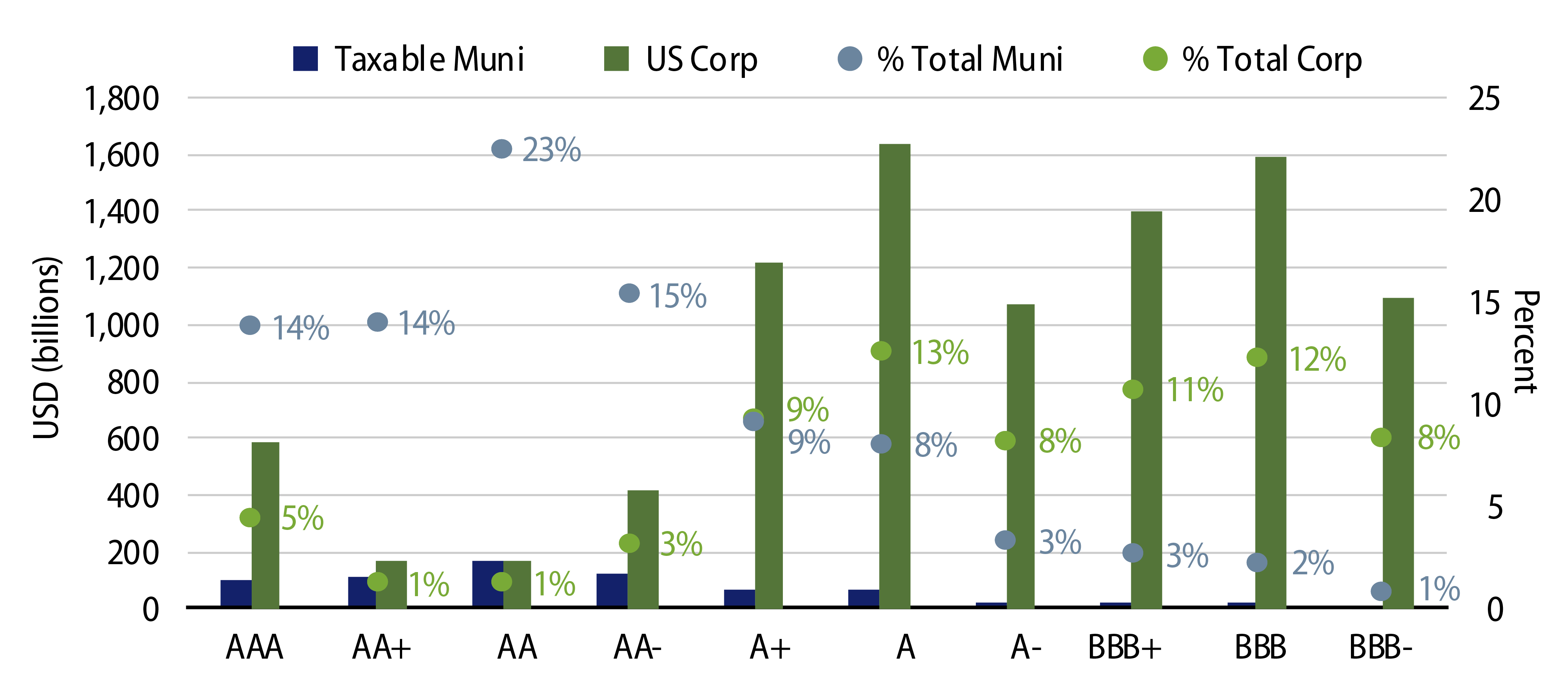

Life insurance companies currently maintain (and are compensated for) relatively high levels of exposure to corporate fixed-income, which is predominantly A and BBB rated. Only 7.5% of the $12 trillion US corporate fixed-income market is rated AA- or higher, compared to the 65% of the $767 billion outstanding taxable municipal universe that maintains a rating greater than AA-, according to Bloomberg.

While the changing economics are likely to move marginal life insurance capital to high quality taxable munis, we do not anticipate robust forced selling or immediate major asset allocation shifts, as legacy holdings will still benefit from relatively higher book yields. In addition, life insurers must still focus on maintaining overall higher levels of current income (subject to reasonable capital constraints) and therefore will still have demand for assets down the ratings spectrum, despite the worsening return on capital profile.

Incremental demand for taxable municipals from life insurance companies would serve as one more demand tailwind for the taxable muni asset class. As highlighted in our prior blog about the growing global interest in US municipal securities, declining hedging costs and attractive relative value for taxable municipals have contributed to higher taxable municipal demand in recent years According to the Federal Reserve flow of funds report as of 1Q21, non-US and insurance company demand increased 5.2% YoY from $599 billion to $630 billion, as high quality yields have been increasingly difficult to source.

Western Asset’s Insurance Solutions Team has maintained a capital solutions framework to assist global clients within various regulatory regimes achieve favorable risk-adjusted return on capital within their fixed-income portfolios. We have long maintained the belief that the municipal asset class offers unique return opportunities on capital benefits for a variety of insurance clients across the globe where in our view could potentially benefit from higher quality sub-sovereign or infrastructure fixed-income asset allocations, and therefore Western Asset anticipates municipals should be an increasingly important aspect of insurers’ solutions going forward.