Municipals Posted Positive Returns Last Week

Top-grade munis outperformed Treasuries last week as ratios declined. Market technicals were supported by strong fund flows that met elevated supply. The Bloomberg Municipal Index returned 0.48% during the week, the High Yield Muni Index returned 0.68% and the Taxable Muni Index returned 0.17%. This week we highlight tobacco consumption data released last week, and its impact on the muni tobacco sector.

Technicals Were Supported by Robust Fund Inflows

Fund Flows: During the week ending May 8, weekly reporting municipal mutual funds recorded $1.1 billion of net inflows, according to Lipper. Long-term funds recorded $982 million of inflows, intermediate funds recorded $25 million of inflows and high-yield funds recorded $392 million of inflows. Meanwhile, short-term funds recorded $55 million of inflows. This week’s inflows lead estimated year-to-date (YTD) net inflows higher to $10.5 billion.

Supply: The muni market recorded $13 billion of new-issue volume last week, nearly double the level from the prior week. YTD issuance of $159 billion is 41% higher than last year’s level, with tax-exempt issuance 48% higher and taxable issuance 16% lower year-over-year (YoY). This week’s calendar is expected to remain elevated at $12 billion. Largest deals include $1.5 billion New York City TFA and $965 million Dormitory Authority of the State of New York School District transactions.

This Week in Munis: Tobacco Declines

Municipal tobacco securities were originally issued following the 1998 Master Settlement Agreement (MSA) between major tobacco manufacturers and states to address the medical consequences associated with cigarette smoking. Following the settlement, many states structured future settlement payments into municipal bonds to fund health care costs. The value of these future settlement payments is influenced by assumed consumption, inflation and interest rates.

Tobacco securities were initially issued with assumed annual consumption declines of 3%, but have since experienced greater declines due to increased health awareness and the availability of smoking alternatives. Consequently, many tobacco bonds have not been expected to fully fund interest payments and principal by maturity. Notably, tobacco securities are unique in their perpetual claim to settlement revenues that allow for payment of revenues beyond maturity. Many of these legacy vintages have since been refunded, resulting in a shrinking universe as the high-yield tobacco bond universe contracted from 30% in 2012 to 8% in 2024.

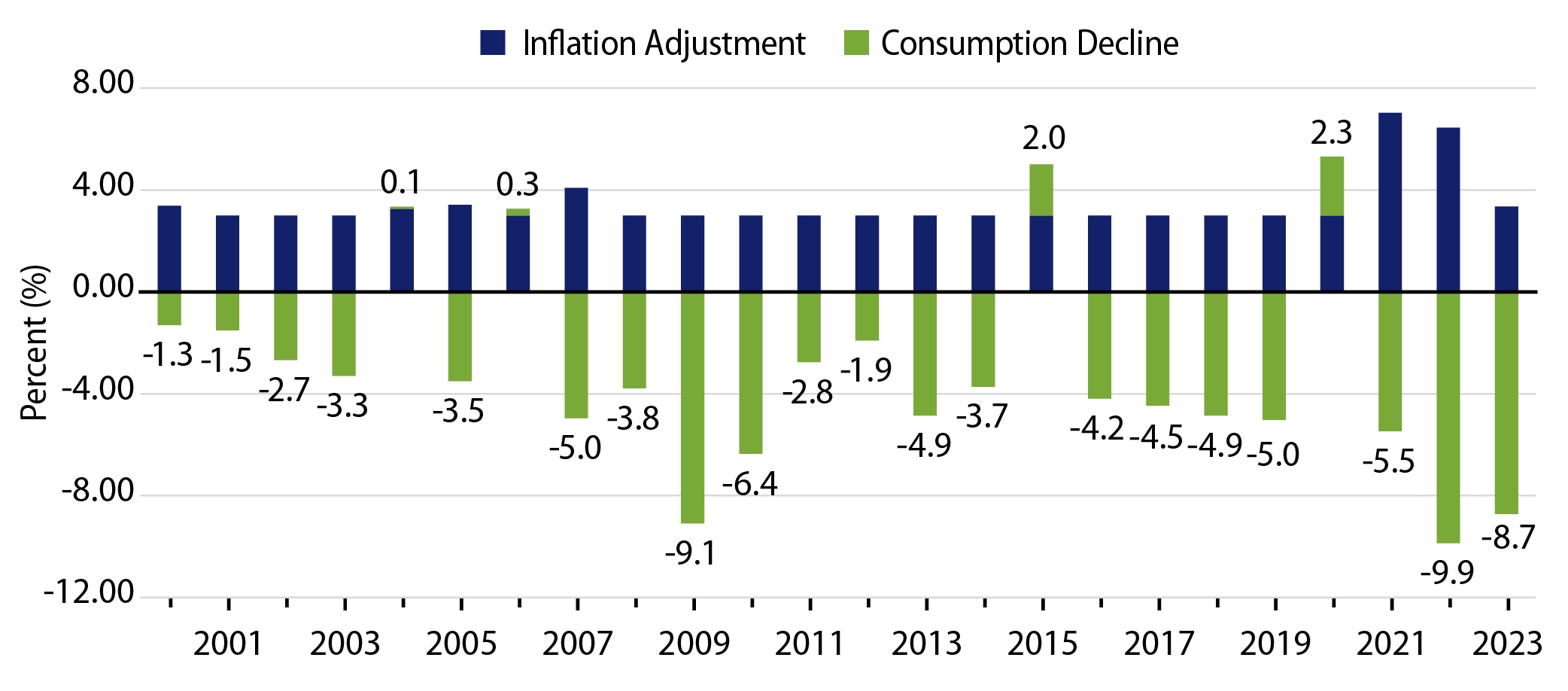

Last week, the National Association of Attorneys General (NAAG) released official cigarette consumption data which highlighted an 8.7% YoY decline in tobacco consumption, a lower decline than the 9.9% drop observed the year prior. While tobacco consumption experienced a lower decline than observed in 2022, lower inflation provided less of an offset in 2023, leading to a greater decline of settlement revenues compared to 2021 and 2022.

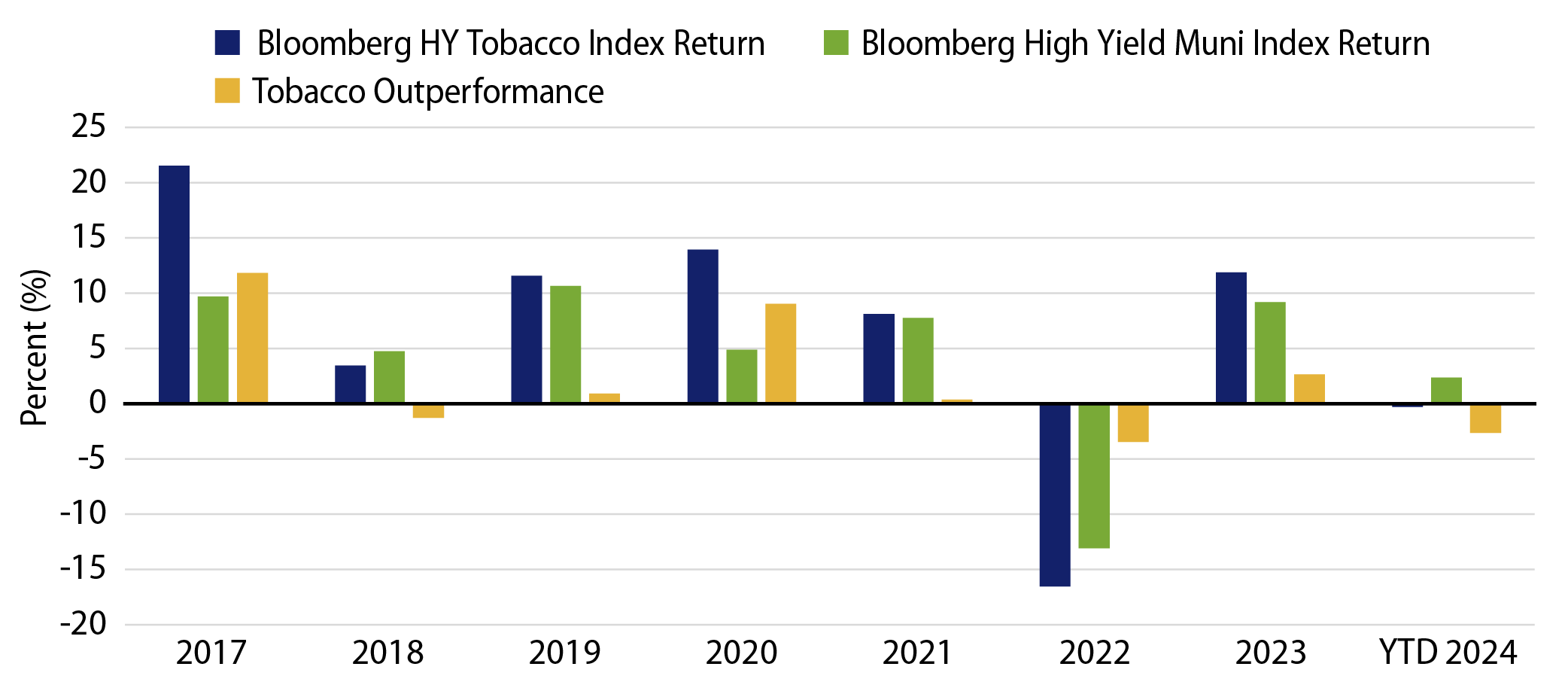

Over the past decade, municipal tobacco securities have benefited from the low interest rate environment, driving a higher value of future settlement revenues and refinancing activity, which has contributed to strong performance relative to the high-yield muni market. However, the recent consumption declines have contributed to underperformance so far this year. Western Asset remains cautious on the tobacco sector, given the greater-than-anticipated consumption declines, reduced benefits from lower inflation, and the potential for a higher interest-rate regime than experienced over the past decade. We see greater relative value in the recent vintages with more conservative consumption assumptions.

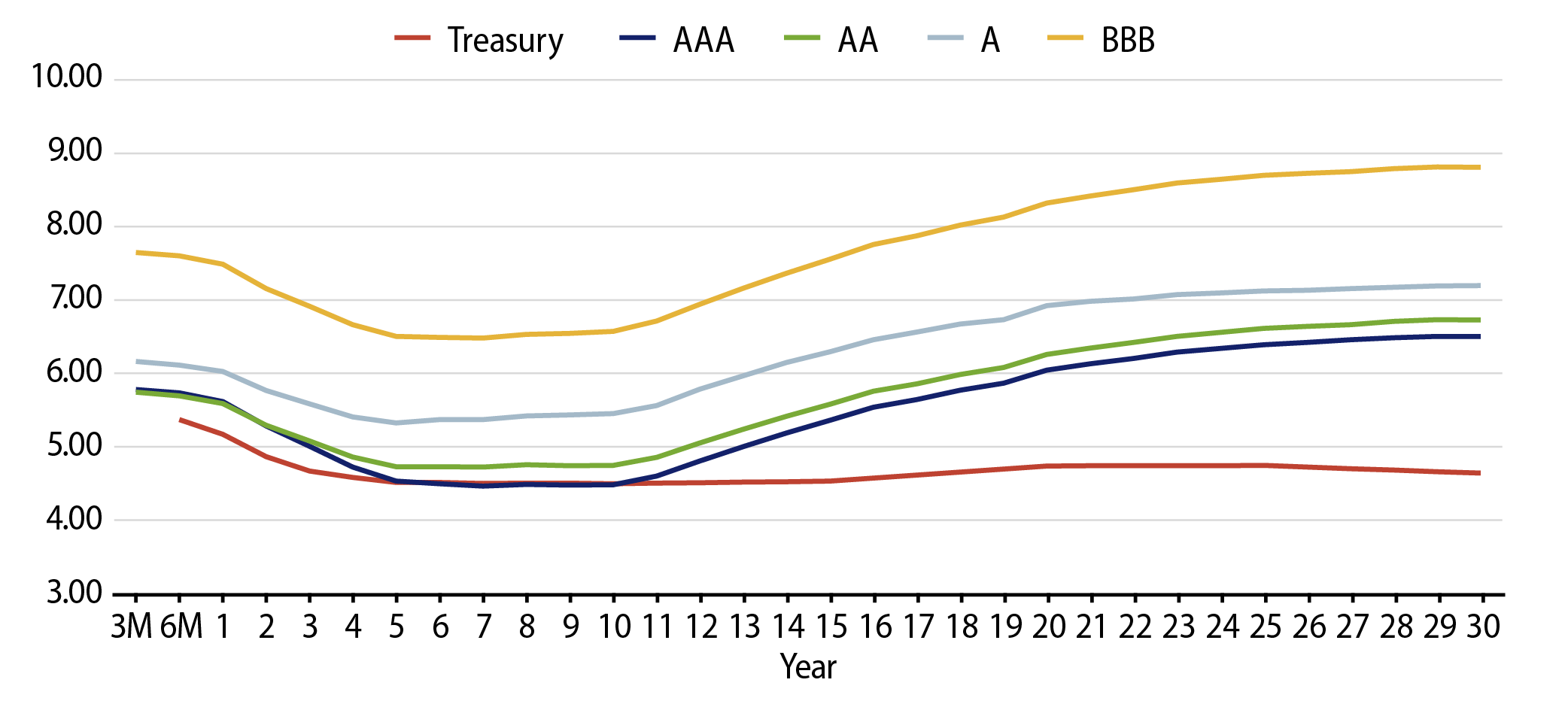

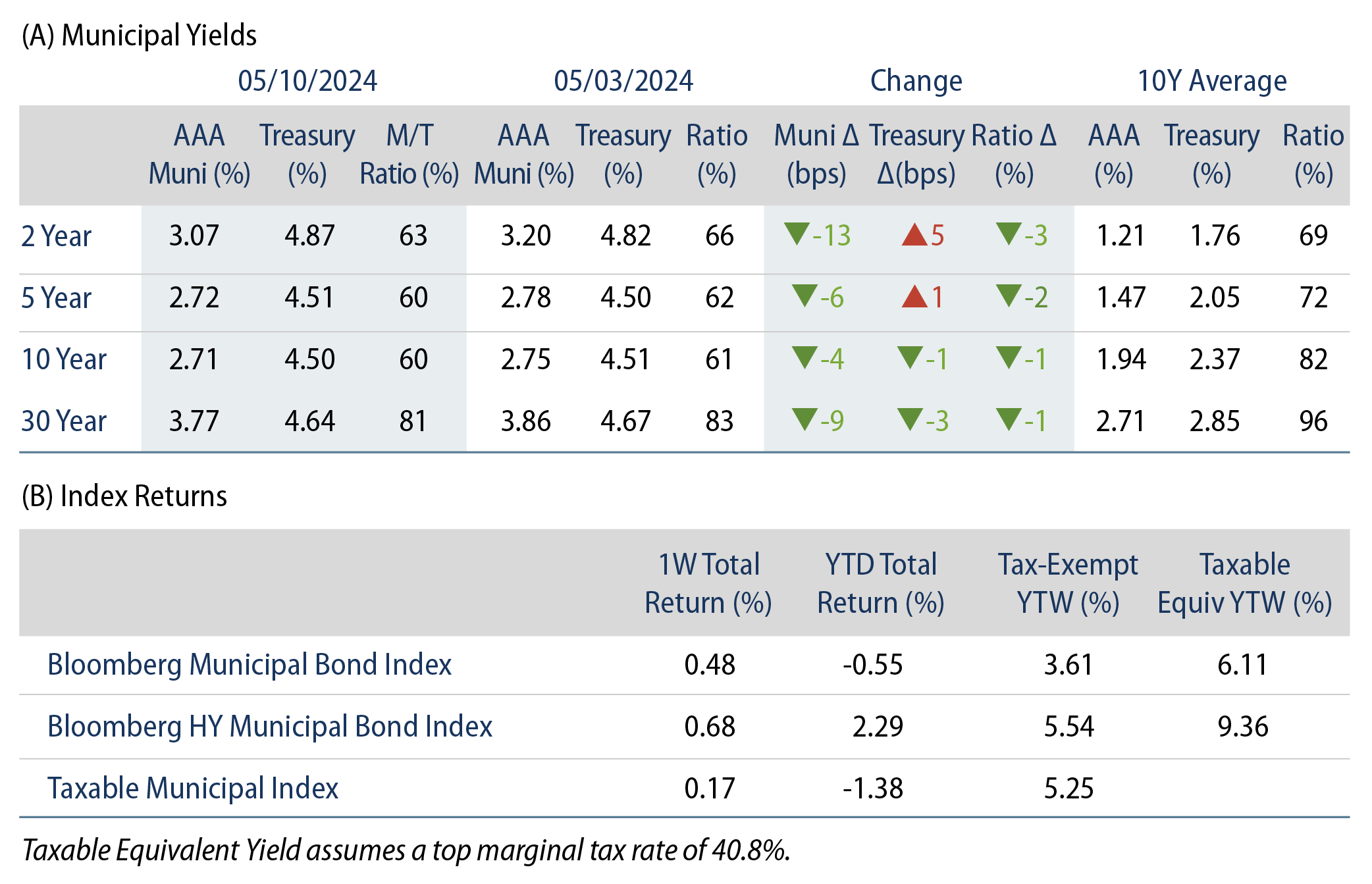

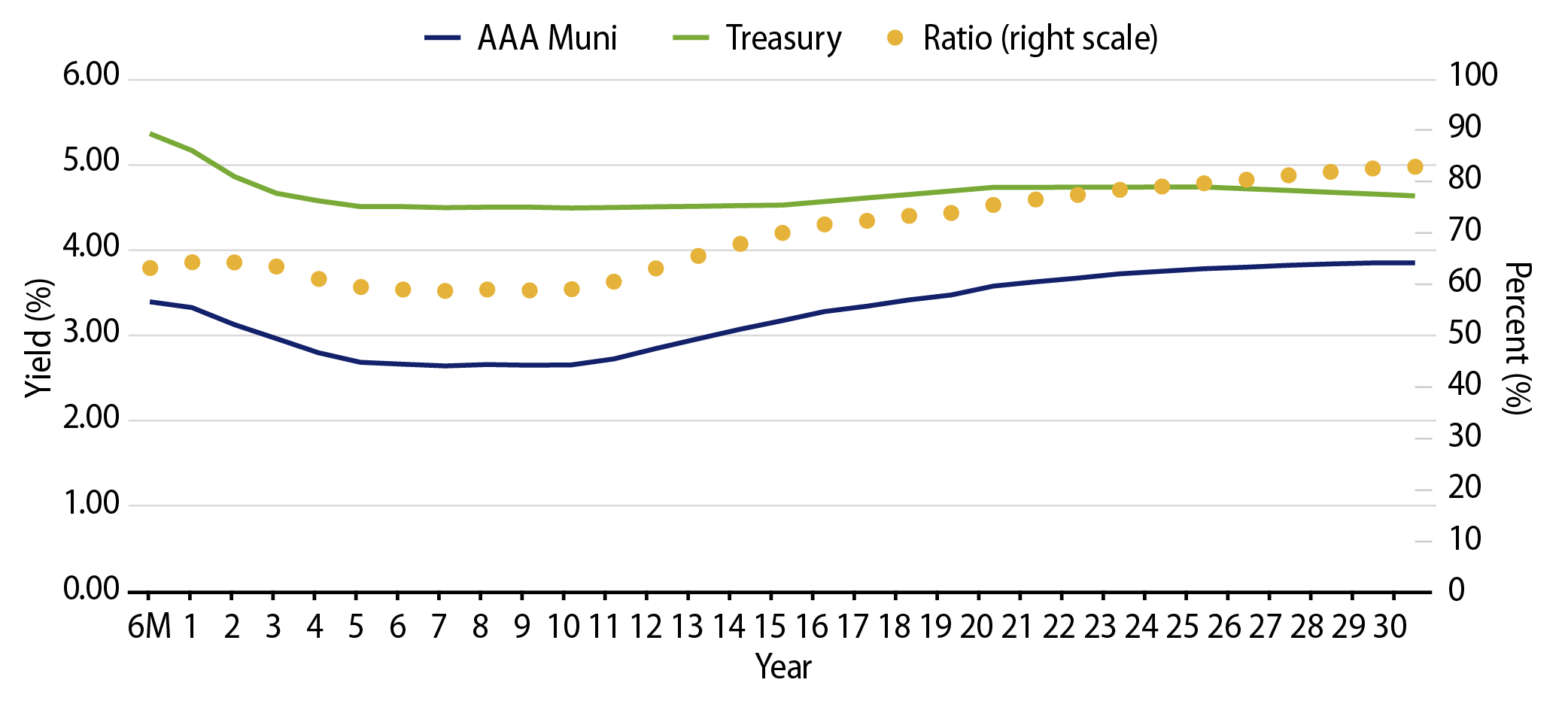

Municipal Credit Curves and Relative Value

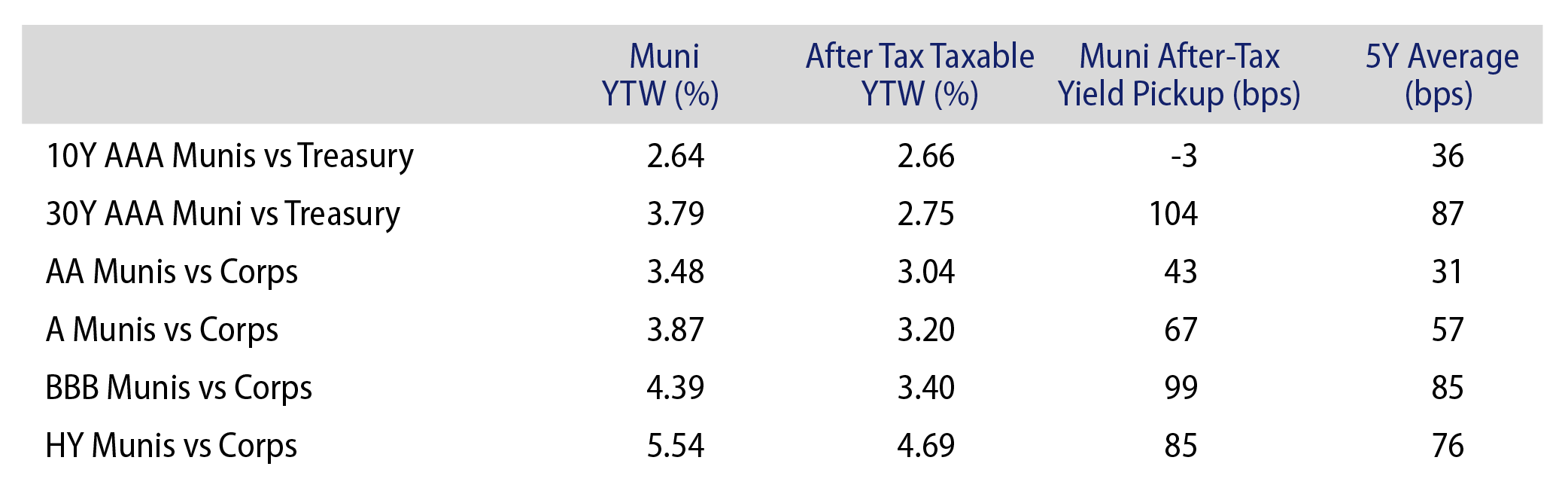

Theme #1: Municipal taxable-equivalent yields are above decade averages.

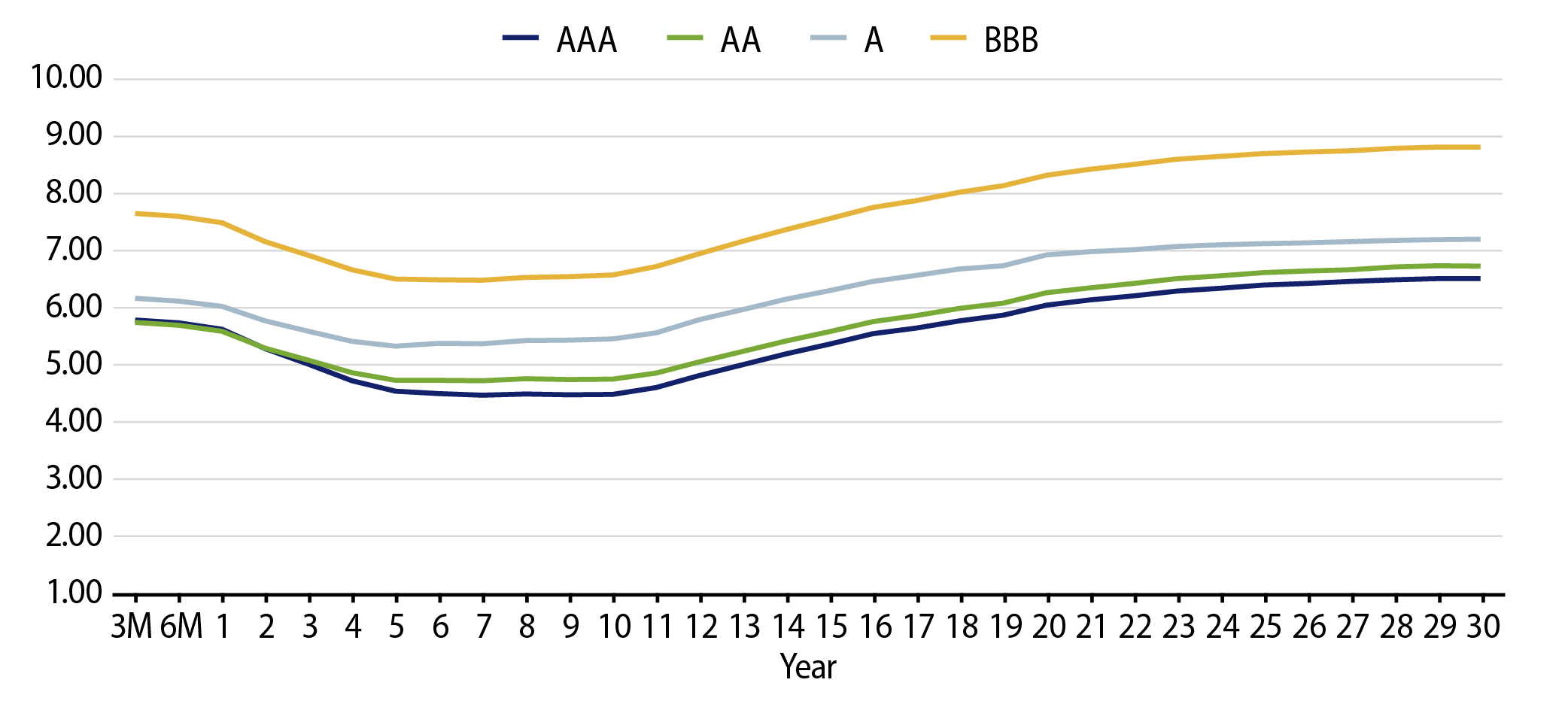

Theme #2: The inverted yield curve suggests less relative value in 5- and 10-year maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.