Macros, Markets and Munis

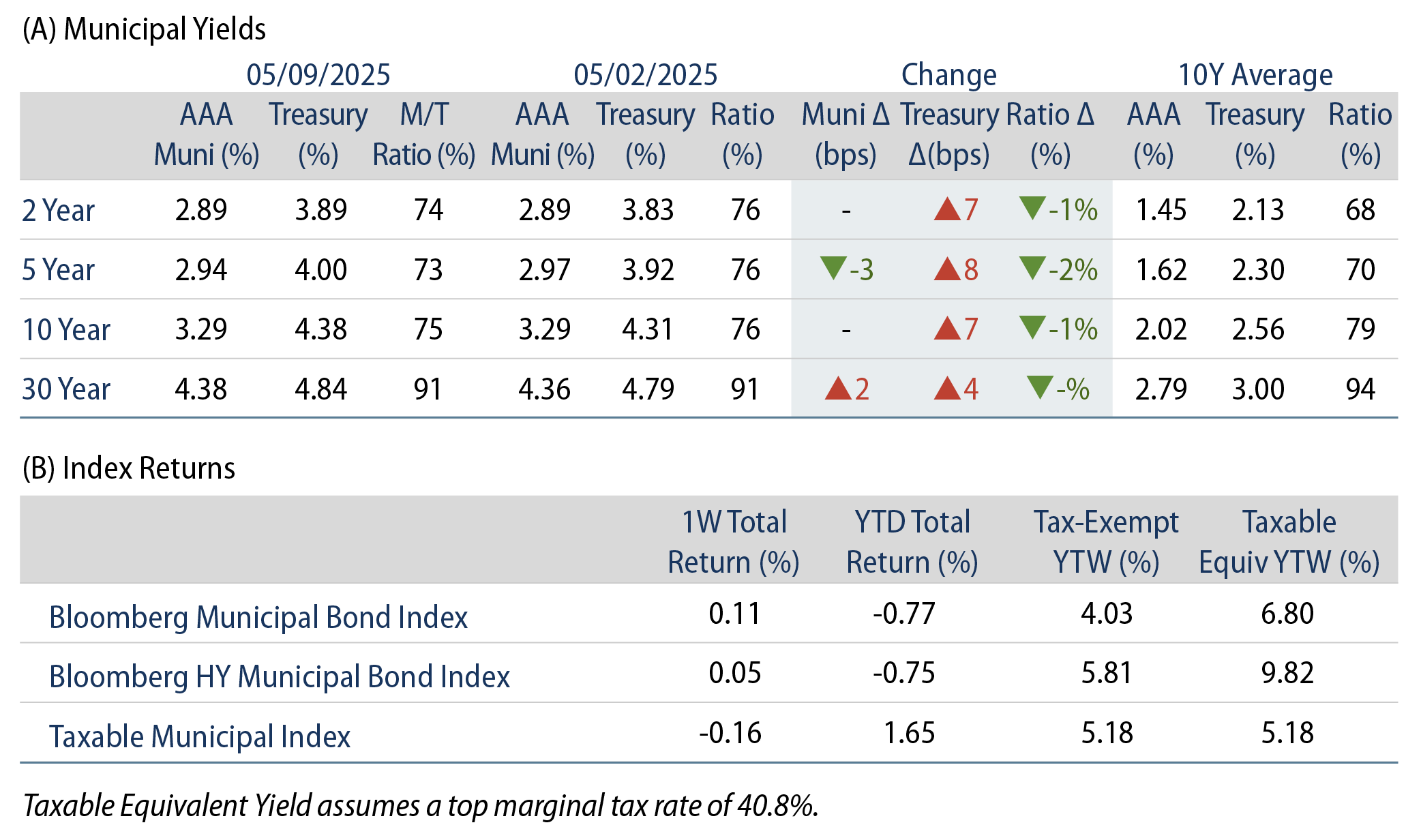

Municipals posted positive returns last week as Treasury yields moved 4-8 basis points higher across the curve. Munis outperformed on stronger supply and demand technicals amid lower supply and continued inflows. During a week of quiet economic data, the focus remained on the Trump administration’s trade policies, with Treasury yields moving higher on headlines of the US and China meeting to discuss a trade deal. Meanwhile, the Federal Reserve kept rates unchanged, as largely expected, with markets continuing to price in three cuts for the remainder of the year. Given the headlines about federal funding cuts and the possible elimination of higher education’s tax-exempt status, this week we look at emerging risks in the muni sector.

Technicals Improved as Inflows Continued for a Second Consecutive Week

Fund Flows (up $1.6 billion): During the week ending May 7, weekly reporting municipal mutual funds recorded $1.1 billion of net inflows, according to Lipper. Long-term funds recorded $597 million of inflows, intermediate funds recorded $96 million of inflows and high-yield funds recorded $348 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $4 billion.

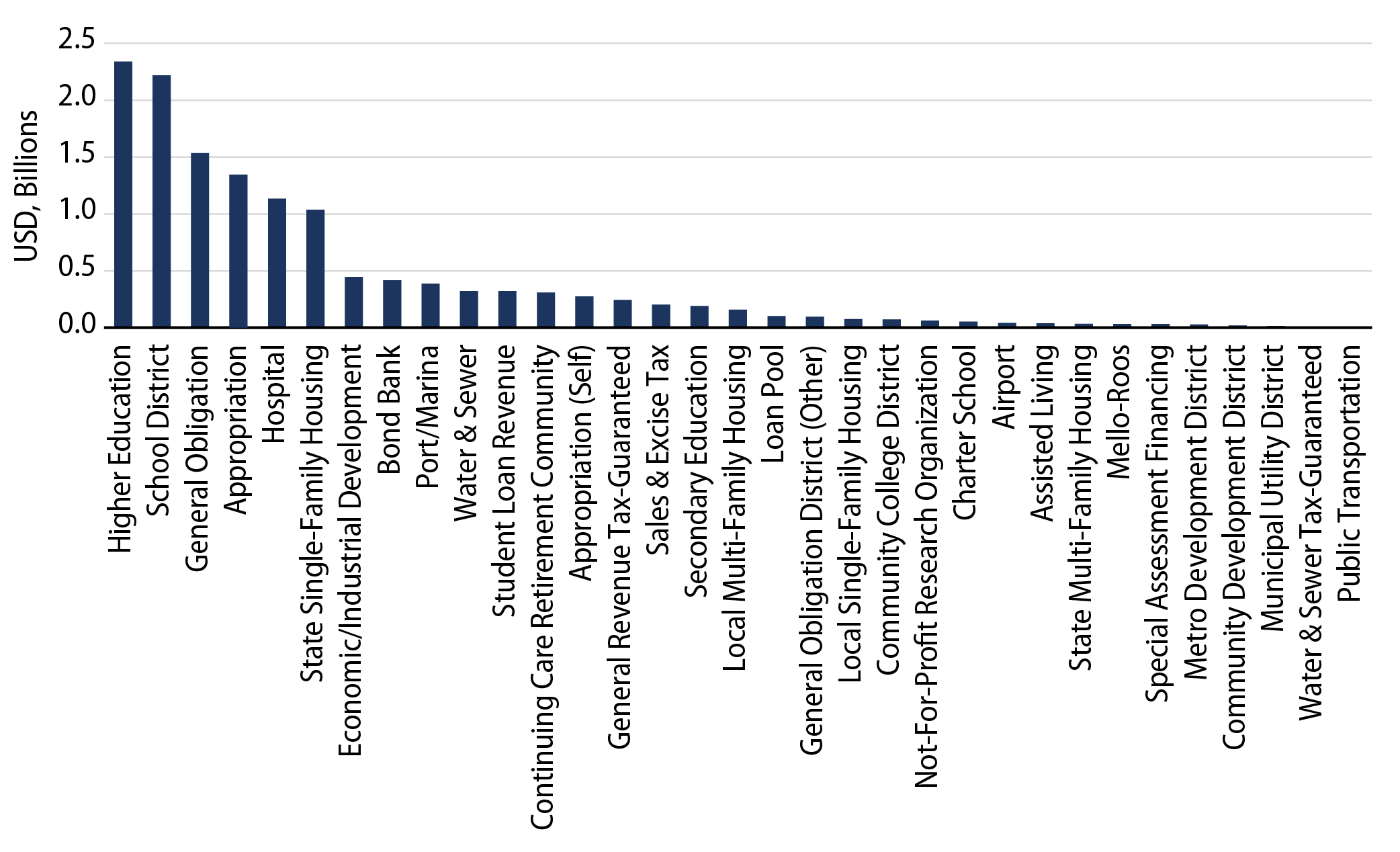

Supply (YTD supply of $188 billion; up 28% YoY): The muni market recorded $12 billion of new-issue supply last week, down 22% from the prior week but still well above historical averages. YTD, the muni market has recorded $188 billion of new issuance, up 28% year-over-year (YoY). Tax-exempt and taxable issuance are up 27% and 42%, respectively, though tax-exempt issuance has comprised the vast majority (93%) of YTD supply. This week’s calendar is expected to jump to $15 billion. The largest deals include $1 billion New York State Dormitory Authority (School District Bonds) and $840 million Harris, Texas Hospital District transactions.

This Week in Munis: Taking Tax-Exemption

Discussion of federal funding cuts are gaining momentum and the Trump administration’s criticism of top higher education institutions have drawn renewed risks to the sector. This year, we have seen significant federal funding and grant reductions to major universities, and President Trump indicated that he would revoke Harvard’s tax-exempt status following a previous announcement that the administration would freeze $2.2 billion in grants and contracts to the university. The scope of these federal funding concerns extends beyond Harvard, as major funding reductions have also impacted Columbia, Cornell, Princeton and Northwestern.

The credit impact on these top schools in the headlines, which have strong demand profiles and robust endowments, is likely limited. Many of the institutions already issue significant levels of taxable debt. However, the loss of tax exemption would likely result in higher costs for smaller schools with narrower operating profiles and greater reliance on federal funding. In addition to the threat to tax exemption, widespread hazards—including changes to student aid and loan grants, cuts to research funding, a potential endowment tax and a reduction in foreign student demand—are also leading to uncertainty regarding the sector’s credit trajectory.

The ultimate legal authority surrounding the administration’s actions remains in question. However, the market appears to be taking note, and major universities have responded. Higher education issuance is up over 26% YoY and has led all other sectors this month. Columbia announced last week that it would cut nearly 180 faculty members as a result of such funding cuts.

From a YTD performance standpoint, the higher education sector has underperformed the Bloomberg Municipal Bond Index, but not significantly more than other revenue-backed sectors (Exhibit 2). Given the widespread risks to the sector—ranging from threats to tax exemption, to foreign student demand, to research funding—Western Asset believes that credit selection will be paramount in avoiding issuers with outsized risk to potential negative policy outcomes for the sector.

Municipal Credit Curves and Relative Value

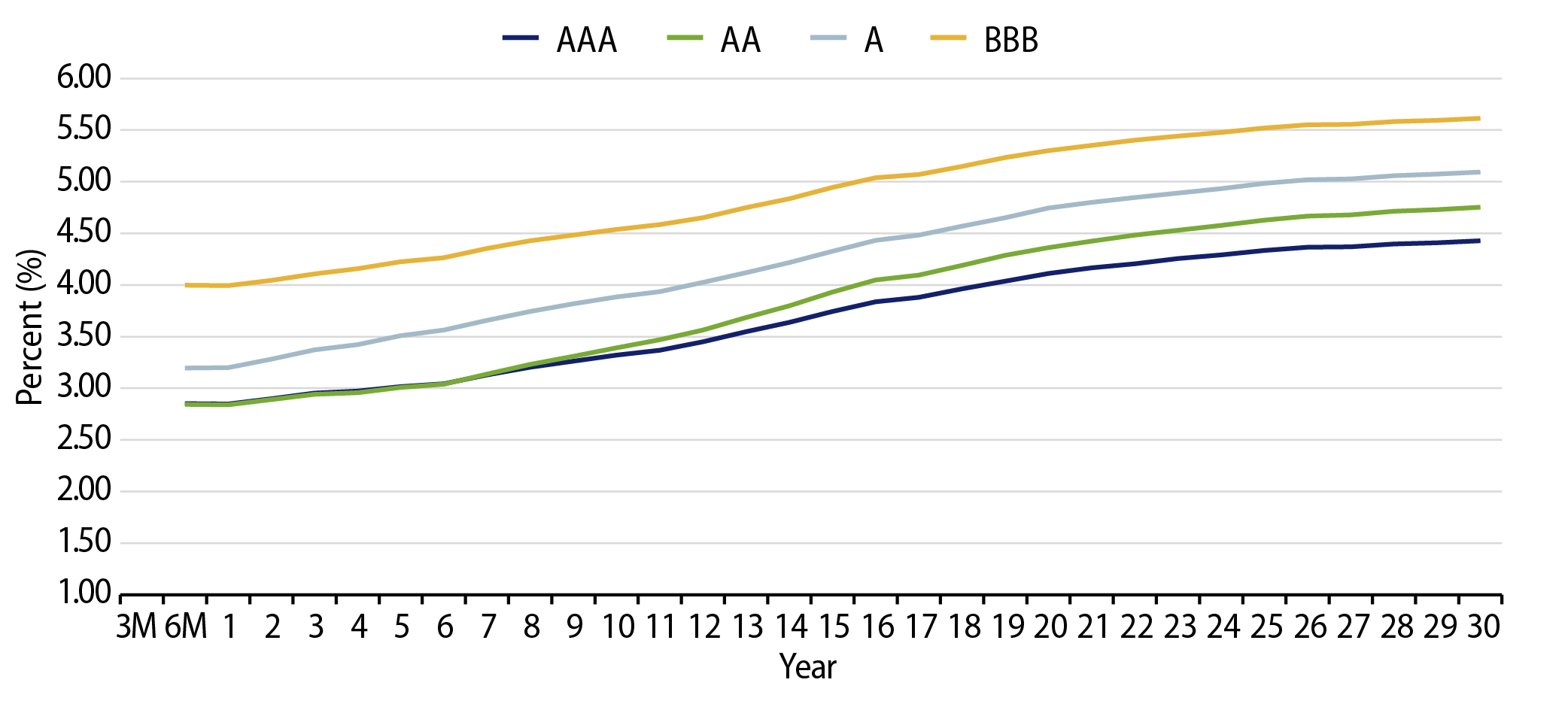

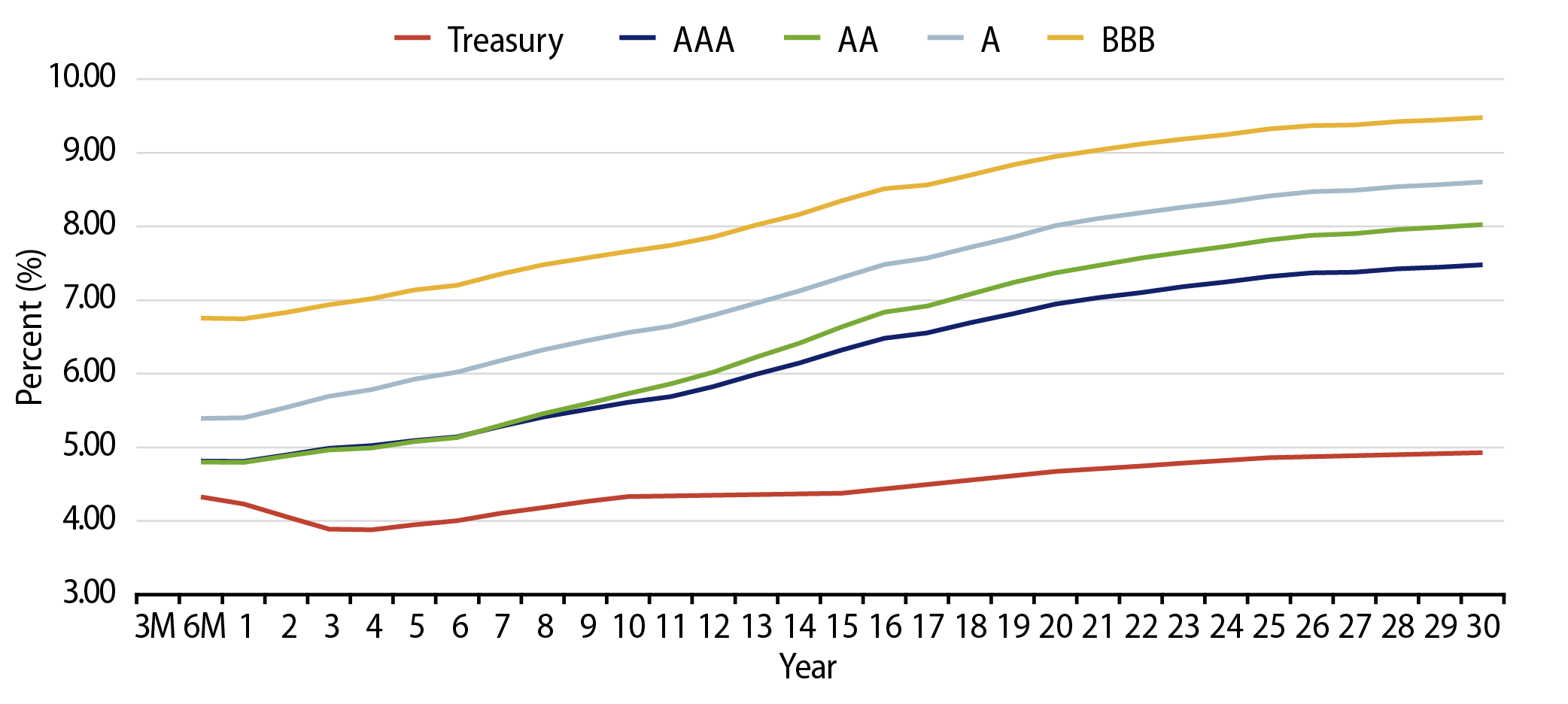

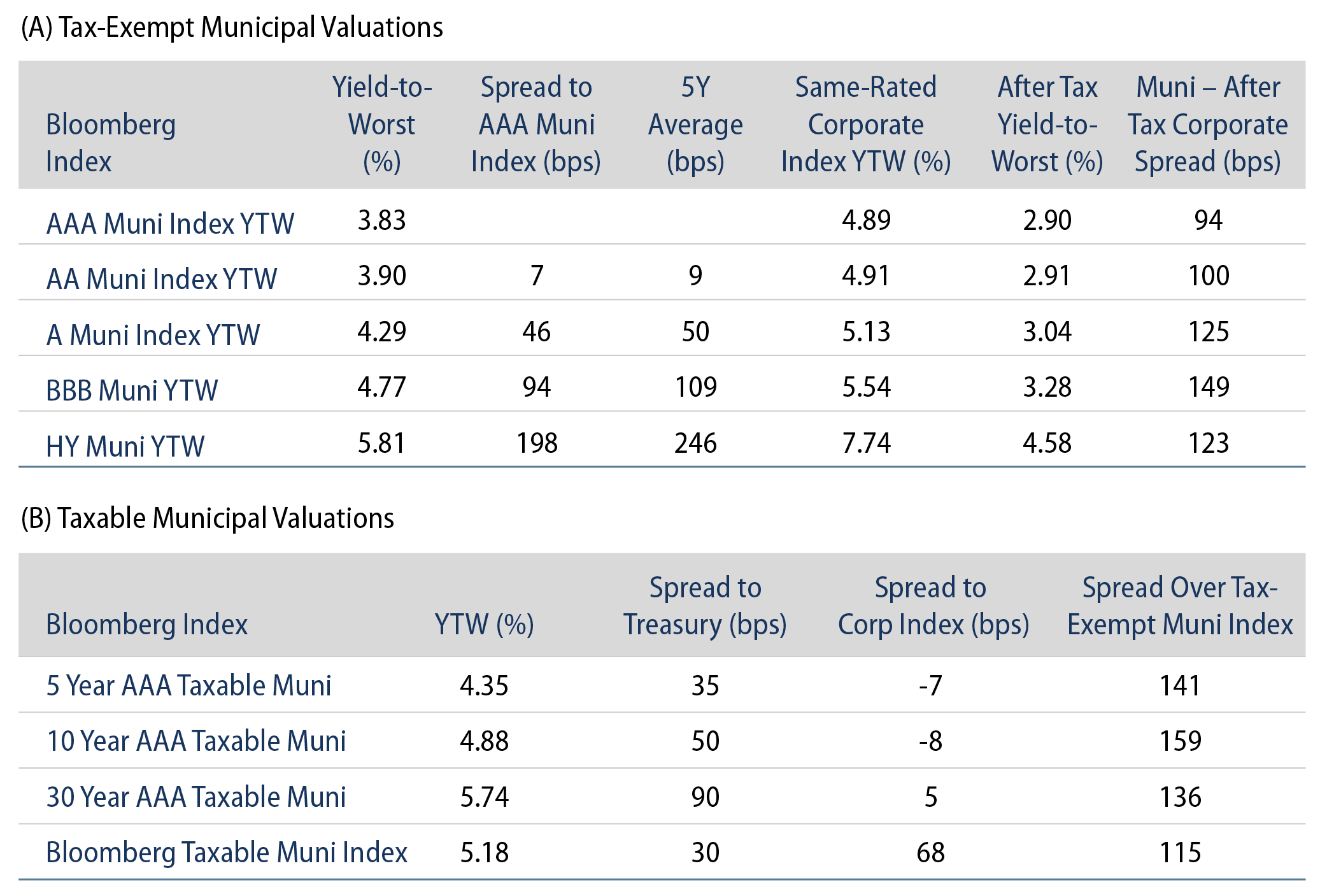

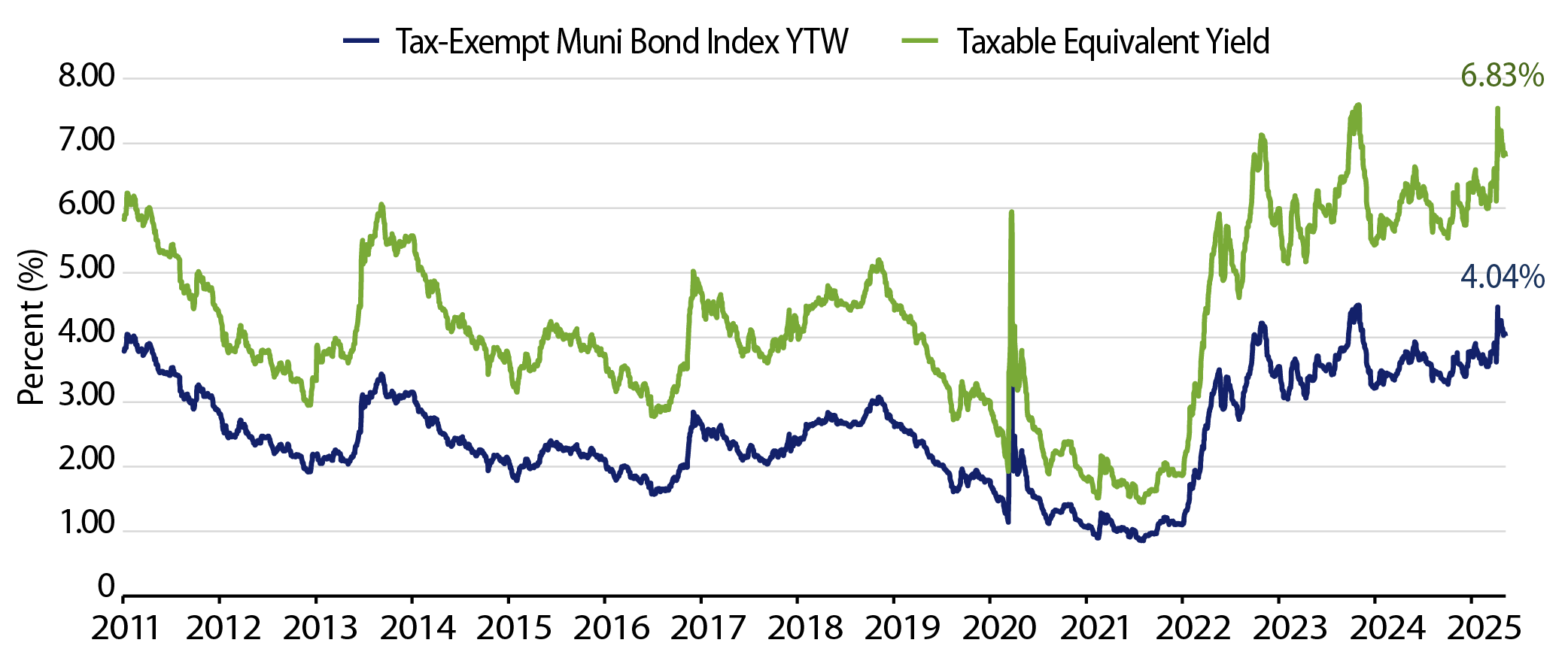

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

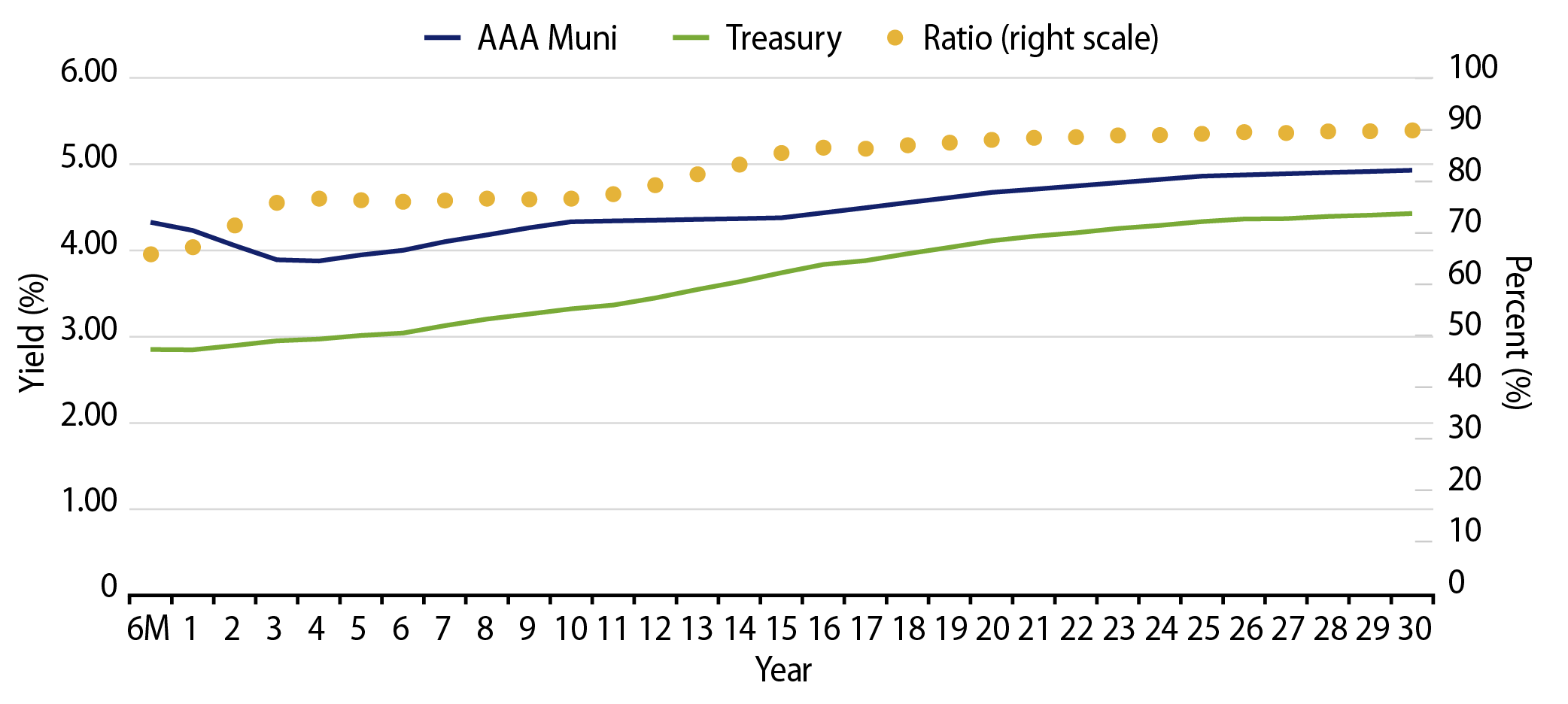

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

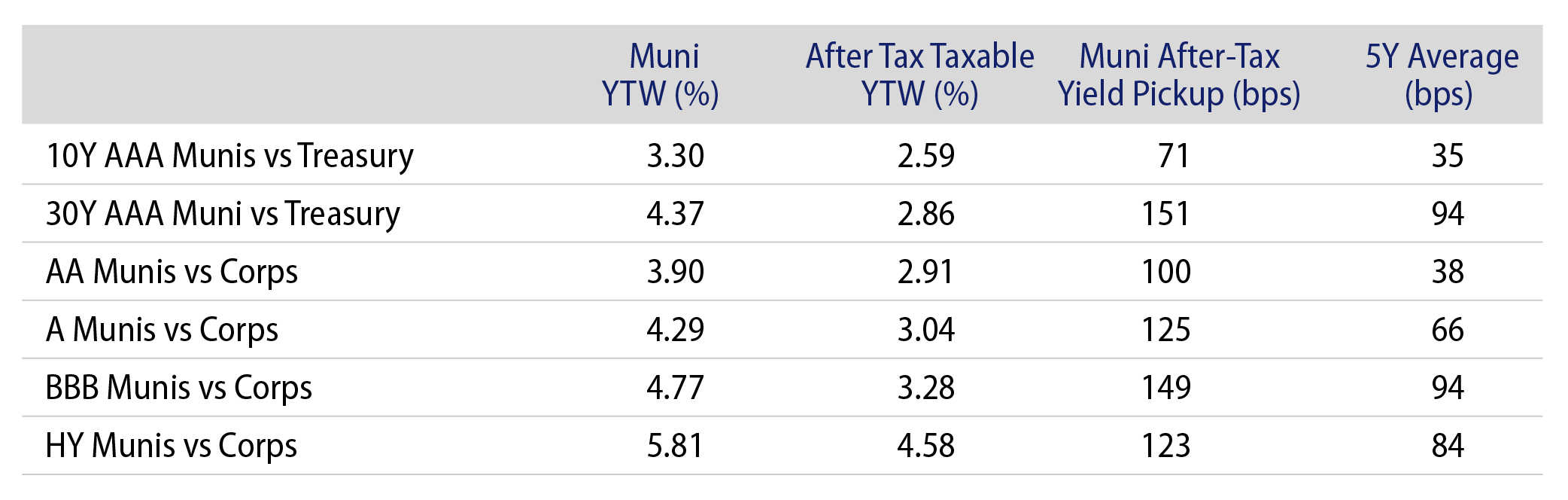

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.