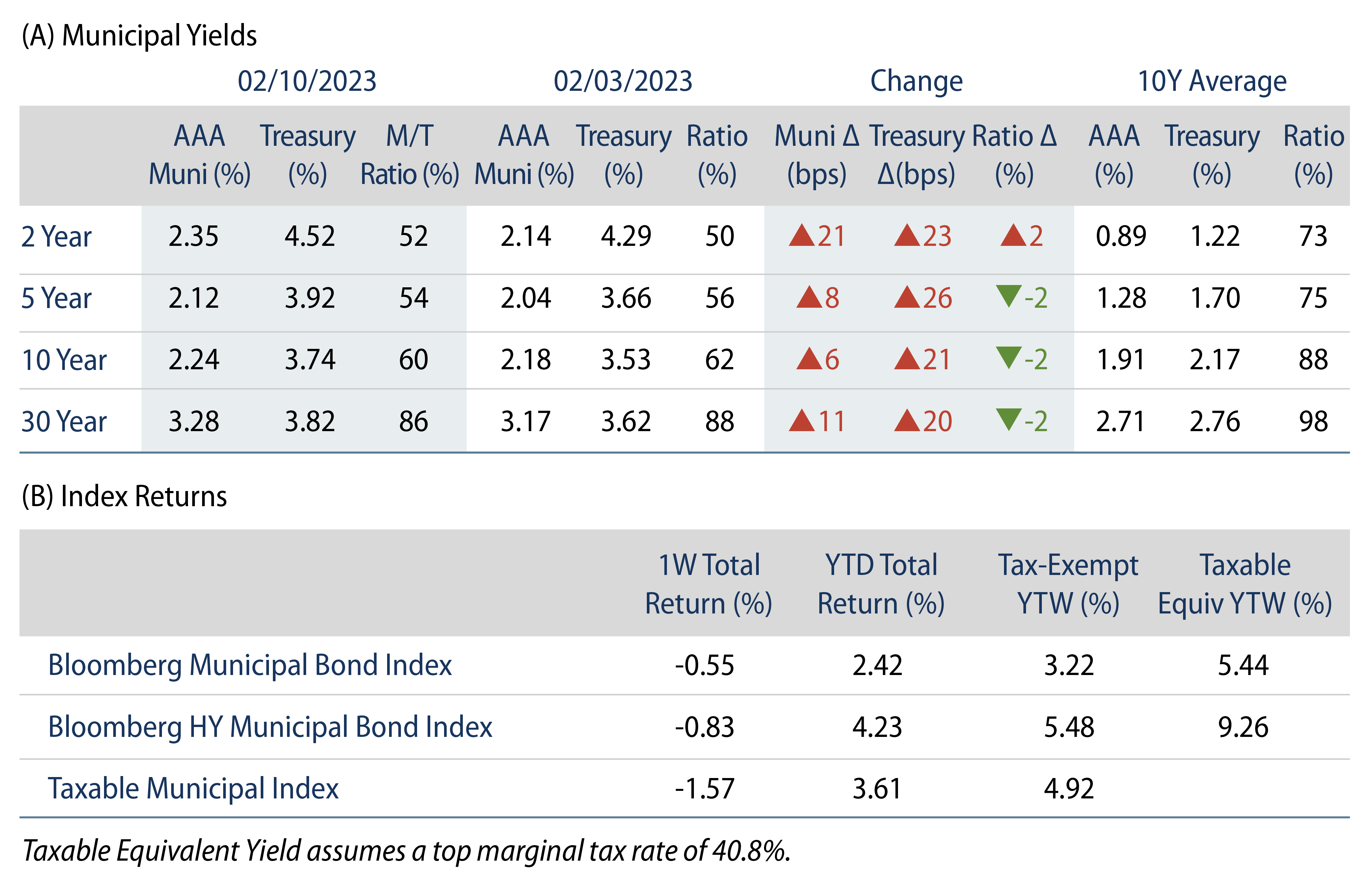

Municipal Yields Moved Higher Last Week

Municipal yields moved higher last week, with high-grade municipal yields moving 6-11 bps higher across intermediate and long maturities, while the 7-day tax-exempt SIFMA rate doubled to 3.74%. Improved technicals supported municipal outperformance versus Treasuries and muni fund flows turned positive as supply moved higher. The Bloomberg Municipal Index returned -0.55% during the week, the HY Muni Index returned -0.83% and the Taxable Muni Index returned -1.57%. This week we highlight implications of the Texas PSF program reaching capacity last month.

Limited New Issuance Supported Market Technicals

Fund Flows: During the week ending February 8, Lipper weekly reporting municipal mutual funds recorded $775 million of net inflows. Long-term funds recorded $1.0 billion of inflows, high-yield funds recorded $530 million of inflows and intermediate funds recorded $233 million of inflows. This week’s flows reversed year-to-date (YTD) outflows to $636 million of inflows.

Supply: The muni market recorded $5 billion of new-issue volume last week, over double the prior week’s issuance. YTD issuance of $30 billion is down 15% year-over year (YoY), with tax-exempt issuance down 10% YoY and taxable issuance down 49% YoY. Next week’s calendar is expected to increase to $8.3 billion. Large transactions include $1.8 billion University of California and $1.0 billion California Community Choice Financing Authority transactions.

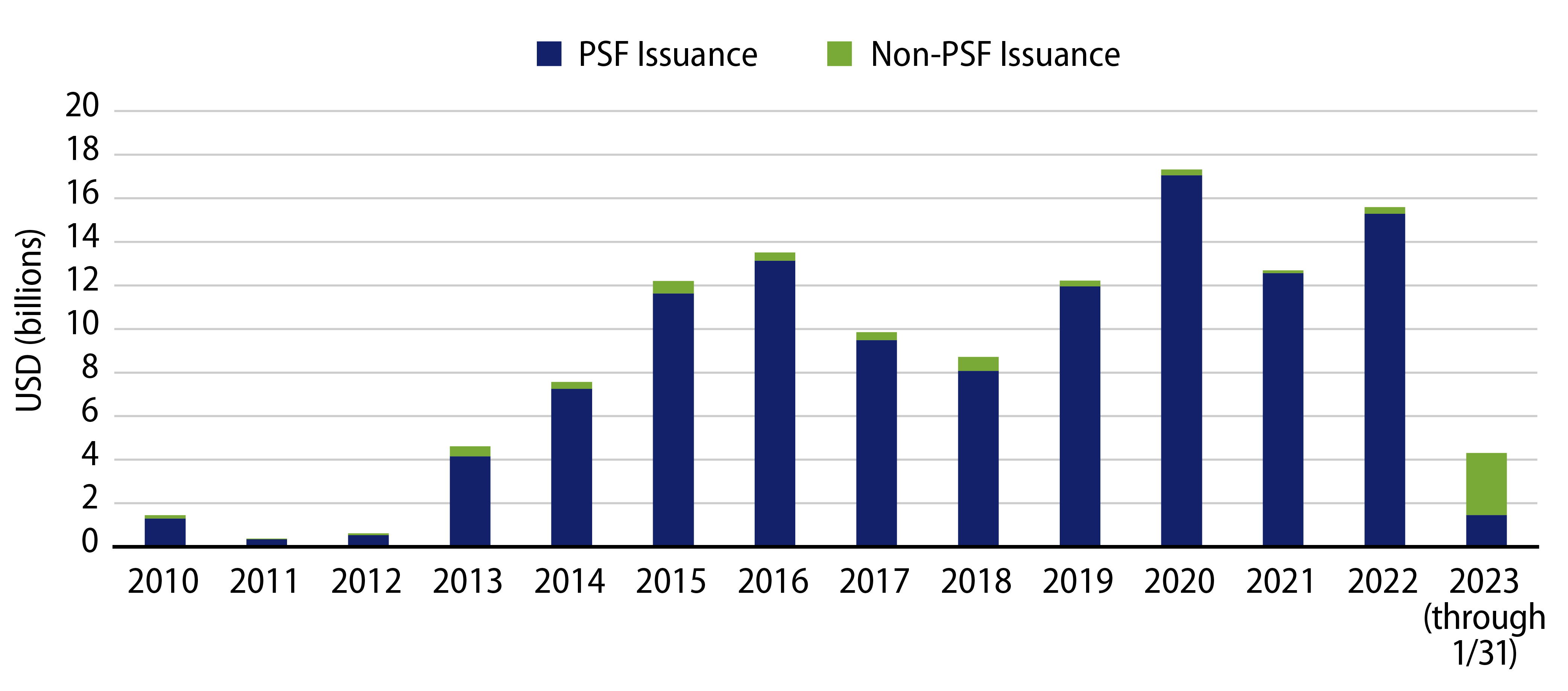

This Week in Munis: Texas PSF Hits Capacity

The Texas Permanent School Fund (PSF) is a state credit enhancement historically available to school districts within the State of Texas. Established in 1854, the PSF allows school districts to benefit from an established $57 billion collateral pool that guarantees principal and interest payments for school districts that issue under the program. With the PSF bond guarantee, small and large Texas school district issuers can fund projects at favorable municipal borrowing rates, commensurate with a AAA rating. In January, bonds issued under the program reached the federally established PSF capacity limit of $117 billion.

As of December 31, $106 billion (or 96%) of outstanding Texas School District issuance benefited from the PSF and its AAA rating, according to Western Asset’s analysis of Bloomberg data. To put this size in context, if the $106 billion of outstanding PSF-guaranteed securities were considered an independent issuer, Texas PSF credit would represent largest issuer within the muni market, surpassing the State of California’s outstanding issuance of $77 billion.

Western Asset believes that the federal limitation on the PSF could be extended, pending IRS approval. However, for now, Texas school districts must either issue bonds on their own independent credit strength, or pay for third-party insurance. In either case, Texas school districts, which are facing increasing infrastructure needs due to growing populations, will likely face above-average borrowing costs to fund facilities.

Meanwhile, municipal investors will be required to navigate increased fragmentation of this sizeable market segment. In the single month of January, more non-PSF guaranteed securities were issued than in the prior seven calendar years combined. We believe the elevated non-PSF issuance should warrant additional diligence from municipal investors, and potentially contribute to relative value opportunities.