Municipals Posted Positive Returns Last Week

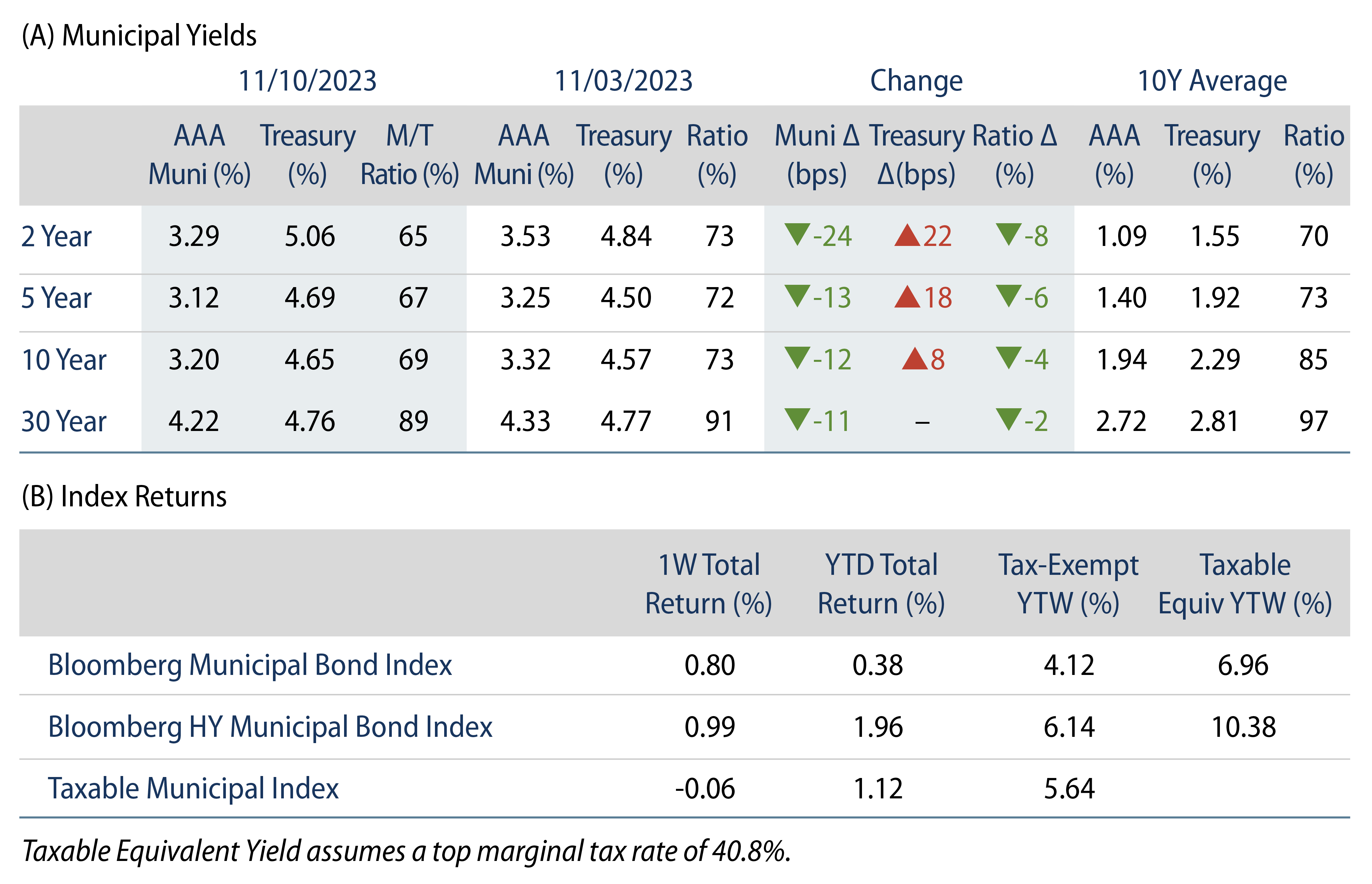

Munis rallied despite Treasury yields moving higher on hawkish Federal Reserve rhetoric. High-grade muni yields moved lower across the curve. Meanwhile, new-issue supply was elevated but net outflows from mutual funds slowed. The Bloomberg Municipal Index returned 0.80% during the week, the High Yield Muni Index returned 0.99% and the Taxable Muni Index returned -0.06%. This week we highlight recent record trading activity among muni investors driven by late-year tax-loss harvesting.

Muni Technicals Remain Challenged by Elevated Supply, Fund Outflows

Fund Flows: During the week ending November 8, weekly reporting municipal mutual funds recorded $151 million of net outflows, according to Lipper. Long-term funds recorded $150 million of inflows, high-yield funds recorded $190 million of inflows and intermediate funds recorded $81 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to an estimated $11 billion.

Supply: The muni market recorded $13 billion of new-issue volume last week, up nearly 3x from the prior week’s level. YTD issuance of $321 billion is down 1% year-over-year (YoY), with tax-exempt issuance 5% higher and taxable issuance down 38% YoY. This week’s calendar is expected to increase to $7 billion. Large transactions include $1.3 billion New Jersey Transportation Trust and $900 million Patriots Energy Group transactions.

This Week in Munis: Swap Season

Individuals often look to the end of the year to minimize tax liabilities by realizing portfolio losses to offset capital gains, referred to as “tax-loss harvesting.” Because of the diversification benefits of the municipal asset class, investors frequently look to their muni portfolios to execute these transactions. In addition to losses that can be realized to offset gains within or outside of their municipal portfolios, the practice also allows investors to purchase higher-yielding municipal bonds to increase tax-exempt income levels.

Western Asset attributes heightened municipal trading activity observed since October to tax-loss harvesting. According to the Municipal Securities Rulemaking Board (MSRB), muni trading activity reached record levels in October with 1.49 million trades, up 15% from the prior record in November 2022. In October 2023 and for the month to date, total items on Bloomberg’s daily municipal bids wanted list was 10,673, more than double the prior five-year average of 4,860.

This year’s relatively high level of tax swapping stems from a second consecutive year of negative returns in the municipal asset class. While municipals marked the lowest returns in over 40 years in 2022, equities also had significant negative returns, allowing for tax-loss harvesting opportunities across asset classes last year. Through September 30, the S&P 500 returned 13.06% YTD, while the Bloomberg Municipal Bond Index returned -1.38% YTD. This has led investors to look at their fixed-income allocations rather than at equity allocations for greater tax-loss harvesting activity.

Western Asset believes that the ability to tax-loss harvest a portfolio can contribute to favorable after-tax outcomes. However, it is important to consider that the municipal market is less liquid than other asset alternatives such as equities, government bonds and corporate bonds. Because of challenged market liquidity, particularly during periods of elevated selling, realized prices can quickly fall below what might be expected or implied by a price evaluation. It can be easy to take losses but more difficult to do so at fair market prices, and the ability to achieve adequate liquidity against tax-loss benefits should be scrutinized. Western Asset believes that partnering with a manager that can communicate market liquidity conditions and potential portfolio implications is important in successfully executing tax-loss harvesting strategies.

Western Asset Key Themes for Muni Investors

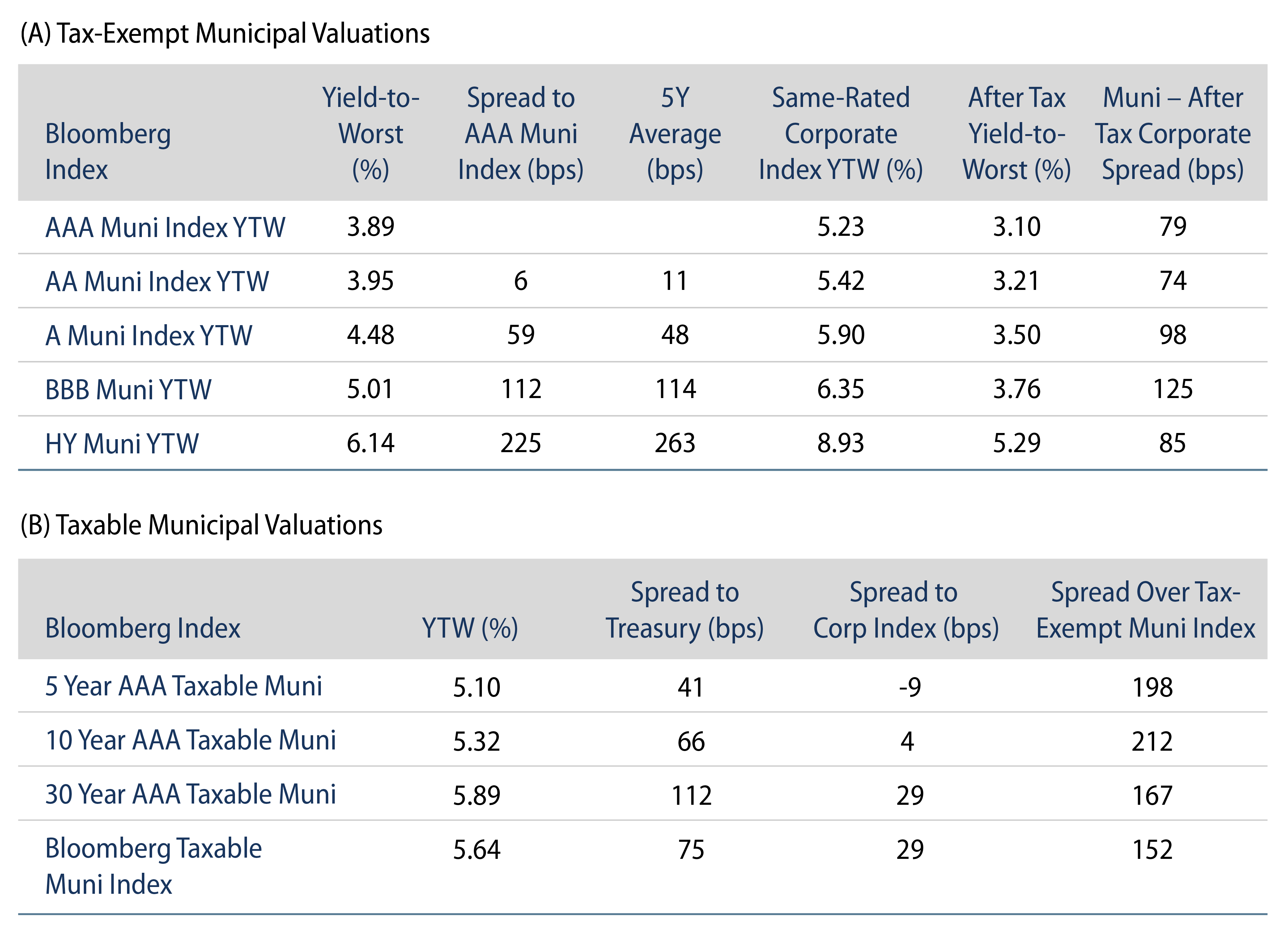

Theme #1: Municipal index yields and taxable equivalent yields are above decade highs.

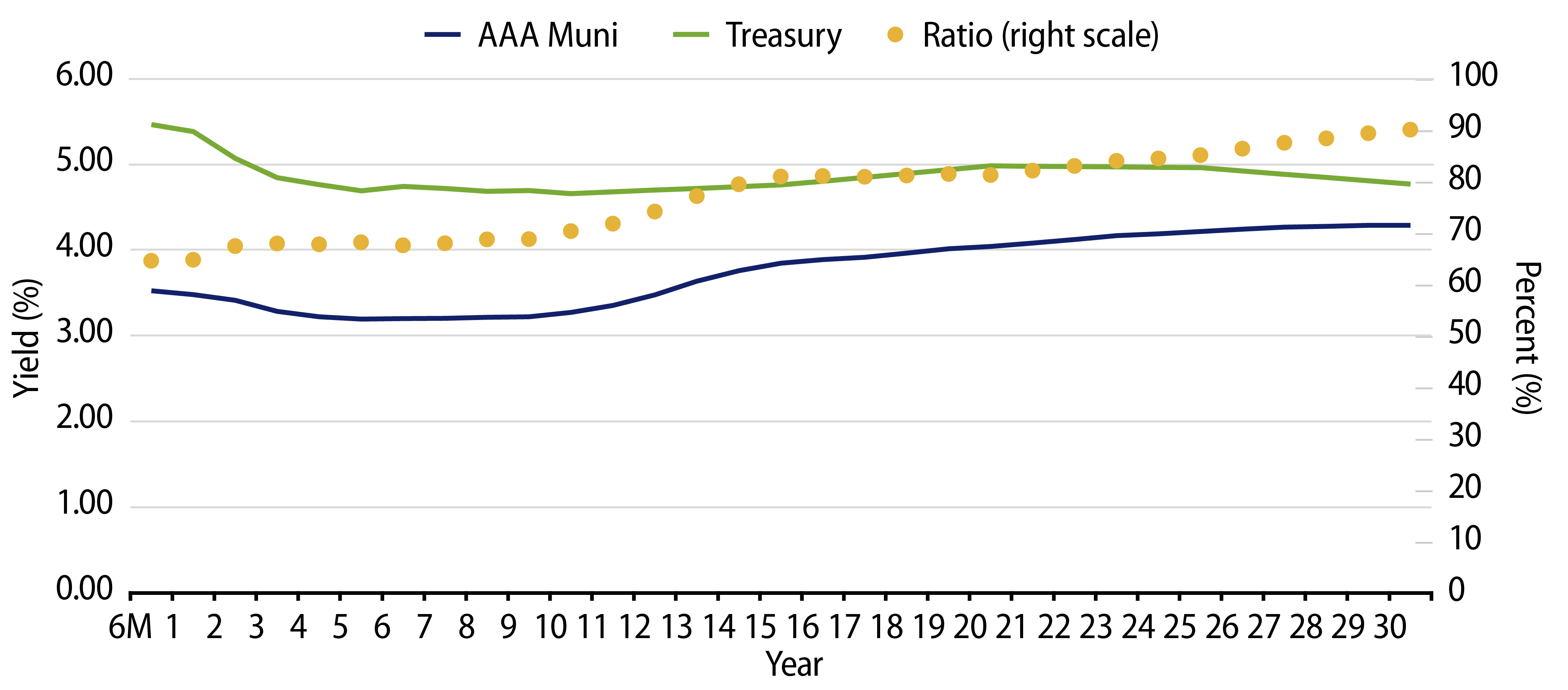

Theme #2: The inverted yield curve offers opportunities in short and long maturities.

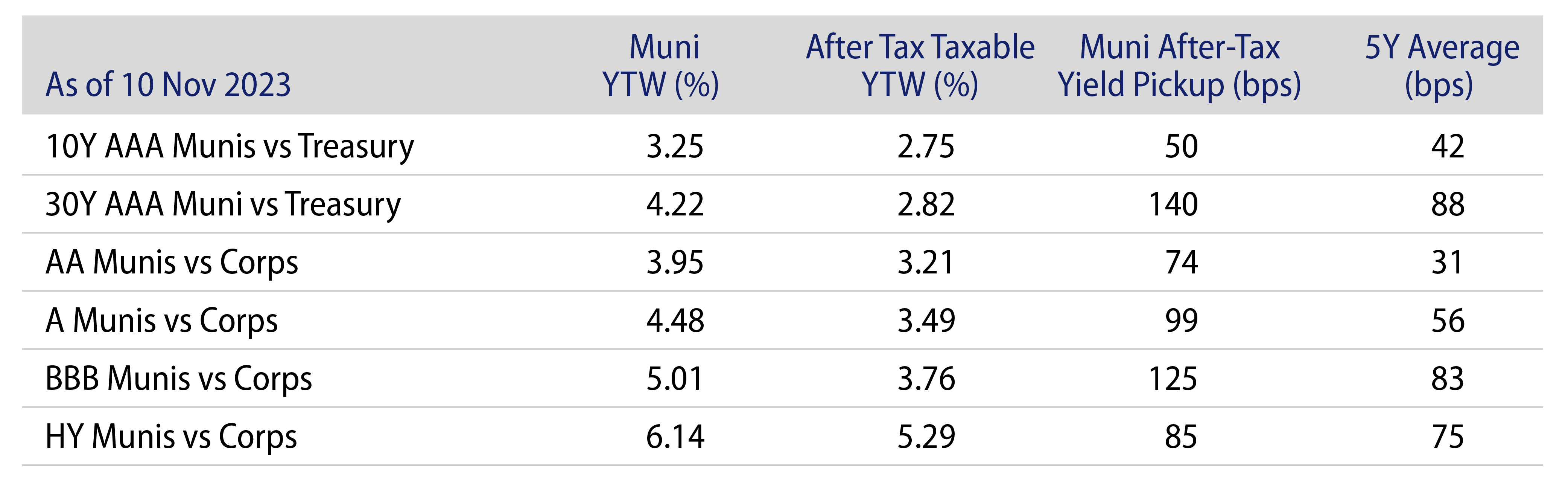

Theme #3: Munis offer attractive after-tax yield pickup vs. corporate credit.