Macros, Markets and Munis

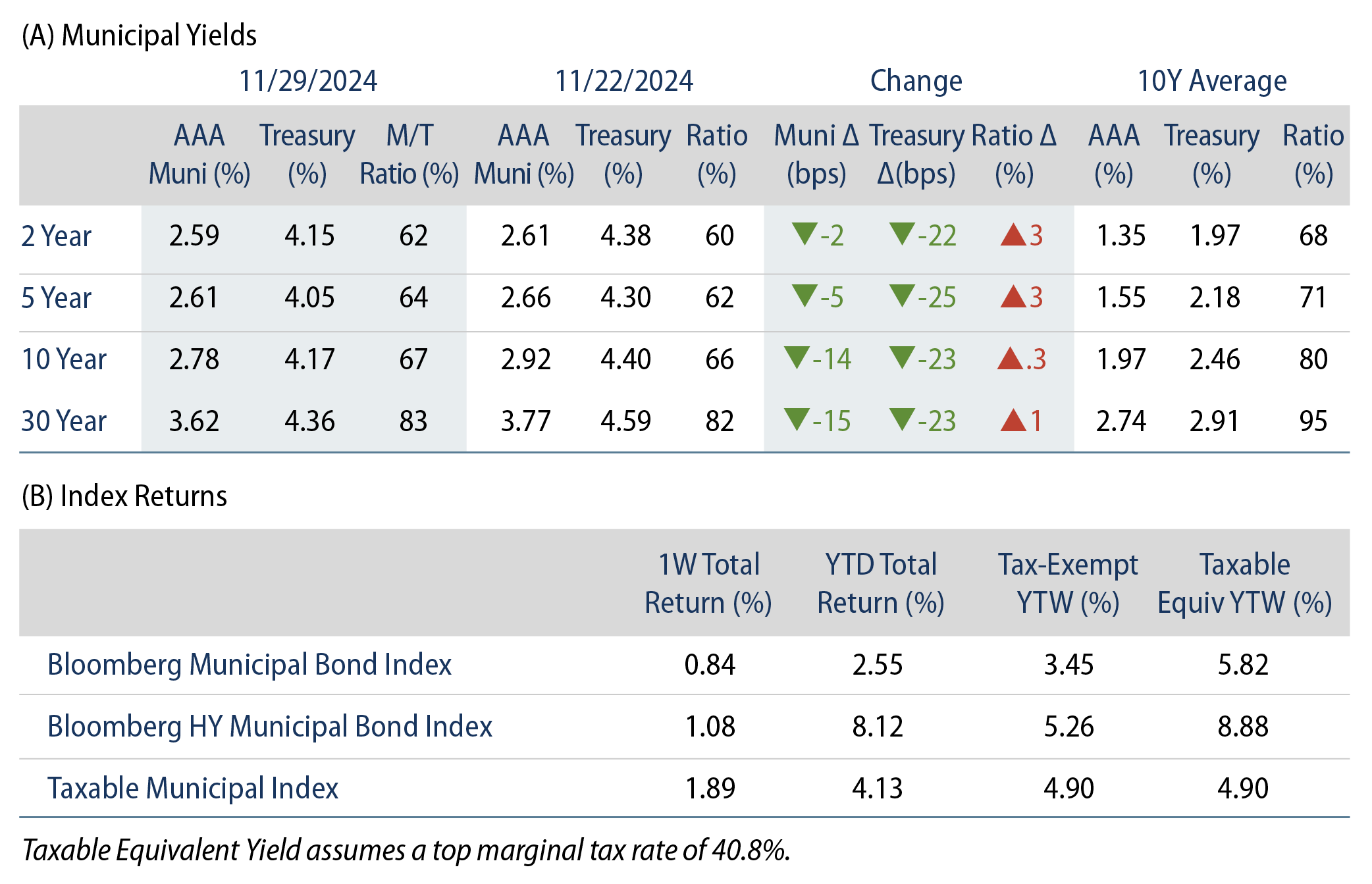

Munis posted positive returns last week as fixed-income yields moved lower, although they trailed Treasuries and underperformed partly due to an under-reaction to the rate selloff earlier in the month. This occurred against the backdrop of President Trump’s selection of Scott Bessent as Treasury Secretary, an appointment viewed favorably by fixed-income markets as it allayed fears of unchecked fiscal expansion. Economic data, including jobless claims, 3Q24 GDP and inflation, were reported in line with expectations and remained relatively unchanged from prior readings. Meanwhile, muni technicals remained favorable amid limited supply and continued inflows. This week we highlight November’s muni supply slowdown.

Muni Supply Levels Remained Elevated as Fund Inflows Continued

Fund Flows (up $561 million): During the week ending November 27, weekly reporting municipal mutual funds recorded $561 million of net inflows, according to Lipper. Long-term funds recorded $657 million of inflows, intermediate funds recorded $123 million of outflows and high-yield funds recorded $301 million of inflows. This week’s inflows marked the 22nd consecutive week of inflows and led estimated year-to-date (YTD) net inflows higher to $40 billion.

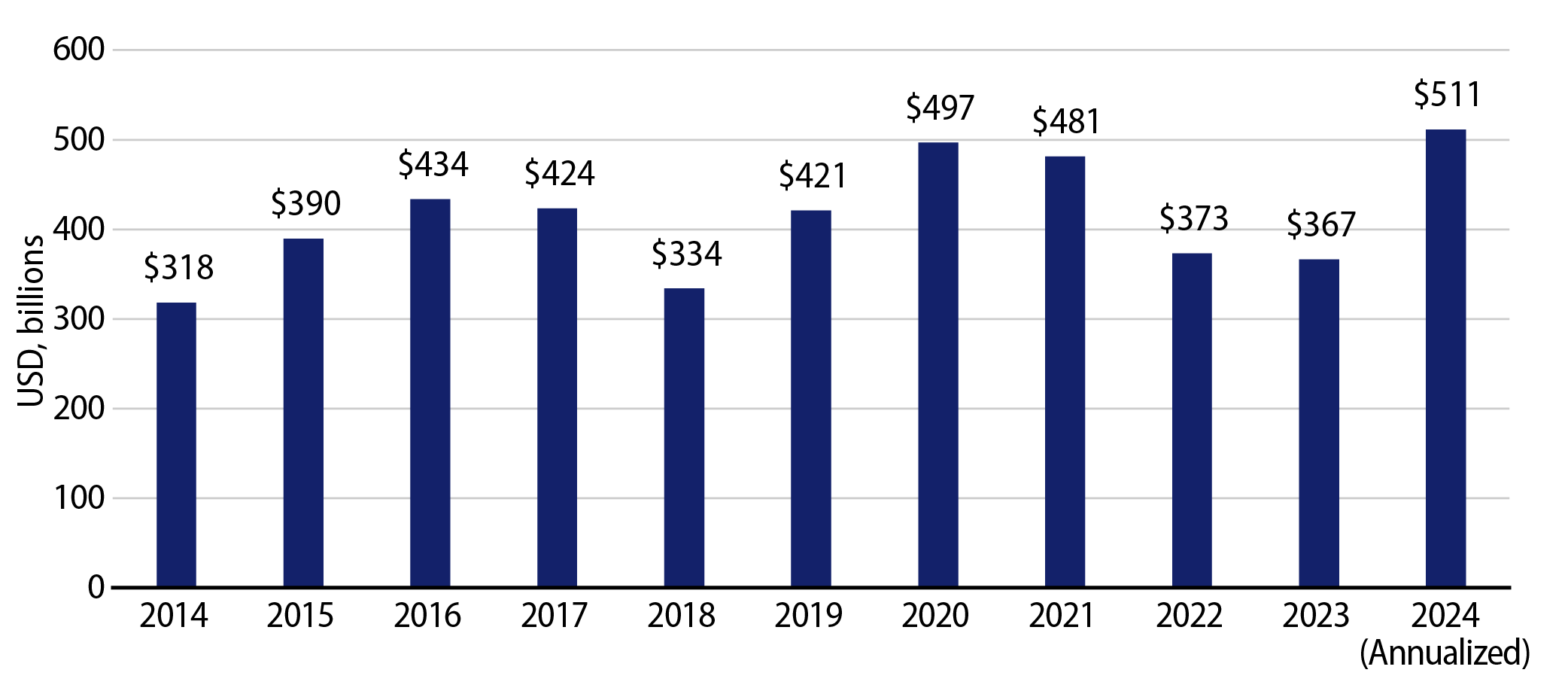

Supply (YTD supply of $468 billion, up 40% YoY): The muni market recorded just $2 billion of new-issue volume last week due to the Thanksgiving holiday. YTD issuance of $468 billion is 40% higher than last year’s level, with tax-exempt issuance 43% higher and taxable issuance 11% higher year-over-year (YoY). This week’s calendar is expected to jump to an elevated $16 billion. The largest deals include $1.5 billion New Jersey Transportation Trust and $767 million State of Connecticut General Obligation transactions.

This Week in Munis: Supply Slows in November

Entering November, YTD municipal supply reached a record pace with total municipal supply of $444 billion representing the highest level of supply recorded through the first 10 months of a calendar year in the muni market’s history. Due to the election, along with the Veterans Day and Thanksgiving holidays, supply has slowed in November as $25 billion of issuance represented the lowest supply level of the year and declined 30% from November 2023 levels.

While elevated supply conditions contributed to municipal underperformance versus other fixed-income asset classes throughout much of 2024, stronger supply technicals along with steady municipal fund flows have supported relative outperformance in November. The Bloomberg Municipal Bond Index returned 1.73% in November, outperforming the Bloomberg Treasury (0.78%) and Bloomberg Corporate (1.34%) indices.

Despite the November slowdown, 2024 supply remains elevated and has been supportive of tax-exempt income opportunities and relative valuations. However, strong November technicals and muni outperformance underscore potential reinvestment risk associated with lower supply and higher demand that could quickly appear in the municipal market. Western Asset anticipates that the 2025 municipal bond supply will remain elevated due to domestic infrastructure needs, but these elevated supply conditions should be well absorbed by demand from individuals seeking higher after-tax income opportunities as the Federal Reserve continues to cut rates. Should supply underperform expectations, persistent demand could lead to additional muni outperformance that could limit future income opportunities, further supporting the entry point offered by attractive municipal valuations today.

Municipal Credit Curves and Relative Value

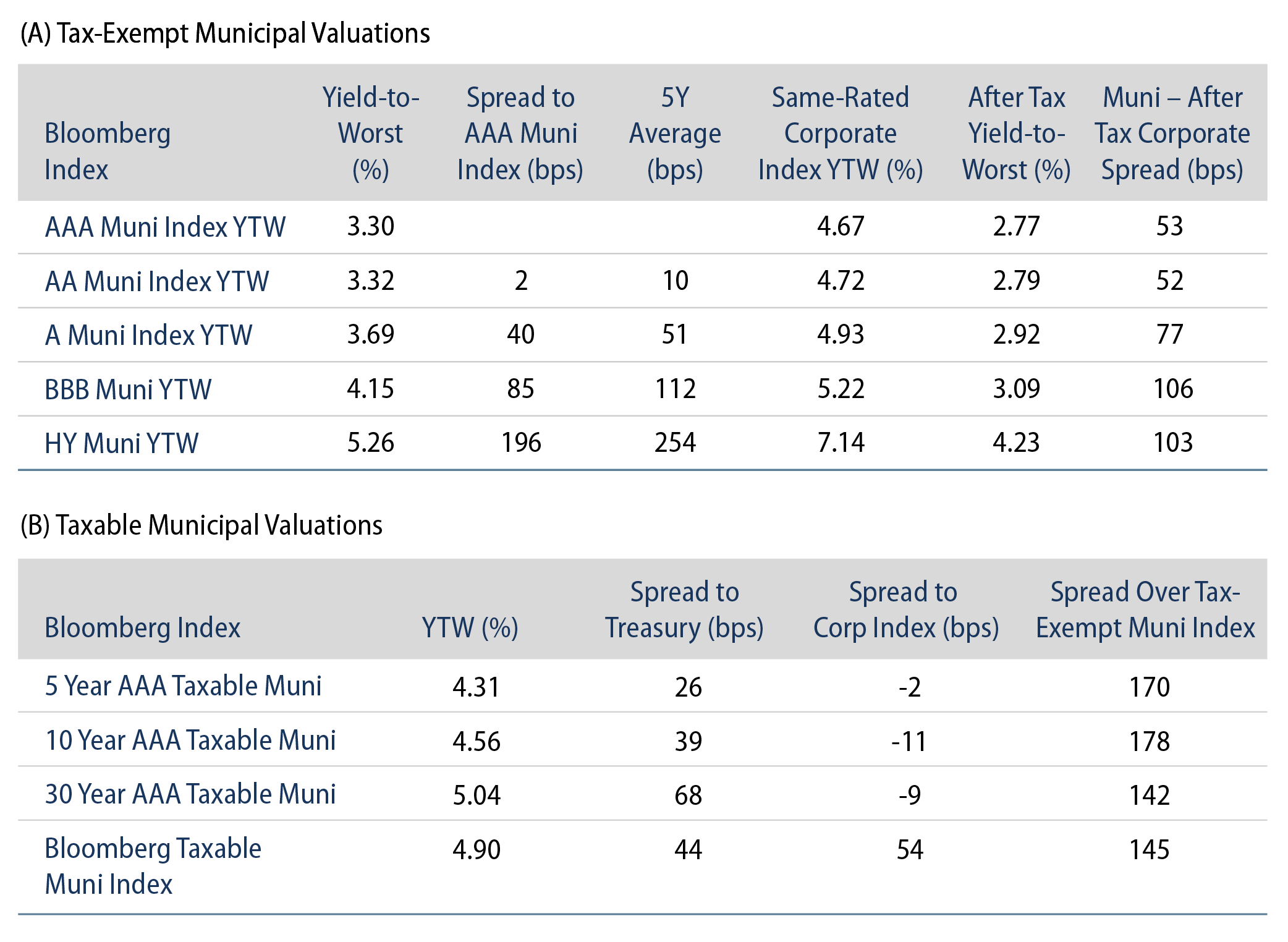

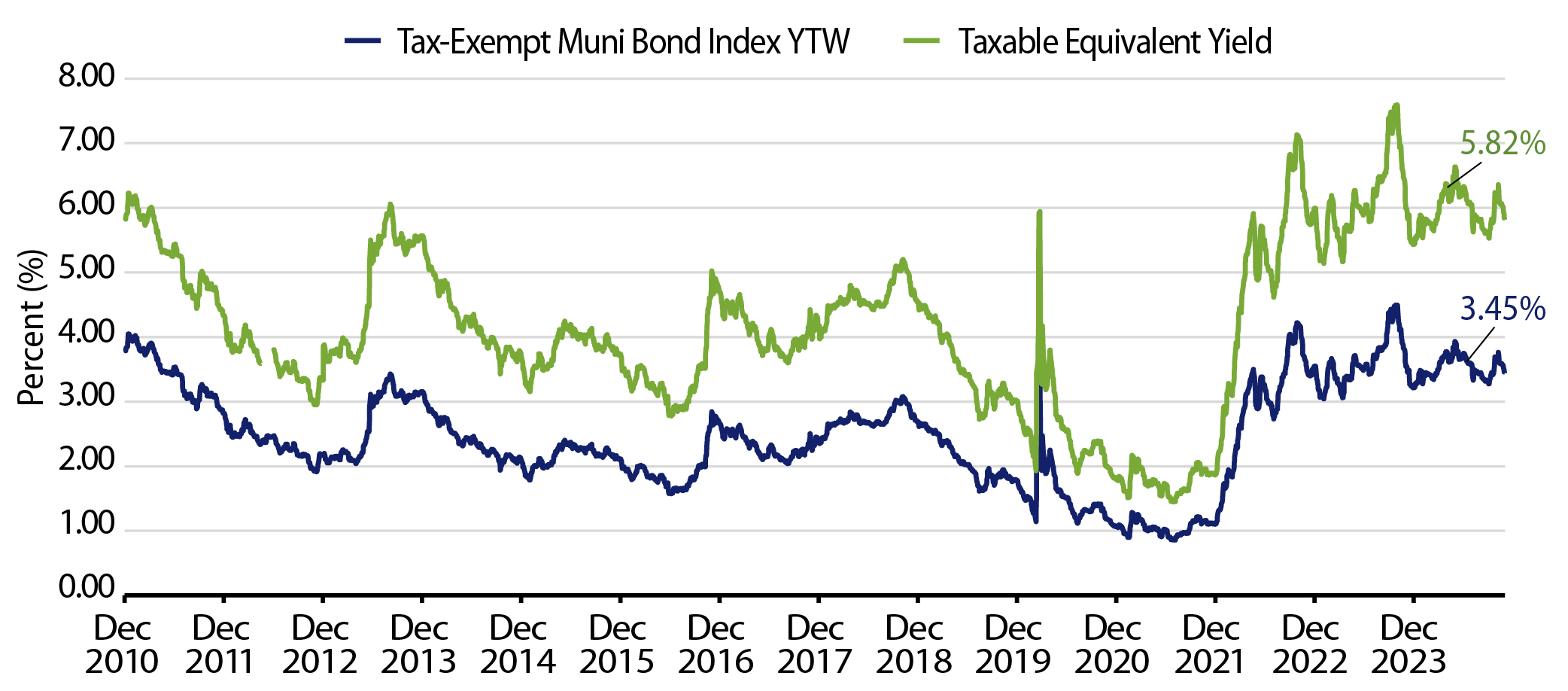

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

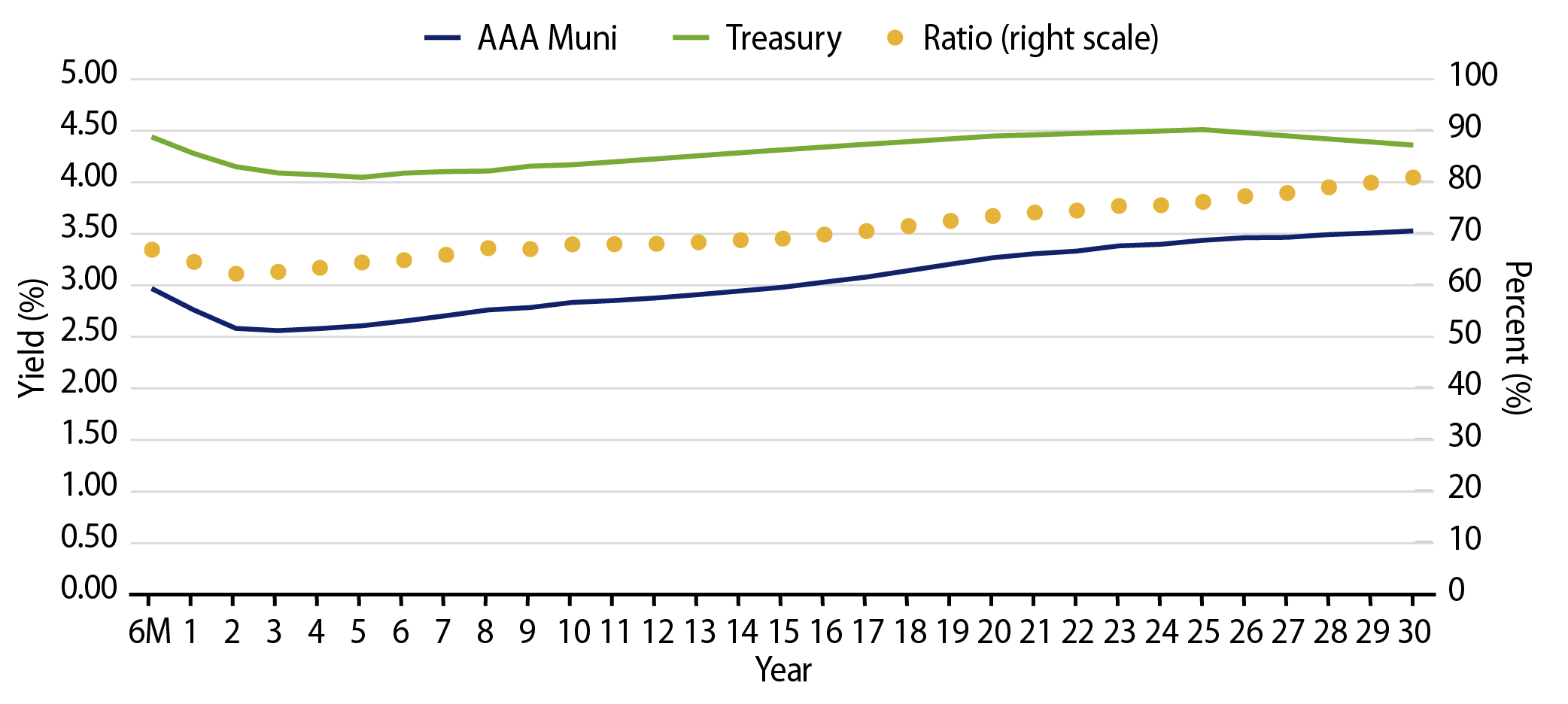

Theme #2: A slight inversion in short maturities underscores the potential value in longer maturities.

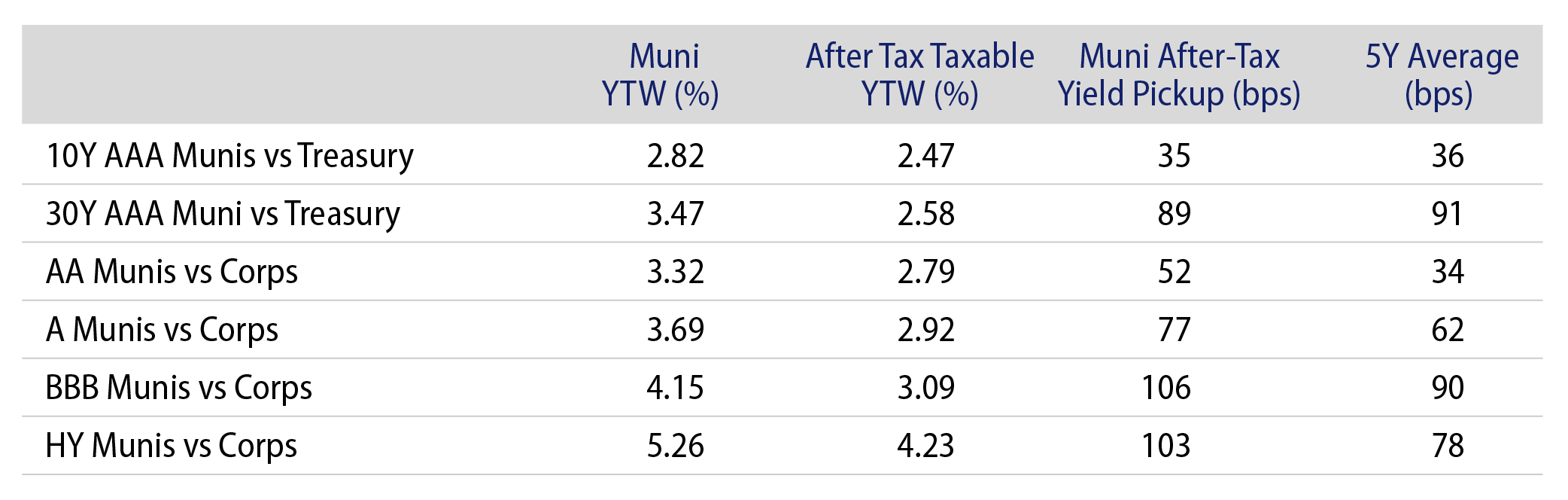

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.