Municipals Were Flat for the Week

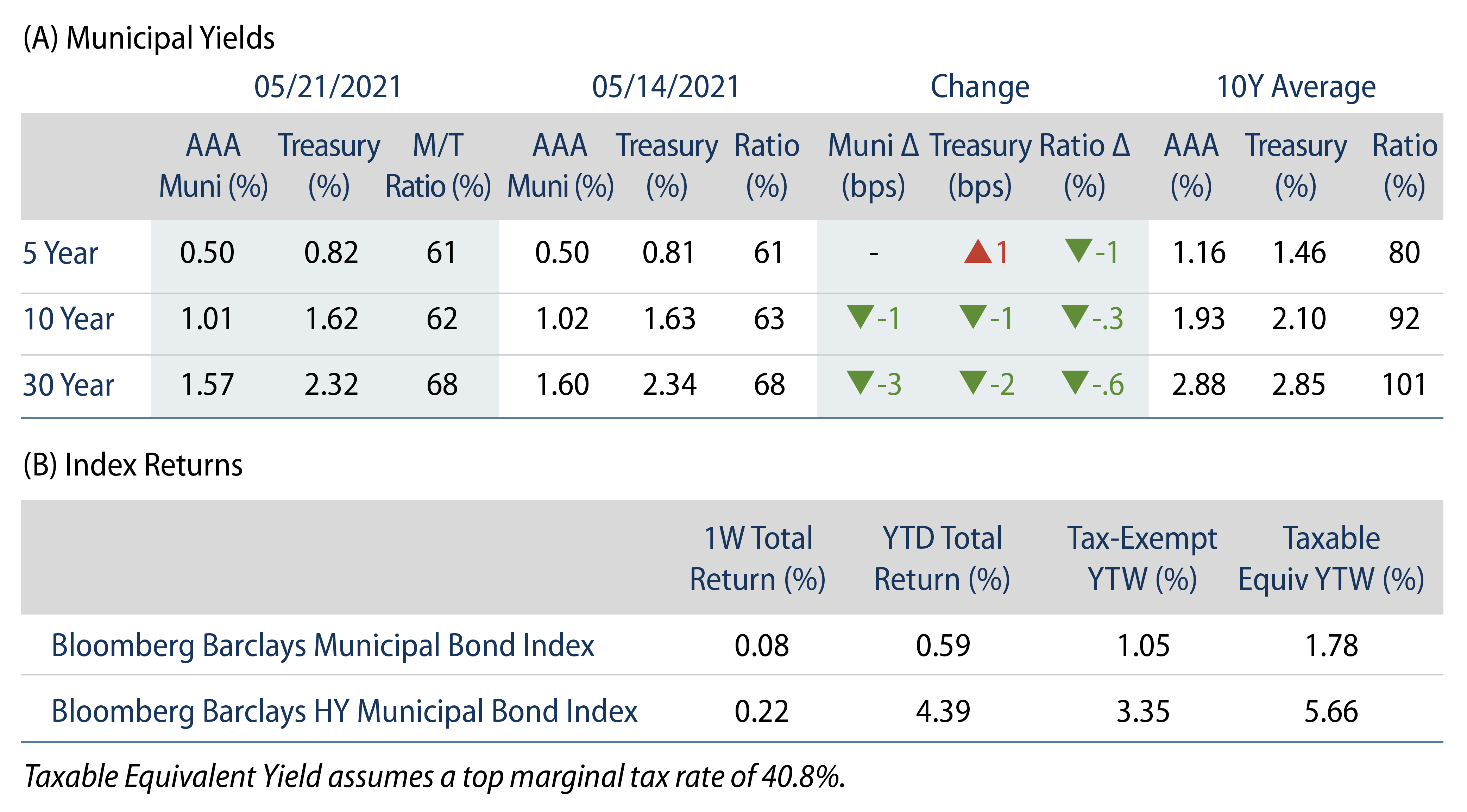

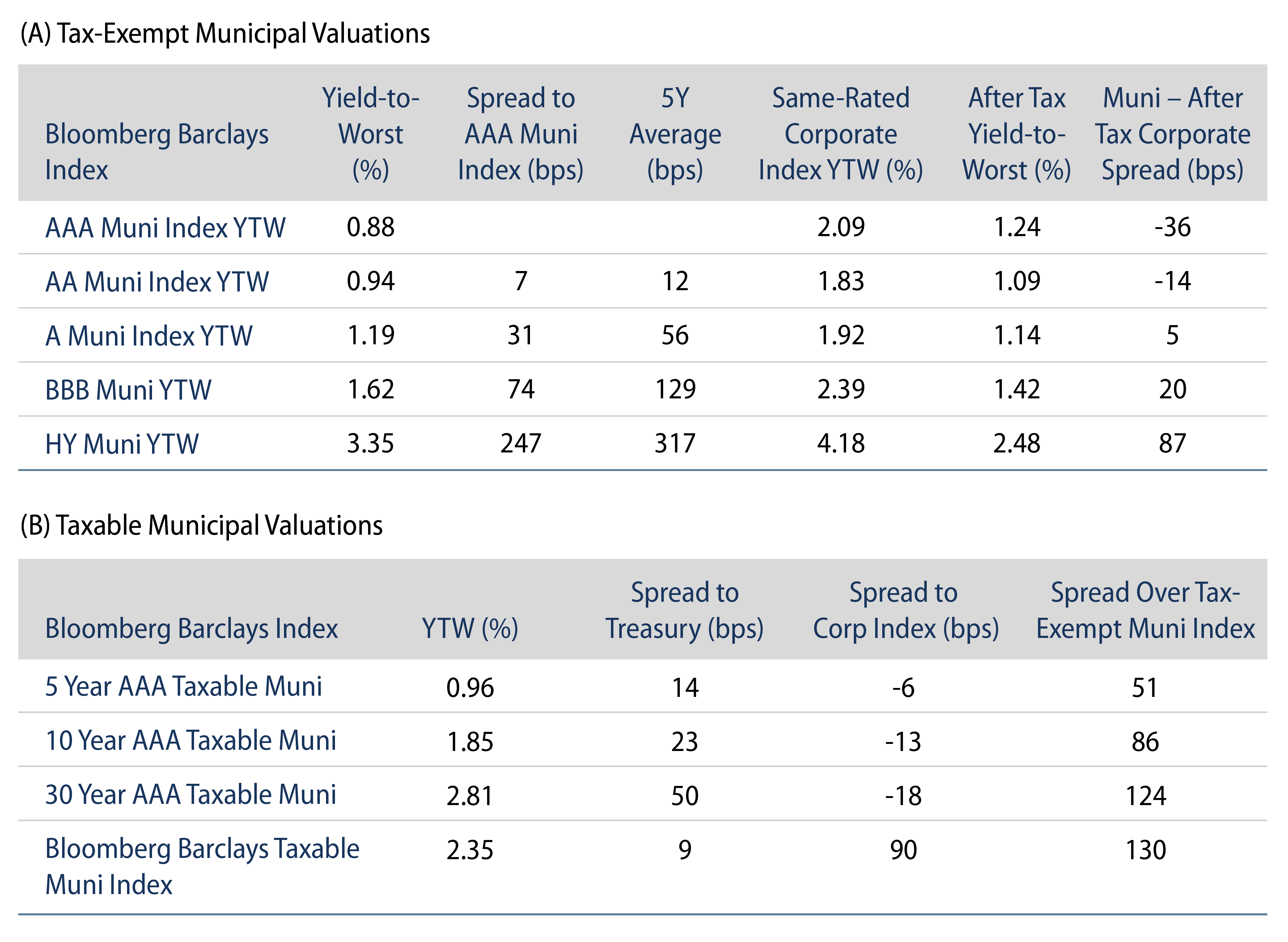

AAA municipal yields were unchanged during the week. Munis modestly underperformed the Treasury curve flattening, with ratios moving higher in intermediate and long maturities. Market technicals remain favorable and strong, driven by persistent fund flows and expected limited supply around the Memorial Day holiday. The Bloomberg Barclays Municipal Index returned 0.08% while the HY Muni Index returned 0.22%. This week, we explore the rebound in state tax collections following pandemic related volatility.

Market Technicals Remain Positive, Supported by Continued Mutual Fund Inflows

Fund Flows: During the week ending May 19, municipal mutual funds recorded $725 million of net inflows (down 3% week-over-week), according to Lipper. Long-term funds recorded $1.2 billion of inflows, high-yield funds recorded $649 million of inflows and intermediate funds recorded $102 million of inflows. Net inflows year to date (YTD) reached $46.6 billion and muni funds have now recorded net inflows in 52 of the past 53 weeks.

Supply: The muni market recorded $9.9 billion of new-issue volume during the week, up 43% from the prior week. Total issuance YTD of $169 billion is up 22% from last year’s levels. This week’s new-issue calendar is expected to decline to $7.0 billion ahead of the long Memorial Day weekend. The largest deals include $874 million Washington Metropolitan Area Transit Authority Green Bonds and $308 million California Public Finance Authority (senior living) transactions.

This Week in Munis: State Tax Collections Rebound

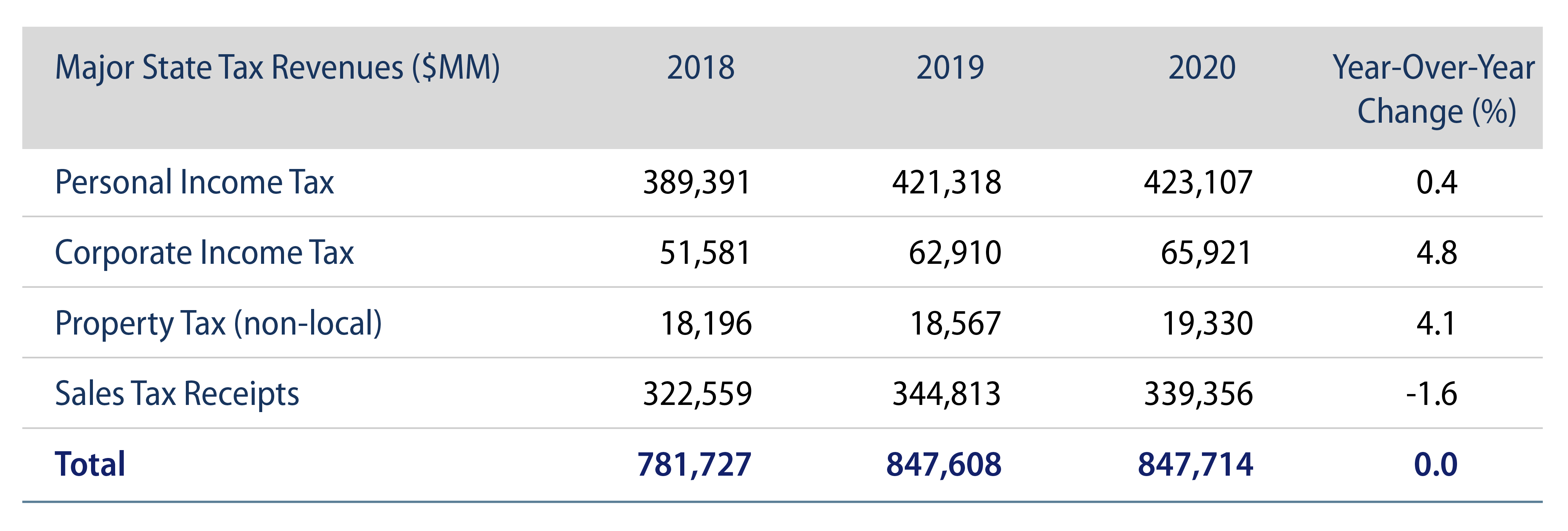

As the federal tax filing deadline passed last week, we explore the volatile year of tax collections observed by states during 2020. Despite the effects of the COVID-19 pandemic, major state tax collections (personal income, corporate income, property and sales taxes) were unchanged versus 2019 levels at $848 billion.

Personal income taxes, the largest component of overall state tax revenues, increased $2 billion (+0.4%) in 2020 to $423 billion. Despite the nationwide unemployment rate rising above 14% in April 2020, personal income tax collections were buoyed by high income earners. The timing of these collections was relatively volatile due to the delay of federal tax collections from the second quarter to the third quarter. While 2Q20 personal income tax collections fell $50 billion (-35%) year-over-year (YoY), collections in the second half of the year exceeded 2019 collections by $48 billion (+27%).

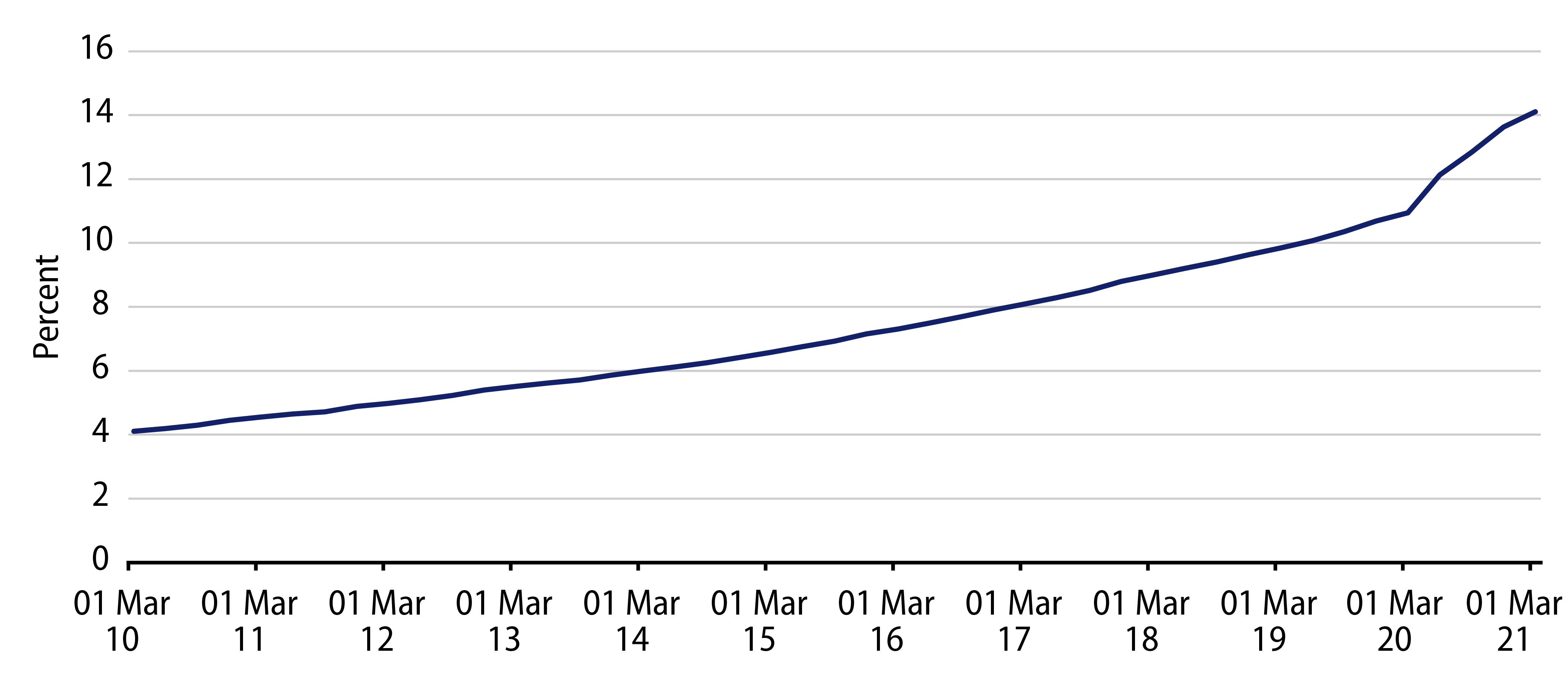

Of the major tax categories, only sales taxes declined YoY, falling $5.5 billion (-1.4%) in 2020 to $339 billion. While regional shutdowns due to Covid weighed on point-of-sale economic activity, sales tax collections were greatly helped by the 2018 Supreme Court decision allowing for states to pass legislation to collect sales taxes from out-of-state e-commerce transactions. According to Census data, e-commerce reached a record 15.2% of total retail transactions in 4Q20, up from the prior three-year average of 10.7%.

Western Asset believes state credit will continue to improve as COVID-19 restrictions are relaxed, economic activity rebounds, and federal support continues to bolster liquidity positions. As most state fiscal years ended on June 30, 2020, ahead of the July 15, 2020 tax collection deadline, at which point reported tax collections were still down 5.2% YoY. Due to the delayed personal income tax collections, states expected a downward trend in revenues, informing many mid-fiscal-year proposals through 2021. Given better than anticipated collections through the end of the calendar year, budget revisions are underway, which will be further aided by American Rescue Plan Act funds received in the 1Q21. California is perhaps the poster child for the revenue turnaround. After originally projecting a budget shortfall, the state’s Legislative Analyst Office now anticipates a $38 billion surplus in FY21, fueled by high income earners and significant capital gains revenue.