Municipals Posted Positive Returns Last Week

Municipals posted positive returns last week, with high-grade muni yields moving lower across the curve. Weaker muni technicals continued to contribute to underperformance versus Treasuries, which continued to rally on a flight to quality sentiment driven by global banking fears, lower than expected Producer Price Index (PPI) data and slowing retail sales. The Bloomberg Municipal Index returned 0.78% during the week, the High Yield Muni Index returned 0.13% and the Taxable Muni Index returned 0.46%. This week we highlight state and local revenue data released by the Census Bureau.

Technicals Remained Weak Amid Fund Outflows

Fund Flows: During the week ending March 15, weekly reporting municipal mutual funds recorded $461 million of net outflows, according to Lipper. Long-term funds recorded $162 million of inflows, high-yield funds recorded $301 million of inflows and intermediate funds recorded $172 million of outflows. This week’s outflows extend year-to-date (YTD) net outflows to $1.1 billion.

Supply: The muni market recorded $7 billion of new-issue volume last week, down 48% from the prior week. YTD issuance of $67 billion is down 12% year-over year (YoY), with tax-exempt issuance down 9% YoY and taxable issuance down 28% YoY. This week’s calendar is expected to decline to $5 billion. Large transactions include $1.5 billion Louisiana Utilities Restoration Corporation Project and $850 million Energy Southeast transactions.

This Week in Munis: State and Local Revenues Grow, but Slow Down in 4Q22

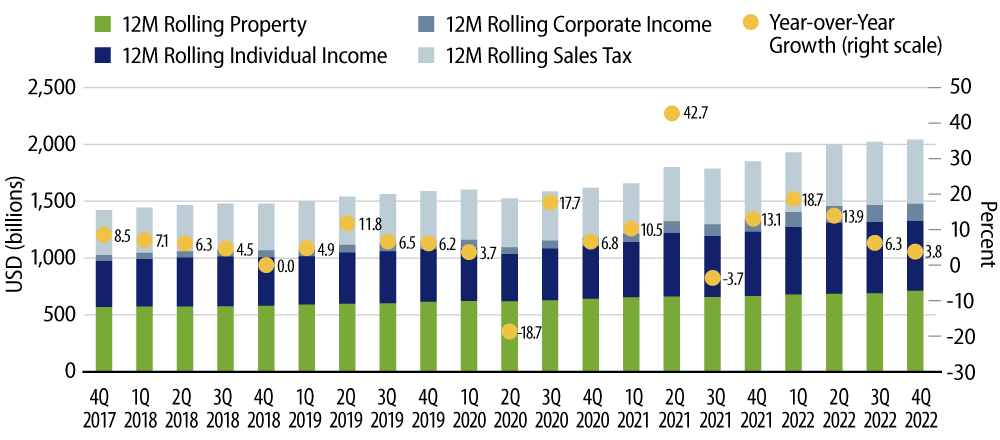

Last Thursday the Census Bureau released 4Q22 state and local tax collection data, which highlights growing but slowing state and local tax revenues. Combined state and local tax collections increased 3.8% YoY in the fourth quarter, down from the 6% to 19% YoY growth rates observed over the prior four quarters. Fourth quarter corporate income taxes recorded the highest YoY growth (+10.9%), followed by property taxes (+8.3%) and sales taxes (+7.6%). Individual income tax collections declined 10.4% over the quarter.

The fourth quarter data capped a record year of state and local tax collections in 2022. Total 2022 tax collections of $2.0 trillion were 10% higher than 2021 calendar-year collections. During 2022, corporate income tax collections increased 34%, sales tax collections increased 11.5%, individual income tax collections increased 8.6% and property tax collections increased 6.9%. Strength observed in income and sales tax collections can be attributed to the strong labor market and the inflationary impact on consumer goods that are passed through sales tax collections.

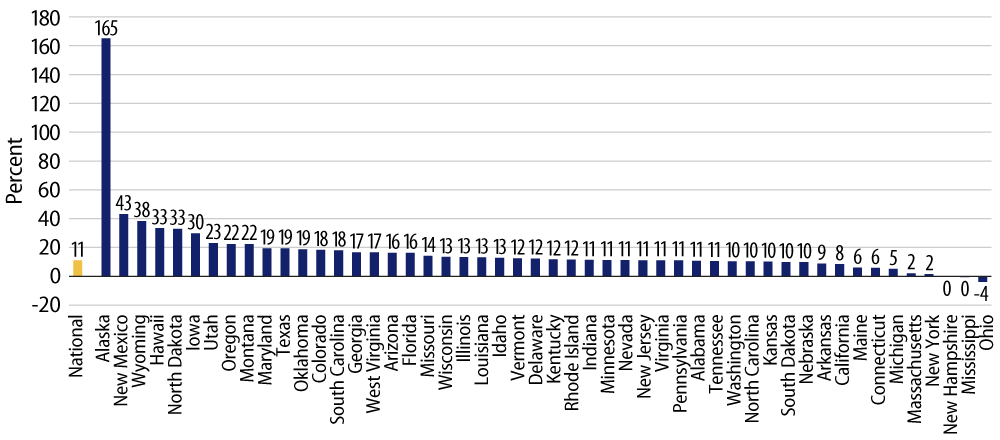

State tax collections (excluding local collections) highlight a more acute slowdown, declining 0.9% YoY to $335 billion in 4Q22. Individual income tax collections, the largest component of state tax collections, were down 12.3% YoY as we surmise that states recorded lower capital gains tax collections during the year. Meanwhile, sales tax collections, which comprise the second largest component of state tax collections, increased 5.9% YoY. Despite the quarter’s decline, full calendar-year state tax collections were 11% higher YoY. Alaska (+165%), New Mexico (+43%) and Wyoming (+38%) recorded the highest YoY growth rates in tax collections, attributable to elevated severance tax collections. Ohio (-4%), Mississippi (+0%) and New Hampshire (+0%) recorded the lowest growth rates among states last year.

As highlighted in our 2023 Muni Outlook, Western Asset anticipates that a strong labor market and inflationary pressures will support income tax and sales tax collections in 2023. However, as the Federal Reserve continues tightening measures to temper growth (including wage growth), and as pandemic-era federal stimulus measures wear off, we expect revenue growth to trend to more normal growth rates as indicated by the most recent revenue data. As municipalities finalize upcoming year budgets we are mindful of revenue assumptions and spending plans in light of the economic headwinds that could further pressure revenue growth.